The Best Budgeting Tips for Beginners (That You Have to Know)!

10 Simple budgeting tips for beginners that all the experts agree on – Part Two in Your Ultimate Guide on How to Budget

Author: Kari Lorz – Certified Financial Education Instructor

This is Your Ultimate Guide on How to Budget Series. Where Iay out every single thing that you need to know to successfully budget your money! No more guessing or wondering if you’re doing it “right”, after following along, you will be 100% certain about what you need to do to organize your money!

– Part One: The Essential First Step with Budget Planning (it’s a must-do!)

– Part Two: The Best Budgeting Tips for Beginners (That You Have to Know)!

– Part Three: The Top 7 Proven Budgeting Methods – Your Perfect Fit is in Here!

– Part Four: Yes! Budgeting Can Actually Be Easy (With a Better Budget)

– Part Five: The 10 Most Common (and Costly) Budgeting Challenges That You Will Face (and How to Fix Them)

Everyone it seems has the “secret formula” for personal finance and budgeting success. I’m here to call BS. There is no “one way” to budget, there are lots of ways to budget, and the formula isn’t so secret.

You just need to find the right budgeting method that works for you! Yet, what I can tell you is that there are some specific ways to set yourself up for success. I am going to go through #10 of the best budgeting tips for beginners that will help you be successful with whatever budget method you choose!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

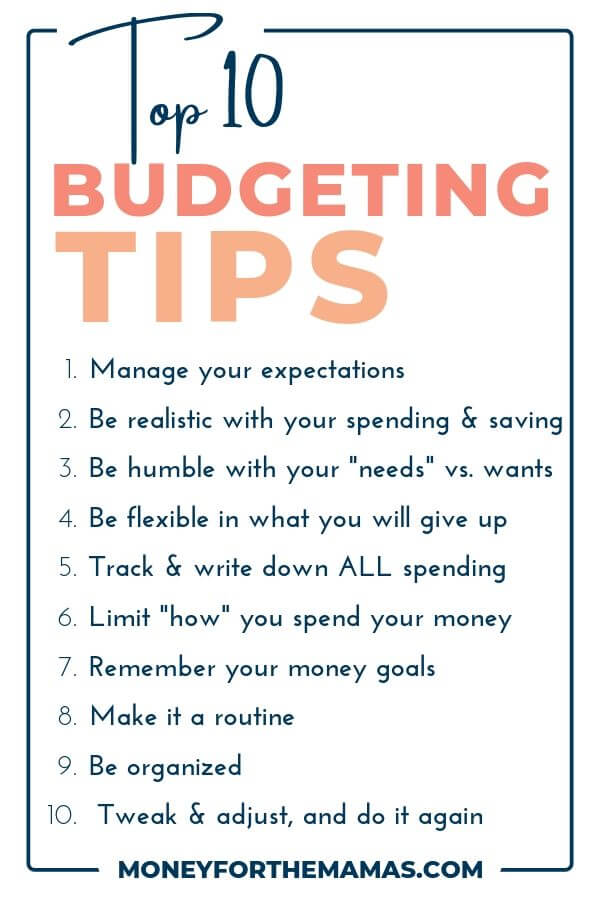

Top 10 Best Budgeting Tips for beginners

1. Manage expectations

I know we talked about getting your head straight in the last chapter, Your Ultimate Guide on How to Budget Series: Part One – Budget Planning, but this small shift is one of the best budgeting tips for you to implement!

This one is tough, as I used to struggle with this a lot. I would say, “This is going to be the BEST XYZ EVER!” and undoubtedly, something went wrong, an unexpected expense, a forgotten bill, etc. I would be crushed.

Yet, if I went into things saying, “This is going to be good, and I may need to adjust or tweak living expenses or increase my income,” then I wouldn’t be so down when things didn’t go well.

Remember, budgeting is simple: it’s addition & subtraction. It’s the execution part (i.e. controlling your spending habits) that is hard. Being mentally prepared to make changes on the fly can go a long way!

2. Be realistic with your spending

In a similar vein to managing expectations, you need to be realistic with yourself about your current habits. You aren’t immediately going to crush your savings goal by tucking away 50% of your income. By all means, try if you want to, but don’t strap your budget down so far that your checking account gets an overdraft fee.

The best way to make sure that you’re realistic with your budget categories is to analyze what you’ve spent the last few months. Try adding up 2-3 categories over the past three months and then average it out. (Don’t forget your irregular expenses like annual fees, and with your variable expenses, always estimate on the high end of things).

