Your Complete Guide to Choosing Which of the Dave Ramsey Books is Best for You

This guide will help you pick the best Dave Ramsey book for your situation + the must-read book for everyone!

Author: Kari Lorz – Certified Financial Education Instructor

The answer to America’s money problems is waiting for you. In fact, he’s screaming at you to come join him! Yup, it’s Dave Ramsey.

Dave Ramsey’s books are fast reads, full of great advice, and given with the heart of a teacher (combined with a drill instructor attitude).

You may not like him, as he’s tough and doesn’t pull punches. He gives it to you plain and straight. Trust me, it’s just what you need, even if you don’t know it yet.

Let’s go through the Dave Ramsey books and see which is best for you right now.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

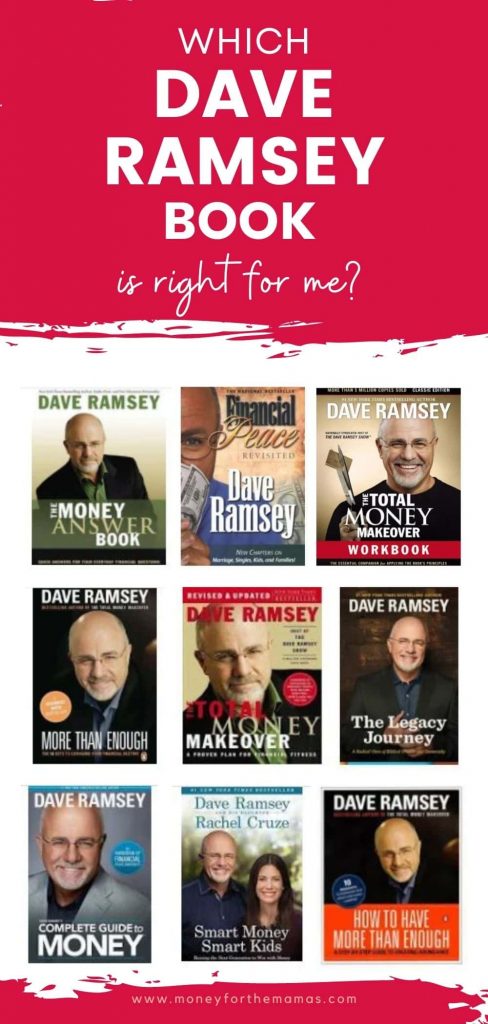

Dave Ramsey booklist

Here is the list of Dave Ramsey books in chronological order. We’ll be covering most of them.

- Financial Peace – 1992

- More Than Enough: The Ten Keys to Changing Your Financial Destiny – 1998

- How to Have More Than Enough: A Step-by-Step Guide to Creating Abundance – 2000

- The Total Money Makeover – 2003

- The Money Answer Book – 2004

- Dave Ramsey’s Complete Guide to Money – 2011

- EntreLeadership: 20 Years of Practical Business Wisdom from the Trenches – 2011 (Didn’t review, as this is a business book)

- Smart Money Smart Kids – 2014

- The Legacy Journey: A Radical View of Biblical Wealth and Generosity – 2014

- Baby Steps Millionaires – 2022 (review in process)

- The Momentum Theorem – not yet published

Dave Ramsey TOP recommended books

If you want the short list of what to get then here you go. But we’ll talk about all your options below.

The four books mentioned here will give you the most complete picture of how to “win with money.” Try and space them out a bit; read one a year (or as your Baby Step timeline progresses. You should probably read each one 1-2 times and have your own copies so you can take notes in the margins.

- ✅ The Total Money Makeover (a must read!)

- Dave Ramsey’s Complete Guide to Money

- Smart Money Smart Kids (if you’re a parent)

- The Legacy Journey

1. Financial Peace Revisted

Published: 1992 & 2003

Quick Summary: This was Dave Ramsey’s first book, originally self-published then picked up later for mass distribution. It goes over his Peace Puppies (aka guiding principles about money that you should hopefully learn about early on in life).

