Easy Beginner Guide on the 70/20/10 Budget (Free Printable)

If you want to pay off debt, save money and spend with freedom, then you need to try out the 70/20/10 budget!

Author: Kari Lorz – Certified Financial Education Instructor

Managing money can be challenging due to bills, debts, and savings goals. Many live paycheck-to-paycheck without an effective budget. The 70/20/10 budget offers a simple solution to track expenses, regain control of finances, and achieve savings goals.

We’re going to walk you through everything you need to know (and a free printable budget template) about how to use the 70/20/10 budget.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What Is The 70-20-10 Budget?

With the 70-20-10 budget, you’re dividing your income into three main spending categories. This budgeting method is a twist on the 50/30/20 method, but it’s a bit more ambitious, as less is going to everyday expenses.

- 70% of income is for spending

- 20% of your income is for saving

- 10% of your income is for debt payoff or giving

Seeing these kinds of budgets is helpful, as people often don’t know how to allocate their money, and they need a good jumping-off point. When you know where to start, you can evaluate how you’re spending your money and if you’re way off base.

Sometimes people don’t even realize their overspending until they see other people’s budgets. So while you should try to stick to the percentages, you do have flexibility.

How is the 70 20 10 budget different from other budgeting methods?

The 70/20/10 budget is a bit different from other budgeting methods because it puts more emphasis on debt payoff as it has its own spending allocation. This is helpful for those who need to focus on debt. (Most budget methods focus only on the saving piece, not the debt payoff piece).

This budget is also good for those that like flexibility with their spending and need to not feel like they’re always too constrained by their budget. Putting 70% in the spending categories gives you lots of flexibility to buy what you need and want while still being responsible and having your savings set aside.

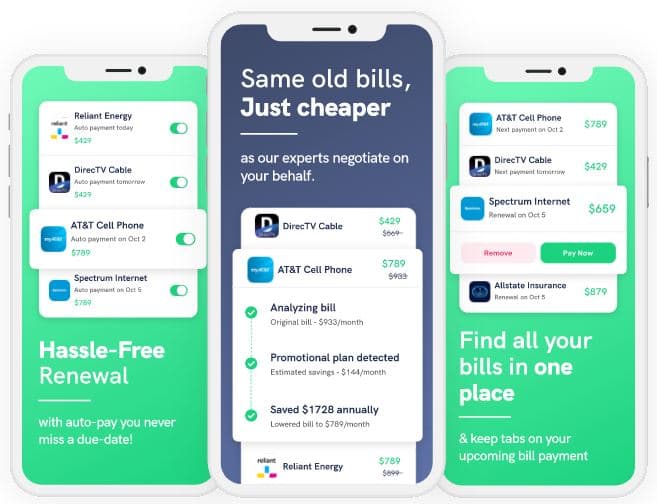

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

70% of income is for spending

The largest percent of your take-home income will go to spending. While this is great, it’s a bit vague. Most budgeting methods make the distinction between necessary spending vs. discretionary spending, or they break things apart by fixed vs. variable expenses.

Let’s take a quick look at these common budgeting terms…

- Necessary spending – this is commonly called taking care of your 4-walls and should be prioritized over other spending. So things like rent/mortgage, utilities, basic groceries, insurance. These are the things you have to spend money on to survive.

- Discretionary spending – this is your fun extra money, the things you don’t need to buy but things you want to spend your money on. Things like a gym membership, dining out, hobby stuff, pedicures, clothes, etc.

- Fixed expenses – these are things that cost the same every month. So rent/mortgage, phone & internet, Netflix subscription.

- Variable expenses – these are things that you spend money on every month, but the amount varies. Things like your electricity bill, groceries, water bill, gas for your car, etc.

When building out your monthly budget, you should always prioritize your necessary spending first and then see what you have left over for discretionary spending. I think we can all agree that you need money for groceries and not necessarily a gym membership.

So let’s look at all the things that fall under the 70% spending…

Necessary spending…

- Rent/mortgage

- HOA fees

- Utilities – water, electricity, natural gas, sewer, garbage, etc.

- Basic groceries

- Insurance – life insurance, health, dental & eye insurance, car insurance

- Transportation – bus pass, car payment, gas for the car, etc.

- Debt minimum payments

Note 1: While a car payment might be necessary (depending on where you live), many people go overboard on the kind of car they think they need. While it might be nice to drive a Mercedes, I sure would like the monthly payment for a Honda better.

