25 Easy Check Cashing Near Me (+24 hr options)

Here are 25 nearest check cashing places – #19 is the easiest!

Author: Kari Lorz – Certified Financial Education Instructor

Many times you find yourself in a situation where you need to cash a physical check. And as luck would have it, it’s outside normal banking hours (holidays, weekends, etc.). Or maybe there’s not your bank branch near you where you’re currently at.

What are you to do? You need the money now.

Don’t worry; we’ll walk you through all the options on how to cash a check near me so you can get the money you need right now.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Check cashing near me: In-Person

1. Issuing bank

You can almost always cash a check at the issuing bank (the bank where the account is held), even without a bank account at that bank. So if you bank at Wells Fargo and have a check from someone who gave you a check from KeyBank, you can go to a KeyBank branch and cash it, as long as you have your ID. You may need to pay a small fee, though.

2. Check cashing at ATMs

This is by far the easiest route to take, just deposit the check, then do another transaction and withdraw the funds. Yet, depending on your bank, you may need to wait for the check to clear (a few days), or you may need to wait overnight for the system to process it and have that money show up as “funds available.”

Most banks will show your current account balance, and then there’s your available balance. This is your balance +/- any pending transactions. These things could take a few days to clear, especially if it’s the weekend or a bank holiday.

Of course, this method only works if you have a bank account and access to an ATM.

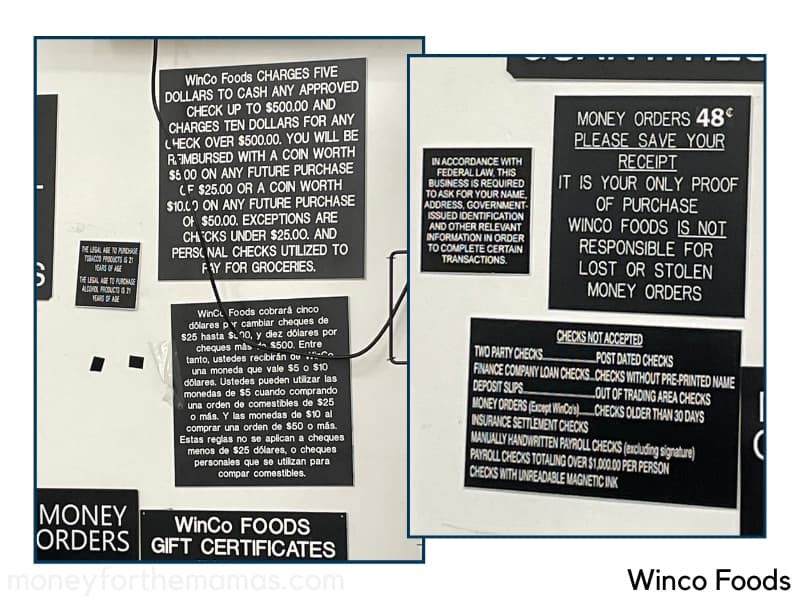

3. Winco

WinCo Foods can cash a payroll check (under $1,000) within their check cashing policy guidelines. You will need a valid ID, and the check must have your address and phone number on it. Your address on your picture ID MUST match the address on your check unless otherwise approved by a store manager.

The check must also pass through their magnetic check reader, and they do not accept checks older than 30 days.

This was the signage posted at my local Winco. The left-hand says that it costs $5 to cash a check under $500, and $10 for a check over $500. While the right-hand pictures shows what type of checks they cash, and that they are required to ask for your personal info and a valid ID.

4. Pilot Flying J gas station

Check Cashing services are available at all locations 24 hours a day at Pilot Fly J. Customers can cash a check (up to $999.99) for a fee. Those who fuel a minimum of 25 gallons can cash a check up to $200 free of charge at the same location within two hours of fueling.

They cash checks from billing companies, Pilot Flying J Direct Bill Customers, and members of NATSO. Identification is required, and the check’s authenticity will need to be verified. It’s important to know that managers can refuse any check that does not meet their check-cashing policy.