Originally, it was his personal experiences that guided the book, then with the “Revisited” update, he added in lessons from his talk radio program. The book covers topics on…

- Spiritual aspects of money

- Career

- Lifestyle pitfalls

- Dumping debt

- Credit

- Saving money

- Investing

- Marriage & money

The “Revisited” edition has expanded chapters and new chapters that help to round out the original version.

Thoughts: It’s more of a self-development book to help you start thinking about how money influences your life (for good and bad). Some of the tactical practices are out of date (due to everything being done online). The book also gives tidbits at the end of each chapter from his wife, Sharon. Her comments, while well-meaning, don’t give the impression that she is an equal partner in financial decisions. They perpetuate the stereotype that women have been battling for decades about deferring to men for financial guidance.

Who This Book is Best For: Those that are interested in learning about money management but don’t know where to start, AND they don’t have any immediate financial problems to work through.

“Personal finance is not a microwave; it is a crock pot.”

Dave Ramsey

2. More Than Enough

Published: 1999

Quick Summary: This book’s main point is great; how to be happier with what you have in your life and how to implement values and principles to help you improve your life. “If you apply the chapters to your life, to your relationships and money, you will begin the process of having “more than enough.” You are focusing on developing personal character traits through a money lens. For example, some of the main topics include…

- Integrity

- Vision

- Discipline

- Unity

- Values system

This book was part of a book deal requirement from his success with Financial Peace. Upon the success of that book, he signed a contract with Viking Penquin for three more books. It seems he wrote this book just to fulfill that requirement.

- Audible Audiobook

Thoughts: While the meaning of the main messages is good, the tone and judgment (the classic Dave Ramsey lack of sensitivity) leave a lot to be desired. You should find a different life guru and listen to DR for his thoughts on money specifically.

Who This Book is Best For: Someone who wants to check off the box that they have read all of DR’s books.

Save big on Amazon purchases (when you don’t have Prime)

If you don’t have an Amazon Prime membership, you can still save with all of the Amazon Prime perks!

You can simply take advantage of their 30-day free trial offer. You can sign up today and be enrolled in the free trial of Amazon Prime and have access to FREE Two Day shipping, Prime Video, and Prime Music.

You will need to put in a valid credit card, which we used to automatically renew your free trial to the full subscription at the end of 30 days. So if I were you, I’d set a calendar reminder to cancel it on day 28 to be safe. Sign up here for free Amazon Prime.

Are you a college student? Students can take advantage of a FREE 6 month trial! Then you will pay just $7.49 a month after six months if you decide to keep it!

Are you a Medicaid or EBT recipient? You can get discounted Amazon Prime at just $6.99 a month. Check to see all the benefits here. (Hint – you can use SNAP benefits on Amazon Grocery).

3. How to Have More Than Enough

Published: 2000

Quick Summary: This is the follow-up companion book to More Than Enough (the previous book on the list). While that book talked about principles and values, this book helps you analyze where you are within those value points. And, if you’re not happy with your answers, then “Changing yourself” is the next step!

“This book is a mirror in which you can see yourself; it’s not for the weak hearted, lazy, complacent, apathetic, or indifferent.”… “This is for someone ready and willing to face the pain of personal change.”

The book does this by being both a self-development book + a workbook, where you write your answers down to a series of questions. “This book is intended to be read, written in, mulled over, and acted on.”

Having more than enough to the author means “more than enough fulfillment, happiness from relationships, more hope, more energy, and more reason for being alive!” Which sounds great. I mean, who doesn’t want to be happier and feel fulfilled?

The content is based on the ten character traits and values that enable people to live their lives with “more than enough.”

- A good value system

- A vision for their lives

- Unity with their spouse (relationships, community, self)

- The ability to hope

- A willingness to be accountable to others

- A need to live life with real intensity

- A lifelong habit of work, diligence, and discipline

- Patience

- The capacity for contentment

- The desire to give to others

And, once you have taken these traits to heart and begin to live them fully, you will have More Than Enough.

