The 7 Simple Steps to Beat Budget Burnout Like a BOSS!

Don’t let budgeting burnout get the best of you! Here’s how to move past it and keep on budgetin’!

Author: Kari Lorz – Certified Financial Education Instructor

Learning how to budget effectively is a skill that you develop over time, with trial and error. Lots of people get overwhelmed with budgeting. That’s normal, and it’s okay. But you need to keep working on it.

Remember, no one is born knowing how to budget. Everyone who does it well has had to learn and practice (just like you).

I’m here to help, and after reading this post, you’ll know the most common reasons why people quit budgeting and how to avoid budgeting burnout and move past your own roadblocks.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

7 steps on how to move past your budget burnout

First of all, know that everyone gets budget burnout at some point, including me. There are some months where I am 100% focused on the outgoing dollars because I have a specific savings goal for the month. Then here are other months where I’m more lax, either due to having too much on my plate or just not feeling it.

Sometimes your mind and body just need a break; emotional exhaustion and prolonged stress can absolutely make you withdraw from things, and budgeting is an easy task to let slide.

This is normal, but it’s how you come back after those times that counts! To help you get going, here are some ways that you can help get yourself back on track!

1. Take a break from budgeting

Yup. Put the calculator down and walk away. Don’t let your emotions control your future. Just take a break, be it an hour, a day, or even a few days. I caution you not to go longer, as you don’t want to give up altogether. That’s the one thing you don’t want to do!

I do this with things. I tell myself that I am going to let something percolate (like when you make coffee). Or simmer in my brain; I just need mental space. I’m giving myself time to let the info sink in and decide how I feel about it and how I feel about my options. Or maybe, I just need to get used to an idea and accept it. Either way, the distance will help you.

2. Run out your anxious energy

Yup, get some exercise. Not only will your body thank you, but it will help clear your mind and get some nervous energy out too! It’s kinda funny, but I always get my best ideas when I’m out on a run. I will stop mid-run and take an audio note of my idea (as I’m afraid I’ll forget it by the time I get home).

If running isn’t your thing, do anything that gets your heart rate up! Or do some restorative yoga, or a peaceful hike in the woods.

3. Talk to someone

Take heart in your community; there are so many people to offer you support; you just need to find the right places to go. Be it a friend or a stranger. Sometimes strangers are great as they are unbiased about our situation and can give a different perspective on your situation.

Money minded Facebook groups are great for this! Just use the search function, you may even be able to find a local group to join at their next meetup.

Word of caution, internet trolls are everywhere; you need to see them for what they are and don’t let it get to you if someone gets a little nasty. Yes, that easier said than done. Usually, those people will get kicked out of groups fast; karma is a bitch huh! So try and join 3-5 groups, you’ll soon know the few that support you the best!

4. Remember your why

What is your primary driver for wanting to make a change in your financial life? Are you doing just for the hell of it? Or does the financial goal really compel you? Your reason for change needs to be strong enough to keep you going when times are tough! Like, I mean really strong! I wrote my personal story of what keeps me going right here in finding your financial why.

5. Try it in a different/new way

Maybe you’re trying to fit a square peg into a round hole. Get back in the saddle by looking for a new budgeting method or new learning method (podcasts, books, Facebook groups, YouTube, digital apps, basic spreadsheets, pen & paper, etc), or find a new teacher. Whatever it is, go about it in a different way to shake up your brain waves!

Maybe you just need a new budgeting form, something arranged differently to help your brain look at your money differently. Here are 50 free budgeting worksheets & templates for you to choose from.

Or maybe try a new budgeting tool. Budget Planners can be a great way to tie all the money pieces together in one cohesive tool! There is a planner to fit every style of budget and every type of person; you just need to find it.

I’ve gone through the top options and identified which planner is the best for who by going through the features, pros & cons of the top 15 budget planners.

Or, if you’re a big Bullet Journal fan, there are some great financial spreads that you can use!

6. Gain some perspective

Sometimes you just need some support from those who have been where are right now and have pushed through. Their stories, insight, and help soothe your fears and can reignite that fire!

Here are the top 50 budgeting quotes and also the top 50 debt-free quotes from those who have walked this path. These are sure to inspire, motivate, and give you some insight on how to tread on.

Sometimes you just need to brush up on skills (maybe some skills you never knew you needed). Here are my top 7 budgeting skills that people need to nail in order to be a great budgeter!

7. Go have fun!

Now, I don’t mean go on a shopping binge! That would totally be self-sabotaging! You need to have some activities lined up that you enjoy that won’t bust the bank (think of it as a mental health tool). You need to focus on raising your vibration! Ummm, what? Your “vibration” is the energy that you are putting out to the world, and what you focus on, is what you will receive.