5. Travel Centers of America

Very similar to Pilot Flying J gas stations are Travel Centers of America, also open 24 hrs. They will accept checks from billing companies and NATSO-approved accounts for up to $999. A service fee for all check cashing will apply in all states, excluding New Jersey. However, you can have the fee waived if you have a qualified purchase within two hours. You’ll receive free check cashing if you’re an UltraONE Platinum member.

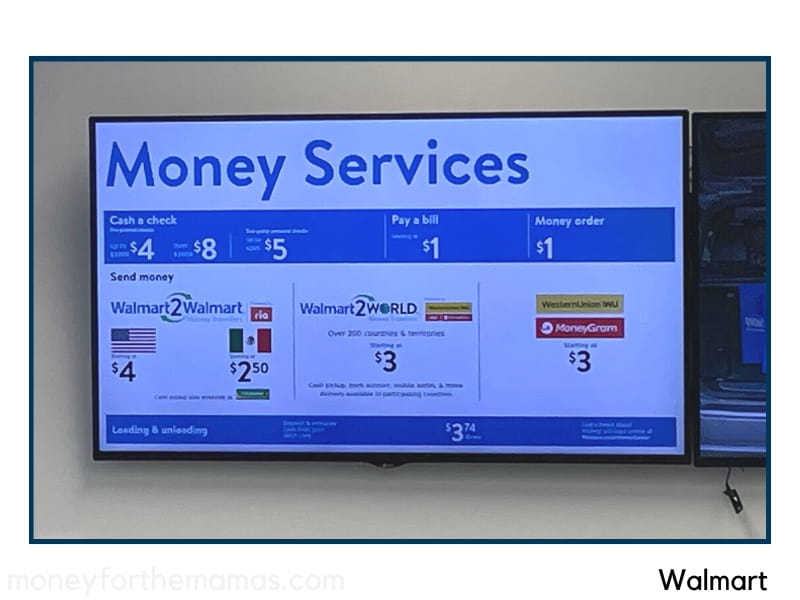

6. Cash your check at Walmart

You can go to your local Walmart store and cash a check up to $5,000 at the service desk. Here’s how much you’ll pay…

- For pre-printed checks up to & including $1,000: max. $4.00

- For preprinted checks over $1,000 up to & including $5,000: max. $8.00

There are several different checks that Walmart can cash for you. These include payroll checks, government checks, tax refund checks, cashiers’ checks, insurance settlement checks, and 401(k) or retirement account disbursement checks. In fact, as long as it’s a preprinted check, they can cash it.

Note: Walmart’s website contradicts itself regarding cashing personal checks. In one spot, it says it does; in another spot, it says they won’t cash personal checks. In the photo below where it shows “$5” (the rest is too blurry, so you’ll have to trust me). It reads, “two-party personal checks up to $200” will cost $5 to cash.

The picture above is at my local Walmart; they don’t display their check cashing policy, just the prices for cashing a check.

7. Cashing checks at HEB

Stop by your H‑E‑B Business Center to cash a check or withdraw cash from your debit card! Fees start at $3. You can cash your government, payroll, dividend, insurance, and Western Union Money Orders purchased at H‑E‑B. Funds are available in cash or loaded to your H‑E‑B Netspend Prepaid VISA® Debit Card.

8. Kroger Money Services

You can cash a check at Kroger family stores, such as Fred Meyers, Fry’s, Dillons, Food Co, Food for Less, City Market, and Baker’s.

They cash payroll checks, government checks, income tax refunds, insurance settlements, business checks, and child support checks. To cash a check, you will need to bring a valid ID. Some locations require you to disclose your SSN to cash a check.

With a Kroger Shopper’s Card, fees start at just a few dollars for checks under $2,000. For checks up to $5,000 and they offer “competitive pricing.” Their check fees vary by state, so they don’t advertise exact pricing online, as they have stores across the US.

