Ultimate Budget Categories List for a Foolproof Budget

Here are 101 budgeting categories so you never forget a budget line item ever again!

Author: Kari Lorz – Certified Financial Education Instructor

Now I know that sitting around and writing out a budget categories sounds about as thrilling as watching paint dry. So I made a budget categories list for you!

I have gone through and thought of every conceivable thing that you could ever have in your budget so you never forget an expense and blow your monthly budget again!

So let’s dig into all the possible budgeting expense categories and build a failproof budget that works for you and your family!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Recommended budget categories for everyone

While we’re going through 101 different budget categories in this article, there are a handful that everyone needs to make sure that they include, as they are a very important part of your monthly expense list. This list of expenses is referred to as protecting your “four walls.”

- Housing

- Transportation

- Insurance – medical, dental, eye coverage, as well as general healthcare expenses

- Utilities

- Basic food

- Short and long-term savings

- Debt repayments – loans, credit card debt, etc.

How to build your budget categories list

You can easily split your budget into a few sections; budget categories for household and personal budget categories.

Some people really like a lot of detail, and some people like more general budget categories lists. Build your categories for how they work best for you. Just make sure you are consistent with them from month to month.

Instead of writing out your own, you can grab a copy of these but getting your free Better Budget templates right here. Just print and highlight which categories you want to include! There’s also a simple budget sheet for you to transfer them to build your own budget!

Categories for household budget

- mortgage/rent

- HOA dues

- property taxes

- home insurance

- utilities – cable, internet, trash, water & sewer, electricity, gas, cell

- lawn care

- gardening supplies

- home repairs & appliance replacement

- tools & supplies

Budget categories personal use

- makeup

- hair products

- hair cuts

- vitamins & supplements

- clothing & shoes

- exercise

- self-care activities

- hobby stuff

- side hustle supplies & costs

- fun money

Budget categories for kids

- clothes & shoes

- haircuts

- school supplies

- school lunches

- daycare

- lessons & clubs

- summer camps & programs

- fees & registrations

- subscription boxes

- babysitters

- fun stuff – toys, art supplies, hobby stuff, books

- Holiday stuff – Easter outfits, Halloween costumes, Christmas pictures with Santa, etc.

Did you know that kids can budget too? Yup, experts agree that you should start teaching your kiddo about money concepts as early as 5 years old and then progress to budgeting. Here are some great free printables to help teach your kids about budgeting.

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

Budget categories list for medical care

- health insurance premiums

- health insurance deductible

- prescriptions

- eye care & glasses

- dental & orthodontics

- co-pays

- first aid supplies

- medical equipment

- therapy

- life insurance

Budget categories for work

- uniform or professional clothing

- dry cleaning

- lunches & snacks

- coffee

- transportation & parking fees

- professional fees & licensing

- after-hours events

- work equipment, tools & supplies

Budgeting categories for transportation

- gas

- car payments

- car insurance

- toll road fees

- public transportation costs & passes

- car repairs

- regular maintenance – oil changes, services, new tires, etc

- parking fees

- car registration

- DMV fees

- DEQ fees

- Hobby transportation (i.e., bike costs, etc.)

Budgeting categories for family

- basic groceries

- splurge groceries

- restaurants & fast food

- meal kits

- subscriptions – Netflix, Disney+, Amazon Prime, etc.

- household supplies – cleaners, soap, paper goods, etc.

- tax prep & legal fees

Budget categories for pets

- purchase price of pet

- veterinary care

- lessons & training

- licenses

- pet food & vitamins

- toys, cages, etc

- grooming

Budget categories list for gifting

- birthday presents

- anniversary presents

- holiday presents – Christmas, Easter baskets, Valentine’s Day treats, Halloween candy

- graduations

Budgeting categories for events & fun

- family reunions

- holiday BBQ’s

- Christmas events

- spring break vacations

- summer vacations

- winter break vacations

- weekend getaways

- day trips – entry fees

- concerts & festivals

- airfare

- trip insurance

- road trips – gas, snacks & supplies

Don’t forget to grab one of these free vacation budget templates to help you plan your dream vacation!

Budget categories for savings

- retirement contributions

- emergency fund

- sinking funds – vacations, home repairs, holidays, etc.

