85 Sinking Fund Categories to Help You Budget Like a Pro

If you want to build the best budget possible you need to check out these 85 sinking funds examples

Author: Kari Lorz – Certified Financial Education Instructor

The next natural step after budgeting is saving money. This could be filling your emergency savings or saving for things you want. This is the main distinction between budgeting and saving.

- Budgeting = spending plan for what you need now (this month)

- Saving = setting money aside for what you want/need later

One of the very best ways to save money is using sinking funds, and I can say that without a doubt that sinking funds have been the key to the success of my family’s finances! It has allowed me to buy my family everything that we need and much of what we want!

Let’s go through a list of sinking funds categories so you can see how you can build the best budget possible and live consistently debt-free!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

The essential 6 sinking fund accounts (out of 85) that every family should have…

- Home repair fund

- Car repair fund

- Medical sinking fund

- Vacation fund

- Christmas sinking funds (if you celebrate)

- Emergency fund

We’ll go more into these six accounts below.

What are sinking funds?

A sinking fund account is basically a way to prepay for the things that you need/want, a mini savings account, so to say. You are planning ahead, which is one of the key budgeting skills that you need to succeed with your personal finances!

You set your sinking fund savings aside, which can be in a separate bank account or a cash envelope.

Sinking Funds categories for the home

Our home is one of our largest (and most expensive) assets. I know that people hate spending money on tedious things like gutter cleaning, but doing these things now, will help prevent future (and more expensive) damage later on.

Do yourself the favor, and take away the instances of desperately trying to scramble for money to fix something, and just save a bit each month. Below are all the things you may want to consider saving for in your sinking fund.

- home repairs

- home annual maintenance – gutter cleaning, HVAC servicing, pool cleaning, propane refills, etc

- home remodels

- new furniture & appliances

- new landscaping

- yard care & annual planting – vegetable garden, etc

- home insurance

- property taxes

- pest control

- annual memberships – Costco, Amazon Prime, Disney+, etc.

- emergency fund – this could fall under either the home, or the family category.

Sinking Funds examples for transportation

This is the next most expensive item that we’ll probably own; a car. Car problems are never okay, and many times they could be avoided by simply keeping up on regular car maintenance.

I know it’s not a fun way to spend your money, but safety should always be on the top of our minds, and doing maintenance on your car keeps you and your family safe. Here are all the car expenses that could go into your sinking fund.

- new vehicle savings

- unexpected car maintenance

- new tires

- scheduled car servicing

- car detailing

- DEQ testing

- car registration

- car insurance

- parking permit

- bus/train pass

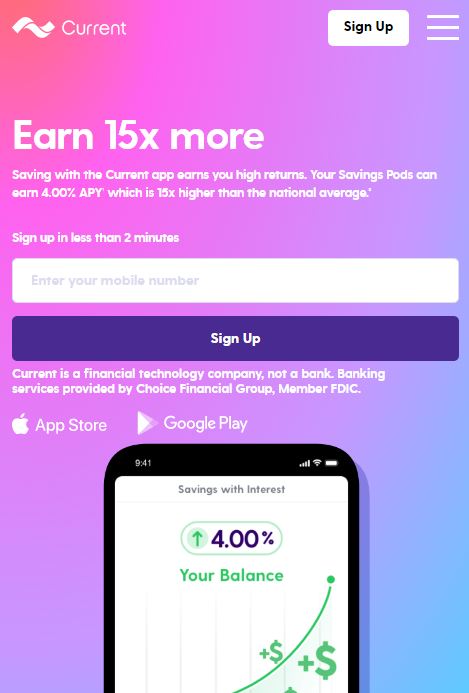

Current banking

Best Place to Hold your Sinking Funds

Current is an online banking app that lets you have three savings pods (sinking funds) that earn 4% APY! This is an amazing savings rate that can help you save more faster! They offer a ton of features – cash advances, get paid early, and more!

Sinking Fund categories for the family

This is the “fun” sinking fund. These are all the fun things that give our life flavor, the big joy bringers! it’s the trips to the zoo, the ice cream parlor, birthday parties, or a new pool for the backyard!