The below picture is my local Kroger store (Fred Meyer), and it shows their check cashing prices. Interesting, they can also do card cashing. While you can only get a small amount of cash back at the register, you can go to customer service and get up to $400 in cash from your debit card. It’s a nice way to save a trip to the bank.

9. Some Credit Unions

Credit Unions have a reputation for being more customer friendly than banks. So you may have luck cashing a check at one. Again, call them before you show up.

Check Cashing Near me places – NO LONGER VALID

Many sites talk about the following three places to cash your check, but these places no longer offer this service (if they ever did in the first place).

Western Union

You cannot cash a check at Western Union, but they do partner with Check into Cash stores. Maybe they used to offer this service (as many people still talk about it), but it’s unavailable now.

Cashing checks at Meijer

Many websites say you can cash checks at Meijer; they even outline the process. Yet, you cannot find any information on Meijer’s website on this service. Only in very small writing on their check acceptance policy do they say, “Meijer does not cash checks (payroll, tax refunds, etc).”

Maybe they used to offer this service, but not anymore.

10. 7-Eleven check cashing (half valid)

Similar to Western Union, you cannot cash a check at 7-Eleven. Maybe in years past, you could, but not anymore. However, there is a roundabout option to cash your checks at 7-Eleven.

You’d need to sign up for their Trans@ct card, which is a reloadable prepaid MasterCard. You can load it with cash at 7-Eleven and use it anywhere Mastercard is accepted.

You can load a check of $100 or more using the Mobile Check Load feature on the Trans@ct App.

This card has a $5 monthly fee, but if you go to 7-Eleven often, there are many ways to earn points and get paid back.

To open a card, you’ll need to input personal information and a government ID card number, which they may ask for a photo.

Check cashing stores near me

Did you know there are stores that specifically cash checks? They usually offer other financial services, like loans, money orders, payday advances, etc. You probably have a handful of these types of stores in your city. Most of these stores have extended hours, so they’re an okay option if you get a check outside normal bank hours.

The main downside of these stores is that they charge very high fees. They each charge a different amount to cash checks, so call and ask before visiting.

Fair warning, these stores also typically offer payday loans. I wouldn’t suggest getting a payday loan from one of these places. The interest rates they charge are incredibly high, on average 400%. These types of loans are considered predatory, as they can trap you into a payment cycle that’s very hard to get out from under, especially if you are a low-income earner.

If you need a cash advance, absolutely check out a new app called Current. Zero to minimal fees and lots of additional features! We’ll go into more detail about them below.

How Does a Check Cashing Service Work?

When you need to cash your check, the process is simple. You take your check and a valid form of ID (usually a driver’s license or passport) to the store, they verify it and then hand you your money in return. Certain stores may require more information to be provided, such as your social security number.

For each store listed, I called them and asked about their fees. I told each that I had a personal check for $325. Overall, getting information over the phone didn’t go well.

However, it may be your only option. So I’ve linked to each store’s location finder so you can find the closest to you.

11. Check n Go near me

Check n Go cashes personal and payroll checks; you just need a valid ID. It’s important to note they do not cash third-party checks.

As for their fees, they say they vary by state, and you are to call your local store. When I called a location to ask about check cashing fees, they told me that their location (in a smaller area) doesn’t cash checks anymore, but larger stores still do. The store representative wouldn’t tell me what the fees used to be, though, which is odd, and not a good sign.

12. Check into Cash near me

There are 650 Check into Cash locations nationwide, so you probably have one nearby. After a few phone calls, I got info on fees. They charge…

- 10% fee on personal checks. So if you have a $500 check, they will take $50.

- 3% fee on business checks. So if you have a $500 check, they will take $15.

I asked the rep if this was a good/common rate, and she said it was pretty standard. Personal checks cost more than business checks as they’re a higher risk. Yet, 10% is a HUGE rate for check cashing in general.

13. Speedy Cash near me

Speedy Cash looks promising as they advertise that you can get a check cashed for as little as $2, which sounds pretty good. They then say they typically charge 2-2.5% of the check amount to cash payroll and government checks. But that rates do vary by location and type of check.

