The Essential First Step with Budget Planning (it’s a must do!)

Budget Planning Must Dos – Part One in Your Ultimate Guide on How to Budget Series

Author: Kari Lorz – Certified Financial Education Instructor

This is Your Ultimate Guide on How to Budget Series. Where Iay out every single thing that you need to know to successfully budget your money! No more guessing or wondering if you’re doing it “right”, after following along, you will be 100% certain about what you need to do to organize your money!

– Part One: The Essential First Step with Budget Planning (it’s a must-do!)

– Part Two: The Best Budgeting Tips for Beginners (That You Have to Know)!

– Part Three: The Top 7 Proven Budgeting Methods – Your Perfect Fit is in Here!

– Part Four: Yes! Budgeting Can Actually Be Easy (With a Better Budget)

– Part Five: The 10 Most Common (and Costly) Budgeting Challenges That You Will Face (and How to Fix Them)

Let’s start by saying that the word “Budget” should NOT drive fear or anger into your heart! I know that some of you are cringing, some of you may have let a bad word slip past your lips, yet some of you may have said: “Bring it on! I am totally ready for a fresh start!”

Well, good news! Over the next four weeks, I am going to lay it all out on the line on how to finally make a budget plan that works for you and your family! Budget planning, when done correctly, can make you excited about handling your money! Yes, that sounds crazy dorky, but it’s the truth!

In this first post, we’re going to talk about how to get everything set up (in your mind and in the physical world) to get ready to successfully budget. Because you just can’t jump into financial planning and expect instant success. Like an Olympic athlete, you need to get the right tools, a kick-ass coach, and the proper training! But don’t worry, this won’t take four years, as in the real Olympics. ? Budget planning, here we come!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is a budget?

A budget is nothing more than a spending plan. That’s it. It’s not a bad word (although it “may” feel like it at certain times), it’s not a jail sentence, and it’s not an instant path to success with money. What it actually is, is a tool to achieve the desired result, aka more money to use as you want (most likely). There are so many other advantages to budgeting than just more money, think lower stress = more sleep –> a happier you!

It’s just a spending plan. Because you are telling your money where you want it to go (thank Dave Ramsey for this nugget). You are simply saying that,

“I want $___ to go to this, and I want $___ to go to that.”

You need to flip the script on the word “budget” and all the negative connotations that go with it.

You are in charge, and don’t ever forget it! Yes, in the beginning, you may feel like a slave to certain restrictions or expenses. Yet that’s only because you haven’t adjusted your mindset or your spending patterns yet. As online Mogul & guru says…

Everything is figureoutable!

Marie Forleo

We just need time, flexibility, and some snacks to get us there.

I also find that thinking of a spending plan as a pathway to my goals, which significantly helps me be more accepting and more positive. I know that this spending plan that I’ve laid out will help me reach the goals that I have laid out for myself. The spending plan gives me permission to spend money on things that are important to myself, and it eliminates the guilt and fear that come from spending.

People typically feel…

guilt – spending money on things that you know you shouldn’t

fear- wondering if you have enough money to cover the utilities or car payment.

Wouldn’t it be nice to get rid of these depressing and draining feelings & worries? You can! By planning a monthly budget that actually works for you. Remember, you control your personal budget, not the other way around!

Who are budgets for?

Short answer: everyone

Long answer: Everyone that has goals can be helped by having a solid financial framework in place.

Budgets are for people who have goals and dreams for themselves, and for their family!

For example; many goals that don’t explicitly revolve around money are indeed backed by money-based decisions, such as

- owning your own home

- take yearly family vacations

- have a She Shed in the back yard (*sigh*)

- send kiddos to sport or music camps every summer

- help care for our aging parents

- help put our kids through college

Firstly, all of these are great goals! Maybe you have similar ones? Notice that these goals aren’t to “have a gazillion dollars.” Yet you can see how budget planning can help all of these goals happen.

If you’re not quite sure of your own financial goals then be sure to check out this resource which will help you clarify your own financial goals and get started working towards them TODAY!

These goals may not be based on having a tangible “thing,” yet they can only be met by being financially in the positive. This is different than being “rich.” You don’t need to be rich to achieve your goals!

