How to Use a Finance Bullet Journal to Make Managing Your Money More Fun

Here are the 5 benefits that come from using a finance bullet journal – and how you can start today!

Author: Kari Lorz – Certified Financial Education Instructor

I am loving all of the customizations, creativity, and endless possibilities that can come from using a bullet journal.

It’s only a natural next step that I use this fun tool with my passion – personal finance. Even though I love budget printables and budget planner notebooks, I know that they aren’t the right fit for everybody.

That’s where the magic of the bullet journal comes in; you can create the exact layouts and pages you need to help you successfully manage your finances. So let’s dig into how you can set up your own finance bullet journal.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is bullet journaling?

That’s the amazing part about BuJo’s; they can be precisely what you want and need them to be. They are part planner, diary, to-do list, journal, calendar, and more.

The creator of the bullet journal method, Ryder Carroll, says this method will help you live a more productive and meaningful life. In fact, Vogue calls it “KonMari for your racing thoughts.” And that sounds like a lifesaver, refreshingly so.

Newsweek reports that our brains average around 6,200 thoughts a day. No wonder we get overwhelmed, suffer decision fatigue, and then default to avoidance. And that’s where the BuJo comes in. It helps you organize and plan out those thoughts in your life.

Bullet journal ideas for finance spreads

There are so many different ways you can use a BuJo for your finances, let’s go over some of the best bullet journal ideas for personal finance.

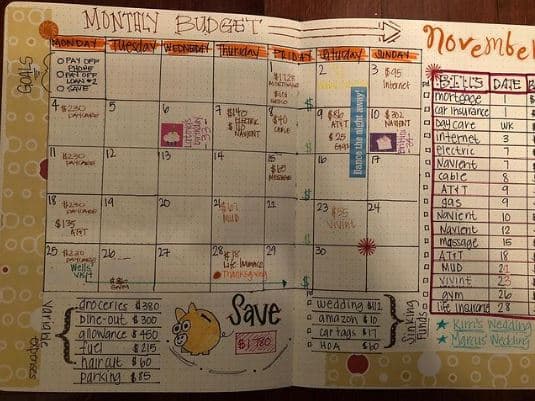

- Monthly budget tracker

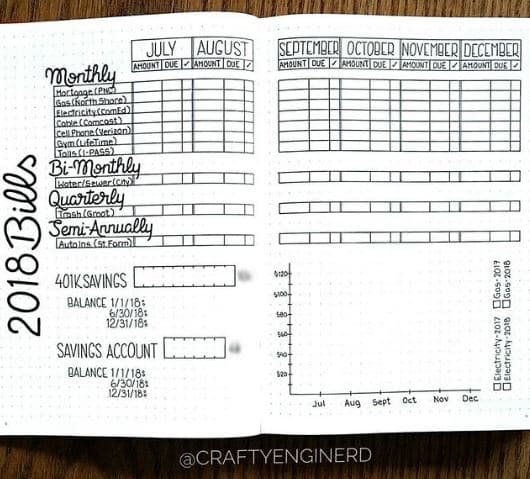

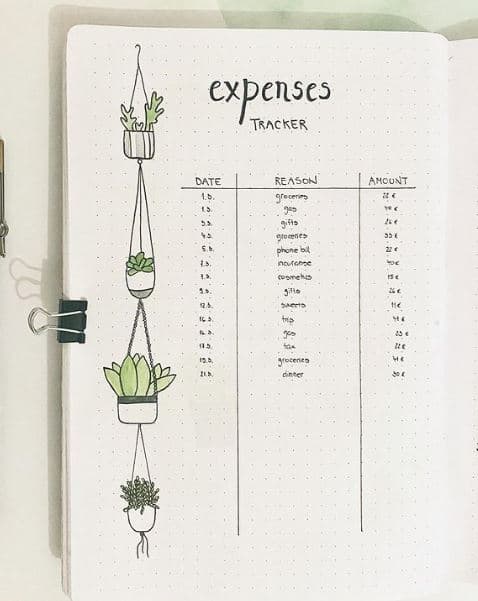

- Expense tracker/ spending log

- Savings tracker– use these to get some ideas

- Financial Goal spread & bullet journal inspiration page

- Bullet journal debt tracker

- Monthly bill tracker/monthly expenses

- Habit Tracker – spending habits (making own coffee, not eating out, etc)

- Savings challenge spread

- Emergency fund log

- Income tracker

It may take a bit to initially set these bullet journal layout ideas up & running, but once you do, it will be easy to maintain them. If you’re not quite sure which spread you need, then start with the basic bullet journal budget tracker.

Yet, if your goal is to spend less money, then go for a spending tracker and a savings tracker. Then once you have those spreads nailed, you can start layering other BuJo layouts in.

Now that we know what we can do with a bullet journal money tracker, let’s go over a few basics to be sure we’re all on the same page.

