The Only Sinking Fund Calculator That Will Help You Reach Your Financial Goals!

You need to save money for that big vacation, but you don’t have a plan… yet. Use this sinking fund calculator to help you!

Author: Kari Lorz – Certified Financial Education Instructor

Saving money for future expenses can be difficult, and without a plan, it can be hard to know how much money to save each month.

A sinking fund calculator will tell you how much money you need to save each month to reach your goal. With this information, you can create a budget and start saving for the things that matter most to you!

Things like paying for Christmas in all cash or taking that big family vacation (you know, your bucket list dream trip). Yes, you can save for it, and here’s how!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What are sinking funds?

For our purposes, here’s the sinking fund definition – A sinking fund is an account which you set a fixed amount of money aside each month to save for future expenses. These are equal payments that you’ve calculated to make the cost easier to manage with your cash flow.

Sinking funds are a great way to save for large expenses, like a vacation, a new car, or home repairs. It spreads out the cost and makes it more manageable.

How do you do sinking funds?

Take your total cost of what you’re saving for and divide it by the periods until you need to spend the money (i.e., four months or six weeks), and that’s how much you save each period. It’s fairly simple math, but it can get confusing when you start adding interest in it or changing your savings plan from months to weeks, etc.

And no, sinking funds aren’t just for people to save for one-off things (i.e., a new car). You can use them for everyday things like having a home repair fund or a car repair fund. You can read all about how I use sinking funds – I have five of them set up; they’re revolving, so they’re never empty and never full.

How do you calculate sinking funds?

You can calculate your sinking fund using a sinking fund calculator (see below) or do it the old-fashioned way with a pencil and paper.

To calculate your sinking fund, you’ll need to know three things:

- The total cost of your goal

- The time frame in which you want to achieve your goal

- The interest rate (optional – if you’re putting money into an interest-bearing account)

Sinking fund formula

How much money you need / How many time periods until the event

= How much money you need to save each period

So let’s say you’re saving for a new fancy BBQ…

$450 cost / 4 months until summer = $112.50 a month (absolutely round it up to $115 to help you cover sales tax).

But, let’s go through how to use the calculator, as it will account for multiple entries, add in an interest rate component, and learn about compound interest.

The Sinking Fund Calculator

Here’s the calculator, and right below is where I run through what each field is for.

Sinking Fund Calculator

Your savings plan for

How to use this sinking fund calculator

Step One: pick your start date and end date

So this is the day you start saving, until the day you need to pay the money. Remember, if you’re putting your expense on a credit card bill, you’ll make the charge on the day you need to spend it, but that money isn’t due until your payment due date for that bill.

So if you need to spend the money on the 15th, but your credit card bill cycle closes on the 28th, and then your bill isn’t due until the 20th of the following month, that gives you an extra 3.5 weeks to save (which makes a big difference).

Step Two: save weekly or monthly

Depending on how you budget, you’ll want to pick your saving frequency. Either saving by the week or the month. You should play around with this option and see what makes the most sense for you.

For example, I have a monthly budget, but I spend by the week (it just keeps a tighter reign on spending as I look at my money more frequently). So for my Christmas savings, I save $20 each week, and I start that on January week 1, to be done by Black Friday as that’s when I start spending.

But for our big vacations, I plan those out about 18 months in advance, so I budget and save for them by the month.

You’ll see a few examples of each below.

Step Three: put in your interest rate (optional)

This field is mostly for people saving for mid-long term financial goals. Such as a new car, a home remodel, a bucket list vacation, etc. And they put these funds into an interest-bearing account.

Your best bet is to use a high-yield savings account. These accounts earn much higher interest than your regular brick & mortar bank accounts.

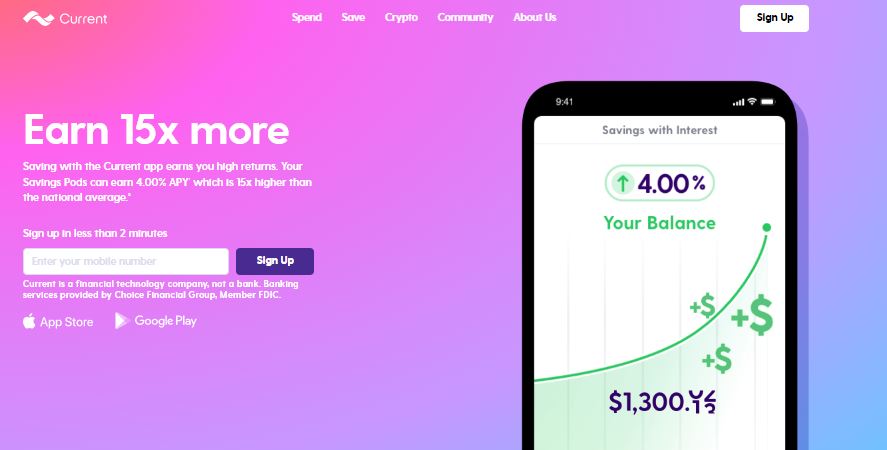

Current is a great banking option, and you can even set it up in 20 minutes! Current is a money management app that offers spending and savings accounts (along with cash advances, teen banking, 2-day early access to direct deposit, and crypto investing).