Think about your goals. List them out. Think of…

- 6 month goals

- One year goals

- Five year goals

- Ten year goals

Can you visualize them? Can you tie them back to being financially stable? If the answer is yes, then you need a personal budget!

If the answer is no, then let’s did deeper. Let’s say your goal is “to live in a tiny home out in the country where you can rest & relax, away from all the money-hungry corporate America BS!” I hate to say it, but your goal is a financial goal.

You need the funds to buy your tiny home, pay for utilities, moving it every few years, etc.

You see, even if you are anti-money, you still need it. This is precisely why you need to get a handle on your money now! Because using it will be with you every single day of your life. That’s why learning how to make a monthly budget plan, one that really works is your best step to achieving your tiny home goals. Unless you’re a homesteader and barter for everything with chicken eggs and apples, you need a household budget!

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

Who are budgets not for?

We covered this; they are for everyone.

Despite that fact, The Fool reported, “Most Americans don’t follow a budget. Only 41% of U.S. adults stick to some sort of budget despite the fact that it’s one of the most effective means of tracking expenses and keeping spending in check.”

“That contradiction is not unusual, says Howard Dvorkin, CPA and chairman of Debt.com. Many Americans think they are smarter than their neighbors when it comes to money. “In two decades as a financial professional, I can’t tell you how many people tell me, ‘I know debt is a huge problem in this country, but I thought I could handle it,'” Dvorkin says. “It’s human nature to expect the best and not plan for the worst, so many otherwise smart Americans refuse to budget – because they don’t think they need it.” (PRNewswire) .

So we all know it’s important, sounds like we need to put our big girl panties on and just do it!

Are you ready to learn how to budget?

This may seem like a silly question, but it’s probably the most critical question to ask yourself. There’s no reason to start this process if you aren’t going to take it seriously, or you’re not super committed to your goals. Why waste your time? The budget planning process needs you to be on your “A-game” if you want this to work.

Some of you may feel that you don’t need to budget because no matter what you do, there will never ever be enough money. It’s all gone the moment you get it anyway because the bills are so high. You feel that budgeting isn’t going to change a thing. First of all, I’m so sorry that you have found yourself in a situation where you think there is no hope. I know it seems bleak, a neverending cycle, so to say. There is hope; I promise you there is a way out of it. Learning how to budget (even as a total beginner) , can be the first step to feeling free of your money problems.

There are many resources around this exact thing, but you need to start somewhere, and sometimes you start at the bottom of a hole. The main thing is to stop digging yourself deeper! Start learning! Even if it’s just one hour a day! That’s how I got started!

Once you start learning (from reputable sources), you will find out small ways that add up and can make a big impact on your finances!

Budget planning step one – nail your mental game

Yup, we’re starting here, because the mental game of money is honestly the most important part! You NEED to believe that you can succeed, or else you’re just going through the motions, doomed from day one.

There are two pieces to this puzzle.

Your Money Mindset

Ask any athlete, and they will tell you that the essential part of winning the game is to get your head on straight! With managing your money, it’s no different! Depending on your outlook, you may need to adjust your thought process, because if you are psyching yourself out at step one, you will have a tough time making it to step two!

There are two main mindsets:

- Fixed: basically, you think that you are all that you will ever be. You cannot grow; your traits are a “given” and unchangeable.

- Growth: people with this mindset believe their qualities and traits can develop through work and effort. (hint: this is your goal!)

“If you have a growth mindset, you’re much more likely to be successful. Why? Because you have the drive, willingness, and overall foundation of belief to aim for bigger, better things. If you have a fixed mindset, you’ll find yourself becoming stagnant, without the motivation to achieve anything greater than what you already have. (source)

If you learned one skill, you can learn another! If you learned that one, then that means you can do another, and on and on. People’s capacity to grow and change is infinite, so please don’t limit yourself to being only as “good” as you are right now.

If you believe that you can learn and grow, but your hold-up is with your money mindset, you can read more about the two main types of money mindsets by clicking the link below.

RELATED: A Positive Money Mindset is a Guaranteed Path to Success!