In looking online, they accept more kinds of checks than other places, and there’s no holding period once they verify funds. They also cash checks up to $20,000, and amounts over that they may take longer to process.

I called a location in Alabama, and while the rep wouldn’t get me a rate, I told her it was a personal check for $300. She quoted me a general price range of $6-$8, which isn’t bad.

14. Ace Cash Express near me

Ace has 850 store locations nationwide (which is good). They do cash many types of checks. But again, no fee chart was posted. So I called a local branch and told them I had a personal check, and they quoted a 6% rate. Then the phone rep asked me the amount, and I said $325. He said that was over their limit for personal checks. Interestingly enough, when I asked what the limit was, he wouldn’t tell me; he said they couldn’t give that information out.

Odd.

They also partner with Porte, which is an online banking app where you can cash checks, and they offer this through Ingo Money Services. We’ll go more into Ingo below.

15. Money Mart near me

Money Mart has a limited number of locations (they’re in 5 states), yet they do have a mobile app for check cashing.

When I called a location and asked about fees, the rep told me they would have to see the check and that there was no standard rate. This seems really shady. Obviously, they want to make sure it’s a legit check, but you’d think they would have a standard rate?

Maybe they want to see the person who’s cashing it; I don’t know. That would be even worse as that veers into profiling.

Overall opinion of check cashing stores

Going to a check cashing store should be your last choice of all the options. Yet, if you have a personal check, it may be your only choice if you don’t have access to a smartphone to use an app. Of all the stores I called, Speedy Cash seemed the most reasonable regarding pricing.

24 hr check cashing near me: in person

Cashing a check overnight can be tricky, but luckily there are a few options.

- Most Winco stores are open 24 hrs a day.

- Some Walmart locations are open 24 hrs a day, especially the Supercenters.

- Flying J gas stations & Travel Centers of America are open 24 hrs (mentioned above)

16. PLS Stores

PLS stores are in 12 states (Arizona, California, Illinois, Indiana, Kentucky, Massachusetts, New York, North Carolina, Ohio, Oklahoma, Texas, and Wisconsin). They are open 24 hrs a day for many kinds of financial transactions, and they cash all sorts of checks, which start at 1% + $1 for payroll checks.

- Paychecks

- Personal checks

- Government checks

- Tax refund and stimulus checks

- Business checks

- Out-of-state checks

17. Community Financial Service Centers

CFSC has over 200 locations across the nation. Some locations in larger metro areas are open 24hrs a day. While some locations just have regular hours, 9-6:30 pm, and some have expanded hours, such as 6:30 am to 9:30 pm. So they open a lot earlier than banks and stay open later too. Be sure to check online for each location’s specific hours.

They cash all sorts of checks (but not personal checks), and you’ll need to bring a valid ID and be ready to hand over all your contact info and SSN to get your check cashed.

They also have a rewards program, so each time you do a transaction, you earn points for discounts on future transactions.

Find 24 hr check cashing near me

Click the green button below to use the 24 hr check cashing locator…

24 hr Check cashing near me: mobile banking apps

Did you know the nearest check cashing place is actually your couch? As long as you have a smartphone, you’re all set with a mobile check cashing app.

18. Use your bank’s mobile app

Almost all banks have a mobile deposit feature, but be sure to look and see what kind of mobile deposit limits they have. For example, with Wells Fargo, there’s a $5,000 daily limit and a 30-day limit of $14,500 for mobile deposits.

You’ll want to pay attention to processing cutoff times as well. For example, again with Wells Fargo), if you deposit it before 9 pm PT, your funds will be available the next business day. If you deposit after 9 pm PT, it will take an additional business day.

After making a mobile deposit, you can then…

- Transfer the money to PayPal (instant transfers cost a small fee or for free for a standard time of 1-3 days). If you owe someone money, there’s a good chance they have PayPal or Venmo.

- Zelle it to someone (most banks support Zelle).

- Pay bills online (which usually has a day delay in processing it, so while processing your payment, your deposit will clear your bank at the same time (as long as you did it during the work week and before the time cutoff).

