Smart Financial Advice for Women Right From the Pros!

50+ pieces of smart financial advice for women that can help you grow your bank balance (and keep it)!

Author: Kari Lorz – Certified Financial Education Instructor

Today, I am laying out all the best money advice for women that real women have taken to heart and shared with me.

Because real women are the ones living life on our level, they know our struggles and our needs, so in my book, they’re the pros!

All of these money tips are valuable, and each has resonated with women on a deeper level.

Read their words of wisdom, and I hope that something “clicks” with you! Because you may have heard it all before, but sometimes, for some reason, someone says something in just the right way that totally blows your mind!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Women & money

According to Forbes, Women investors consistently outperform their male counterparts, which could leave them with hundreds of thousands of dollars more at retirement.”

In fact, Fidelity’s analysis also “found that when comparing annual savings rates, women come out on top. Looking specifically at workplace retirement planning, women consistently saved a higher percentage of their paychecks than their male counterparts at every salary level.

Women saved an annual average of 9.0 percent of their paychecks, compared to an average of 8.6 percent saved by their male counterparts.”

So it sounds like once we women have some knowledge and confidence on how to save & invest, we’re on a roll to financial success!

But how do we get more women to that point of financial planning? Easy, we lead each other there! We take friends & family by the hand (if they are willing and curious, of course), and we show them where they can learn, just like we did.

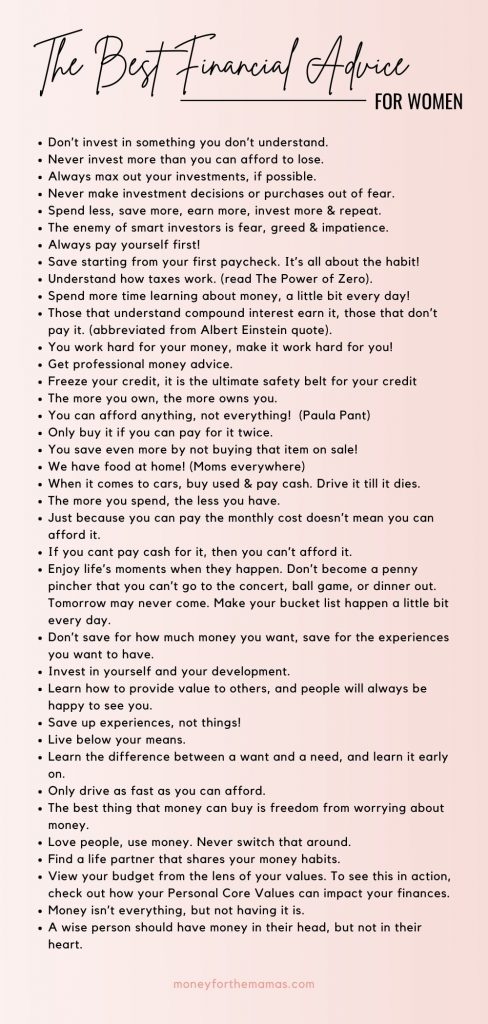

The best money tips on investing | 1-7

- Don’t invest in something you don’t understand.

- Never invest more than you can afford to lose.

- Always max out your investments, if possible.

- Never make investment decisions or purchases out of fear.

- Spend less, save more, earn more, invest more & repeat.

- Don’t just save money, invest it! Spread it out into different buckets for safety.

- The enemy of smart investors is fear, greed & impatience.

These are some of the best money tips for women that will help us reach our financial goals faster! I am not claiming these quotes/advice as my own; neither are the women who mentioned it. All advice was shared via a Facebook thread on the topic.

If I know the source, I will cite it accordingly. You could call this the quick & dirty intro to financial literacy, these tips will get you thinking, and then hopefully acting!

Financial advice on being the boss of your money | 8-17

- Always pay yourself first!

- Save starting from your first paycheck. It’s all about the habit!

- Tell your money where to go, not wonder where it went. (Dave Ramsey)

- Understand how taxes work. (read The Power of Zero).

- Spend more time learning about money, a little bit every day!

- Those that understand compound interest earn it, those that don’t pay it. (abbreviated from Albert Einstein quote).

- You work hard for your money, make it work hard for you!

- Get professional money advice.

- Freeze your credit, it is the ultimate safety belt for your credit

- There are two “haves.” Have a budget, have multiple streams of income.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

Albert Einstein

Hard money truths on spending your money | 18-27

- The more you own, the more owns you.

- You can afford anything, not everything! (Paula Pant)

- Only buy it if you can pay for it twice.