Another way to help reframe your things is to take inspiration from those who have come before you. These budgeting quotes are sure to inspire, even if a little cliche!

Your Goals

Have you ever stopped to wonder about what you really want in life? I’m talking more than just daydreaming. Sitting on a beach at a tropical island sounds nice, but is that all you want from life?

Remember up above, we talked about goals, and that in some way or shape they have their root in being financially stable? (forgot? scroll up, I will wait for you!)

If your dream is to own your own home (many people’s financial goal), then great. How bad do you want it? Because let me tell you, you need to WANT it, and you’re going to have to work for it and save for it. If the thought of working hard for your own home sounds lame, then you need to identify a better goal. I bet there is something that you really want! Something that truly matters to you (not just an expensive handbag kind of want).

If you need some help identifying your goals and getting a strategic plan for your money goals then check out this guided workbook!

You’re going to need to pull on these feelings to succeed. Many people call this finding your “why.” As in why are you even doing this thing? To get your brain wrapped around this and to help you identify your own why, I wrote a very honest piece about my personal financial why in a post. It was my most nakedly honest piece ever, and I’ve reread it 1,000 times.

Sometimes to get inspiration, sometimes to feel all the feels. Sometimes to kick my butt into gear! Click below to check it out and see how you can frame something in your own life to be super impactful to you, which will make you take action and crush your savings goal!

RELATED: You Need to Have “THIS” if You Want to Hold Onto Your Money

Budget Planning: step two – find your tribe!

It’s funny how we’re talking about budgets, which is mainly addition & subtraction, and we haven’t talked about actual dollars at all. And we’re still not. Why? Because you NEED a framework for success! You need a tribe of people and resources that you can count on to help you!

No one got to where they are all on their own! They had people! Steve Jobs had people, and Bill Gates had people, Genghis Khan had people. Yes, military warfare may be a part of your success! You may need to slash some expenses or kill some bills to reach your goal. So an ancient Mongolian warrior & ruler reference is totally applicable.

Don’t limit yourself to thinking of only traditional people, hiring a financial planner may not be in the cards, but there are lots of other great resources to help you build a financial plan.

Things to bring into your life

People to Learn From:

You need people that aren’t only well versed in how to earn & save money successfully, you need people with the heart of a teacher (DRamsey truth in da house again!) We don’t want to people who claim to be helping you but really have self-serving interests at heart (say no to debt consolidation and payday loan companies!). You want people who take the budget planning part seriously, not just quick fixes by putting a band-aid on it!

You want teachers, helpers, and true leaders, and you want experts in what they are teaching! The easiest way to get started on this is to download podcasts from reputable sources. I never intended to be a Dave Ramsey fan club promoter, but it’s hard to argue with his success in helping people that are brand new to learning about money. He gives very straightforward and honest answers (albeit sometimes he might be too direct for your tastes), but hey, no one ever achieved greatness from being coddled, that includes you!

Podcasts are great with helping you learn how to budget because they are free, easily accessible, and can go anywhere with you. You can listen for 10 minutes at a time or binge seasons of content. Other good ones are MoneyGirl, HerMoney with Jean Chatzky, Afford Anything, So Money with Farnoosh Torabi, and so many more. Download a few different people, and see who connects with you and your situation. Remember, you want someone who challenges you to learn and grow!

People on the Journey With You:

Along the same lines of a teacher are people who you can lean on, people who are going through exactly the same thing as you! Trust me; you are not alone; there are thousands of others, right beside you who are struggling with managing their money.

SOAPBOX ALERT: Our Education

Why is everyone having such a hard time with money? In 2018, the average American’s personal debt (not including their house) was $38,000. (source) Which hit a record-breaking $13.21 trillion! yes that’s $13,210,000,000.00

Whoa Mama!

And why? Simply that we as consumers were never taught how to manage our money. You took economics in high school when they should have been teaching us about credit card interest rates and home loans! I absolutely 100% agree that the American system failed us, and it continues to fail us. Sad. So we are left finding out “the hard way” with overdue bills, collections notices, and bankruptcy, not to mention the stress that comes along with it! To read about personal finances teachings in your state check out Champlain’s Center for Financial Literacy Report.