When you set aside money specifically for these “fun expenses,” it makes you feel less guilty when it comes time to spend it. You know you have all your other bases covered, and this money is specifically for fun!

- vacations (see a more detailed breakout below)

- backyard plusing – pool, swing set, patio set, etc

- entertainment – festivals, day trips, gaming system, etc

- annual & monthly memberships – zoo, gardens, aquarium, etc.

- donations & giving

- family member birthdays – present, decorations, cake, entertainment, etc.

Medical expenses sinking funds

No one likes a medical emergency, even less so when a trip to the ER costs $4,678 due to an ambulance ride. Now, not all expenses will be that high, but if you have a family of four, each with their own medication or therapy it adds up quick!

- out of pocket insurance

- annual deductible & premiums

- prescription drugs

- co-pays

- medical equipment

- medical specialties – orthodontics, glasses & contacts, etc.

- things insurance won’t cover – chiropractic care, extended physical therapy, etc.

Sinking funds examples for your kids

Parents always want to say yes to their kids. We want our kids to have everything (well, maybe not that pet tarantula). Yet, so many times, we need to tell them no, or just “not right now.”

But, how many times do we wish we could say yes to them playing soccer this year, but we just don’t have the money for all the sports fees. Having a kiddo fund can help you plan to say YES!

- camps & lessons – sports, hobby, etc

- hobby stuff

- back to school clothes & supplies

- birthday party & presents for friends

- school activities – sports, clubs, etc.

- music lessons

- school events – prom, graduation, etc.

- new baby expenses – furniture, supplies, clothes, etc.

Including your kids on how you are saving money with sinking funds is a great teaching moment. Teaching them about patience, waiting, and working to save money for things that are important. Remember, kids learn more from how we act than what we tell them.

So show them your savings, and give them the opportunity to help save right along with you! You can even grab one of these free kids budget printables to help you!

Examples of sinking funds just for you

Everyone needs to splurge on themselves every once in a while, and a sinking fund just for you makes that possible! As with the family sinking fund, you don’t ever have to feel guilty about spending money on yourself.

Yes, moms do this all the time, “I shouldn’t buy myself new workout shoes, my old ones will last a bit longer, besides little Suzie wants a new bike.” NO mama, stop sabotaging your happiness! You’ve saved this money for yourself, so spend it on whatever makes you happy!

- new wardrobe

- membership & clubs

- subscription boxes

- lessons

- self care – day spa, therapy, nails, etc

- hobby supplies

- date night with sweetie pie 🙂

Holiday sinking funds categories

American holidays are causes for all things celebration – well, does anyone go big on President’s Day? probably not, but that’s okay. You can save more money for your family’s big 4th of July Backyard BBQ Blowout!

Besides, you’ve always wanted to get that giant chocolate bunny for your hubby for Easter, you know, the one that’s three feet tall? And now you can, with help from your Easter Sinking Fund.

Pro-tip – you don’t need to save for all of them all the time. Once one holiday is over, start saving for the next one, and so on; this helps spread the cost out.

- New Year’s Eve party

- Valentine’s Day date/candy/present

- Easter outfit, basket, and candy

- Memorial Day & Labor Day weekend BBQs

- 4th of July picnic & fireworks

- Halloween costumes and candy

- Thanksgiving dinner

- Christmas – this is its own category, see below

Special Occasion sinking fund

You may only need to plan one or two of these events in your life. However, the cost of these events can be huge depending on your societal norms and family expectations. That being said, start saving for these events as early as possible (think 3-4 years to spread out the cost/savings into manageable amounts).

- golden anniversary party

- wedding

- quinceanera

- sweet sixteen party

- bar mitzvah

- retirement party

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Christmas holiday sinking funds

Since the holidays encompass so many different categories, I wanted to detail out all the possible things you may need to save for. Now, don’t get me wrong, you don’t need a separate envelope for each thing. Consider having a budget & savings for presents and stocking stuffers. Then a separate savings for everything else altogether.

- Christmas tree & wreaths

- holiday decor

- holiday meals

- holiday craft & treat baking supplies

- gift wrap, tissue & bags

- presents & stocking stuffers

- holiday cards and postage

- entertainment – festivals, theater, pictures with Santa, etc

- travel costs – airline tickets, gas, etc.