- Ramsey, Dave (Author)

Thoughts: I didn’t care for the previous book, More Than Enough. The tone was too high-handed and judgy for me to take in the messages, no matter how on point they were. So, I didn’t have any high expectations of this follow-up book.

That being said, I did like this book a lot more than I expected to. The “tone” that was pervasive in the previous book was significantly less. It seemed more genuinely helpful vs. a sermon on how you should be.

I also liked the workbook component of it, as people are guided to look inside of themselves and answer honestly. Not just read about a concept and a fictitious person who dealt with this topic.

You might be wondering, why is a personal finance guy writing about this? This is fair, as it does seem a bit far-reaching. Yet, I do believe that these two aspects are connected. Sad to say, we live in a world where buying things is jokingly considered therapy. But it’s not a joke, and buying more stuff isn’t going to make you happier or feel more fulfilled. Only you can do that from the inside out.

The author goes a step further with the topic of money & values,

Who This Book is Best For: This book is for someone interested in living their life more in line with their values (even if they don’t know what those values are at the moment.

“Money is much more than a means of exchange. In many ways, your money is you! How you make your money, how you spend your money, how you save and invest it, or what you spend it on are some clear indicators in your life regarding your values, vision, priorities, and commitments. Money talks – but what is it saying about you?”

Dave Ramsey

4. ✅ The Total Money Makeover

This book will change your life (if you put in the work!)

Published: 2003; with the latest content update in 2013.

Notes: As of August 2017, over five million copies have been sold, and the book has been on The Wall Street Journal’s bestsellers list for over 500 weeks.

Quick Summary:

This is considered his quintessential personal finance book, the one that is the most recommended to people. The main concept is his Baby Step program, his “proven plan” to get you out of debt and on the road to financial freedom!

In this book, Ramsey shares his path of being a millionaire and then crushing debt and eventual bankruptcy. He goes into the emotion & feelings of what being out of control with your money habits feels like. Yes, the book goes through his baby step program but as a narrative. As the book says, “it weaving inspiration and information together in a step by step plan.”

This book has some templates and forms at the back of the book to get started with the math piece (i.e., budgeting, debt repayment plan, etc.).

Thoughts: It seems that this is content that we’ve heard before, but with a “slightly” different spin. Dave himself distinguishes this book from his first, Financial Peace, by saying that this book is more of an action plan, a process book, while Financial Peace is more of a concept book.

I like that Dave Ramsey doesn’t sugarcoat things, and he doesn’t cut you any slack. He’s abrupt and slightly rude, but it’s with the purpose of getting you to drop your BS and come to terms with your financial reality. Yes, he could be more PC, more understanding, but that’s just not him.

I was a little disappointed with some of his tactical advice, as it hasn’t kept up with the times. These days people don’t write checks and mail things anymore; they pay online. So some process pieces are out of date and need to be tweaked.

Who This Book is Best For: This book is best for the person that knows they need to make a change, but they’re not quite sure what kind of change. Or for the person that needs convincing that the system works. There are many personal story contributions from people who have gone through the program and seen success, which can help reassure you.

The Total Money Makeover Workbook

Published: 2003 & 2018

Quick Summary: This is the companion workbook to the processes taught in The Total Money Makeover book. Some of the informational content is the same. Still, it gives lots of additional pages for you to not only work through the math portion of your finances but it goes into helping you identify the mental hurdles you may be facing.

For example, it asks you how you feel about key concepts given in the book, and you do some exercises to help your narrow down your sticking points. It has multiple choice questions, fill in the blank, true and false questions. So it tests your knowledge to help you realize if you’re as “smart” about money as you think you are.

This book also has forms and templates in it for helping you to set up a budget, but it has additional exercises for you to complete. Go here, if you’re looking for the Dave Ramsey budgeting method.

Thoughts: This book does a good job of guiding you specifically to the point of realization that you either do need to change or you’re comfortable continuing in your current financial situation. So if you’re looking for validation that things need to change, this can help give you that clarity and show you how to change.

I do think that this book is great to buy in addition to the original text of The Total Money Makeover. Yes, it covers the same info (with additional pieces), but at this point in the game, you need to hear things multiple times for it to register with your brain.