The most significant chunk of our extra spending is on food (groceries & eating out), clothing, and entertainment (subscriptions, movies, hobbies).

If you total it up and your math says that you averaged spending $624 in food for the past few months, then you should…

a) Recalculate. Always double-check your math!

b) If you know you go overboard every month eating out, and it would be easy to cut down the spending, then maybe go with $400 as a starting point, as that’s realistic when you started at $624. If you write down $150 for this category, you are going to be in a world of hurt come month’s end and feel horrible about your results.

Remember, the $400 with this budget category is a “starting point,” you’re not tied to it forever, and depending on the budget method you pick and how it calculates, you may need to go down a bit further to help meet your savings goals (like having a full emergency fund).

If you want a good idea of what you should be aiming to spend in each category, then be sure to check out Dave Ramsey’s Budget Percentages, where he lays out his budget & spending recommendations.

3. Be humble

Adding on to being realistic is to be modest with your “wants.” Be objective about what counts as essential expenses and what is a luxury. As much as you like going to the gym, it is not a genuine “need.” Unless you are a professional bodybuilder, and the gym is your office and your paycheck.

You can run for free outside, and you can weight lift for free (Have you seen Rocky IV? He used a huge rock and a wooden wagon to train). Yes, a gym membership is nice, but it’s not necessary.

Necessary:

- home insurance

- phone

- gas/electric

- food

- water/sewer

Not Necessary:

- gym

- manicures

- eating out

- buying books

- Netflix

When budgeting, you list your necessary items first, the things you have to pay for. Then go down in importance. Sad to say, but gyms and nails are down at the bottom of the monthly budget form.

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

4. Be flexible

Your first attempt at budgeting probably won’t be a smash hit. (sorry) This is totally and 100% normal! You will mess up, and learn, tweak something, and try it again. Probably adjust something else, tweak another thing, and try again.

What you need to focus on doing is to keep trying! DON’T QUIT! I mentioned that there are many different methods out there; you just need to find the budgeting process that works for you!

Honestly, the last sentence, “You just need to find the right budget plan for you.” is probably the most important budgeting tip of all.

If it comes down to just not enough income coming in, and too much going out, you need to be flexible on the things you can cut to make it all work. If your partner cuts out his weekly fun money of a $30 poker night with the guys, then you need to be ready to offer up your $45 manicure. It’s a give-and-take process on both sides of the road.

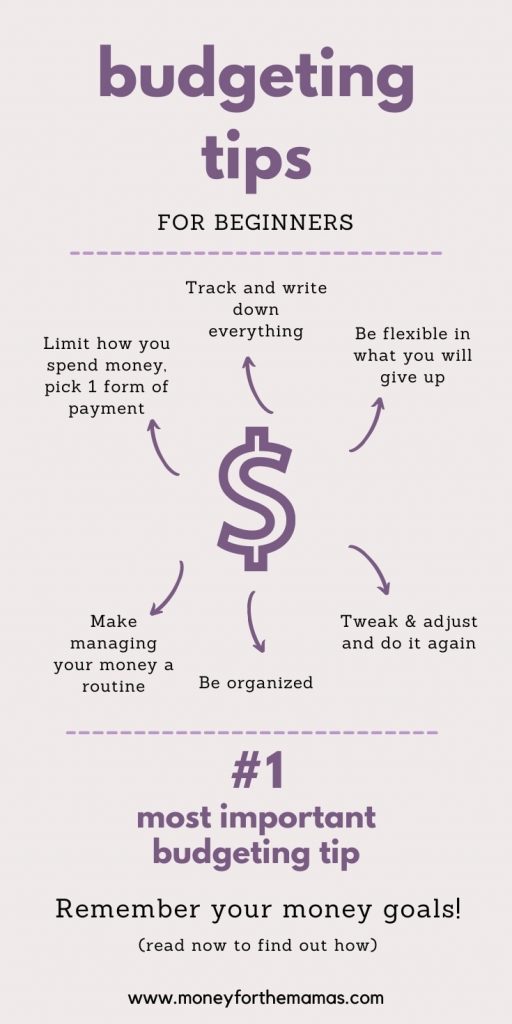

5. Track & write it all down

If you are brand new to budgeting, no matter the budget plan you use, the coach/teacher will probably have you start tracking your variable expenses and fun money, to see where it is going. You don’t want to adjust any spending here; you want to get an accurate picture of what your spending habits are right now.