To make saving for Christmas a little more fun I have some cute savings printables to help keep you on track!

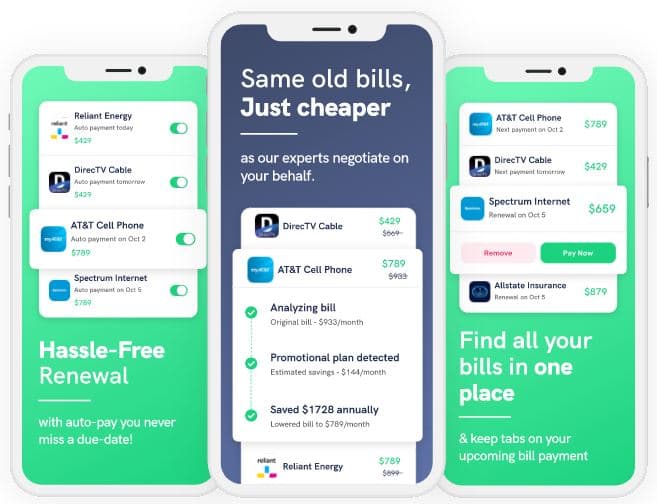

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

Travel sinking fund

This category is similar to Christmas savings & spending. There are so many different things, so I don’t want you to forget about an expense. Here, again, don’t have separate savings for each thing. Consider lumping them together in groups (i.e., hotel costs & travel costs, food & entertainment, and then fun/miscellaneous).

To help you get on track, I have a great printable vacation planner. Yes, it has a page on budgeting, a brainstorm planner, an itinerary, info for the family at home, etc. Or you can grab one of these free simple travel budget worksheets for free.

- airfare, train tickets, or gas expenses

- travel insurance

- rental car & insurance

- shuttle fees

- meals & snacks

- hotel or Airbnb

- resort fee or parking fee at the hotel

- passport fees

- TSA pre-check fee

- tickets to events or sightseeing places

- activity rentals – kayak, camping gear, etc

- souveniers

- cash for tips – hotel staff, tour guides, etc.

Whew! That was 85 bullet points of items to include in your sinking funds!

Sinking Funds Examples

Long term sinking funds examples include…

- Down payment for a home (this is a really large dollar amount, so it will take a while to achieve)

- New car fund

- Vacation fund

- Kiddo fund

These are what I call revolving sinking funds, as every month, money goes in, and usually, some money comes out when I pay my bills. These savings accounts are never empty, and they’re never full.

Short term sinking funds include…

- Day spa afternoon

- Valentine’s date night dinner

- Peloton bike

- Capsule wardrobe

Sinking funds can also be revolving, or they can be a one-and-done.

For example, a holiday-type sinking fund is a one-and-done (although you may do it every year). Once you spend the money on Halloween candy & costumes, it’s done. You stop saving money for it.

But a revolving sinking fund could be a home repair sinking fund. Money flows in and out of it every month, the account never gets “full,” and it never gets empty (hopefully).

Let’s say each month you put $40 in the home repair fund, then in February, you need a new dishwasher and out goes $400. Then in March, you need paint to go over all the scuffed-up baseboards in the house, so out comes $40 for paint & brushes.

The essential sinking funds every family should have

Even though sinking funds are an optional financial step, there are a few funds that have enabled my home to run so much smoother. They have turned significant financial obligations into a minor inconvenience.

For example, my husband’s car needed $1,400 worth of work done. Sure, it was a bummer to spend it, but we had the money just for this purpose. But if we hadn’t had the money, we’d have to scramble to come up with it, which would be very stressful.

At the very least, you should have five sinking funds…

- Home repair fund – things break all the time. Dishwasher, more insulation in your attic, a new dinner table, etc.

- Car repair fund – oil changes, new tires, registration & DEQ testing, plus repairs (if you have a car).

- Medical sinking fund – prescriptions, co-pays, deductibles, extras such as orthodontics, glasses, etc.

- Vacation fund – weekend trips to the beach, an afternoon adventuring in a new town, palm trees & sandy beaches. (I always need a vacation to look forward to, even if it’s 18 months away, I still get excited.)

