Easy to Use 30/30/30/10 Budget (Free Template)

Let’s walk through everything you need to know about the 30/30/30/10 budget and get your monthly budget set up today!

Author: Kari Lorz – Certified Financial Education Instructor

You might have heard of the 50-30-20 budget, or the 60-10-30 budget, but what about the 30-30-30-10 budget? This approach is just as effective as any other budgeting strategy, and it’s a great way to start managing your money.

The 30-30-30-10 budget method is a simple solution that can help you take control of your money and get ahead with your financial goals. This straightforward breakdown will help you stay on track with your spending while also making progress toward your long-term financial goal of financial freedom.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is a 30-30-30-10 budget, and how does it work?

This budget is a simple approach to financial planning for those who want to prioritize their financial goals, like saving or buying a home. It’s based on percentages, which breaks down your spending into four categories.

Here’s how your expenses should breakdown using the 30-30-30-10 budget percentages…

- 30% for housing costs – rent, mortgage, property taxes, and maintenance costs.

- 30% for necessary expenses – utility bills, basic groceries, and transportation.

- 30% for financial goals – build your savings, pay off credit card debt, or save for retirement.

- 10% for wants – non-essential expenses, like Netflix or gym membership.

This budgeting method prioritizes saving for your goals while cutting back unnecessary spending. So if you know that you overspend on wants and make a lot of impulse purchases, this budgeting method could help you.

How to set up your 30-30-30-10 budget

1. Figure out your after-tax monthly income & create financial goals

The first step is to figure out how much money you’ll have left after taxes and payroll deductions from your gross income (aka net income). Then, decide your goals and how much you’d like to save each month towards them.

If you have debt payments, you should have multiple goals you’re putting money towards. For example, you should put half the 30% of “savings” towards debt repayment (be sure to follow either the debt snowball or avalanche method). Then you could put the rest of the 30% towards filling your emergency fund, saving for Christmas, a car downpayment, etc.

In an ideal setting, you would have a separate account for each of your savings goals. That way, there’s no confusion about what money is for what purpose. You can see how I use multiple bank accounts for budgeting right here.

If you want to open a few accounts, then I suggest checking into a high-yield savings account to help your money grow faster. Current is an online banking app with savings pods, and you can have three of them, and they earn great interest rates (I think it’s 4.00% APY right now – April 2023).

Current for Android

Current for iOS

2. List out your monthly expenses

You should grab your latest bank statement, credit card bills, etc. Then list out all your recurring monthly expenses. Don’t forget about bi-yearly expenses (i.e., car insurance) or things charged yearly (i.e., Amazon Prime subscription).

3. Categorize your spending into Needs & Wants categories and cut back if needed

Categorizing your spending into essential spending & discretionary expenses (aka needs & wants) can be very hard for some people. You should always prioritize your “4 walls”. These are the thing that you absolutely must have to stay alive.

Things like rent/mortgage, utilities (water, heat, electricity), insurance, and basic groceries. Your rent/mortgage is the first budget percentage category Housing 30%.

Then comes your Needs category, which is also 30%. These are the utilities mentioned above and other bills like cell phone, internet, daycare, credit card minimum payments, etc.

Your Savings category is also 30%, where you give the dollars to the financial goals you laid out in step one. Don’t forget that you need to both save money for later (ideally for retirement) and reduce your debt (these are payments above your minimum payments). We’ll go into details below in the tips for succeeding with the 30 30 30 budget rule.

The last budget category is your Wants, which is 10% of your spending. In this category comes your dining out budget, fun money, spending on beauty treatments, hobby stuff, etc.

This is where most of us need to cut our spending back, as we like to think some things are needs when they’re really not. For example, Disney+ and Hulu are not needs; eyelash extensions are not needs; clothes shopping (other than basics) is not a need.

4. Track during the month

The best way to stick to the 30-30-30-10 budget method is by setting up a spending tracker system. You can use a spreadsheet, an app like Mint, or even pen and paper to keep track of your spending. I have a handy bill and expense tracker that you can download and print at home.

