The Top 10 Advantages of Budgeting That You Absolutely Want to Have

I’ve got 10 dang good benefits of budgeting that will make you want to jump on this bandwagon!

Author: Kari Lorz – Certified Financial Education Instructor

We all know that we should budget. But not all of us do it. Budgeting is the “smart thing to do,” but has anyone ever explained why?

I mean, I think that budgeting is the bee’s knees, but that’s because I’m a money nerd 🙂 But it seems a lot of people complain about it (and do it loudly).

Taking an active role in managing your money is so important, and I’m going to walk you through the 10 most important advantages of budgeting your money. And after this, you’ll be waiving your budgeting nerd flag right here with me!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Top 10 advantages of budgeting your money

1. Budgeting puts you in the driver’s seat of your life.

When people are intimidated by something or fear it, they shy away from it; that’s a natural human response. When you aren’t actively engaged with your personal finances, you have no idea what’s really going on. You hope for the best while that nagging feeling rests at the back of your brain. And then, once a month, the hammer drops when your credit card bill arrives.

You pay part of the credit card debt and go on your merry way, shoving that sinking feeling back down. Yet, sad to say, it will be repeating each and every month until you get fed up with that feeling and decide to do something about it!

Taking control of your finances, even just starting at one hour a day (like I did), puts you in the driver’s seat of the most important factor in your life. You may still be intimidated, that’s fine, but you will grow more and more comfortable with learning about and managing your finances.

Once you start to manage it, you understand it, and you see different ways to tweak it, guide it, and begin to mold it to suit your plans. You aren’t a powerless victim anymore. You are the driver, and you can “feel” that you are a more confident driver. Then, you take action!

2. Making a personal budget personal enables you to focus on your goals & dreams

This is a natural lead-in to point #1. When people start talking about their lives, goals, & dreams, it’s usually with a long sigh and the thought of “if only.”

If only I could afford … Maybe one day…

Well, how is that going to happen one day if you don’t start planning for it today? It won’t happen unless you make it happen. This isn’t manifestation where you put your dreams out into the universe, and magically the next day, it happens!

Although I do believe in the power of having a positive money mindset, where manifestation plays a piece, it must be backed up by hard work!

Budgeting your money and making room in that monthly budget for saving money is key to making your financial goal happen! If you want to travel the US in an RV, you’ll need to buy an RV, and for that to happen, you’ll need to save for it.

Start by opening up a savings account, naming it “RV 4 LIFE”, and deposit just $10 in there to start. There, you are one step closer to your dream! Every month, make room for another $10 deposit, then maybe next month bump it up to $20, and so on.

You are making your money goals happen, little by little, every day!

Maybe your big goal is a dream trip. Don’t worry; we’ve got you covered with these 10 free vacation budget worksheets, guaranteed to take the stress out of your vacation!

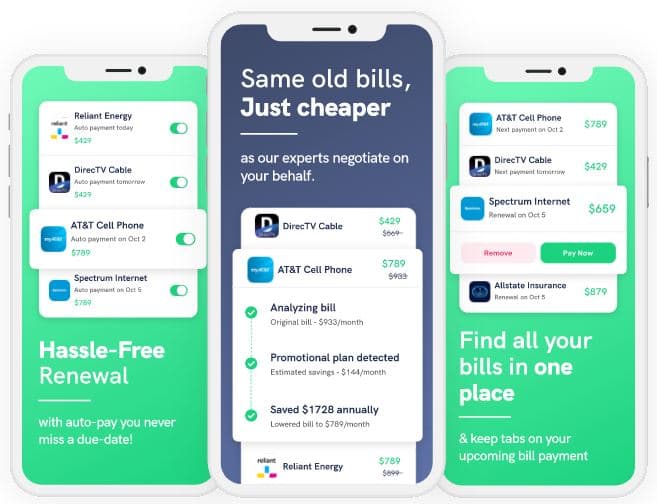

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

3. Having a monthly budget prepares you for emergencies

One of the most critical budgeting advantages is that it helps keep you safe in an emergency. This is because rule #1 for budgeting is to spend less than you earn… BUT rule #2 is to build an emergency fund of 6 months of living expenses. This will help keep you and your family safely housed if you lose your job or become injured and can’t work.