Who This Book is Best For: This book is best for people that aren’t comfortable in their current financial state but are unsure what’s really “wrong.” They want to take tactical action and have a more hands-on and guided experience with The Baby Steps.

There is also a full Total Money Makeover Bundle Pack, which comes with three titles – The book, the workbook, and the journal.

Don’t forget that if you’re a bullet journal fan, there are so many ways you can track and manage your money with some helpful finance bullet journal spreads.

5. The Money Answer Book

Published: 2004

Quick Summary: This money book is different than his other titles. It’s just him answering common questions that he hears people ask. It’s a “Q&A to help you find your topic-specific answers in an easy, concise format.”

He goes over all the standard topics…

- Debt & credit

- Budgeting

- Saving & Investing

- Insurance

- Retirement

- Buying a car

- Real estate & mortgages

- Ramsey, Dave (Author)

Thoughts: The questions asked in this book are more than your generic “How do I budget?” type, which is great, makes it more interesting than I anticipated. Here are a few examples…

- Does the national economy really affect my personal economy?

- What’s the most important financial principle?

- Isn’t some debt good?

- What happens to my parent’s debt after they die?

- How should I handle collections?

- I’m deceiving my spouse about money. How can I come clean?

Overall, it’s a quick read. Nothing to put on the top of your reading list, but it’s not bad either.

Who This Book is Best For: This book is good for someone who likes to know small details. This is a book you read for fun while working on your Baby Step process. You could probably get all the answers from Googling these questions, though, so don’t buy it. If you’re interested, your best bet is to get it from the library. (I checked it out as an eBook from the library through my Libby app and read it on my Kindle).

“Sacrifice the unnecessary to gain the necessary.”

Dave Ramsey

Be sure to check out the Dave Ramsey online store, where he sells all of his books. Some are even bundled together by topic. There’s a bundle for college, a bundle for marriage, and even a bundle with 15 of his top titles!

6. Dave Ramsey’s Complete Guide to Money

Published: 2011

Quick Summary: This book talks about different areas of personal finance but always within the Baby Step methodology. So the information sounds very similar, yet it’s different. Some of the topics covered are…

- Relationships & money

- Cash flow planning

- Credit practices

- Insurance

- Investing

- Retirement and college

- Home Buying

- and more…

Dave Ramsey states in the book that this is “more than the Baby Steps… this book is the practical hands-on guide for navigating your way through some of the details. Saving, investing, etc.”

- Hardcover Book

Thoughts: This was the first DR book that I ever read, and it’s still one of my favorites. It introduced me to what financial goals are and how working toward them can change everything. It doesn’t beat you over the head as much as some of the other books do. So it’s a good way to get into Dave’s teaching style.

I also like that it gives you key points and questions for reflection at the end of each chapter. So after reading, you can see if you took away the core concepts of Ramsey’s advice, and if you didn’t, then you can go back and reread it.

Who This Book is Best For: This book is for the people that have already started budgeting and want the sure fire plan “what’s next.” Now you don’t have to be a great budgeter, but you need to understand general personal finance practices to understand the book.

If you’re new to financial literacy, then my suggestion is to read/do The Total Money Makeover, get partway through Baby Step 3 (Save 3-6 months of expenses in an emergency fund), and then read The Complete Guide to Money. Then a year later, come back and reread it, as you’ll be in a different place and ready to absorb information that you couldn’t before.

8. Smart Money Smart Kids

Published: 2014

Quick Summary: This book was co-written with Rachel Cruze, Dave’s daughter. She has since gone on to write two more books, so this was most likely her chance to dip her toes into the publishing world.

But who better to talk about kids & money than this duo. The pair trades off in each chapter, talking about the topic and their experiences in raising kids and being raised in a home where money is a consistent topic.

This book is geared to those that want to start a new family tradition – a tradition of money knowledge and positive money character traits. All to help kids be successful with managing their money.

