Smart Money Rules That You Need To Know

Find out the 6 rules of money management that can make or break your finances!

Author: Kari Lorz – Certified Financial Education Instructor

Did you know that there are some fundamental money rules that you need to follow if you want to be money-savvy? Do you know if you’re breaking any of the most important personal finance principles?

Ummmm…

Let’s go ahead and break the money rules down so that you can change your course immediately if you find yourself making some of these financial mistakes!

Trust me; these rules will keep your money safe, growing, and keep you on track with your financial goals!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

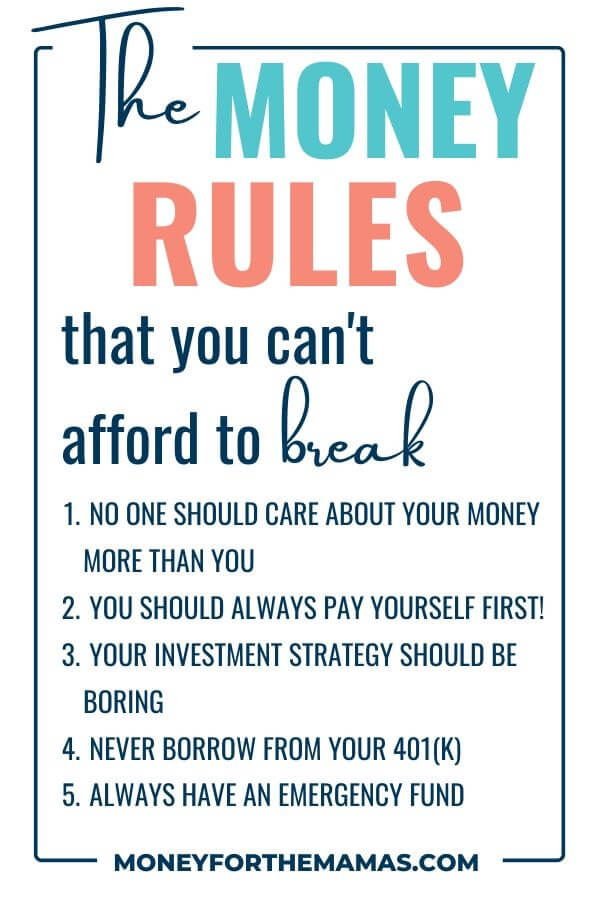

6 Money Rules to live your life by

Everyone has an opinion, and everyone thinks that their opinion is great/correct. So be sure that you are talking to experts in that field because you wouldn’t ask a general practitioner to do heart surgery right!

I did some unofficial polling in a women’s money nerd Facebook group on money rules and, specifically the best piece of money advice that they had heard and the comments were amazing! Their advice was golden but broad, but for the rules, almost everyone agreed!

There are a few main rules that you should follow and a few minor, lesser-known ones that will help you as you plan your financial future. Let’s start with the big money rules first!

Money Rule #1: No one will/should care about your money more than you!

This is your money (imagine an aggressive hand clap!), you need to be the financial decision maker, telling it where to go and what to do. You shouldn’t farm this out (unless you have a very competent and trustworthy investment advisor).

If you are married and your spouse manages everything, you should still know the general plan, the login info and review the information periodically (yearly at a minimum). (Remember personal finance is personal!)

Why, you may ask? Well, what happens if your spouse was in an accident? (sorry, that’s rough I know). Do you know what needs to be done? Or what if you two separate? Do you know the total amount of your assets and where they are held? Do you know what you are entitled to?

I hate to say it, but all too many times, the women are in the dark about their finances, and then they don’t get their fair share, or they give up a key component just because they didn’t know how valuable it really was.