When you bank with Current, you can open up three savings pods in that account, which is exactly what we want). The best part is that you can earn 4.00% APY (as of October 2023) on up to $2,000 in each pod (so $6,000 total). This is a phenomenal rate!

Since there’s a cap on interest-earning, this is great for smaller sinking funds like Christmas, vacations, etc.

You can get Current on Android or get Current on iOS

Using a high-yield savings account allows you to spend less out-of-pocket money for your goal, and that’s always a good thing.

If you are going to keep your savings in a cash envelope (which is ideal for smaller amounts and short-term goals (i.e., less than five months), then just keep the interest rate field at 0%.

Note: high yield accounts accrue interest monthly. So if you are saving by the week, you can still transfer money to this account weekly, but the interest grows and is accrued monthly. Banks usually refer to it as APY.

The annual percentage yield or APY indicates the total amount of interest you earn on a deposit account over one year. Although it’s based on the interest rate, APY also considers the frequency of compounding interest to give you the most accurate idea of what you’ll earn in a year.

Step Four: Input your saving categories

If you are only saving for one thing, then put this in the first entry field…

“new couch” $600

This is how most sinking fund calculators operate – one total amount. BUT, this calculator is different, as when people save up money for big expenses (i.e., vacations), there are a lot of little expenditures under that big “vacation” umbrella.

For example, for a big category, like vacation, things like airplane tickets, parking at the airport, bag fees, shuttle to the hotel, hotel, food, souvenirs, etc., all come into play.

Listing all these line item expenses out gives you a better understanding of your budget, and if you need to cut things out to save money, you can do so easily.

Step Five: Calculate

When you’ve entered in all your line items and their amounts, hit calculate and scroll to the bottom. The results box will tell you how much you need to save every period to reach your goal.

Step Six: Save

The calculator just shows you how much you need to save. Now, it’s up to you to work that savings amount into your monthly budget and set that money aside each and every month.

Since I am a sinking fund nerd, I have a lot of them…

- Vacation

- Home repair

- Car repair

- Kiddo

- Christmas

So each month, right after payday, money gets automatically transferred from the main account into these sub-accounts. I don’t have to lift a finger (except once to set it up, which takes less than 5 minutes).

And every month on my budget form, these expenses are already listed.

Vacation sinking fund example

Vacations can get expensive, and there are so many things that can go into them (even at all-inclusive resorts). My main goal with a sinking fund is to save beforehand so that while I’m on vacation, I’m not stressed about how much everything costs and dreading the credit card bill afterward. While on vacation, I just want to relax, and saving beforehand helps me relax.

So you’d input each individual item. For my recent vacation (yes, it was to Disneyland), my line item entries were…

- Plane ticket – $348

- Parking at airport – $72

- Shuttle to/from hotel – $98

- Hotel – $1828

- Cash tips – $100

- Food – $350

- Souvenirs – $100

- Park tickets – $233

- In park add-ons – $80

I started planning this at the beginning of October, and my payment date wasn’t until mid-May. So I had 223 days (7 months a week and a few days) to save. (The calculator figures this all out automatically.)

It said that I needed to save $458.43 as my monthly savings goal.

So every month leading up to my trip, I put this amount into my monthly budget as a savings line item.

Christmas holiday savings sinking fund example

I love the holidays (usually), but lately, they have become much more complicated, busy, and expensive. I wasn’t having fun or enjoying the season; I counted the days until January 2nd, when everything calmed down. But I didn’t want to be like this, so I knew I had to change some things to help me get back that “most wonderful time of the year” feeling.

I made a Christmas planner, and in it, I put everything that I could think of that could help me have a more streamlined, organized, and less expensive holiday season.

This is a comprehensive planner; I mean treat baking planning, grocery lists, to-do list organizers, holiday card address list, etc. Don’t worry – I have a pared-down version, and you can snag it here for free.

Part of that was figuring out my holiday spending and budget. So we have the categories of…

- Presents – $400

- Stocking stuffers – $75

- Holiday meals – $150

- Holiday treat supplies – $50

- Christmas tree – $80

- Decorations – $50

- Fun holiday activities – $100

- Wrapping supplies – $30

- Cards & postage – $30

- Misc – the catch-all category (just in case) = $30

I plan all of this starting January Week 1, which gives me the longest time frame to save (so I need to save less every week), and all the spending info is fresh in my brain from having just done it all.