Bullet journalling basics

Writing by hand takes time, and your stream of consciousness doesn’t always make sense. Insert rapid logging, which is the language that you use in your BuJo. It’s how you capture thoughts in a more streamlined way.

Bullets are short-form sentences paired with symbols that visually categorize your entries into – Tasks, Events, or Notes. That’s the base of rapid logging.

I know that I struggle a bit when things are too “open for creativity” I like a starting structure, get to know that framework, practice a little, and then I can take off from there.

Framework of the BuJo

According to Good Housekeeping, which interviewed BuJo creator Ryder Carroll, “Every bullet journal should include these collections in the following order:

- Index: This section is at the front of your notebook and serves as a table of contents with page numbers to different collections and a symbol key that you update as you go.

- Future Log: This four-page spread is a year-at-a-glance calendar with future events, goals, and long-term tasks. Add birthdays, travel plans, and major holidays.

- Monthly Log: This two-page spread includes a calendar with a bird’s-eye view of the month and a task page with things you want to tackle during the month.

- Daily Log: This is your day-to-day to-do list.”

These are the backbone pages of your BuJo. You add in your financial tracking pages to this, in addition to pages like…

- Books to read

- Habit tracker

- Wish list

- Short-term and long-term goals

- Things you want to try – food, workouts, travel destinations

- Gratitude practice log

- Affirmations and inspiration

- Financial vision board

Symbols used in bullet journaling

As you fill up your pages, pick the layout and purpose, and then use symbols to log your entries. It’s faster, cleaner, and simpler to record, read and organize.

- Tasks: •

- Events: O

- Notes (facts, ideas, and observations): –

- Priority: *

- Inspiration: such as mantras, insights, and ideas- !

Bullet Journalling process

Writing out the initial pages sounds fine, but I became stuck with how it would all flow in the beginning. I understand the initial mechanics, but how would it work on an ongoing process. I love to see a process in action, so here are two great videos that show you how it all works.

The straightforward way to bullet journal

This video comes straight from the official Bullet Journal Company, so it’s safe to say this was the original intention on how to do it. Yet, it’s very basic (no insult intended); it’s just very straightforward and simple. WHICH may be precisely what you need to get everything out of your brain and organized. If this isn’t your jam, then no worries, the 2nd video will probably be your style.

BuJoing for the creative mind

Now, this is where we get to have a lot of fun with bullet journaling. The video is from 2019, but everything is applicable no matter the year. I love her creativity and the multitude of ways that she uses it!

Making your BuJo fit YOU

As every avid bullet journalist knows, you need to make it “yours.” That means making it to your style. Use your favorite colors, and fill it with money affirmations and budgeting quotes to inspire you!

Get a bunch of stickers, and some nice pens (see below for cool examples), get some stencils, etc. Just do something to make it fit your personality & style (this way, you’ll be more likely to use it)!

Bullet journal supplies

Now that you’re all pumped up to get organized and be the most productive you ever, you need to get your tools together. You don’t need a lot of fancy things, just a journal and a pen to start. You may find you want to get the extras to let your personality shine and ideas flow in the way you want them to.

- BEST-SELLING HARDCOVER JOURNAL: This medium 5.7 in by 8 in dotted notebook features durable and water-resistant vegan leather cover, rounded corners, 160 pages, inner expandable pocket, sticker labels, ribbon bookmark & elastic closure band.

- VIBRANT COLORS: Smart Fineliner Color Pens Set 18 Unique Colors, 0.38 mm Fine Point Colored Pens, With water-based ink, Minimal Bleed Thru Ink, Assorted Color Fine Tip Marker Pens. Perfect as Journal Pens, Planner Pens, Journaling Pens, Calligraphy Pens, Cool Pens, Cute School Pens, Colored Pens, Aesthetic Office Pens, Teacher Pens, Drawing Pens, Crafts & Art Supplies, and Planner Accessories.

- Boost Your Productivity: Design your own day with the reusable ZICOTO journal stencil set; the journaling stencils perfectly align to 5mm dot grid journals & are also the perfect size for most organizers and notebooks

- Colebrook, Helen (Author)

- Amazon Kindle Edition

- Bullet Dotted Journal Set with the most bonus : Feela notebook set with 1 teal Bullet Dotted Journal Notebook, 15 colors Fineliner pens,5 Pieces of Reusable Stencils,6 Sticker Sheets,6 Washi Tape set,1 Black Pen.Unbelievable Abundant and Intimate!

What if using a bullet journal just isn’t for me?

I hear you, sometimes, the pressure to be creative is too much. If you like the idea of a budget planner but want one that’s already structured, then check out 15 of the Best Budget Planners to Help You Build Your Financial Empire.

These are all preformatted budgeting binders that can do the same thing as a BuJo. There are lots of options, so be sure to read the pros & cons for each one.

5 Massive benefits of a finance bullet journal

One of the main reasons that I love the idea of having a finance bullet journal spread in your everyday BuJo is that it’s front and center, right along with all the other information that’s important to you. I want to clarify, it’s not its own journal, it’s part of your regular BuJo, and that’s key!