Your children develop their money story at a very young age (their impressions start at around 5 yrs old), so it’s imperative to talk positively about money all the time as little ears are everywhere!

The book covers…

- Work (and work ethic)

- Spending money

- Saving money

- Gifting money

- Budgeting

- Debt

- Saving for college

- Contentment

- Family

- Generational wealth building

Thoughts: This is probably my new favorite personal finance book. The principles and concepts taught here are so important! We all know parenting doesn’t come with a manual, AND personal finance isn’t taught to us in schools, so this book is our best bet to build money smart kids!

This book also makes it on my list for the best money books just for women. Women have different financial needs than men, so it only makes sense that we customize our finances to meet those needs. Be sure to check out all the books on the list and see my #1 pick!

The tone and temperament of the book are more light-hearted than in his other ones (perhaps that’s Rachel’s influence). So there wasn’t a lot to cringe at.

Who This Book is Best For: Parents! Or anyone who is helping to raise a young child. But please, please, please don’t wait to start until your kids are grown. Start the messages when they are young. It doesn’t have to be heavy and serious sit-down lessons. They give plenty of ideas on how to do this and for all age groups.

From the very beginning, my parents gave me a legacy of debt-free living, and that’s one of the best gifts any parent could give their kids.”

Rachel Cruze

9. The Legacy Journey

Published: 2014

Quick Summary: This book is all about managing your money through the lens of the Scripture. Meaning, what does the Bible say about money and how you should handle it if you want to be a good steward of the money that God gave to you. “What you do with His resources is what your legacy is all about.”

As with most of Dave’s books, the foundation is the Baby Steps, and this still holds true in this book, but they take a back seat to the process that works alongside the Baby Steps (in particular, once you’re past Step 4 and have reached financial security). It’s the framework of “Now-Then-Us-Them” regarding your financial focus.

For example, when you’re just starting on your personal finance journey, you need to put out some fires (i.e., high-interest debt, an unstable housing situation, food for your family, etc.) That’s the “now” stage. But as your finances change for the better, you can shift your focus to other priorities. Such as planning for the future (“then”), covering your whole family (“us”), and then once you have that covered, you work on helping others and your community (“them”).

What is the legacy you want to leave behind? Do you want to do good in the world and help us all to rise? Or, do you want to safeguard your personal position? This is a pendulum that swings from one side to the other, and we all fall somewhere in the middle, constantly shifting.

Remember, your legacy isn’t just about money; it’s about what you teach, who you support, who you influence. It’s a whole wheel. And money plays a role in all of these things.

The book covers…

- Generational wealth

- Charitable giving

- Family, relationships & parenting with money

- What the Bible says and doesn’t say about money

- Biblical importance of work

- Safeguarding your estate

- Living a life honest to your biblical values

Thoughts: I will be honest, I wasn’t looking forward to reading this book. I’m not a religious person (although I do believe in a higher being), and I very much dislike people beating you over the head with their religious belief system.

Since I’m not religious, I found that If I took “religion” out of it and went with what I believe is morally right and true, I agreed with many points that he made (but not all). He discusses the importance of contentment, working hard for your money, leading from your heart, etc. All those things I can get behind.

In it, he covers what the Bible says about money. Other people’s interpretations (especially those he feels are incorrect or misleading), and then he gives his own opinions about what he thinks that God and Jesus are saying about money. Which is, of course, his interpretation and could be equally incorrect.

In one chapter, he states, “I’m not a biblical scholar; I’m just a guy who’s studied the financial teachings in the Bible to try and understand God’s way of handling money.” This is interesting, as he so emphatically tells you other people’s interpretations are wrong and that what he says about the passage’s intent is correct. Hmmm… no thanks.

Who This Book is Best For: If you want to know more about popular opinions about money and the Bible, you might find this interesting. However, I’d pass over some of his Bible Cliff Notes declarations and focus more on the aspects of being a good person.

Also, if you’re on Baby Step 4 and you want to know what other things should be on your radar, then this gives you some great options to consider on how to use your wealth to help the greater good, while still achieving financial independence.

