Dave Ramsey’s How to Budget for Financial Peace

The Dave Ramsey budget explained, demystified, broken down, and all laid out!

Author: Kari Lorz – Certified Financial Education Instructor

Alright, you’ve read Dave Ramsey’s Total Money Makeover, you’re pumped, you’re ready… let’s make a BUDGET! But wait, where does he talk about budgeting in the book?

I mean, he tells you that you need one, and he gives templates in the back of his book… but how do you do it? It doesn’t really detail it out.

Don’t worry; I’ve got you covered on this! I’ve compiled all the tidbits from his different books, resources, and guides to help you with this process.

We’re getting nitty-gritty with it, so let’s call this my Dave Ramsey How to Budget guide!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is Dave Ramsey’s budget?

Dave wants you to sit down with your partner and have a monthly budget meeting before the new month starts. You plan where you want your money to go before you even spend a dime. At this meeting, you’ll build a family budget – one for the whole household to follow so everyone is on the same page financially.

There are essentially three main steps to the Dave Ramsey how to budget method, with a few substeps too.

His process uses a zero-based budget method, where you give every dollar of income you have a job to do. Your money should be working for you all the time!

Dave Ramsey’s how to budget steps

First, you need to write it out or type it out, whatever makes it easy for everyone to access. Pen & paper is great for your first monthly budget.

Step 1: List your monthly income

Write down your monthly income at the top of the page for each spouse. If you make an irregular income, list out the lowest possible amount you could take home. If you get paid more, then that’s a great bonus!

Step 2: List out your expenses

Dave always wants you to list your 4-walls first, as they are the essential things on your budget! What do the “4 walls” mean? Your walls are…

- Mortgage/rent

- Utilities – water, sewer, electricity, gas

- Basic food (aka standard groceries) – here’s a guide if you’re wondering how much you should be spending on groceries.

- Transportation – car payment, gas, oil changes

The largest part of all household budgets is spent on your mortgage/rent. If this household budget percentage is overspent, then you are going to have a hard time coming in under budget. But, the good news is that the Dave Ramsey budget percentages give ranges for most of the budget categories.

Now you can move on to listing out your monthly fixed expenses (they cost the same every month). You might have to dig through your credit/bank statements to find these numbers.

- Insurance payments

- Debt minimum payments – credit card debt, student loan, etc.

- Internet/phone

- Gym membership

- Giving

- Roth IRA contributions

When you have those essential expenses covered, you can move on to your discretionary spending, which is usually variable personal spending (the amounts change from month to month).

- Entertainment

- Dining out

- Hobbies

- Clothes

- Miscellaneous (aka fun money)

To figure out these amounts take a look at your previous three months of spending, total each category up, and then divide by three to get your average spending.

Most likely, if you’re new to budgeting, it’s because you need to spend less money. So writing out your average spending on dining out is step one, and know that you’ll need to adjust it.

If you’re not sure how much you should be spending in each budget category (it’s helpful to know what’s “normal,” right?) Then check out Dave Ramsey’s budget percentages. This is a great place to start!

Dave Ramsey how to budget step 3: Subtract your income from expenses

Here’s how this looks…

- Income

- Minus four walls

- Minus fixed expenses

- Minus variable expenses/spending

- Should equal $0 or be a positive number

If your number is positive, then add that extra to your debt payoff plan. If we’re following the Baby Steps plan (and we are), then all your extra money goes towards getting your starter emergency fund or dumping your debt with the debt snowball method!

If your number is negative, which is where most of us start (you’re in good company), then it’s time to put your big girl panties on and start cutting those unnecessary expenses. Here’s where you should be cutting your spending first…

- Dining out at restaurants or coffee shop spending

- Memberships and subscriptions – gyms, Hulu, Disney+, boxes, Spotify, etc.

- Clothing, makeup, or beauty treatments

- Hobby purchases – no more yarn, bike parts, circuit supplies, etc

- No vacations or weekend getaways (Don’t worry, we’ll save for these later).

You get the picture; anything that isn’t a must spend needs to get cut. Remember, you’re trying to come in with a balance of $0. And every extra dime you have should go towards Baby Step 1 or Baby Step 2.

Remember, you can’t spend more than you make; if you do that, you are digging yourself into a hole that can be very hard to get out of!

Dave does recommend that even though you’re using a zero-based budgeting method, your bank account balance should never be zero. He recommends a buffer of $200 for safety.

That’s it! You’ve made your monthly budget!