- Christmas sinking funds – we know that Christmas is coming every year, so why don’t we take the stress out of it and plan ahead? On January 1st, I start a new holiday cash envelope, and each week, I add $20 to it – simple and easy.

- Emergency fund – this is the #1 most essential sinking fund!

Sinking Fund Formula

No one likes math, but in this case, math is helping you reach your goals, so doing math here is kind of exciting! Here’s the sinking fund formula for when you’re saving for a specific (non-revolving event).

How much money you need / How many months until the event

= How much money you need to save each month

So let’s say you’re saving for a new backyard patio set…

$450 / 4 months until spring = $112.50 a month (absolutely round it up to $115 to help you cover sales tax).

If you want a very quick way to figure out your savings rate, then check out my sinking fund calculator. You input the dates to start/stop saving, the amounts, and if there’s any interest (if the money is in an interest bearing account, like a high-yield savings). The calculator will tell you exactly how much to save each week and/or month; super quick and easy!

How do you set up a sinking fund?

- Decide if it’s a permanent/revolving sinking fund or a short term (one-and-done sinking fund)

- If a permanent fund, then open a separate savings account for it

- If a short term sinking fund, use a cash envelope

- Decide how much money a month you’ll put into it

- If it’s a permanent fund, tally up how much a month you usually spend on this category, then strive to match that amount. Or you can start with a straight $20 or $50 a month, depending on how costly it is, if you want to keep it simple.

- If it’s a one-and-done sinking fund (i.e., Halloween stuff), then figure out a total budget for the items (i.e., costumes, candy, decorations, treat baking, etc), and then take that total and divide it by the number of months until you need to spend it.

- Decide how you will contribute to the fund

- If permanent, then set up an automatic transfer of the amount for a few days after your payday. This way, you’ll always have money in the account for this financial goal.

- If short-term, set a calendar reminder of when you’ll pull money from your bank account and stuff your cash envelope. To help you keep track and organize it all, be sure to check out the Sinking Funds Simplified Workbook to make everything flow seamlessly!

It’s a sinking fund tracker, a planner, and a brainstorming helper all rolled into one workbook.

- How to spend your money

- If a permanent sinking fund, when paying your bills at the end of the month, track on your credit card statement (or go through your receipts) and tally up how much you spent on purchases within that sinking fund category.

Then transfer that amount from your sinking fund savings account into your regular bank account and pay your bill from there. - If short term, then just spend your cash.

- If a permanent sinking fund, when paying your bills at the end of the month, track on your credit card statement (or go through your receipts) and tally up how much you spent on purchases within that sinking fund category.

How is a sinking fund category different from a budget category?

You might think that these categories are similar to budget categories as a monthly expense, and there is some overlap.

A budget category expense is planning on a specific expense in an immediate time period. For example, your budget category is transportation, the line item in that category is your monthly bus pass, and it costs $32. While a sinking fund category can be…

- for an unexpected expense of an unspecified amount, at an unknown time, such as a home repair fund.

- A planned expense coming up in a longer time period, such as a vacation.

How is a sinking fund different than an emergency fund?

So this is a complicated question, as everyone thinks of emergencies differently. In essence, a broken water heater is a cause for an “emergency.” So you should be able to use your emergency savings fund for this. However, I (and some others) view an emergency fund differently.

In our household, our emergency fund is strictly for the use of replacing our income if my husband was out of work. Then that emergency fund would be used to pay our regular monthly expenses.

While a broken water heater is something that needs to be fixed/replaced immediately. You knew at some point it would break and need to be fixed. Just like your car will need new tires, it’s a known expense. It’s the timing of the upcoming expense and the extent of the cost that is the unknown.

The main point is that when you create your emergency fund, you get very black & white about what that money is for and what it cannot be spent on.

Where do you keep your sinking fund money?

Depending on the fund, you can keep it in one of two places. In a separate account or in a cash envelope. The main thing that you MUST DO is keep your savings separated from your general money.

Most people have a checking account and then a separate savings account. I don’t have my money set up that way. We have the main checking account, then four separate checking accounts for our sinking funds, a regular savings account (as I opened it when I was 16), and then a high-yield savings account for our emergency fund, as well as a few cash envelopes for one-offs.