What I mean is, if you’re always mad at your financial situation, and all you talk about is how it sucks then that’s what you are drawing to you! I know this sounds a little odd, but believe me when I tell you that this is a “real thing”. Your money blocks could be holding you back, you need to focus on attracting the positive into your world! To do this find things to do that make you happy and do those things! Things like…

- hiking

- painting

- puzzles

- happy hour with a friend (just don’t get tipsy and order one of everything! Go inside with $20 and that’s it)

- sitting by the pool relaxing and reading

- journaling

- sight-seeing in your hometown

- driving adventure (backroads country driving is fun!)

Be sure to check out your local library, as some places have cultural passes. Which can include free admission to local museums, activity places, vast gardens, and other places that are perfect for decompressing!

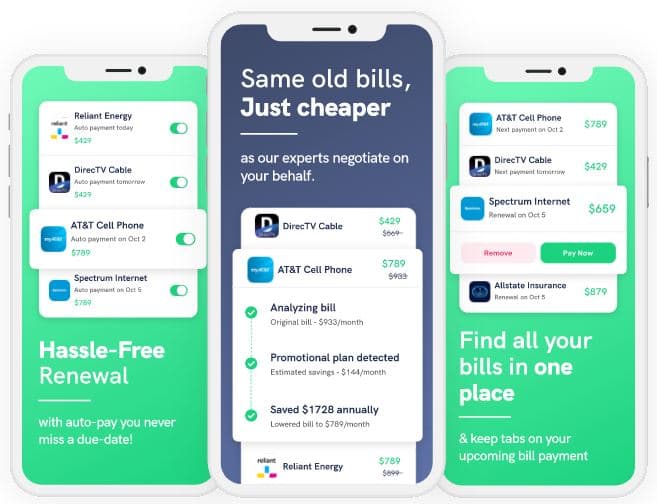

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

3 most common reasons for wanting to quit budgeting

1. Budgeting just doesn’t work for me, I’m not getting it!

Breathe. It’s okay. So many people go through this phase. You’re feeling like all new students feel.

Maybe you’re trying to jump in at Chapter 4 when you need to start at Chapter 1. Slow down, and start at the beginning! When we feel like we know a topic, we skip ahead. Skimming a post will save you time, but it may cost you! Sometimes you just need to hear something at a specific moment, at a particular point in your life for it to click! (full discloser, I think Marie Forleo said this, or something really close to it, but I can’t for the life of me find her quote, sorry)

Or maybe you need to find a new teacher, if you’re reading a book and the author is just confusing you like crazy then find a different book from a different author. They might be booooring, or they’re a jerk. Or worse yet, you just can’t relate to them. There are tons of money gurus out there, find your flavor!

Or maybe you need to find a different way to learn. I love to read, but with some topics, it just doesn’t compute. I found that watching YouTube videos (where I can see people doing what I need to do) works so much better for certain things. If only I would have figured this out sooner!

Along this train of thought is the idea that “I’m just not smart enough”.

Oooohhhh, girl, hell no!

This is such an easy trap to fall into, and that’s exactly what it is, a trap. You are smart, and the sheer fact that you are reading this means you want to do better. You want to learn, you just need a bit of patience and a bit of practice. That’s all.

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

2. Why even bother budgeting, I’ll never have enough money for it to matter!

This can be a hard one to admit to yourself and an even harder one to manage. You are your own best cheerleader and your own worst enemy. Your money mindset is so powerful (even if you don’t believe that having a money mindset is a thing)!

Yes, right now, you may be short on cash and on prospects. But I never, ever want you to sell yourself short and think that you won’t be all that you dream in your heart!

Hey, you remember a woman who once lived in an apartment with her baby daughter? You know, the woman with the abusive ex-husband from a short marriage, no job, no real furniture to speak of, threats of her electricity being shut off in her government-assisted housing? Oh, and let’s throw thoughts of suicide along in there too.

And now she’s worth a rumored $1.2 billion! Yeah, the highest-paid author in the world, JK Rowling was once poor with no prospects. She never quit writing! Yes, she changed stories, characters, and plots but she never quit! Budgeting is like writing, there are lots of ways to do it!

Now, you may not be the next rags to riches story, but your potential is mainly limited by what you believe to be true!

Even if you don’t make that much money, it’s even more critical to make every dollar you spend count towards your goals! You need to plan, be purposeful, and be positive!

If buying a new shirt isn’t going to help you toward your goals, then that means it’s taking you away from your goals. Some may call this self-sabotage. Call yourself out (gently), and then recommit to your goals. Do this as many times as it takes!

3. I’m busting my budget every month; what’s the point?

Budgeting isn’t a set-it-and-forget type of thing. It’s fluid. It was made to be tweaked, adjusted, and sometimes totally scraped, and start fresh! Yes, you can quit a type of budgeting method; you just need to find a different one that will work for you!