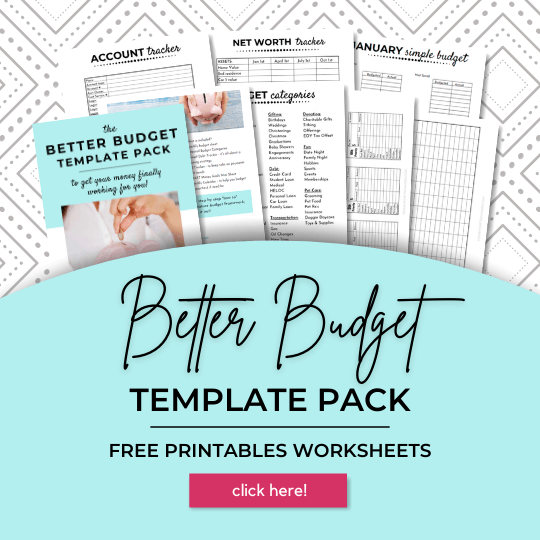

If making your own monthly budget template sounds overwhelming, then don’t worry; I’ve got you covered. I have printable budget templates for each of the main budgeting methods, even the zero based budget method. You can have these in your hands and work on them in the next five minutes! Just go here, add to the cart, buy, and print!

Spending during the month

If you’re following the Dave Ramsey budgeting method, then you’ll be using cash envelopes for all your discretionary & variable spending. Remember, the magic with cash envelopes is that you literally can’t overspend; when the envelope is empty, the spending stops. Also, be sure to consider getting a cash envelope wallet to help keep you organized!

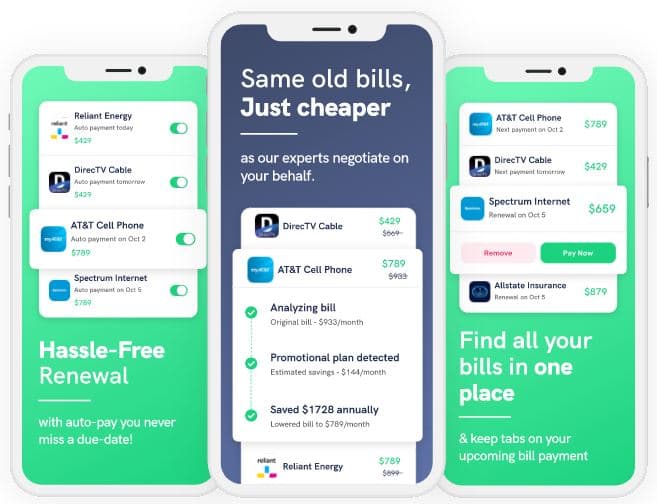

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

You can find many useful forms online, here’s a short Dave Ramsey budget form, and click the Quick Start form. But you can grab more budget worksheet forms in The Shop.

How to close out your monthly budget

Since you made a budget, you want to know how you did, because you might need to adjust things for next month’s budget. So here’s how you close out your budget at the end of the month.

- All month you should be keeping track of your spending. You can grab a free printable expense tracker right here with my free budgeting printables!

- Look at your projected budget amount for each category, did your actual spending match up? If not, did you overspend like crazy because you couldn’t say no, or was your original budgeted amount not reasonable? Adjust as needed to each category.

- Move any leftover money into working Baby Step 1-3, whichever you are working on at the moment.

- If you were overspent for the month, then you’ll need to shift money from this new month’s household budget to pay for last month’s spending. That money should come from your discretionary accounts like clothing, dining out, etc.

- Think about how you need to do better for next month. Make an action plan! Usually, people need to spend some dedicated time with meal planning as food is one of our biggest expenses, and it gets out of control quickly. I’ve put together some great resources for you so you can nail the budget category next month!

- Don’t forget to celebrate! Yes, even if you overspent, you still need to recognize the time and effort that you put into it this last month! Be proud of yourself, and continue to work towards your big money goals.

You can also do your budget on Dave Ramsey’s EveryDollar app! It’s simple, straightforward, and free! Here’s what you have to know about the EveryDollar budget app.

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

How to budget for unexpected expenses

My personal secret weapon with budgeting is using sinking funds. Honestly, they are the key to my family’s financial success! Sinking funds help you save for known expenses when you’re sure exactly when they will happen.

For example, your pet will need medical attention at some point. Your car’s engine will need to be worked on at some point, and your refrigerator will need to be replaced at some point. (You get the idea).

So every month, I contribute a predetermined amount to a category-specific sinking fund…

- Home repair fund

- Car repair fund

- Vacation fund

- Kiddo fund

Every unexpected expense for my family falls into one of these four buckets. So when it happens, I move money out of that sinking fund account and into our main checking at the end of the month and then pay the bill from the primary checking.

You can fill sinking fund accounts in one of two ways…

- Put in a set amount every month, say $25, $50, or $100.

- If you’re saving for a specific event (i.e., Christmas). Take the total amount you want and divide it by the number of months until that event. So if you want $1,300 for Christmas and it’s seven months away then, $1300 / 7 = $186 a month that needs to be set aside.

Now sinking funds aren’t just for unexpected expenses; you can use sinking funds for anything!

- Want a new pet? Use a sinking fund

- Planning a wedding? Use a sinking fund

- Does your kid want to go to soccer camp? Use a sinking fund

- Want a new home? Use a sinking fund to save for your down payment.

For smaller sinking funds, you can use a cash envelope. Set up a separate checking account for ongoing/revolving sinking funds; yes, it must be separate!