It doesn’t matter which way you track, just that you do track. That way, you can see where your money is going and ensure you’re keeping up with your goals.

Ideally, you’d track what you spent at the end of the day, but that’s not always feasible. At a very minimum, you should track your discretionary spending weekly. If you wait too long, you won’t have enough time to course-correct your spending.

5. Evaluate & adjust your spending

At the end of each week & the month, evaluate if you stayed within your budget. If you overspent in one category, figure out where the money went and why. You’ll want to find those problem areas to adjust your budget for next month.

You should also look at how much progress you made toward your financial goals. Savings trackers are a fun way to keep your goals up front and visual. I know I am guilty of setting a goal and completely forgetting about it. I don’t want that for you! So start tracking your progress!

I also want you to know that nobody (and I mean zero people) gets their budget perfect in the first month. All budgets need to be tweaked and adjusted; it’s a normal part of the process. So don’t feel bad, guilty, or worse yet, quit. I want you to take heart that everyone goes through this trial period.

Yet, I don’t want you to waste your time forcing this method to work when it just won’t. I advise you to give any new budget method at least three months before you throw in the towel. If it’s still not working after three months, then no worries, pick a different budgeting method; there are lots!

Don’t let anyone tell you that there’s only one right way to budget, there are lots of ways. Different people need different features and guidelines. The only right way to budget is the way that works for you and that you’ll keep doing for the long term.

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

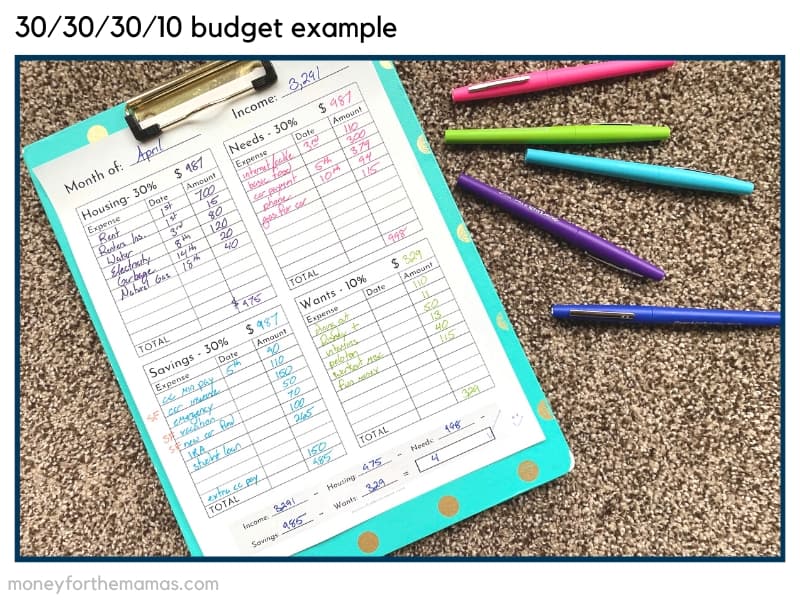

30 30 30 10 budget example

According to the US Bureau of Labor Statistics, the median weekly salary of a full-time worker in the US was $1,085 in the fourth quarter of 2022. So let’s x by 52 weeks = $56,420 annually, which comes to be $4,700 a month.

Note the $4,700 is before taxes & deductions, so let us assume a standard 30% paycheck deduction, which brings your take-home pay to $3,291 a month.

So with our 30-30-30-30-10 budget rule, here’s how it would shake out…

- 30% Housing = $987

- 30% Needs = $987

- 30% Savings = $987

- 10% Wants = $329

I know this doesn’t look like a lot; few places go for $987 or less a month. So you may need a roommate (if you’re single). If you married, then of course, double these figures to get your household take-home pay.