- Write an eCheck, and the bank will mail a physical check to them.

✅ 19. Use Current

Current is my first recommendation for mobile banking with check cashing options. It’s an easy-to-use banking app that aims to win your banking business with its huge list of features and low fees. They offer…

- Mobile check deposit

- Debit card with rewards

- Zero to minimal fees – no overdraft fees, no membership subscription, no minimum balance fees, no bank transfer fees

- Overdraft protection (now up to $200)

- Get access two days early to your paycheck with direct deposit

- Teen banking options for your kids

- Crypto investing

- Savings buckets with an amazing 4.00%APY!

- Peer-to-peer payments

- Simple budgeting help & tools, such as Insights – which breaks down your spending by category and compares month-to-month patterns

Get Current for Android or Current for iOS

Current is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Member FDIC.

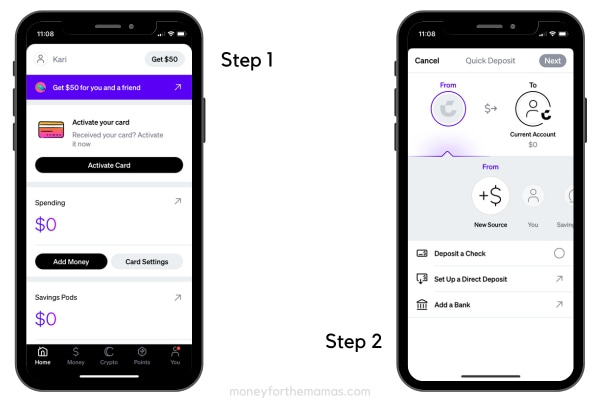

Cashing a check on Current is very straightforward…

- Open the app

- Tap on “add money”

- Tap “deposit a check”

- Add the amount

- Endorse the check and take a picture of the front and back of the check, and submit

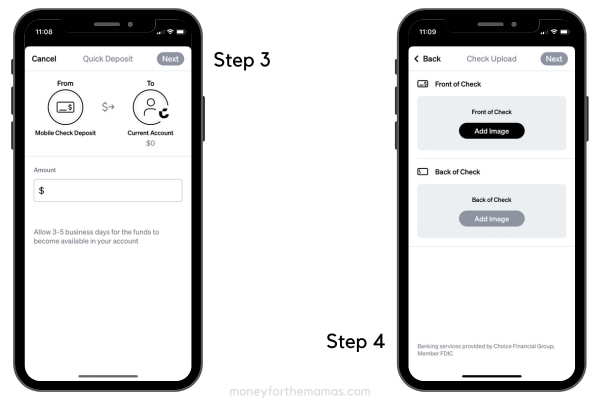

20. Use PayPal to cash a check without ID

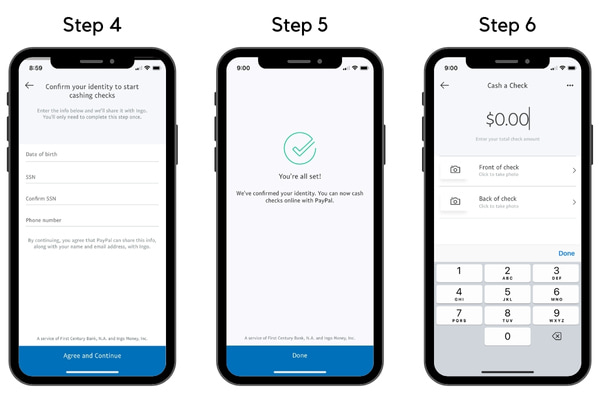

Almost everyone has a PayPal account, and you can now cash a check without ID! The app now provides this service as they partner with Ingo money (listed above). Here’s how to get started.

- Step One: Open your PayPal account

- Step Two: Go to the Finances tab, and tap “cash a check”

- Step Three: Agree to the privacy policy and terms & conditions

- Step Four: Input your personal information – birth date, SSN, phone, and confirm

- Step Five: They will confirm your identity, BUT you may be asked to upload your ID and proof of address. This could take up to two business days if you need to upload documentation.