If you’re not into Dave Ramsey but are still looking for some great reads, be sure to check out my top 10 best financial literacy books to help you transform your finances.

Dave Ramsey books that I didn’t read

Some of Dave’s books are outside the scope of this post; they’re for a different audience, so I didn’t review them here.

Entreleadership: 20 Years of Practical Business Wisdom from the Trenches

Entreleadership is a business book presented as “This book presents Dave’s playbook for creating work that matters; building an incredible group of passionate, empowered team members; and winning the race with steady momentum that will roll over any obstacle.”

Junior’s Adventures: Teaching Kids How to Win with Money!

Junior’s Adventures is perfect if you’re looking for more opportunities to help your kids learn about money, then this series might be just what you need. There are a few titles covering a good range of topics…

- The Super Red Racer (Work)

- Careless at the Carnival (Spending)

- The Big Birthday Surprise (Giving)

- My Fantastic Fieldtrip (Saving)

- The Big Pay-Off (Integrity)

- Battle of the Chores (Debt)

These books are recommended for kids age 3-10, yet I’d probably wait until they are 5-6yrs old.

Other Dave Ramsey books

There seem to be quite a few little books, guides, or pamphlets roaming around. Yet getting your hands on them is difficult. Maybe they’re out of print, or he incorporated them into later editions of other books, so not relevant anymore?

Sometimes, I found a book title that sounded promising (and found publication info) but was really a DVD or audio version, probably from one of his seminars.

Here are some of the titles that I couldn’t locate copies of…

- Starting Over: Dave Ramsey’s Post-Bankruptcy Survival Guide

- Dave Ramsey’s CORE Financial Wellness

- Priceless: Straight Shooting, No Frills, Financial Wisdom

- Foundations in Personal Finance

- Dumping Debt: Breaking the Chains of Debt

- Cash Flow Planning: The Nuts and Bolts of Budgeting

- The Great Misunderstanding: Unleashing the Power of Generous Giving

- Financial Peace for the Next Generation

If you’re 100% sold on learning from Dave Ramsey, then you should get the All in One Value Pack; it’s a collection of his most popular titles for one low price! This is a seriously jam-packed deal, and it’s frequently offered on sale (check out the price now so you’ll know when it’s a good price later on).

Don’t all Dave Ramsey books say the same thing?

Well, yes – and no.

Most of his personal finance books do follow the process of his 7 Baby Steps. Yet, each book will have a slightly different twist or look at it through a different lens.

Besides, we, as humans, don’t learn something the first time we read about it (or hear it, or see it). It takes a lot of repetition (aka exposure and practice) to learn a new skill. And managing your money effectively is absolutely a learned skill!

Forbes recently interviews Josh Kaufman, the author of The Personal MBA. He states, “Most of us are deeply disturbed at the prospect of being horrible at something, even temporarily. When you try something new, you’re usually very bad, and you know it. The easiest way to eliminate that feeling of angst is to quit practicing and go do something else, so that’s what most of us do.”

This is absolutely what people do with budgeting. They read something, try it, it turns out to be hard, or it doesn’t work quite right, so they quit.

Josh continues, “It takes 10,000 hours to become an “expert in an ultra competitive field” but to go from “knowing nothing to being pretty good,” actually takes 20 hours.”

Now don’t think you can spend 20 hours in your first week of budgeting and “get it.” You won’t. It takes exposure and practice over time to learn how to manage your personal finances.

Dave repeats his financial advice because we need to hear these things a lot to really take it in and have it click for us. This has happened to me so many times. Whether maybe I’ve read something and had no clue about it and then read about the topic 2-3 more times until I finally grasped it.

The Total Money Makeover

This is the quintessential book that has turned thousands of people’s life around! Learn his Baby Step program and start your comeback story today!

Dave Ramsey books FAQ

Which Dave Ramsey book is the best to start with?

If you’re brand new to Dave Ramsey, then The Total Money Makeover is a must-read! It lays out the program along with real-life stories of people that have turned their finances around! This book is a motivating step by step guide through his Baby Step program.