Note 2: While debt is its own category, your minimum payments are things you MUST PAY, so they go under your must-spend list. Then, the amount in the debt category (10% of spending) that’s for your debt payoff strategy plan, so you can get out from under your debt.

Discretionary spending…

- Subscription boxes

- Landscaping & yard care

- Luxury car payment

- Dining out

- Beauty extras – pedicures, lashes, facials & massage

- Hobby stuff

- Phone, internet, and streaming services

If you’re having difficulty remembering all your expenses, you should grab your latest bank statement, credit card bills, etc. Then list out all your recurring monthly expenses. Don’t forget about bi-yearly expenses (i.e., car insurance) or things charged yearly (i.e., Amazon Prime subscription).

20% of your income is for saving

You should be saving for both short-term and long-term goals. Don’t forget to include an emergency fund as part of your 70-20-10 budget.

Short term savings goals

For your short-term savings goals, think of things that will take less than 3-5 years to save for. Things like vacations, braces for your kiddo, soccer camps, upcoming birthdays, Christmas holiday spending, etc. You can usually save for these short-term goals in cash envelopes.

I use a few envelopes as sinking funds – quarterly home cleaning, Christmas spending, and a beauty fund (getting my hair done, pedicures, etc.). We also have a few separate savings accounts; these are our revolving savings. We have a car repair fund, a home repair fund, and a kiddo fund. Every month money goes in, and some months money goes out.

Long term savings goals

For your long-term savings goal, these are things that will take more than five years to save for. Most importantly, you should save for your retirement (especially if your job doesn’t have a workplace retirement plan). You can open your IRA at investing houses like Vanguard, Charles Schwab, or Fidelity.

In the long-term savings category, you should also have your emergency fund. You can also have things like new home savings, new car savings, or whatever applies to your family.

Our emergency fund is in a high-yield saving account (a must-have! Don’t let your savings sit in a regular savings account – you’d be losing money). We also have a new car fund as well that we’ve slowly been filling.

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

10% of your income is for debt payoff or giving

Debt payoff

If you have any debt payments (student loans, credit card debt, car loans), you should include this in your monthly budget. The goal here is to get out of debt as soon as possible.

Generally speaking, you should focus on your high-interest consumer debt (credit card debt). Things like 15% interest or more. Yet there are two distinct methods for debt reduction – debt snowball vs. debt avalanche.

- Debt snowball method – this is where you pay the lowest balance off first.

- Debt avalanche method – this is where you pay the highest interest rate first.

Most people find it more effective to do the debt snowball method, as you can see your progress and make headway a lot faster than with a debt avalanche. Remember, motivation is key to keep going, and the snowball method can help.

Giving

Giving back is also an important part of living a balanced life, whether it’s to your church or your favorite charity or non-profit.

With the giving category, I want to be very clear. It’s your money; you can do with it what you want. Don’t ever feel pressured or guilted into giving your money away. Because if you’re guilted into it, you’re not giving with your whole heart – and that’s an important part of the giving mentality.

My husband and I like to donate to Give Kids the World, an organization in Orlando, FL that gives kids with life-threatening illnesses vacations to the Orlando theme parks (aka Universal or DisneyWorld SeaWorld, etc.) It’s like Make a Wish Foundation, but the facility hosts Wish Kids, so more of the donation gets used for its intended purpose. Make a Wish is like a middleman, and when you cut out the middleman, more money goes directly to the kids and their vacation.

If you like this budgeting style but aren’t sure the budget percentages fit your needs & financial goals, then you can try the 30/30/30/10 budgeting method instead.

How to set up your 70:20:10 budget

Step One: Use the 70:20:10 template

You can easily grab a piece of paper, divide it into three main sections, and build your budget right there. But sometimes, it can be nice to have something ready to use. You can grab your 70/20/10 budget template right here (it’s free).

Step Two: Calculate your after-tax monthly income

The first step is to figure out how much money you’ll have left after taxes and payroll deductions from your gross monthly income (this is your net income, also called your take-home pay). You can deduct a standard 30% from your gross pay if you just want to ballpark it.

Then fill out your budget form with how much you can spend in each category.