It’s stupid. The collective “we” should be doing better for ourselves and our children. Let’s stop the cycle of ignorance and commit to bettering our future! (end soapbox).

This also includes hanging out more with positive people, they may not be learning about money, but they have goals, ambition, and drive, just like you! Their goal-digging ways are infectious, and you definitely want some of it!

At the opposite end of the spectrum, there are some things and people we may need to say goodbye to, in order to keep ourselves afloat.

Things to cut from your life

Temptation –

You need to be fierce! Remember Genghis Khan? Yup, you need to cut out what is taking you away from achieving your goals!

- unfollow retailers and certain social media influencers that are focused on selling you something (trust me, you don’t need it, whatever it is!)

- delete your credit card info on your devices (make it cumbersome for you to purchase). In fact, delete these accounts!

Negative People –

This one may be tough, because some of these people may be family or others that you feel are even closer. Now they needn’t necessarily be “bad,” but their influence is. You know, the friend that always wants to go out to lunch and shop the afternoon away. Or maybe even your sister, who gives you the backhanded compliment to you for being happy “in your situation.”

You need cheerleaders!

Not saboteurs or doom & gloom preachers.

I cut someone out, it was hard, but it was absolutely worth it. She was a self-serving friend, who only called me when she needed help, she was bossy, egocentric, a bragger, unfeeling toward others, and overall just not nice.

I cut her out. I said goodbye, and I never looked back. Harsh? Probably, but the relief I felt was palpable!

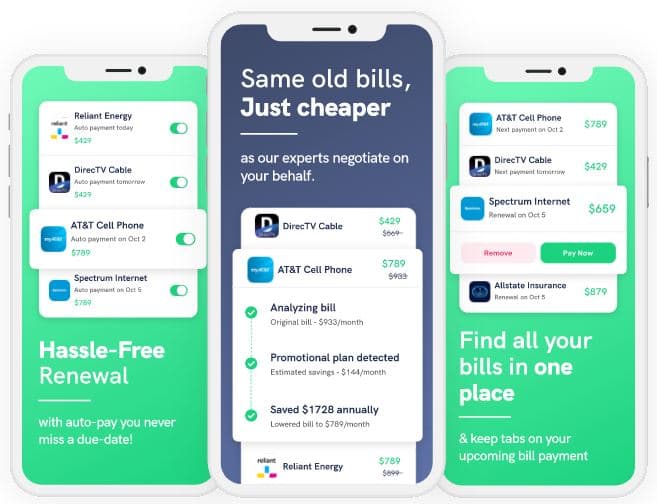

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

At the end of the day

Your budgeting process has to have your mental game upfront in the priority position! It should be the first (and most considered) step in learning how to make a monthly budget and in making your own budget. If you try and skip past this step, you will find yourself slogging through the process, and one day getting frustrated and giving up.

Your goals and dreams are worth giving this process 100% of your attention. When you know your “why” and can feel it deep down in your bones, and you will fight for it.

You will fight for it. Every. Single. Step. Of the way!

This is Your Ultimate Guide on How to Budget Series. Where Iay out every single thing that you need to know to successfully budget your money! No more guessing or wondering if you’re doing it “right”, after following along you will be 100% certain about what you need to do to organize your money!

– Part One: The Essential First Step with Budget Planning (it’s a must-do!)

– Part Two: The Best Budgeting Tips for Beginners (That You Have to Know)!

– Part Three: The Top 7 Proven Budgeting Methods – Your Perfect Fit is in Here!

– Part Four: Yes! Budgeting Can Actually Be Easy (With a Better Budget)

– Part Five: The 10 Most Common (and Costly) Budgeting Challenges That You Will Face (and How to Fix Them)

Budgeting doesn’t have to be intimidating and I appreciate your post explaining this. Can’t wait to see the rest of the series!

So glad you liked it!

Great post, Kari!

We are saving up for building our house and have some major financial goals ahead of us for the next 24 months. Your post is very helpful for budgeting ideas.

Building your own home is so exciting! Congrats on the big step and much love to you during the hectic (and crazy) process!