Yes, you can use a budgeting app to track your spending, like Mint or YNAB. But what the experts don’t tell you is that by using apps you are cheating yourself of really absorbing the info and understanding it.

What should you do instead of using apps? You should handwrite it and keep it in a budget binder or grab a budget planner book. (WTH?) Yup, the act of writing something drills the information down deeper into your brain (figuratively, of course) and helps you process the information and retain it for later use.

If you’re a bullet journal pro, there are some great ways to add some financial spreads to your planner! Here’s how to get started with finance layouts!

If you want to start RIGHT NOW on your budget planning, then you can go over to the shop and grab a printable budget planner. It will take two minutes. Just click and print!

NPR did a review of a study published in Psychological Science, Mueller of Princeton University and Oppenheimer of the University of California, Los Angeles who sought to test how note-taking by hand or by computer affects learning.

“When people type their notes, they have this tendency to try to take verbatim notes and write down as much of the lecture as they can. The students who were taking longhand notes in our studies were forced to be more selective — because you can’t write as fast as you can type. And that extra processing of the material that they were doing benefited them.” (source)

Now I know that note-taking is different than writing your latest expense down on a sheet of paper. But trust me, there is something visceral about writing down that you spent “$76.47 at Taco Joe’s Margarita House!”

Am I trying to shame you? No. I love tacos (guacamole even more). Going there is totally okay, just as long as you have the funds available in your budget category!

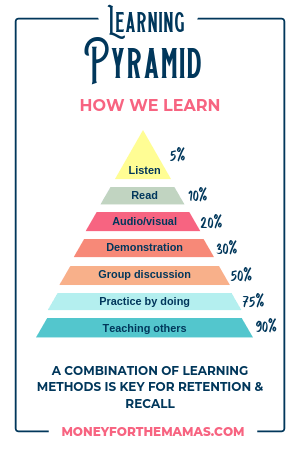

How we learn best

It’s somewhat similar to the concept of the learning pyramid from old-school education. Some may argue that the learning pyramid is out of date, but honestly, it just makes sense. The more you do something in different and more engaging ways, then the more you process, retain, and can recall the information and use it to make better decisions going forward.

But handwriting it, really gets you to think & process your discretionary expenses, did I need that? Could I have gone without? Was it worth it? What can I do differently next time?

Sometimes people even get to the point where they don’t buy anything because they don’t want to write it down. Maybe they felt guilty about the purchase? Perhaps they knew their money could be better used somewhere else. Whatever the reason, I would consider it a win using this easy budgeting tip!

Don’t worry; you don’t need to handwrite everything down forever. Once you get through the beginning, have a good rhythm, and aren’t impulse buying on every day that ends in “y,” you are totally good to use a budgeting app if you want.

If you want to see some of the more obscure skills that you need to learn to be a good budgeted, then check out this best budgeting skills post. The “skills” may surprise you!

What do I do for my family’s budget? I have been budgeting and tracking the same way for the past four years. I use Excel, it’s what makes sense in my brain, and I’m successful at it. But when I started, it was with a pen and paper.

To help you get started, I have created a super simple, one-page budget template and accompanying budget worksheets that will take care of all your budgeting needs. It’s very straightforward, easy to use, and doesn’t take a lot of time. The main monthly budgeting template is broken into sections…

- Monthly income – W2 work, tips, rental income, irregular income, etc

- Savings – both small and large financial goals

- Non-negotiable expenses – insurance, rent, utilities, etc.

- Debt payments- credit card debt, student loan debt, car payments, etc

- Negotiable expenses – fun money

That’s it. It sounds easy because it is. Click here to grab the super simple personal budget template.

6. Limit “how” you spend your money

One of my favorite acronyms in the world is “KISS.” Keep It Simple Stupid. The simpler you keep things, the easier it will be to track & monitor your money.

For example, if you take cash out of the ATM, use credit card #1, and use credit card #3 for another thing, use PayPal and then Venmo, I’m sure you can see how easy it is to lose track of your spending.

Do yourself a favor and pick 1 (or at max 2) ways for your money to flow out of your bank account. The best method for people who are new to budgeting and sometimes overspend is to use cash envelope system. Because when the money is gone, it’s gone – no more cash.

If you are good at not overspending and want to keep better track of your money, then pick a single rewards type of credit card. The best option (aka the one that you will most likely use) is a straightforward cashback credit card.