It’s easy to think positively and think that nothing horrible will happen. But we all have our rainy days, they may look different from our neighbors, but the fact that we need money to help us keep our family warm & fed is the same.

4. Budgeting helps you be generous

They say it’s better to give than to receive, but when you’re scrimping for every dollar it’s hard to have room for generosity. It’s natural, it’s human nature to protect your own. Yet, during the budgeting process, you may want to set up a give fund. You can just put $5 in it to start, but over time it will grow, and when that “moment” comes, you’ll be ready to help.

It could be a family member who needs help, the person in front of you at the grocery store whose card was declined (and the mom is buying diapers, apples, and goldfish crackers). You can reach into your wallet without a second thought and help.

Or it could be your favorite cause that you give to, either a local food pantry or an organization that helps kiddos grow into their full potential.

It’s a warm feeling, a comforting feeling to help someone for no other reason than just to help. I want that for you!

5. Budgeting helps create security and reduces stress

This is probably one of the most underrated financial benefits of budgeting. Yet, I feel it’s the most important. Financial stress is a BIG DEAL, it’s no joke, and everyone at some time in their life has felt that sinking feeling, that heavy as hell feeling in the pit of their stomach, the sense that they don’t have enough money.

Yes, even if you have an emergency fund, you can still have financial stress from the day-to-day worries. Bobby needs a new soccer uniform, Suzi fed Fido her Squigz, and now there’s a vet bill, oh and your car needs to go in for its 80K check-up, and you know something is making a weird clinking sound, and it sounds expensive!

Budgeting will let you set aside money for any unexpected expense. Little by little, every month, you put away money into sinking funds for these very things. You are covered! You don’t need to worry or stress out and eat Tums like their PB Cups! If you need some ideas on ways to track your savings, check out these bullet journal savings trackers!

Long-term stress wreaks havoc on your body, your emotions, and your happiness. You can take away part of that stress by better budgeting your money. Now, of course, you need to spend within your means to have all the stress go away, and that can be a long time coming, depending on your financial situation.

But you can take the first steps today and start healing your mental wellbeing by budgeting your money.

6. Having a household budget helps you be a better parent

Budgeting your money not only teaches your kids about having patience (“No, I’m not buying you McDonald’s for lunch, we are three minutes from home”). It also teaches them about working hard for the things they want.

The ripple effect of budgeting will naturally flow down to your kids, as you’ll be saving up for things, forgoing immediate gratification, and talking about being happy with the toys and items they have now.

These are all fantastic conversations to have and will help set the foundation for them to have healthy habits with their own finances. Which seems a far way off, but tell me, how has your parent’s views about money impacted you?

Many people carry negative money baggage from their parents as traditionally, most parents didn’t discuss money with kids or around the house. But it should be! A persona’s relationship with money will be one that they carry for their entire lives. As parents, shouldn’t we try and build it to be the best that it can?

Talk to your kids about what you’re saving for, talk about why it’s important. This doesn’t need to be a 1 hr conversation, it can be a 45-second convo about not buying a trampoline because you’re saving money for that trip to the beach this summer.

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

It’s never too early to teach your kiddos about money! Grab a few of these kids budgeting worksheets to help you get started (they’re free)!

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

7. Budgeting your money helps you see sinkholes in your wallet

As the saying goes, what gets measured gets managed. And if you haven’t been measuring how much money you’re spending on your habit of eating lunch out everyday while at work, then I’m sorry to say you have a shock coming. Get ready.

So you spend $11 on lunch every day at work…

$11 x 5 days = $55 a week

$55 a week x 50 weeks (as I’m assuming you take some days off) = $2,750 a year. Well, that doesn’t sound so bad; I mean, you have to eat, right.

In 10 years, that’s $27,500! But what’s worse is if you had invested that money (with an average rate of return of 7% compounded annually), you could have had $39,688.

Now think of all the other habits which you may be trying to break. Add them into the mix, and that’s a lot of money going to something you should have stopped doing a long time ago!

You could be putting that money towards your financial goal of going on a family vacation to the Caribbean. But if you don’t budget and see where your money is going, then you’d never know about this sinkhole. An easy way to help you spot these budget bombs is to use a spending log. You can see some great examples of bullet journal expense trackers and decide how you want to track your outgoing money.