- You save even more by not buying that item on sale!

- We have food at home! (Moms everywhere)

- When it comes to cars, buy used & pay cash. Drive it till it dies.

- Play the “is it worth it” scenario in your head for every nonessential purchase. Sometimes it may not be worth the money, but it may be worth the time.

- The more you spend, the less you have.

- Just because you can pay the monthly cost doesn’t mean you can afford it.

- If you cant pay cash for it, then you can’t afford it.

Money advice for living your best life | 28-36

- Enjoy life’s moments when they happen. Don’t become a penny pincher that you can’t go to the concert, ball game, or dinner out. Tomorrow may never come. Make your bucket list happen a little bit every day.

- Don’t save for how much money you want, save for the experiences you want to have.

- Invest in yourself and your development.

- Learn how to provide value to others, and people will always be happy to see you.

- Save up experiences, not things!

- Live below your means.

- Learn the difference between a want and a need, and learn it early on.

- Only drive as fast as you can afford.

- The best thing that money can buy is freedom from worrying about money.

Money tips for your heart & relationships | 37-41

- Love people, use money. Never switch that around.

- Find a life partner that shares your money habits.

- View your budget from the lens of your values. To see this in action, check out how your Personal Core Values can impact your finances.

- Money isn’t everything, but not having it is.

- A wise person should have money in their head, but not in their heart.

Hard money truths about having debt | 42-47

- Eliminate all debt, no matter what.

- Don’t waste your money on depreciating assets.

- Debt is a curse; avoid it at all costs.

- Don’t ever get sucked into the interest-paying trap.

- Always pay off your credit cards in full every month.

- Freeze your credit cards, literally in a big bowl of water. By the time you get them thawed out you won’t want that purchase anyways.

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Money advice on earning a paycheck | 48-55

- Learn how to make passive income.

- Learn how to turn $1 into $2, and you will never be broke.

- Stop trading time for money and start trading value for money.

- Get out of a “job” mindset and change it to that of a career. You will make a lot more money and be more fulfilled.

- Time is the only nonrenewable resource; you can always make more money.

- When you get a raise, increase your 401k by that same amount, you won’t miss it.

- Know your real hourly wage! Do you really want to work for 14 hours to buy that shirt?

- Work to live, don’t live to work.

Money advice on saving money | 56-61

- Save, save, save!

- An emergency fund is a must!

- If your spending, you should be saving.

- Save as much as you can when you are young, harness the power of compound interest! This is my biggest financial regret!

- Save first, live on what’s leftover.

- Spend a little, save a little.

Women in finance

If these finance tips got your brains turning and you want to continue improving your financial literacy then there are some great teachers that you can learn from!

Suze Orman started as a waitress in the 80’s and moved on up to be a financial advisor with Merril Lynch. In 1987 she quit working for others and founded her own financial group. Now decades later, she’s written 10 New York Times bestsellers all about money, and most talking directly to women!

Jean Chatzky founded HerMoney.com and host of the podcast HerMoney. She’s been the financial editor of NBC Today for 25 years and the Financial Ambassador for AARP, she appears on CNN and MSNBC. She is a New York Times and Wall Street Journal best-selling author.

Rachel Cruze is a #1 New York Times bestselling author, financial expert, and host of The Rachel Cruze Show. She is the daughter of getting out of debt guru, Dave Ramsey, so needless to say smart money is in her DNA!

What are the money learning stages?

So many of us just starting out learning about money can get lost in the weeds. There are so many things to focus on; where do you even start? Don’t worry; I’ve laid out a very rough three-tiered learning plan for what you should be focusing on as a newbie, intermediate-level, and pro-money planner! Again, these are general things, and I couldn’t possibly include every small financial goal, task, or nuance here.

I’m a money newbie!

- Learn how to make and follow a monthly budget.

- Be working towards a full 6-month emergency fund.

- Get current on consumer debt – credit cards, medical bills, personal loans.

Money medium level planner

- Consistently contribute to your workplace retirement saving plan.

- Have sinking funds for your financial goals and dreams – i.e. new home down payment, vacation fund, kid’s 529 college plan, etc.

- Know what’s in your credit report (aka be pulling it 1-2 a year), and know your credit score.

- Be working towards being 100% debt free – student loans, HELOC’s, etc.

- Have a rough draft of a financial plan written out.

Money top tier planning

- Have retirement accounts in addition to your workplace plan. Open an IRA or a brokerage account.

- Be maxing out your yearly contributions (or as close as your budget allows).