These next ones could be considered easy budgeting tips for beginners, but their more like hacks. Hacks are “a strategy or technique for managing one’s time or activities more efficiently.”

Budgeting Hack #1: For partners, some credit card companies allow you to have one account, but with two different credit card numbers (one for each spouse), so when the bill comes, it’s already split up by each person’s card. We have USAA, and ours does this automatically. It makes bill reconciling super easy. A huge time saver!

Budgeting Hack #2: Or maybe you have two credit cards (always a good idea, in case something happens to one card). Put all your regular expenses like utilities and insurance on one card, and then all your discretionary spending on the other card. Then when you pay your bills, it’s already all segmented out for you. Another big time saver!

7. Remember your financial goals

When writing out your budget, and you’re finding it hard to trim down your spending, remember your money goals. In fact, remember your goals in general!

I want to draw attention to the fact that this is “personal finance”, for which they should be extremely personal! Your financial goals should be your own, not someone else’s!

Maybe you’d like to read more books (free from the library, of course). Well, if that’s one of your goals, then perhaps you can cut your cable/Hulu/Netflix subscriptions.

Cutting these line-item expenses would get you closer to your goal of reading more books (because you’re not on the couch binge-watching anymore). Now you’re now using the money to help you save for a down payment for your first home. BAM! Two goals!

I know that saving is hard, and not very sexy, but it’s the best skill that you can cultivate! Yet, the road is hard, we all fall off the saving wagon from time to time, but you need to get back on! Here’s some saving money motivation to help you get back to it!

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

8. Make it a routine

Routines are probably the most boring yet most effective way to get good at something. Yup, truth. Routines and habits are how you get good at something! You practice!

Daily:

- minimum – put all your receipts in one place

- A+ student – log your expenses in your spending log/tracker/budget planner

Weekly:

Spend 20 minutes logging purchases and looking over what you spent money on the week before. Don’t let this pile up for weeks; if you have questions, you’ll have a hard time remembering the details.

Note any slip-ups or overages, think about why you overspent, and come up with a game plan for next time a similar situation rolls around. Give yourself some grace and move on. Do this on a set day/time each week! Like Sunday night after you clean the kitchen.

Don’t forget to adjust +/- for the next week’s spending depending on how you did this past week.

Monthly:

Have a date night with yourself, or for you and your partner, if you budget together. Do your budget first then plan something fun for afterward. Or if your favorite treat is a chocolate cupcake, get one and set it aside for after you do your monthly budget review! Nom nom!

Look over what you earned & what you spent. How did you do? Be honest; no one else is going to see. If you’re not honest with yourself or you make lame excuses, then you’re not going to get very far. Do you need to adjust some budget categories? Do you need to find a cheaper option for getting to work (carpool or mass transit vs. driving?) Ask yourself (or your partner) the hard questions and be prepared to offer an honest answer in return.

Tracking your progress is a great way to see how you are trending with your goals! Have you saved more every month? Have you paid down your debt more every month? Not sure? Then you need to grab your financial progress tracker so you can see it all in black & white!

9. Be organized

In order to make budgeting as stress-free as possible, you need to make it easy on yourself! Like, super easy. No one likes this personal budgeting tip but it’s often one of the most important for your sanity.

Put all your bills in one spot, or in one email file, and put all your receipts in one spot, like in a budget binder, so when you go to make a new monthly budget or reconcile last months you’re not searching all over the place for your info! Such a time suck, and it stresses you out when you can’t find stuff!

You also need to be organized with your spending! You need to know what’s coming up that you may need to spend money on. Things like…

- birthdays

- holidays

- annual subscription renewals

- car registration

Some people refer to these type of items as being great for sinking funds. (I happen to agree.) With sinking funds your never going to have that one off expense that totally derails your budget. It’s like a safety net, you can check out the guided workbook here, Sinking Funds Simplified.

Budgeting Hack #3: You should also be looking at which months have five weeks vs. four. As this impacts your pay (if you get paid bi-weekly), and can impact spending for that month’s bills. For example…

If you spend $7 at lunch every day during a four week month, that’s $7 x 5 days a week = $35 x 4 weeks in a month = $140 in lunches.

If that month has 5 weeks then,

$7 x 5 days = $35 x 5 weeks = $175 in lunches.

Now $35 may seem a small amount to go over, but when you add in everything for that five-week month then that adds up! Once you get good with your spending habits, you can make it easy and average every month to being 4.33 weeks (52 weeks a year / 12 months). So knowing some months, you’ll go over by a small amount and other months you’ll be under a bit.