Note: these funds/accounts are separate from your emergency fund; remember that the rainy day fund is for when you lose your job or get into an accident, etc.

Why should I use the Dave Ramsey budget?

That’s a fair question, especially if you’ve never heard of Dave Ramsey before. We’ve talked in-depth about his experience and qualifications in Dave Ramsey’s Baby Steps. But let’s do a quick recap…

- He had millions in his early 20’s from real estate deals (house flipping).

- He lost it all and filed bankruptcy in 1988 – he was 26 with a wife and two kids.

- He started to read the Bible and found God & Grandma’s way of handling money; he changed his money habits and began to teach others to do the same.

- He built his empire on that process, now has seven New York Times bestsellers, has a radio show listened to by 13 million people, has lead 5 million people through his Financial Peace University money course, and has a net worth of $200 million.

So if anyone knows how to budget, it’s him. When you’re learning how to budget, you will have to try a few different ways/methods, as nothing is a perfect fit the first time. But so many people have found success with his plan (and it’s a pretty good method, in my opinion), then why not give the Dave Ramsey budget method a try?

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Dave Ramsey how to budget tips

When you’re new to budgeting, here’s some advice that can make the process a lot easier and work more seamlessly.

- If you’re married and have older kids, make sure everyone participates in the monthly budget meetings. It will never succeed if everyone isn’t on board with this.

- Be honest with your family (if the kids are old enough to understand) about where you are financially AND where you want to be. You need to have financial goals, so everyone knows what you’re working towards.

- Discuss the difference between wants and needs. No one likes to give up their favorite thing, but for a time, you will have to. Personal spending is usually the first to go.

- Track your progress in a timely fashion. That means every few days, you need to be updating your spending log with how much you spent. At a minimum, this should be once a week, but 2-3 times a week is better. You need to give yourself time to course-correct if you are overspending.

- Personal finance is personal, you can’t use someone else’s numbers.

- Tweak and adjust your budget throughout the month. Don’t worry, this is normal; no budget is perfect from the start. Usually, it takes people three months to really find their groove.

- When making a new month’s budget, don’t forget to look ahead for those one-off purchases. For example, a birthday celebration, an annual expense is due (HOA fee), your car needs new tags, etc. Those one-off expenses can be so demoralizing if forgotten about, so don’t bust your budget just because you failed to look ahead!

- Follow the Dave Ramsey Baby Step program, it absolutely works if you put in the work, and you will reach financial freedom!

Dave Ramsey how to budget programs

While you can absolutely follow Dave Ramsey’s budget plan on your own. They do offer quite a bit of resources and programs if you want to get as much support as possible.

Financial Peace University is Dave’s signature program. When people talk about doing the Dave Ramsey plan, this is what they’re referring to. “FPU is the nine-lesson course that teaches you the step-by-step plan—aka the Baby Steps—to pay off debt fast and save more money for your future.”

You can stream the lessons from home, or join a live group taking the classes together. You also get three months of the premium version of the EveryDollar budget app, and lots of bonus content.

Financial Peace University is basically the full meal deal for those looking to change their finances completely around.

At the end of the day

Following the Dave Ramsey How to Budget plan is a great starting point for people. There are so many resources and support for people to get help with his method; this practically guarantees any question you have has been asked and answered already.

Budgeting is simple; it’s addition and subtraction. But living within your ideal household budget is hard; at times, it’s dang hard. BUT, as the saying goes, you haven’t come this far only to come this far. You can do it!

Articles related to Dave Ramsey How to Budget Guide:

- Dave Ramsey Budget Percentages

- Choosing the Best Dave Ramsey Book for You!

- The Good, Bad & the Ugly of Dave Ramsey’s Baby Step Plan

- Here’s What You Have to Know About the EveryDollar Budget App

I LOVE all of Dave Ramsey’s tips. My aunt gave me one of his books as a wedding present and it changed our lives. I was already doing college debt free pre-marriage because I got scholarships and I was working during school. But once I got married, both my husband and I paid for college that way too. We worked all throughout school and the summers off. We weren’t having as much fun as our peers since we were working so much, but it is so nice we have ZERO student loan debt now.

Having zero student loan debt is a HUGE accomplishment! You should be so proud of your efforts and know that it has set you up for success!!!

This is such a wonderful post. I’m very familiar with Dave Ramsey and his budgeting suggestions. It is important to be a good steward of all that is entrusted to us. It is a continued work in progress to keep track consistently of your finances. Thank you so much for sharing this post.

Yes! Our finances are a work in progress, always flowing and needing to be managed, and adjusted.

Ooo this has me so interested! I’ve been doing budget tracking my own way for a while, but I keep hearing so much talk of Dave Ramsey I might want to start seeing how I can include his steps!

You should absolutely check him out. Even if you only pick up 1-2 tips it’s well worth it!

Thanks for writing this, it was so thorough! I love the idea of sinking funds. I will be adding a sinking fund to my next budget for sure!

Sinking funds are so effective for saving money, you’ll be surprised at how fast it adds up!