- Seek the help of a financial professional (if you want to), such as a Certified Financial Planner.

- Have zero debt, or be working on paying off your mortgage (usually this is the last debt for people to clear).

- Have an estate plan – (i.e. Living Revocable Trust, etc).

Make sure that your plans, accounts, and strategies flow together and connect. A comprehensive financial plan for women is your long-term goal. But looking at one, in the beginning, might be a bit overwhelming, so for now, start with step one.

At the end of the day

We don’t need to recreate the wheel or make the same mistakes as those who have come before us. These pieces of money advice are given from the heart (and the logical brain; it’s how money nerds work). So learn from our mistakes as well as our wins. Because, if you can do better in less time, then you should absolutely do it, and these are the money tips for women that will get you to the financial future of your dreams!

Articles related to financial advice for women:

- Time vs. Money – Which is More Important to You?

- Problem Overspending? The Solution is Your Real Hourly Wage

- Your Personal Core Values are the Key to Setting and Reaching Your Goals

- How to be a Financial Powerhouse – the Power of Compound Interest

![[By Rachel Cruze] Love Your Life Not Theirs: 7 Money Habits for Living the Life You Want-[Hardcover] Best selling book for |Financial Accounting (Books)|](https://m.media-amazon.com/images/I/513ni+N1gYL._SL160_.jpg)

Lots of excellent tips that help us to understand our money. Warren Buffet and other successful individuals all followed some of these ideas and things worked out well for them, hopefully the same will happen to you and me.

Fingers crossed that it will!

Great post! I definitely should follow these! I always struggle with handling my finances.

Finances are definitely a hard aspect to crack, you just have to find that “thing” that motivates you or the teacher that speaks to you!

My younger brother (just graduated high school) and I have been talking a lot of about money and how to handle it during the time of global pandemic. I’ll definitely be sharing with him. Great piece!!

Congrats to your brother! Dave Ramsey made a small book for HS graduates, I got it for my nephew when he graduated!

Wow, this is fabulous! Thanks for a lifetime of valuable tips 🙂

So glad you found it helpful Julie!

These are great money advices!

This is such an amazing and helpful post.

Thanks so much Ravina!

I loved reading these tips. They are absolutely true and we’d be so much better off if we followed them.

You’re right, we would be better off! But humans aren’t logical, we’re emotional beings, which is amazing, yet it also gets us into trouble! 🙂

Great tips and I loved the one that is: don’t save for how much money you want in your life but save for the experiences you want to have. Amazing!

Yes! It’s our experiences that we remember forever, not “stuff”!

“If you cant pay cash for it, then you can’t afford it.”

True words! Cash is the answer. If you don’t have the money, you shouldn’t buy it! I just wrote about using cash envelopes to help manage the cash allotted to spend. It takes some getting used to, but well worth the effort as it will help you keep to your budget.

The cash envelope method is a GREAT way to get a hold of your spending! Cash is King!

I absolutely love this and needed to hear some of these tips so bad! I often get trapped in the “if we can afford the monthly cost” then we can afford it! I am going to share everywhere and pray my husband reads this lol!

Fingers crossed for your hubs finding it 🙂

Great wisdom to live by. Save and save some more. Thanks for sharing. Going to bookmark.

So glad you liked it Sabrina!

Love your tips !! Informative Read

Thanks so much! Happy to hear that you liked it!

This is a great list! I love Dave Ramsey and he’s the main reason that I track my finances so well and I’m using the snowball method to pay off debt!

The snowball method is great for paying off your debt! Good luck!

Good advice especially for those who have not been taught wise ways to manage money.

Thanks so much! Money education is a tricky subject, as our schools don’t teach us about this, but for some reason we need to know geology 🙂

These tips are so great! Tons of advice to take in that’s for sure!

So glad you liked it Amy!

These are great money tips! There’s so much money advice I wish I’d followed sooner, like not applying for credit cards in college just to get a free t-shirt. That one definitely could have been useful. I’m just glad that I finally figured money out, even if it took me a while!

Oh the college free t-shirt is a super popular scheme! But no worries, now that you know you’ll do great!

These are great practical tips! Definitely a lot of nuggets on money management and finances!

So glad you found it helpful!

These are all such great pieces of advice. I have never heard if you can’t pay for it twice, you can’t afford it – I like that one a lot!

That one was new to me too! Always learning huh!

This is such an amazing and helpful post. I love the advice and recommend a lot of the same principles on my own website! Awesome post!

So glad you liked it, thanks for stopping by!