(I set this system up before the feature of “buckets” within one account was available. But read below for my pick on the best bank option for having separate savings buckets).

I’d like to think that I’m pretty smart that I keep track of everything! But it’s not true. I forget things, sometimes I confuse myself, and sometimes I am just plain dumb (hello math errors)! I know this, and I accept it. How many times have you accidentally spent the water bill money on a dollar spot binge at Target? Uh-huh, it happens to all of us?

So I separate my money and label things accordingly so that there is no confusion about what the money is for. I use checking accounts for my permanent sinking funds, and for one-off sinking funds (i.e., my Christmas sinking fund), I use cash envelopes.

They work so well that I have a bunch of different styles for whatever you need; just print, cut, and tape and you’re all set to save money!

Having multiple savings buckets with Betterment

Betterment is an online money manager and one of the largest independent online financial brokerage firms. Betterment helps you manage your money through cash management, guided investing, and retirement planning.

Betterment Cash Reserve is a cash account designed specifically for the money you save. You can create separate buckets for specific savings goals and even set up auto-deposits into each bucket. The money in your Cash Reserves account currently earns 1.10% APY, which is better than regular banks.

Best of all, there are no fees and no minimum balance requirements.

Have multiple savings buckets (with great interest rate) with Current

Current is another good banking option (it’s all online), and you can even set it up in 20 minutes! Current is a money management app that offers spending and savings accounts (along with cash advances, teen banking, 2-day early access to direct deposit, and crypto investing).

When you bank with Current, you can open up three savings pods in that account, which is exactly what we want). The best part is that you can earn 4.00% APY (as of January 2023) on up to $2,000 in each pod (so $6,000 total). This is a phenomenal rate!

Since there’s a cap on interest-earning, this is great for smaller sinking funds like Christmas, vacations, etc.

You can get Current on Android or get Current on iOS

7 benefits of using sinking funds

Okay, so besides the obvious benefit of saving money there are a few other key benefits to this system of saving money

You make better purchases

You’re planning ahead for purchases, so you have time to think about which necklace is the best for your mom’s birthday present. In essence, you’re more mindful of your purchase so you’re likely to make a better choice and not just snatch up something halfway decent at the last moment, which is when you don’t really care about the cost and you end up overspending.

Gives you peace of mind

Now this right here is honestly the biggest benefit to me. It’s having peace of mind! Before I had sinking funds up & running I would be so worried about a random but known expense, the new car tires I had to buy that day. “How the hell could I come up with $500 in the next month to pay off that credit card?” Now, I don’t have to worry about it, sure it’s annoying but it’s no big deal!

Cuts down on impulse purchases

When you’re saving towards something, a goal that you have, you’re less likely to blow your money on something you may not really need. You know, something you just decided in this instance that you want. Sure, you “want” a new couch, but on the other hand, you’re so close to saving for your dream kitchen remodel; and not blowing your money on a couch will help you reach your goal faster.

You hold on to your emergency fund

Many experts differ on how they view an emergency fund. Some say it’s for large unexpected purchases, while some say to keep it to pay for monthly expenses if you should lose your job/income.

I am in the camp of saving your emergency fund in case you lose your job. As I feel that you should expect things to break (i.e. car, water heater, couch, etc.) These things aren’t an “if” but a “when.” So, ideally, you should be saving for the “when.” And keep your emergency fund for a true 100% emergency.

Increased anticipation & motivation

They say that “getting there” is half the fun, right? So when you have a savings tracker, let’s say for vacation, it’s a lot of fun to color in that next spot! It’s building the excitement, the anticipation. And besides, each time you fill in a segment you are damn proud of all your hard work! (way to go!) It keeps you motivated to keep saving!

You pay less

When you have sinking funds set up you pay less for an item (usually). Let’s face it, we’re a credit card society. And when you purchase with a credit card, you then usually carry a balance (unless you pay it off every month), which is the goal). So you end up paying interest on that item. That $45 shirt may end up costing you $67!

“Credit card balances carried from one month to the next hit $422 billion in December 2020”, according to NerdWallet’s annual analysis of U.S. household debt. That’s a lot of interest that’s being racked up! YIKES!