- Step Six: Endorse your check, input the check amount, take a picture of the front & back of the check, and submit. Your check will be reviewed and will take 2-5 minutes to be approved

21. Cashing a check on Cash App

Some Cash App users have the check cashing feature (but not everyone). You’ll go to your Money tab (the tab that shows your account balance) and then scroll down to the bottom. If your account has this feature, you will see “deposit check” as an option.

Cash App commonly rolls out new features to only select users, so if you don’t see this option right now, you can check back later to see if it’s available.

Don’t forget that there are lots of great ways to earn money with Cash App, so be sure to consider this as an option!

22. Cashing a check on Venmo

You can cash your check on Venmo and add the money to your Venmo balance.

To use the Cash a Check service, you must have completed the required identity verification by applying for a Venmo debit card or setting up direct deposit. You will need to input your birthdate, SSN, and address (not a PO Box), and in some cases, upload a photo of a valid ID.

Once you’ve done that, here’s how you can cash a check:

- Download the Venmo app

- Go to the go to the “Me” tab by tapping your picture or initials

- Tap “Manage Balance” in the Wallet section

- Select “Cash a Check.” You’ll be prompted to verify your account information if you have not already done so.

To begin, input the value of your check. Then, grab a photograph of both sides with your smartphone and tap ‘Next’ to complete the process.

Select how quickly you want access to your money (fees may apply if you want the funds available immediately).

It usually takes a few seconds to review a check for approval, although it can take 10-15 minutes and sometimes up to 1.5 hours to verify to approve your check.

Upon approval of your check, you will be instructed to write “VOID” across it and present a photo demonstrating proof that it was done. When all steps are complete, you will receive a confirmation page displaying the amount of money successfully transferred into your Venmo account.

23. Use Ingo Money

A few of the apps above use Ingo Money for their check cashing process. They’re great if you need additional banking services, but if the only thing you need is to cash a check then you can just go to Ingo Money.

Ingo Money is an app that allows you to cash checks (even if you don’t have a bank account) on your mobile phone. Creating an account only takes a few minutes, but you will need to give your social security number to them so they can verify your identity. You’ll also be prompted to link any accounts you want – bank account, PayPal, reloadable credit card, etc.

Once your account is set up, you can cash a check – up to $5,000 (paychecks, personal checks, business checks, and money orders), and then send that money to another account. When your check is approved, you can transfer your money to your bank, prepaid card, or PayPal account, buy an Amazon.com Gift Card, pay your credit card bills, or pick up cash at a MoneyGram agent location.

For instant payment, this service, of course, does cost you. They have standard pricing and Ingo Gold Preferred pricing (for those who cash more than six checks in a 90-day period).

- Standard Pricing will vary based on if it’s a payroll & preprinted check or a personal check. You’ll pay $5 if it’s under $250/$100, respectively, or 2%/5% if it’s above those limits.

- Ingo Gold Preferred Pricing also varies based on what kind of check it is. Preprinted & payroll checks or personal checks. You’ll pay $5 if under $500/$125, respectively, or 1%/4% if it’s above those limits.

Or, if you don’t need the money right away, you’ll receive your funds in 10 days for free (to the account you designated in the online deposit process).

For a $5 fee, you can pick up your cash at a MoneyGram store location. But you will need to present ID, where the names must match what’s on the Ingo account, for them to release funds.

Once you submit your check (endorse, take pictures, and send), they say it usually takes 2-5 minutes for your check to be reviewed and approved, but it can take up to one hour in some cases.

24. Other apps to cash a check

There are lots of other mobile banking apps that you can use to cash a check instantly. These are similar to traditional banking (but there’s no physical location). It’s also important to note that many of the apps are a combo of a tech company with a traditional bank as a partner.

The tech company handles the app/user platform (because that’s what they’re good at), and then the bank keeps the money safe (what they’re good at). So your money is always FDIC insured.