If you are breaking this rule… Start by learning about one aspect of personal finance. Some broad categories with a few examples are…

- Retirement investments – traditional IRA’s, Roth IRA’s, 401k’s, mutual funds, risk tolerance

- insurance – life insurance, home owners, car insurance, disability insurance

- bank accounts – savings accounts, checking account

- savings goals – emergency savings, sinking funds, your net worth

- budgeting – monthly budget, monthly income, living expenses, cash flow

- debt repayment plan – student loans, credit card debt, personal loans

Here’s how I started learning about money in just one hour a day. Once you feel comfortable with a concept, start asking questions! Slowly you will feel more empowered and in control, which is absolutely a good thing!

Financial Rule #2: You should always pay yourself first!

This is something you need to start as soon as you can possibly can, maybe even today. I wrote a whole post on why paying yourself first is essential for financial security and how to do it. But let’s do a quick run-through of it.

PYF is a money management strategy that puts your savings goal before anyone else. That means that a few days after you get paid that you transfer a portion of it to your savings. That’s the very first thing!

Traditionally, we do it the opposite way; you save what is left over after you pay your monthly expenses. BUT there’s never anything leftover, right?! You need to flip it, trust me! I have been budgeting and cash flowing accounts this way for almost five years, and we save money every single month.

Here is a very simple budget form, but the way it’s laid out is different from others. Your “savings” category comes first, so you know that you take care of your family first. Then after that comes bills & monthly expenses.

If you are breaking this rule… It’s okay, “we” as a society have always handled our money this way. If you want a new result, you need a new way of doing things! Start by saving a small percentage of your paycheck right after payday, then work yourself up to 5% of your pay, then 8%, then 10%, and then 15%. You can go as high as you want, but just start small to get the hang of it.

Money Rule #3: Your investment strategy should be boring

I know that it’s very exciting to hear about double-digit gains, year after year, and the hot new IPO coming out next week with HUGE guaranteed returns. BUT, this is what gets people into trouble.

Slow and steady, AND boring wins the race! Oh, and for the most part, the simpler, the better. One of the best books to explain the how & why’s of this is The Simple Path to Wealth. It’s not flashy, but it makes total sense.

If you are breaking this rule… Evaluate your investment strategy’s risk. Are you comfortable with that, (aka risk tolerance)? If so, and you have at least 20+ years until retirement, you can probably weather a few storms. But if you are close to retirement (7 years or so), you should be looking for more stable options, like bonds. Or, if you are younger, look at mutual funds that are labeled target-date funds, where they automatically adjust investments to be lower risk the closer you get to your retirement date.

Financial Rule #4: Never borrow money from your 401(k)

I know your retirement savings looks like a nice fat calf, and your bills may be pressing on you. But please, (pretty please) don’t ever do this. This is one of the most sacred financial rules, and here’s why.

- If you default on paying the loan back (usually a five year loan period max) then it will be considered an early withdrawal, and that means paying income tax on it, and an early withdrawal penalty fee of 10%.

- You’ll need to repay the loan with after-tax dollars, and then when you go to withdraw the money later on (normal withdrawals can start at age 59 1/2), you’ll pay taxes again. Being taxed twice is a total bummer.

- If for some reason, you lose your job, that money will need to be paid back immediately (within 60 days usually), or it’s considered a full withdraw = taxes + penalty fees.

- Most companies will not allow you to make regular contributions if you have a loan out. That means you will miss any employer match % that you would have otherwise earned.

- One of the most significant drawbacks is the amount of interest you will lose while your money is out of the account. Earning compounding interest is the key benefit of having a retirement plan. It’s kind of like cutting your toes off to fit into some shoes. Yes, that was intentionally drastic.

If you are breaking this rule… First of all, don’t beat yourself up if you did take out a loan, no really tells us not to, or if they do tell you they don’t give a compelling reason why this is bad. All you know is that this money is just sitting there, and you need it now. It’s a life preserver, and you grabbed it. I get it. But let’s move forward!

Talk to your HR department about payback options. Usual terms are that a specific % of your paycheck goes to repay this, or you can pay it back in one lump sum. This sounds scary, but you can do it! Start saving everything so that you can dump this chain that is dragging you down!