- Take-home income x .70 = spending

- Take-home income x .20 = savings

- Take-home income x .10 = debt reduction or giving

Step Three: Set up your financial goals for your savings category

I always think you should pay yourself (aka your savings accounts) before focusing on other people’s priorities. Your goals are the most important!

What do you want to save up for? Of course, you’ll need an emergency fund, which should be 3-6 months of living expenses (at a minimum). But what else? Remember, think about both short-term and long-term savings. Maybe a vacation, maybe a downpayment on a home?

In an ideal setting, you would have a separate account for each of your savings goals. That way, there’s no confusion about what money is for what purpose. You can see how I use multiple bank accounts for budgeting right here.

If you want to open a few accounts, I suggest checking into a high-yield savings account to help your money grow faster. Current is an online banking app with savings pods, and you can have three of them, and they earn great interest rates (I think it’s 4.00% APY right now – April 2023).

Step Four: debt repayment & giving

Now that you have how much you can spend on debt repayment and giving, decide what specific debts you want it to go towards. Remember, when paying off debt, you need to follow a strategy, don’t just throw a little extra onto each bill; you won’t make traction that way.

List out some possible places you want to donate to. If it helps, many organizations say it’s more impactful to make 1-2 large donations vs. 3-5 small donations to different places, as a portion of each donation goes to overhead.

Step Five: Categorize your spending from the last three months

You should grab your last three bank statements, credit card bills, etc. Then list out all your recurring monthly expenses. Don’t forget about bi-yearly expenses (i.e., car insurance) or things charged yearly (i.e., Amazon Prime subscription).

Separate these into your necessary spending and your discretionary spending, writing your must-spend items at the top of your budget. Now this is where it gets hard, as you will most likely have to cut out a few items on your discretionary spending list to make it fit into your budget.

So you may have to stop getting your lashes done, but you can keep pedicures, or maybe do a pedi only once a month vs. getting it done every two weeks. Everyone struggles with this part of budgeting, so don’t feel that you’ve done something wrong if you find you need to cut more than you expected.

Step Six: Track your spending

Setting up a spending tracker system is the best way to stick to the 70-20-10 budget method. You can use a spreadsheet, an app like Mint, or even pen and paper to keep track of your spending. I have a handy bill and expense tracker that you can download and print at home.

It doesn’t matter which way you track, just that you do track. That way, you can see where your money is going and ensure you’re keeping up with your goals.

Ideally, you’d track what you spent at the end of the day, but that’s not always feasible. At a very minimum, you should track your discretionary spending weekly. If you wait too long, you won’t have enough time to course-correct your spending.

Step Seven: Evaluate and adjust your spending

Review your expenses at the end of every week to determine if you stayed within your budget. If you spent more than planned in a particular category, analyze where the money went and the reason for it. Identifying these areas will help you adjust your spending for the next week.

You should also look at how much progress you made toward your financial goals. Savings trackers are a fun way to keep your goals up front and visual. I know I am guilty of setting a goal and completely forgetting about it. I don’t want that for you! So start tracking your progress!

It is important for you to know that no one gets their budgeting plan perfect in the first month; in fact, it is quite common for people to adjust and tweak their budget as they go along. So don’t feel bad or guilty about it, and certainly don’t give up. This is a normal part of the process that everyone goes through.

Yet, I don’t want you to waste your time forcing this method to work when it just won’t. I advise you to give any new budget method at least three months before you throw in the towel. If it’s still not working after three months, then no worries, pick a different budgeting method; there are lots!

There is not one correct way to budget that applies to everyone. Individuals require distinct features and guidelines to meet their specific needs. The best way to budget is the one that suits you and that you will continue to use in the long run.

Pros & Cons of the 70 20 10 budgeting method

Advantages of the 70-20-10 budget plan

- Less restrictive than other budgets – you have more flexibility.

- It prioritizes saving and debt reduction by keeping that money separate.

- It is simple to use. Sometimes people get too overwhelmed if there are too many categories; the 70 20 10 budget just has three categories, easy peasy.

Disadvantages of the 70-20-10 budget plan

- There is not as much structure, so people may find it lacks guidance and get confused.

- It doesn’t define between spending for needs and wants, which is the hardest part for people to work through. You need to be very honest with yourself about what is an actual “need.”

- You need to layer in other financial principles with it. For example, with savings, you must distinguish between short & long-term goals and use a Pay Yourself First method. With debt, “You” have to decide to use a strategy (debt snowball vs. avalanche). So if you’re not money savvy, you may miss these things.