Mobile banking apps are a great choice for those underserved by the banking community. According to the FDIC’s 2021 survey, about 4.5% of US households do not have a bank account, which means almost 6 million households.

Interestingly, “Don’t have enough money to meet minimum balance requirements” was the most cited reason by unbanked households for not having an account in 2021. The good news, almost all of the banking apps below do not have a minimum balance requirement. In fact, their fee structures are usually very user-friendly.

While I really like Current (mentioned above) and GO2bank, there are other banking apps where you can cash a paper check with mobile deposit…

You will need to create an account and input your personal info so they can verify your identity (in accordance with Federal Law – US Patriot Act), but you don’t need to upload an ID. At least, I didn’t when I opened an account at two of the options listed above. In fact, the process was very easy and took maybe 10 minutes max.

Some apps require you to set up direct deposit with them to use services, while some have a subscription fee. Some of them require you to link another financial account with them (i.e., a bank account, yet sometimes Chime works with other apps as a verifying bank, which is a good option.

Many of these apps have other great features, like budgeting help, getting paid 2 days early when you sign up for direct deposit, and credit building help. You can see our full guide, where we compare the best credit builder programs to help you pick the best option.

Other ways to cash a check

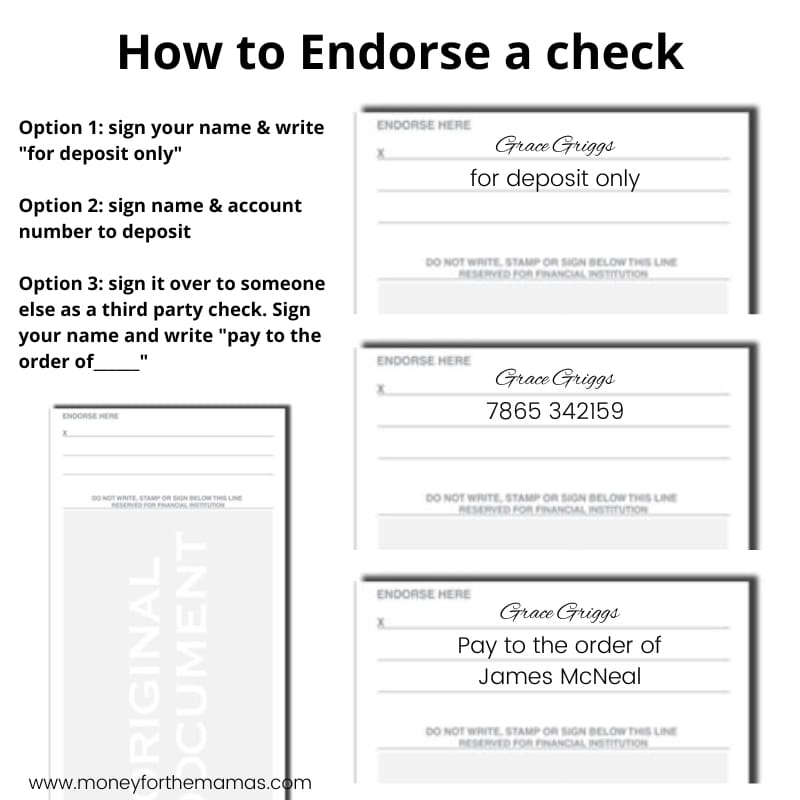

25. Sign it over to a friend

People used to do this all the time, but since most of us don’t write checks anymore, it’s kind of dropped off our radar. Signing over a check tells the bank that you are giving up ownership of these funds, and the money now goes to the person you named on the check. This is what’s called a third-party check.

Here’s how to do it, first sign your name on the back of the check, then right below it, write “Pay to the order of: ____” then fill in the person’s name. That person can now go to the bank and cash the check with their ID.

Of course, you will first want to ask the person if this is okay, as it can be more difficult to cash a third-party check. You’ll want to make sure they have access to a bank and an ID to cash it.

We cover everything about signing over a check and making it a third-party check here.