- college fund for kids

- charitable giving

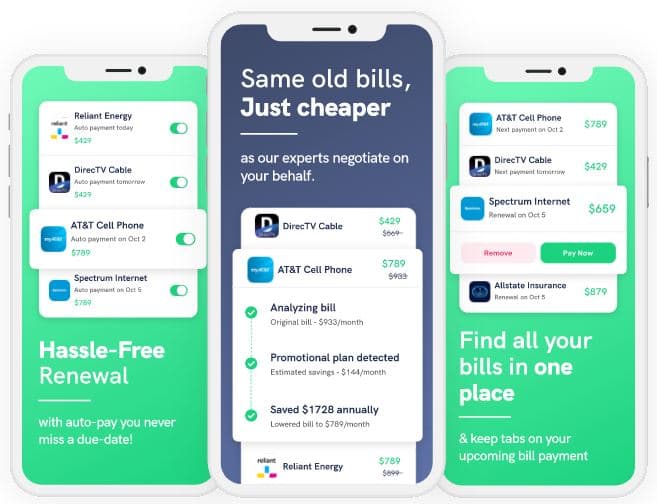

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

Budget categories for debt

- minimum payments

- fees & charges (i.e., late fee, overdrafts, etc.)

- personal loan debt

- student payments

- HELOC repayment

- credit card debt

- car debt

Don’t forget that you can grab all of these bullet points printed out (and a budget worksheet to lay it all out in) and ready by grabbing your free budgeting templates right here!

Holy cannoli! That was 101 budgeting categories list! Whew!

Why you need budget categories

Everyone’s financial situation is different, and what makes sense to one person may not make sense to you. So you must build a budget that works for you because if it’s too complicated or not really applicable to you, you may end up quitting on your budget. Neither of us wants that!

The main reason for going through this monthly budget categories list is to help you remember what you spend/buy. There’s nothing worse than building what you thought was the perfect monthly budget and then realizing that you forgot 8 different irregular expenses.

Then, you totally busted your monthly budget, got pissed off, then depressed, and are tempted to quit.

Seriously, when I started budgeting, I forgot so many different things (mostly periodic expenses, such as the every 6-month auto-draft type), and it made me so mad at myself (that’s the worst kind of mad!)

Besides, having a specific set of budgeting categories allows you to measure month-to-month how you are doing, see trends, and course-correct if need be.

Budgeting Tip – be sure to log your purchases and the cost soon after buying it, so you still have time to adjust during the month. If you get too far behind logging stuff, you may find you’ve already spent everything allotted in that budget category.

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

How to put these budgeting categories into your monthly budget form

As I said above, all of these bullet points might be overwhelming; I get it. The good news is that there are many ways to budget, let’s dig through a few of the top methods.

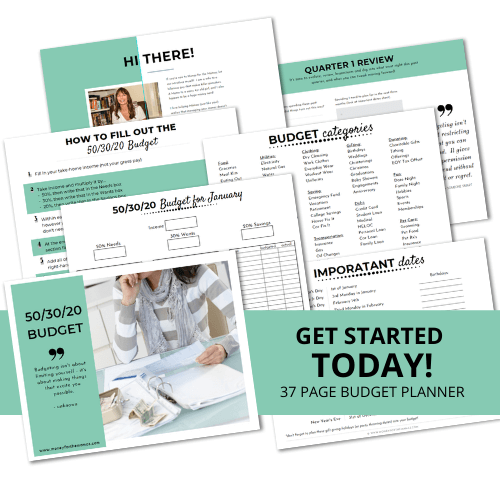

Simple budgeting method – 50/30/20

In that case, you may want to stick to a simple budgeting category list, say maybe 10 or less. This would work best with a flexible budgeting method, such as the 50/30/20.

This budgeting method has three main categories

- needs = 50% of spending – (i.e. housing, utilities, etc)

- wants = 30% of spending – (i.e. discretionary spending – aka personal budget category)

- savings = 20% of income gets saved – (all savings goals)

If you want to see it laid out (I’m a visual learner, so I like to “see it” to help me understand. You can see it here.