Who is the 70/20/10 budget rule good for?

This budgeting method is good for people who…

- Are brand new to budgeting and need to get in the habit of budgeting and tracking their spending.

- Like flexibility with spending, who are more spontaneous.

Who is the 70/20/10 budgeting rule not good for?

This budgeting method might not be good for people who…

- Are detail-oriented. People who like everything spelled out exactly.

- Have a lot of debt; you might need more than 10% of your income to pay off your debts in a timely manner.

- Overspend on wants instead of focusing on needed purchases, as this budgeting method doesn’t officially distinguish between the two.

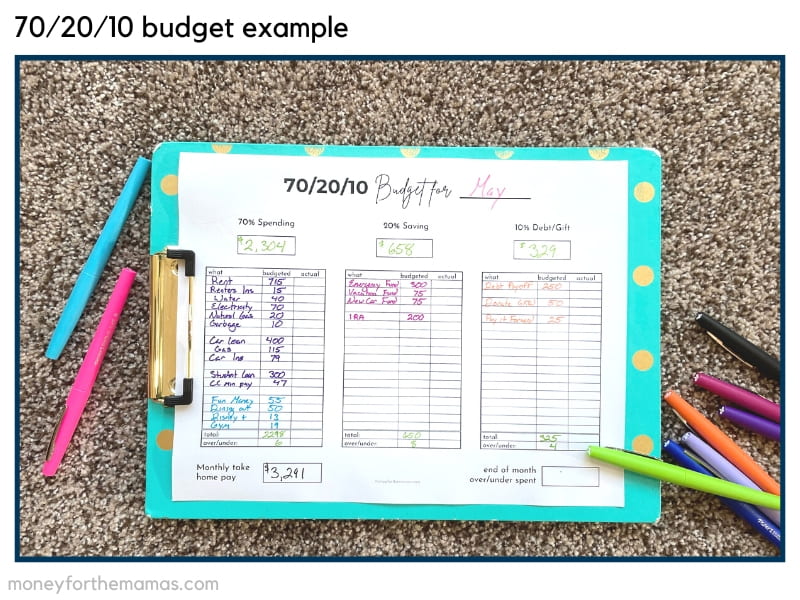

Example of the 70/20/10 rule budget

According to the US Bureau of Labor Statistics, the median weekly salary of a full-time worker in the US was $1,085 in the fourth quarter of 2022. So let’s x by 52 weeks = $56,420 annually, which comes to be $4,700 a month.

Note the $4,700 is before taxes & deductions, so let us assume a standard 30% paycheck deduction, which brings your take-home pay to $3,291 a month.

So for a take-home income of $3,291…

- Spending = $2,304

- Saving = $658

- Debt/Giving = $329

Spending 30% = $2,304

Must Spend:

- Rent/mortgage

- Property taxes

- Insurance – home/renters, health, dental, vision, life, etc.

- HOA dues

- Utilities – water, electricity, sewer, natural gas, garbage

- Basic groceries

- Transportation – bus pass, car payment, gas for the car

- Debt minimum payments

Discretionary spending:

- Gym membership

- Streaming services

- Dining out

- Fun money

- Hobby supplies

- Amazon Prime subscription

- Unexpected expenses – i.e., parking ticket

Savings 20% = $658

- Emergency fund

- Vacation fund

- Home repair fund

- New car down payment fund

- Kiddo sports fund

- IRA contributions for retirement (or brokerage account)

Debt & giving 10% = $329

- Debt payoff (snowball or avalanche method). These are amounts over and above your minimum payments.

- Giving to your favorite non-profit or tithe to your church.

70/20/10 Budget Template

Don’t forget to grab your free 70/20/10 budget template, just click the green button below…

At the end of the day

The 70/20/10 budget is an excellent starting point for those just getting acquainted with budgeting. It helps limit spending without totally restricting it, allows you to save and pay off debt in manageable chunks, and gives you further freedom to donate to causes that are important to you.

This budgeting strategy may not work for everyone, of course, so be sure to keep track of your overall budget and make changes if need be. Whatever kind of budget you adopt this year – whether it’s the 70/20/10 or something else – try reevaluating it each quarter. This will allow you to reflect on what’s working and what needs adjustment so that by the end of the year, you have made progress on your financial goals.