You have purchasing freedom

You can buy what you want (with your sinking fund money) and not feel guilty about it! You have responsibly saved for this purchase (while saving for other mandatory things too), so you’re not being irresponsible. You are in fact, enjoying the fruits of your labor.

This mental freedom can be huge for the person who feels bad buying things for themselves! Or for people who tend to worry while on vacation, your vacation sinking fund can keep you from worrying the whole time, “How am I going to pay for this?”

Because when you’re on vacation, you want to enjoy it, not panic about the fact that your husband ordered the seafood extravaganza platter for dinner!

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

The problem with sinking funds

Firstly, if you haven’t guessed, I LOVE sinking funds! They have made my debt-free life possible! But there can be too much of a good thing. As with everything in life, moderation is key.

Yes, you should have multiple sinking funds to allow you to keep your money separate so there’s no confusion (with cash envelopes or in a bank account, or a mix of both). But sometimes people get so excited about sinking funds that they set up 57 different sinking funds, each for a small tiny thing.

That’s too complicated; you don’t need a separate fund for “vacation transportation,” and for “vacation tickets,” “vacation food.” Just a general “vacation” sinking fund will do along with a vacation budget planner to help you itemize expenses.

When you have too many sinking funds, you are spreading your money out pretty thin, so it will take you longer to reach your goals. Sometimes you need to space out your savings. For example, in January, you start a Valentine’s Day fund, and then once that holiday is over, you can start saving for summer vacations, and then when that has happened, you can save for Halloween stuff. It’s all about strategy!

Resources for setting up your sinking funds

In essence, all you need to start using sinking funds is paper, a pencil, and some money. But some things can make it a lot easier (and faster) to get up and running. I made my Sinking Funds Simplified workbook for exactly this reason. It walks you through the entire process from start to finish!

The workbook includes…

- guide on how to review last year’s spending to plan ahead for this year

- year at a glance guide

- sinking fund brainstorm session

- sinking fund tracker and more!

Or you can grab just a simple sinking funds tracker.

If you’re looking to save a specific amount of money for something, be sure to check out Savings Charts for Supercharging Your Money Stash. There are some fun ideas for how to track your progress towards your money goal!

At the end of the day

Using sinking funds is a fantastic way to step up your budgeting game! You know you’re going to spend money on this general “thing,” so planning for it and saving for it now spreads the cost out and makes it much more manageable.

I mean, would you rather save $10 every month for something or get faced with an unexpected $120 bill for something? $10 is a lot easier to fit into your budget, and that’s why sinking funds keep us debt-free and working towards our big savings goal!

Articles related to Sinking Funds Categories:

- Why Sinking Funds Are Your Ticket Buying Anything You Really Want!

- Use a Cash Envelope Template and Start Your Savings Empire Right Now!

- How to Save Money Like a Pro! The Sinking Funds Simplified Workbook

- Savings Charts for Supercharging Your Money Stash

Managing finances are really important. Not a lot of people do it. Thanks for sharing this article.

You’re very welcome, thanks so much for stopping by!

What an interesting idea. I have never heard this term before, and I really like money. 🙂 Great way to avoid expenses that sneak up on you.

Yes, those sneaky expenses that pop up can be the death of your budget! So sinking funds area great way to plan for the unexpected!

Very interesting! I suppose I have always done this I just didn’t realized it had a name. Now I know. I know a few people who could use this well thought out guide!

So glad that you’ve already been using sinking funds! So glad you liked the post, and yes please share it with anyone you think it might help!

So interesting! I had no idea this had a name! We have multiple “savings” accounts set up that money directly disperses to every two weeks. Sinking funds for Christmas, vacation, our car tags, HOA fees, etc. It works SO well for us. Thanks for sharing!

So glad that you’ve found sinking funds to be effective for you! It makes saving money AND spending it so much easier!

This was really helpful. I’d never heard of sinking funds before. You may have inspired me to give this a try 🙂

So glad to have given you a little fire to your budgeting skills! 🙂

Interesting, I had no idea what sinking funds were. I’m currently binging your blog, heh! 🙂

Ohhhh well to the “dark side” my friend 🙂 Sinking funds are amazing, kinda of the secret sauce to budgeting!