8. Budgeting your money helps you focus on what is most important to you

One of the most important advantages that traditional budgeting has done for me personally is that it has helped me set my priorities. We talked a bit about this is #6, but I think it deserves its own space.

By budgeting your money, you are cutting out unnecessary spending, so you can focus on the things that are important to you. For example, I don’t spend money buying new clothes because I discovered that buying clothes doesn’t make me happy in the long term. I built a capsule wardrobe, and that’s it.

No more spending what seems like forever in my closet just staring and wondering what to wear. Because before I did this, I wasted so much time & energy on my clothes, it was frustrating to have a closet where nothing fit right, or it wasn’t cute, or whatever. I might be tempted to shop when I spy something cute, but I know that it doesn’t fit into the capsule so I pass it by.

Many minimalist moms talk about how buying less stuff (and having less) makes their home run so much smoother, without the crazy messes of 40,000 toys or spending all day cleaning up all-the-things. Now they clean for maybe 15 minutes a day and can use the rest of their time enjoying their family, doing their hobby, or just relaxing.

I want to spend my money, time, and energy on the important things and drive me closer to my goals and goals for my family. Doesn’t that sound like a better option than buying more “stuff”?

9. Budgeting your money helps you get your money to work for you

Wouldn’t it be great if you could earn money by doing nothing? Well, you can in the world of personal finance, and many people do it. One of the main benefits of budgeting your money is being able to invest. I know that investing sounds boring and even intimidating.

But if you want to retire one day and still be able to do your hobbies, maybe even travel a bit, then you’re going to need money. And investing is the way towards this kind of financial freedom.

Most people have access to a workplace retirement plan, which is a great place to start. Be sure that you are contributing enough of your paycheck to get the full employer match.

Usually, it’s something like you put aside 5% of your pay, and your employer will match that 5%. So contribute enough to get the full amount; otherwise, you’re leaving money on the table, and that’s never a good thing.

Now how much you contribute and what you invest in (mutual funds, bonds, individual stocks, INDEX funds) all play a part of the puzzle. The standard rule of thumb is the Rule of 25. Forbes says, “The 25x Rule is a way to estimate how much money you need to save for retirement. It works by estimating the annual retirement income you expect to provide from your savings and multiplying that number by 25.”

So if you want to be able to spend $50,000 a year you’ll want to have $1.25M by the time you retire.

There are many other guides that you can use, or seek a financial advisor’s help to make sure you’re on track to retire when you want to. You don’t want to plan on retiring at 60 only to find out at 59 that you need to work seven more years to make sure you have enough to live on.

10. Having a better marriage is a huge advantage of budgeting

It’s no surprise that money is a reason for tension in American homes. According to Marketwatch, “Nearly half of Americans (48%) who are married or living with a partner say they argue with the person over money… Most of those fights are about spending habits.” It’s also no surprise that these continued arguments lead to them splitting up and in some cases divorced.

When you budget your money (correctly), you are getting input from your spouse on that budget plan and your monthly expenses. It can’t be a one-way street with you carving the budget in stone like it’s the 10 Commandments. You need a “partnership.”

So when you and your spouse have these conversations, you see each other’s viewpoint, understand where they are coming from. You tend to come closer to being on the same page, hopefully, and eventually, both aligned with the same financial goals.

Now, this won’t happen overnight. But the critical piece is having these conversations regularly, where you are open & honest about the math and what you want. Over time these conversations will get easier, less filled with angst or charged emotion. And if you can nail this “big thing” (aka money in a relationship), then you are well on your way to your Golden Anniversary!

I’m sold on the benefits of budgeting, where do I start?

I’m so excited for you! Your first step is to just learn for a bit, and absorb information like a sponge! In the beginning, it’s hard to just jump in, as you don’t know what you don’t even know yet. Find some money guru’s and absorb their content, read blog posts, listen to podcasts and join some money-minded Facebook groups.

Pretty soon, you’ll need to pick a budgeting method, track your expenses, write up some financial goals, follow a debt payoff strategy, and start saving.

Just know that the budgeting process is a curvy road, there is progress and there are setbacks. But for effective budgeting, you just need to keep at it, adjusting and tweaking as needed. The budget process is just that, a “process”, you’ll do great when you find your groove, and a great place to start is here: Your Ultimate Guide on How to Budget.