10. Tweak, adjust & do it again!

This one goes hand in hand with our #1 tip of managing expectations, you probably won’t get it 100% right on the first go. That’s okay, that’s normal. Just don’t take the easy way out and quit. That’s just lame. Don’t be lame.

Keep going!

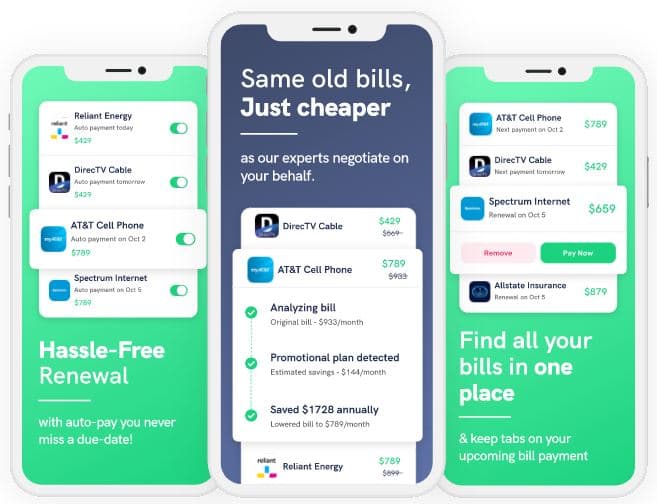

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

At the end of the day

Know that budgeting is a process; it’s a process for everyone! There is nothing “wrong” with you if you don’t get it right. Use the personal budgeting tips here, and you’ll have a much better shot at getting your numbers closer to your spending goals!

Just don’t quit! Keep tweaking; keep trying!

This is Your Ultimate Guide on How to Budget Series. Where Iay out every single thing that you need to know to successfully budget your money! No more guessing or wondering if you’re doing it “right”, after following along you will be 100% certain about what you need to do to organize your money!

– Part One: The Essential First Step with Budget Planning (it’s a must-do!)

– Part Two: The Best Budgeting Tips for Beginners (That You Have to Know)!

– Part Three: The Top 7 Proven Budgeting Methods – Your Perfect Fit is in Here!

– Part Four: Yes! Budgeting Can Actually Be Easy (With a Better Budget)

– Part Five: The 10 Most Common (and Costly) Budgeting Challenges That You Will Face (and How to Fix Them)

Great article! Thank you for sharing these budgeting tips, very helpful. I hope many can get a chance to read this as they can learn a lot of things from this about handling your finances.

So glad you liked it Olivia! Thanks for stopping by!

Looking Forward to the budgeting checklist! Such great information!

So glad you liked it Amy, thanks for stopping by!

I think starting with your number one point – Manage expectations is an absolute must! If you know where you want to be and how you can get there its easier for the other elements to fall into place! Great article, I look forward to reading the rest of the series!

So glad you liked it! I had to learn “manage expectations” the hard way 🙁 But once it clicked it all fell into place!

I love the tips you gave cause I can over spend most times

ogeenyi.com

So glad you liked the budgeting tips!

I’m honestly kind of glad I stumbled across this post. Haha. Me and my friends are trying to move off campus next semester and I’m definitely going to use some of these budgeting in tips.

How exciting for you guys! I’ll keep my fingers crossed for your move! 🙂

I like that learning pyramid because it’s so true that the more you do things the more you can learn what works or doesn’t work. And the more it begins to become a habit. But it all begins with the right mindset!

Yes! Practice makes progress! Thanks for stopping by!

These are definitely great tips and I agree about writing it down. I use an app to track to my purchases but it works better for me to still write it out and see visually where all the money is going.

Visual impact is huge for so many things! Thanks for stopping by!

This is great tips and advice on budgeting. I will be budgeting better.

So glad you liked it!

Very helpful! We try to budget time and time again but always end up on amazon or at Target.

We will definitely try some of these tips. Maybe something will stick and we can get a hang of this finally.

I’m rooting for you! 🙂

This is great! I wish they taught this in schools so young adults could know how to budget before they go into adulthood

So glad you liked it! Yes, financial education should be more available in our schools!

I’m guilty of not being humble haha. I loved how you included a few apps that keep track of monthly purchases. I downloaded MINT.

I think we’re all guilty of not being humble at some point 🙂 That’s okay, learn to recognize it, evaluate it and then decide if you really want to use your money that way. It’s all about a conscious spending decision and not impulses.