Some really good advice and tips here that I will use with my own budget planning. Thankyou for taking the time to put this together

You’re so very welcome! Thanks for stopping in!

This is a great post, a budget is really the cornerstone of your financial house. Having the right mindset about why you’re doing it goes a long way toward helping you stick to it.

Absolutely, it’s all about the mind power! Thanks for stopping by!

You did a great job on this. Having a budget has done wonders for us. It’s a great way for me as a mom to see where my money is going. Thanks for sharing!

So glad you liked it! Thanks for sharing!

I definitely feel like negative people are the hardest thing for my husband and I. People try to constantly act like we are inconveniencing them because we choose to eat all our meals at home. We have definitely eaten out some just so people don’t call us debbie downers.

Oh, so sad, no one wants to be a Debbie Downer, I think you’re a rather Super Smart Stephanie!

As an educator, I have always advocated for money management in our curriculum. It’s incredulous that we release unsuspecting young adults, with no real concept of money and budgeting. I like your no nonsense approach to budgeting and agree that without the right tribe and mentality, your budget is doomed.

Much love for the no-nonsense approach! 🙂 Thanks for helping to keep our kiddos on the right path with every lesson you teach!

So much info… yet surprisingly easy to digest. You really break budgeting down into manageable chunks. Every penny in our budget has a place, but I always feel like there is room for improvement. I DEFINITELY need to unsubscribe from some email lists, especially the next couple months. Stay on that soapbox! Definitely looking forward to next week.

So glad you’re excited for next week! I am too 🙂 See you then!

This is a wealth of information! Loved this post and I am looking forward to the others in this series. I couldn’t agree more with you on cutting any negative, toxic relationships. Also, unsubscribing from retailers is something I did about a month ago and I’m so glad I did! I kept a couple that I do buy from every now and then, for the coupons/sales.

It’s funny, I used to looooove Anthropologie, but the moment I unsubscribed I totally forgot about them! It’s a little sad but great! But subscribing for coupons is a smart idea!

I love this budget plan. And I love the idea of a tribe to help you save money, that’s so smart!

Having a like-minded (and goal-focused) tribe is so important! Thanks for stopping by!

I love this guide. Budgeting has always been a huge part of our life as a family but this guide takes it to the next level.

Yaaaa for budgeting! So glad the whole family is a part of it!

I’ve read many budget planning guides and I have to admit that yours was very easily understood. It’s easy to get overwhelmed by the process and sometimes people say things in a way that adds to that fear. But I felt inspired and encourage “I CAN do this!” Thanks for sharing. Looking forward to next weeks post

I couldn’t be happier! You saying that you were inspired & encouraged just made my day! Thanks so much for sharing!

This is such a helpful post for not only budgeting but a healthy money mindset as well! 🙂

Having a strong & positive money mindset can really set you up for success! Thanks so much for stopping by!

Super inspirational article Kari! I’m all about the mindset. That’s the foundation behind my writing and why I’m now 100% Debt-Free. Because you’re thoughts control your feelings which then control your actions. And that leads to your results either positive or negative. So it’s super important to get your mind right first!

Absolutely! Your thoughts control & impact so much (sometimes without you even realizing!) Thanks for reading!

I found this really helpful! Thanks!

So glad you liked it!

Ohmygod yes! Unsubscribe from all the emails because i have made so many bad impulse spending decisions from an email! lol

I love the concept of a money growth mindset, we have it for our mental health, physical health, why not our financial health too? 😉

Yaaaa for the email cleaning! It’s too tempting sometimes so why even go there to begin with! 🙂

Such great tips! Budgeting can be so difficult for a lot of people! Thanks for sharing!

Thanks so much, glad you liked the post!

I agree on unsubscribing to emails from retailers. It can be very hard to avoid them.

Those emails are always so tempting! Yet the moment I unsubscribed, I never thought about them again for a long time!

Thank you so much for this wonderful information that’s much needed in my budget life! I’m just not good at it whatsoever! I’m going to purchase your planners they may help me stay on track! Keep the posts coming♥️♥️

So glad you liked the post! And please do let me know if you found the How to Budget Guide helpful, feedback is always appreciated!