If you’re a budgeting pro and are looking to level up your finances, then Smart Money Smart Kids should be your next read (or if your kids are older then check out The Legacy Journey.

What is Dave Ramsey best known for?

Dave is most well known for his no nonsense approach to helping people get out of debt. His Baby Step plan lays out exactly what to do when you’re deep in debt and don’t know where to turn.

Be forewarned; he doesn’t sugar coat anything, and he’ll ask you hard questions that you won’t like to answer. But thousands of people have gone through his program and his success rate is hard to beat.

What is the order of Dave Ramsey books?

Dave has written a lot of books, pamphlets, guides, webinars, and more. But here are his major books by year of publication.

1992 – Financial Peace

1998 – More Than Enough: The Ten Keys to Changing Your Financial Destiny

2000 – How to Have More Than Enough: A Step-by-Step Guide to Creating Abundance

2003 – The Total Money Makeover

2004 – The Money Answer Book

2011 – Dave Ramsey’s Complete Guide to Money

2011 – EntreLeadership: 20 Years of Practical Business Wisdom from the Trenches

2014 – Smart Money Smart Kids

2014 – The Legacy Journey: A Radical View of Biblical Wealth and Generosity

2022 – Baby Steps Millionaires

TBD – The Momentum Theorem

At the end of the day

Learning about a new topic as important as personal finance isn’t easy. It’s intimidating because so much rides on you getting it right. Yet, Dave Ramsey has transformed tens of thousands of people’s lives through his books, seminars, and programs.

It’s hard to argue with the level of transformation and success that people have experienced through his Baby Steps, and I don’t really want to. Yes, his tone and judgment may be a little much for some readers. But he calls it like it is, no sugar coating it, and no hiding from the real issue (which is usually ourselves).

So should you read Dave Ramsey’s books? Yes, if you want to change your financial life around, then you should. But with a grain of salt and a thick skin… but soon your wallet will be thick too!

Posts related to Dave Ramsey books you need to read:

- Dave Ramsey Recommended Budget Percentages

- Developing Your Money Story – Turn Tragedy into Triumph

- Why is Financial Literacy so Important?

- The Good, Bad & the Ugly of Dave Ramsey’s Baby Steps

- Dave Ramsey How to Budget for Financial Peace

- Here’s What You Have to Know About the EveryDollar Budget App

- The Best Books on Money – Just for Women!

I have been working on my finanaces and “binging” on Dave Ramsey and was eager to buy his books to learn more. But I was very confused where to start as he has so many! After readng this article, I knew exactly where to start and which ones to purchase. Thank you for taking the time to write this article! Very much appreciated!

I’m so glad this helped you! This was exactly the reason why I wrote it. He has so many books it’s confusing to know where to start.

Excellent article! It combines things I love, books, good writing about books, and encouragement to use books to better one’s life. I think I’ll seek out the personal growth workbook and the legacy book. Thanks for so much food for thought!!

So glad you liked it Alison, and ya for books! There’s SO MUCH knowledge out there in books… if only people would actually read it! 🙂

Having done the financial peace university course, I think the book that stands out to me and peaks my interest is ‘The Legacy Journey’. As much as I have thought of money outside of myself, but also for others, I haven’t highly been active in implementing it and would love that.

The Legacy Journey is a great book, which helps you focus on the good that money can do beyond your own immediate circle. You’ll love it!

This is such a throrough review of each book! I am impressed! I have only read Total Money Makeover and Financial Peace Revisited, but now I have added a few others to my list to read! Thanks!

So glad you liked the list! That’s great that you’ve already read Total Money Makeover, that’s my #1 recommendation for people! I’ve read it a couple of times as I know there was info I missed the first time around from just being a bit overwhelmed by it all.

This is like the perfect Dave Ramsey article ever. Managing finances is the number one thing you should focus on.

So glad you liked it Aditi! I happen to absolutely agree with you, getting a handle on our finances is something that everyone should focus on! Our collective stress levels would drop dramatically and then everyone would probably be calmer and nicer towards each other 🙂