Check Cashing Near Me FAQs

What do you need to cash a check?

Generally, you need a valid government-issued ID to cash a check. Other forms of identification may be accepted depending on the location and the type of check being cashed. People typically use their driver’s license or state ID card.

What are the fees for cashing checks?

Fees vary by check-cashing location and type of check being cashed. You can always cash a check at your bank for free. If you’re talking about going outside of your bank, then cashing a personal check usually costs more than a business check, as there’s a higher risk of it being returned with non-sufficient funds.

How can I cash a large check without a bank account?

If you’re cashing a large check, your best bet is to use a mobile banking app, as they can cash a check up to $5,000 (depending on the app). If you want to cash a check in person, you’ll want to set aside time to call places before showing up.

Where can I find a check-cashing service near me?

Easy – click the green button below to find the closest check cashing service…

How much does a check cashing service charge?

It’s cheapest to go to your bank; usually, they do not charge a fee when you have an account. At all costs, avoid check cashing stores as they charge the highest rate. So if it’s a preprinted check, go to Walmart; that’s the easiest as there are so many locations.

What is the disadvantage of using check cashing services?

Depending on where you go, they may hold the funds for a certain period or change a significant fee.

Will Walmart cash a personal check?

This is up for debate, as in one spot, their site says yes, up to $200 for personal checks. Then in another section, Walmart says no personal checks.

Where can I cash my check instantly?

What if I can’t cash my check? I need the money!

This is tough, and I’m so sorry you are in this position. I always suggest that people have a mobile banking option (even if they have a regular bank), as many of them offer cash advances as a feature. You will likely need to set up a direct deposit with them to be approved for this feature.

How much does Walmart charge to cash a check?

Walmart’s website states that it costs $4 – $8 to cash a check, depending on the check amount.

Can you deposit a check on Cash App?

Some users can deposit a check on Cash App; it all depends if you have this feature. Cash App commonly does limited rollouts of new features, so hold tight if you don’t have it right now; you may soon.

Where can I cash a cashier’s check?

Many of the store locations mentioned (i.e., Walmart, HEB, etc.) will cash a cashier’s check.

How long do you have to cash a check?

Personal checks are legally good for six months from the date of issue (180 days), while government checks are good for one year. Some business checks have a “good thru” notice on them.

While you can try and cash a check after the stated period, you may be charged a returned check fee, usually around $30.

Can you cash a check at an ATM?

Absolutely, this is usually the easiest option to cash a check (as long as you have an account at that bank).

Are mobile banking apps safe?

Yes, mobile banking apps are completely safe as they are always partners with an FDIC insured bank. While there are money scammers out there, just be safe and don’t send anyone you don’t know money. If you follow that one rule, you’ll be fine.

Where can I cash a check on Sunday?

You can try any of the stores mentioned above – Walmart, Heb, Winco, or Kroger to cash a check on a Sunday.

Can you cash a ripped check?

Yes, you can cash a ripped check as long as all of the pertinent information can still be read. Info such as account & routing number, signature, payee, and amount. It’s okay if the check is torn at the top; that’s common when people are ripping the check out of a checkbook.

If the check has a big rip, your best bet is to take it to a bank. I wouldn’t want to take it to a grocery store that puts it through a reader, and then it gets ripped more. At a bank, you have a little more leeway if that happens.

How to cash a check if the person is incarcerated

First, you would need power of attorney for the person whose check you want to cash. Most prisons regularly deal with this, so it should be easy for them/you to get papers drawn up. Then you can legally cash the check.

How to cash a check for someone else

They would need to sign the check over to you and make it a third-party check). They’d endorse it on the back and then right under that, write “pay to the order of {your name}.”

If you don’t have power of attorney, the person in jail can sign it over to you as a third-party check.

At the end of the day

Finding a check cashing place seems daunting at first, but there are plenty of options to choose from. Whether you go to the bank, an app such as Current or Ingo Money, a grocery store, or a credit union – make sure you know the rules and fees attached to that specific service before going forward. You should also have your ID on hand and ready.