So basically, 46 weeks to save, as I want to be done saving by Black Friday, which is when I start spending.

So when I input everything into to calculator, it tells me…

For this, I use a Christmas savings envelope, and then I buy two $500 Visa gift cards from the store, as I want to be able to shop online too.

House downpayment sinking fund example

The sinking funds above were fairly small amounts and for a fairly short time period. so let’s look at an example where putting your money into a high-yield savings account will make the most sense.

Goal: Save for a downpayment for a $350,000 home; you don’t want to pay PMI, so you want at least 20% of the purchase price saved up = $70,000. You’d like to buy your home in three years’ time.

So you input your dates (three years), and you input your single amount of $70,000 and hit calculate…

$1,944.44. That’s a lot to save each month!

so you decide that you’re going to open up a HY savings account, which earns 2.10% APY.

So you input your dates (three years), and you input your single amount of $70,000, your 2.10% APY, and hit calculate…

$1885.54, which is almost $59 a month cheaper and will save you a total of $2,124. That’s better; besides, when you saving up, every little bit matters!

Where do I start a sinking fund?

You can start a sinking fund with any amount of money, but most people prefer to start with $20 – $50 to get the account going.

Ideally, you would have a separate savings account for each sinking fund financial goal that you’re saving for. That way, when it comes time to spend the money, you’re not confused about how much in your main account is for vacation, or for car repairs, or your emergency fund.

If you don’t want a separate account, you can use cash envelopes (I used envelopes for my small savings goals).

What are examples of sinking funds?

You can make a sinking fund for just about anything, but don’t fall into the trap of creating 347 different sinking funds because then you spread your money too thin and won’t make much traction.

Some examples of sinking funds could be…

- Vacation

- Car repairs

- Home repairs

- Christmas

- New clothes

- Entertainment

- Date nights

- Birthdays

- Back to School supplies

- Summer camps

And really, the list goes on and on; you can find the full list of potential sinking fund categories here and see what fits your needs.

Sinking funds FAQ

What’s a revolving sinking fund?

In this post, we’ve mostly talked about a set start/stop sinking fund. These are just like they sound; they start on a certain date and stop on a certain date.

The other type of sinking fund is a revolving sinking fund. This is where the account is never “full,” and it’s never “empty.” I personally mostly use these types of sinking fund accounts.

For example, I have a car repair fund. When I set it up, I totaled up the yearly car cost (i.e., oil changes, added $300 for new tires (I get them every other year or so), and then about $1300 for any repairs that need to be done. Then I added it all up, and let’s estimate that it was $2000 total.

So $2,000 / 12 months = $166.67 a month goes into our car repair fund. Every month money goes in, and some months money goes out to pay for a car expense.

What’s the difference between a sinking fund and an emergency fund?

An emergency fund is an account you only use in case of job loss, medical emergencies, or other major unforeseen circumstances. Once the money is used, it needs to be replenished. Finance experts say you should have 6-9 months of living expenses in your emergency fund.

A sinking fund is an account for a specific planned expense, like buying a house or car, taking a vacation, etc. These are known or planned for expenses, while an emergency fund is for unexpected expenses.

Why can’t I just use my savings account?

You could, but I think it’s very helpful to have the money in a separate account so you’re not as tempted to spend it (or get confused about how much of the balance is for what). When it’s in a general savings account that’s earmarked for a specific purpose, you know it’s off-limits unless it’s for that purpose.

Besides, you’re not earning any interest in a regular savings account. Trust me; it adds up fast; more on this in the question below.

What kind of sinking fund should I have?

Everyone should have something they’re saving for, even if it’s just $5 a month into the account. You may not feel it’s much, but it all adds up. Plus, there’s a sense of accomplishment from making progress on your financial goals.

That being said, I recommend a few funds for everyone…

1. Vacation fund – you always need something to look forward to.

2. Home repair fund – if you own a home (vs. renting).

3. Car repair fund – if you have a car.

I also have a kiddo sinking fund and a Christmas sinking fund. In addition, you should have an emergency fund, but that’s technically not a sinking fund.

Where should I keep my sinking fund money?

If it’s a short-term sinking fund, such as Back to School clothes & supplies, then you should use a cash envelope as it’s easy and accessible.

But if it’s for a longer-term sinking fund (5+ months), I like to keep it in a high-yield savings account so that I can earn a little bit of interest on the money. See Current above.

Don’t forget that you earn interest on the principal amount and any interest earned.

At the end of the day

A sinking fund is a great way to save money for important purchases. Using this sinking fund calculator, you can determine how much money you need to save each month to reach your financial goals.

Have you started saving for your next big purchase? If not, be sure to check out our sinking fund calculator and get started today!