If you need a loan, consider getting a HELOC, or try applying for a 0% APR credit card (usually 0% for 12 or 18 months). Or if you’re a two-car family considering selling one of them and doing without one for a year or so.

Money Rule #5: Always have an emergency fund

It’s depressing thinking about all the bad things that “may” happen to you and your family. Yet it’s something you have to consider, as things will absolutely happen. You don’t know when it will happen or how much money it will take to fix the issue, but “it” will happen.

Just how much you should have in your fund will vary by family. If you’re just starting, and have some debt, then getting $1,000 together as a starter emergency savings. Then after you have paid off your debt, you can focus on fully funding it. Experts agree that 6-9 months of expenses is a fair amount to have.

Don’t make filling your emergency fund a drag, keep it fun with a cute savings printable template! Here are a few different choices!

Don’t be a slowpoke and put $50 in a month (if you can do a lot more). If $50 is all you can do then fine, but if you’re spending considerably more on splurges, then you need to pull your big girl panties on and just do the damn thing! Fully funding your emergency fund protects you and your family! Now, what’s more important than financial security?

If you are breaking this rule… It’s easy to feel that times will always be good. Except for the past month, when everything went bat shiz crazy with the pandemic. Do you wish that you had a larger emergency fund now? Probably. Now is not the time to get down on yourself; it won’t do you any good. Come up with an action plan to start saving so that you can implement it in a few months (or however long it takes to rid us of this pandemic).

Right now, you may just need to tighten your belts and spend less to get through this period. Bye-bye Hulu, Netflix, and your gym membership!

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Money Rule #6: Never spend more than you make

This is probably the most important of the money rules to master, yet it’s the hardest for people to live by. If you don’t live your life by this, you will never have true financial health. Now, I wouldn’t consider this advice applicable if you were buying your home, which you will use as your primary residence. I would consider that an investment, as it’s an appreciating asset (as long as you buy a quality home in a decent neighborhood.

Learning to live (and be happy) on what you can afford is a skill that is developed over time. It also gets easier with time. I was once a typical 20 yr old girl, going to Nordstrom on the weekends, buying cute tops and uncomfortable heels. Now, I buy maybe 2-5 clothing items a year (and guaranteed that one will be a new pair of jeans, because I wore holes in my old ones, and the other will be a fresh white t-shirt to replace the one that has a stain on it). Believe it or not, I’m okay with this. I don’t want new clothes; I want to see some zero’s at the end of my bank account balances!

If you are breaking this rule… We want what we want, but that doesn’t mean it’s good for us. Start evaluating your purchases. Are you spending within a good range? Yes, there are recommended ranges for how you should allocate your budget & spending. Be sure to double-check to be sure you’re close to those budget numbers.

Ask yourself, “Will this make me happy in the long run, or just for a few days? Do I really love it? Do I already have something similar at home?” If you are consistent with these questions and painfully thoughtful & honest with your answers, you will start spending less.

For a deeper dive into this, check out how to frame your spending to be in line with your Personal Core Values. This mindset shift will absolutely help you to quit buying crap!

3 lesser-known rules of money management that can help you plan your dream life

1. Your retirement nest egg should be 25x your annual expenses

You don’t want to work forever, do you? Probably not. That means you should start saving money so that when you’re older, you can stop working and enjoy the freedom & flexibility that retirement can bring!

If you figure that you’ll need $40,000 a year to live off of, then you’ll need $1M (plus inflation of 3% or so a year). There are tons of online retirement calculators out there for you to use. Most will ask…

- your age

- age at which you’ll retire

- life expectancy

- current savings total

- how much a month/year you’ll want to spend in retirement

- anticipated rate of return on investments (7% is a safe bet)

- social security income (optional)

They give you a nest egg total, and some will tell you if your saving enough or what you need to be saving in order to meet your goal. (if you find a calculator isn’t making sense to you, try another! There are A LOT of different ones. You should use the one that makes the most sense to you!