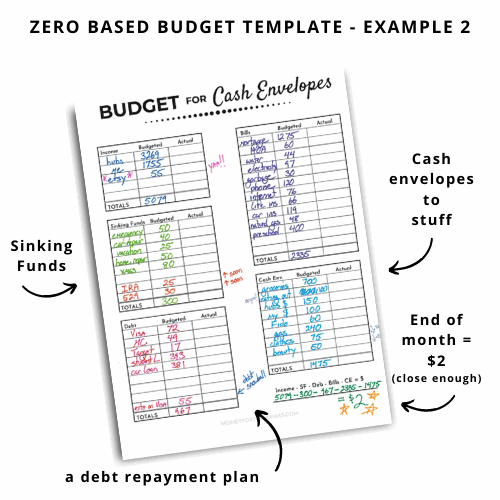

More detailed budget catergories – zero based budget

Sometimes people want to plan for everything. There’s comfort in having a detailed & strict plan. One of the most popular budgeting methods is the zero based budget. This is where you take your income, and subtract every single expense until you have $0 leftover. You are giving every single dollar a job to do.

Dave Ramsey has popularized this method (and I use it myself). Yet, Dave gives some good advice on how much you should spend in each of your main budgeting categories, which is helpful to know. Here’s how he breaks it down.

- Giving: 10%

- Saving: 10%

- Food: 10-15%

- Utilities: 5-10%

- Housing: 25%

- Transportation: 10%

- Health: 5-10%

- Insurance: 10-25%

- Personal Spending: 5-10%

- Miscellaneous: 5-10%

If you want to dig into the details be sure to check out the full breakdown of his budget list.

Irregular expenses

When filling in your budget worksheet (or in your budgeting app), don’t forget about the irregular expenses; you know those once every 6 months, or once a year type of spending. Think Amazon Prime subscription, Annual HOA dues, etc. Those are typically larger charges that can throw your monthly budget out of whack in an instant!

If you buy stuff for work and then get reimbursed for it, you may need to float that business expense for a month or two. So be sure to add a business expense category to your budget spreadsheet. Just be mindful of what you buy, and complete your reimbursement claims regularly.

Budgeting categories FAQ

How many categories should be in your budget?

There’s no magic number for everyone. You want to be sure to include everything but not have so many categories that you get overwhelmed. Start by covering your four walls (housing, utilities, insurance, basic food, transportation, savings and debt repayments) as a must-have. Then build out some personal spending categories that suit your household monthly expenses.

What are good budgeting methods?

The best budgeting method is the one that you will stick to for the long haul. So that could change from person to person. Some popular ones are…

– 50/30/20

– Zero based budget

– Budget by paycheck

– 30 30 30 10 method

– Half payment method

At the end of the day

I know I just delivered a ton of items on this monthly budget category list, and you absolutely shouldn’t use all of them (too overwhelming). Just choose the ones that make the most sense for your situation and build a successful budget.

The biggest benefit of doing this is that you plan ahead for expenses, then nothing comes up unexpectedly, throwing your budget completely off track! Because when that happens, you either go into debt for the expense or take money from your Walt Disney World vacation fund! GASP! Anything but that!!!!!

Articles related to Budgeting Categories List:

- How to Save Money Like a Pro with These Sinking Fund Categories

- Budgeting 101 – the Straight & Simple Guide for Beginners

- 5 Printable Budget Planners That Can Save Your Finances (and Your Sanity)!

- 50 Free Budgeting Templates (Download Your Perfect Budget Now)

I like your money management strategy. I thought I was doing well with controlling my expenditures, but I learned from you that I should set more detailed categories. Thank you for sharing, I learned a lot from you.

Thanks so much for sharing, I’m so glad you found some useful new info! There is so much to learn about money, I am sure you are doing great!

This is a great list! I’m going to have to check my budget and make sure nothing is missing!

So glad you liked it Erin! Thanks for stopping by!

PS – I’m sure your budget is great!

Great post!! Thanks for sharing ?

So glad you liked it Ally!

I do love your three main budget categories! We do pretty well with our budget but my categories are nowhere near as detailed as yours. We tend to say contribute to savings first, then pay needs and anything left over can go to wants. Hopefully your categories can give me a little more structure!

Saving money first is the best thing that you can do for yourself! Great job!

What a very helpful list thanks for sharing

You’re welcome Jimmy, thanks for stopping by!