Budget example for a fictitious person named Alicia. She…

- Lives with a roommate in a 2-bedroom apartment

- Has average utilities (according to apartmentlist.com)

- She has a car

- She’s into health & fitness stuff

- She has two credit cards she’s trying to pay down

Housing 30% = $987

- Rent/mortgage

- Property taxes

- Home insurance

- HOA dues

Needs 30% = $987

- Water & sewer

- Electricity

- Natural gas

- Garbage

- Internet

- Phone

- Basic groceries

- Credit card minimum payments

- Basic transportation

Savings 30% = $987

- Emergency fund

- Debt payoff (snowball or avalanche method)

- Vacation fund

- New car down payment fund

- IRA contributions for retirement (or brokerage account)

You can also set up small sinking funds within this category, but only do 10% or less of the funds in this category, as most of it should be used for long-term savings goals. Sinking funds are a great way to save up for things. Things like Christmas presents, Halloween outfits & candy, new hobby stuff, etc. You can find tons of sinking funds category ideas here.

If you have more complicated savings goals – say multiple expenses for an upcoming vacation, be sure to check out the sinking fund calculator, which can tell you exactly how much you need to save each month to reach your savings goal in time.

Wants 10% = $329

- Gym membership

- Streaming services

- Dining out

- Fun money

- Fancy car (above basic transportation)

- Hobby supplies

- Amazon Prime subscription

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

Pros & Cons of the 30 30 30 10 budgeting method

Advantages of the 30-30-30-10 budget

- Meet financial goals faster – By allocating 30% of your budget to financial goals, you can direct a significant amount of your income toward these goals and hit them a lot faster than with other budgeting methods.

- Be more disciplined – If you want to reign in your spending, this method will help you, as you can only spend 10% of your take-home pay on wants. (but we should say that making a monthly budget is fairly easy; sticking to it is the hard part.

- Clear direction on spending – this is good if you’re a details person.

Disadvantages of the 30:30:30:10 rule budget

- It might be hard for natural spenders to only spend 10% on wants.

- Not much flexibility, so people who like options and are spontaneous may find this method too constraining.

- Those with irregular income may find it hard to fully contribute towards their financial goals when working less than anticipated.

Who is the 30-30-30-10 budget rule good for?

This budgeting method is good for people who…

- Want to save more money

- Already have their household set up (so they don’t need to buy a lot of things for the home)

- Want to stop the consumerism spiral

Who is the 30-30-30-10 budgeting rule not good for?

- It can be hard to save 30% of your income when you’re a low-income earner.

- It can be difficult to meet each percentage consistently if you make a variable income and you’re not sure how much you’ll be paid each pay period.

- If you live in a high-cost-of-living area, it will be hard to find housing for only 30% of your income. You’d have to adjust it up to 35% or even 40%, significantly lowering your savings rate.

- Couples who have different mindsets about spending & saving. Both partners need to be on the same page for this to work.

If you like this budgeting style but aren’t sure the budget percentages fit your needs & financial goals, then you can try the 70/20/10 budgeting method instead.

Tips for success with the 30/30/30/10 budget

No matter your budgeting method, one tip can help anyone stick to their spending plan. It’s the “pay yourself first” method, where you move the money you want to save directly after getting paid. You are paying yourself (and your savings goal) before any other expense.

Move it to a separate savings account, and forget about it. That way, when looking at your monthly bank account balance, you see only what you have to spend.

A tip to make this easier is to set up an automatic monthly transfer (or bi-weekly if you get paid twice a month). For example, if you always get paid on the 28th of the month, then set up an automatic transfer for the 1st (give it a few days to make sure it clears the account, even on weekends and holidays).

Then all you have to do is nothing. You save every month, like clockwork, without having to do anything. This works because when we leave our saving to do manually, we’ll forget, decide that we need the money for something different, or whatever excuse we give ourselves to spend that money instead of saving it.

30 30 30 10 budget template

You can easily just grab a piece of paper and break it up into 4-quadrants. But I also know it’s nice to have printed out nice looking 30 30 30 10 budget template (it makes it feel more official, doesn’t it?)

Here is an easy form you can use…

At the end of the day

The 30-30-30-10 budget can be a great way to manage your finances and help you reach financial goals faster. It allows for all your needs while still allowing room for wants. With the right attitude and commitment, using the 30-30-30-10 budget could be an effective tool to get out of debt quickly and build wealth over time.