If you’d like a little bit of more in-depth dive into retirement numbers, then check out the post that I did on creating a DIY Financial Plan. It walks you through a retirement calculator and gives guidance on norms and assumptions around finding your net egg number.

2. The 4% rule

This is the general rule of thumb that you can safely withdraw 4% of your investments and not risk running out of money. This is a very basic calculation that can be used for general planning. For example, if you have $900K in investments, then you can safely withdraw $36,000 a year. Yet you will need to consider any taxes you’ll need to pay on this if your investments were in a Traditional investment account. With a Roth account, you will get the full $36K as you already paid taxes on it.

3. Rule of 72

The rule is another money planning formula. It says that if you want to know how fast your money will double, then take the interest rate of your investment and divide 72 by it. So, for example. You have $20,000, and if you have a 7% interest rate, it will look like this…

72/7 = 10.2 years for your $20K to turn into $40K. BAMN!

At the end of the day

Yes, rules are (generally) tedious. But these money rules that we just went over will absolutely save your life by helping you set yourself up to win with money! There were a few of these that I ignored earlier on that I absolutely regret those past financial mistakes! If I had started saving earlier on, my accounts would be a lot heftier, and I could be focusing on other things.

Yet, we can’t change the past. I can only move forward and do better now that I know better. The same goes for you too!

Related Articles to Money Rules:

- Financial Literacy – the Proven Path to Freedom From Your Money Problems

- The Smartest Strategy to Build Wealth

- Your Personal Core Values are the Key to Setting & Reaching Your Goals

- DIY Financial Plan

- The Money Advice the Pros Wish You Would Actually Take

These are really great financial tips. I really like how you were practical with your advice and gave real life situations that people are in!

So glad you liked it Audrey! Thanks for stopping by!

These are some great tips. Thanks for sharing. Keep creating good write-ups like this one. Cheers ?

So glad you liked it!

Great tips Kari! We learned how important it was to have an emergency fund after we went through hard times and ended up drowning in credit card debt. We got rid of the credit cards and started an emergency fund, and would not make purchases unless we had the cash to pay for it, or when something unforeseen happened we were able to cover the costs. It gives you a feeling of financial security and alleviates the stress you can feel.

Denise, it sounds like you are on exactly the right track! Congrats on all your hard work and dedication to the process! I agree, the feeling of security cannot be beat!

These are all great tips! Thank you for sharing! I learned some new tips on budgeting and money.

Thanks for stopping by Michelle!

Such great tips with much wisdom! Thanks so much for sharing!

Thanks for stopping by Faith!

I have always wondered how much would be a good baseline for retirement! Now I know – thank you so much!

25 X is just a good starting point, of course your specific numbers may shift a bit (but hey, we all need something to aim for)

I need to start paying myself first that’s definitely a problem I have. Love these tips.

Yes! Absolutely pay yourself first! Your goals should come before anyone elses!

I love #4 and hope I never have to face that.

#4 is a hard one, as it’s such a tempting stash of money, just seemingly sitting there.

This is a great list. I need to become more financially savvy. I would say I follow most of them, but still it never hurts to learn more!

Always be learning! Such an important step in keeping ourselves engaged and focused!

These are great tips that I totally agree with!!

So glad you liked it, thanks for stopping by!

You included some great tips in this post. I think what gets a lot of people in trouble is not paying yourself first, not having an emergency fund, and spending more than you’re bringing in. Doing those three things can really get people in some bad situations.

An emergency fund can be an absolute lifesaver! AND it brings such peace of mind, which to me makes all the hard work totally worth it!

These are such great tips!

So glad you liked it Amelia!

These are great! We are all about budgeting, but still fall off the wagon sometimes!

Everyone has a bump in the road now and again, totally normal and totally okay! The important part is picking yourself back up and getting back to it!

Yesss these 6 rules are great and all ones we live by!

Yaaaaa Kinzy! Love it!