1. It keeps your finances front and center

When you look at something daily, you begin to see trends, and you become more involved. As the saying goes, “where consciousness is, action follows.” And since ignoring our finances is a common problem for people, this is a great way to encourage yourself to become more involved.

Where conciousness is, action follows

unknown

2. Bullet journal finance tracker makes your finances simpler

If you get easily overwhelmed when looking at financial papers, then a BuJo can be a game-changer. You only put information on there that is key to you. Now, you can’t just leave out the actual hard numbers (aka your debt figures). You can, however, leave out small details or change the layout so that the info makes more sense to you.

3. Using a BuJo for your finances makes managing your money more fun

When you BuJo, marking up the pages with colorful markers, using stickers and washi tape is all part of the process. You get to let your creative side mix in with more traditionally boring topics (i.e., math).

Now, I think running numbers is fun, but I know that I’m in the minority. So anything that makes it more fun for you and gets you to interact with it in a more positive way is a huge win! It doesn’t matter if it’s a bullet journal bill tracker, a money challenge, or a savings goal spread. If you like it, you’ll use it!

4. You can see your whole financial life in one spot with a finance BuJo

When you manage your finances, you have to look in many different places to find the info you need. Your bank accounts, your credit card statements, your retirement accounts, your goal planner, etc. All that work takes time, and it becomes tedious.

When you use a BuJo for a financial tracker, you compile all that info into one spot, so you can quickly see your complete financial profile. Seeing the whole picture vs. scattered sections clarifies where you should focus, and maybe see trends that you wouldn’t otherwise notice.

5. Writing things down in your finance Bullet Journal makes it more real to you

It’s not news that writing something down (vs. just looking at information or even typing it), you remember it better. When you write something, you are engraining it on a deeper level in your brain (consciously and subconsciously).

Forbes reports that “Handwriting increases neural activity in certain sections of the brain, similar to meditation” It stimulates creativity and reinforces the feel-good receptors. It creates neural pathways to what you’re writing and your subconscious. So if you’ve previously had a hard time remembering money details, then this is an excellent tactic for you to try!

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

At the end of the day

Managing your money should make you excited, and I know that standard financial papers can be as exciting as plain instant oats for breakfast. Yes, it’s good for you, but you’re never excited to eat it.

Using a bullet journal for your finances brings the two sides of your brain, the creative and the analytical, together. This makes managing your money more fun, and when you have fun, you’re more likely to look at your finances more often, and when you look at the information more often, you think about how to do things better/differently… and on and on and the cycle continues…

Soon everyone will be dreaming about managing their money! #nerdsunite

Articles related to making your own finance bullet journal:

- The Best Budgeting Tips for Beginners – 10 things that you need to know!

- Budgeting 101 – The Ultimate Guide

- 15 of the Best Budget Planners to Help You Build Your Financial Empire

- 10 Easy Bullet Journal Savings Trackers (That Anyone Can Do)!

- 10 Easy Bullet Journal Expense Trackers to Help You Slash Your Spending

- Your Perfect BuJo Budget Spread!

I have tried to keep track of my finances with spreadsheets on the computer, but my layout is very basic and dry and I procrastinate a great deal about going in to update my information. A bullet journaling is calling to me! I don’t need a lot of fancy flourishes, but I think a bit of color and a slightly different layout might be all I need to stay consistent.

Sorry that you’ve been struggling with Excel, sometimes programs make it seem very dull and tedious. But a journal is a lot more fun, I hope you like it!

I am so horrible at money management and being organized. This post definitely motivates me to get my act together and start tracking my finances. Thanks for showing me how to make it fun and providing all the free templates!

You’re so welcome Anaiah! Yes, money isn’t fun for everyone, but you can always find a way to jazz it up.

I love this article! Thank you so much for sharing! My husband and I have been working hard to pay off debt but staying organized has been a challenge. I am definitely going to implement some of these strategies.

You and your husband will do great! Just keeping going, and you will get there!

what a great informative post. I admit I’ve never used a bullet journal before, but my plan for this year was to be more organized in life and in finances. You’ve done a great job outlining why a bullet journal will help both those things. Thanks!

So glad you liked it! Getting organized can be intimidating for sure, but after you start you’re so glad that you’ve done it!

Oh I love journalling and planning. Recently created a new Google sheet to keep track of everything and loving it! I soo after with you, it’s not just about spending and earning… It’s also about managing and tracking

Ohhh I love excel sheets! Especially for planning and tracking, so easy to do with dollars (because it adds and I’m horrible at math)! 🙂

You have explained bullet journal quite extensively. I also maintain a finance journal, nothing decorative just the basic. I am also into different types of journaling, check my blog out if you feel like?. Thanks for sharing.

Thanks so much! I too like a basic journal with minimal flourishes, it’s just more my style. And hey, no one is grading us on our bullet journal aesthetics! 🙂