While I’d be very honored if you decided to use my free budgeting forms (I worked hard on these, and they are top-notch!), you can grab any of these free budgeting templates here; I’ve gathered 50 free budget templates!

How many people actually budget their money?

If making a household budget is such a big thing, then everyone would be doing it, right? Well, not necessarily. The most recent Gallup poll on the topic (which, sad to say, was 2013) found that only 30% of Americans make a monthly budget. YIKES, that’s not a lot.

Debt.com has done a more recent poll “Eighty percent of Americans told Debt.com they’re on a budget – compared to the last two years when 70 percent answered “yes” to the same question.” So that’s a more encouraging statistic (yet, still very informal and not official).

With American debt figures on the rise, revolving debt (i.e., credit card debt, which is what we’re mostly talking about) “set a record of about $1.1 trillion in February 2020″ (pre-pandemic). In January 2021, it fell 12.2% to about $965 billion”. According to The Balance.

While we are trending down, which is good, $965 billion is a staggering number.

That being, many Americans want to know, what’s the best way to get out of debt? And the answer is to budget your money.

BUDGET. YOUR. MONEY.

Really, all caps? Is that necessary?

Ummm, yes. Yes, it is. BUT while that figure is impressive, it’s not compelling enough; it’s not visual enough for most. So let’s go over the top 10 benefits of budgeting your money.

At the end of the day

I know “budgeting” isn’t sexy, but trust me, the results can make your heart go pitter-patter, especially when you step off the plane at your palm tree bucket list resort.

Yup, you paid for your trip in cash, no worries about a huge bill coming up to bite you. Yes, it may have taken you a bit longer than you wanted, but hey, you got here on your own power, and you can be damn proud of that! And that’s one of the most significant advantages of budgeting, the pride you feel, knowing that you did it!

Articles related to advantages of budgeting:

- The Essential First Steps with Budget Planning (it’s a must-do!)

- The #1 Thing You Need to do to Dump Your Financial Stress

- Budgeting 101 – The Straight & Simple Guide

Excellent reasons to start budging! I’m an economic person and have been budging in periods when I have had less money, but I really should get started again!

Yes, start now and start budgeting for things that really add to your happiness (not just things that add convenience).

Thanks for the post. So much goes into budgeting money wisely. This can be a ready reckoner

So glad you liked it, thanks for stopping by!

Great reasons..I esp. agree with #3 and #4.. and I hate surprises!

I hate surprises too! Unless it’s a surprise donut 🙂

I never considered myself a “shopper” before I took a good hard look at my budget. When I did, I realized that just because I didn’t go to the mall, it didn’t mean I wasn’t spending my money on ridiculous purchases every month! Great article with awesome points!

You’re totally right! I don’t consider myself a “shopper” either as I never go to the mall, or buy clothes, but I am certainly a grocery “shopper”, which I never before viewed in the same light. Our minds are funny things.

A few years ago I started using a budgeting app that allowed me to input monthly expenses and quickly show me what was left over as I logged purchases into the app. This was the one thing that helped me because you can see it in real time, otherwise it’s pretty easy to “forget” all those unnecessary amazon purchases.

Yes, seeing your progress (or lack of) in real-time is great! You can then correct & shift on the go to help you still meet your current spending & savings goals!

I love this post- you are spot on! So many people think that making a budget is restrictive, but it’s really about being present, gaining financial freedom, and reaching your goals. Thanks for sharing!

So glad you liked it Erin! Yes, budgeting isn’t restrictive at all, it’s just planning on how you want to spend your money! It’s a mindset shift.

learning to budget and how to keep track of my finances was one of the most useful lessons I have learnt in life. Once you start to keep track of how much money you spend and where, you start to tighten up and use money more wisely. Long term goals become more important than the short term buzz of mindless spending. Great Post.

I love how you worded this, “long term goals become more important than the short term buzz of mindless spending!” SO TRUE!

I love this post. I think sometimes we might start budgeting with all the right intentions but end up slipping up here and there. You are right, it is a progress and we should perhaps allow for setbacks rather than feel defeated!

Yes! Budgeting setbacks are totally normal, and we learn our best lessons when they happen the hard way. So take the setback, learn from it, and move forward, it will be fine!