What we need to do is figure out why your numbers aren’t aligning up as they should.

- Math errors. Believe it or not, this totally happens. Double-check, and triple-check it again. Make sure you’re looking at your take-home pay and not your gross salary. Make sure that you’re allowing interest to grow on your debts. Understanding how interest rate fees add up is essential, as this is a cycle that so many get caught in and can’t find a way out of.

- You tried to cut spending too drastically. Yes, things may look good on paper, but living those dollar amounts out is a whole different story. It’s not realistic to take an $800 a month eating out spending habit, and then take it down to $160 per month and expect it to go peachy.

If you tried this, then no wonder it didn’t work out as you expected it to! Don’t waste another minute feeling bad about it; just focus on progress (not perfection). You need to have realistic goals, and a good start to your new spending plan would be to cut $150 each month until you get down to the level you want. - You picked the wrong budgeting method. There are a lot of different budgeting methods to choose from, and the best one is the one that you can stick to! Yup, trial & error here again.

Check out the post linked above to see all the seven main types of budgeting methods and who they work best for. Or head on over and grab a Printable Budget Planner so you have the exact framework and layout that has been proven to succeed! - You harboring a vampire. You know that one expense that is taking up a ton of your income! One area that people commonly overspend on is their car. You may need a car, but do you need a super nice BMW or a massive truck with all the accessories?

NO! You don’t. Who cares what kind of car you drive as long as it is safe and can get you from A to B. Seriously, is the kind of car you drive that important? Why? Just for kicks, take that car payment amount and put it into your debt snowball calculator, and see how fast you can dump your debt and be free!

Are some of these mistakes close but not quite the right match to what you’re experiencing? Check out this post on budgeting mistakes that can hold you back.

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

What does financial burnout feel like?

This sounds like a silly question, but it’s totally valid. We are all individuals, and we feel things differently. You could feel

- discouraged

- anxious

- angry (at yourself, others, and the situation)

- irritated

- ambivalent

- tired of it all

- hopeless

- sad

- foolish & stupid (which isn’t true!)

Sometimes people call these feelings about money “frugal fatigue,” as it can be hard saving every dime! You should recognize these feelings. Don’t push them aside. Recognize and let yourself feel all the feelings. Give yourself a bit of time.

You want some space to decompress and then get back in the game!

In America, money & anxiety go hand in hand

If you think you’re alone in being stressed out over money worries, let me reassure you, you are not! Mobile banking company Varo Money “polled more than 1,000 U.S. adults and found that, while a whopping 85 percent say they “sometimes” feel stressed about money, a full 30 percent say they’re “constantly” stressed about their finances.”

What fears are driving these concerns? According to a survey by LendingTree, “Topping the list of concerns were unexpected expenses (43%). Making ends meet was a worry for one-third of everyone asked (34%), followed by healthcare costs (29%).”

It’s the 34% figure that we’re talking about today because budgeting is precisely what can help those who can’t make their money stretch to cover everything. Yet, so many times people get frustrated and overwhelmed, and they quit budgeting, or trying to save money, or whatever it is. They are so close to success, they just need to hold on!

Yes, the 34% are general money concerns, but getting a solid budget in place and being consistent with it is what will get you to the other side of fear! Yet, the anxiety and overwhelm with budgeting may stop you before you get to step #1, which is making your first budget!

I talked with many women about how financial stress makes them feel (like deep in their bones type of real). Check out that post to see if you connect with any of them, and can relate. I know that I feel so much better when I can say, “OMG, that’s exactly how I feel! I’m so relieved I’m not the only one!

At the end of the day

If there’s one thing I want you to take away from this post, it’s to not give up and quit budgeting! Yes, personal finance can be overwhelming, hard, confusing, frustrating, and maddening! So many of us have felt this way along our financial journey. Maybe it’s a right of passage to get so mad that you throw your calculator, and immediately cry because you realize it was your phone! (true story) .

Yet, remember that budgeting will allow you to grow your bank account balance, reach your dreams and live your life the way you want to live it! Is that worth fighting for? I think so, and I hope you do too!

Articles related to: You The Top 3 Reasons Why You Want to Quit Budgeting (and How to Beat it!)

- Need a Guaranteed Plan to succeed? Change Your Money Mindset!

- 5 Proven Printable Budget Planners to Make Budgeting a Breeze!

- You Need to Have a Financial Why if You Want to Hold Onto Your Money

- The Top 7 Proven Budgeting Methods – Part Three in Your Ultimate Guide on How to Budget Series

- The 10 Budgeting Mistakes You Don’t Want to Make! Part Five in Your Ultimate Guide on How to Budget Series

I have started to look at budgeting as “money planning”. I have bills (money appointments) that I know are coming up, and things /goals I want to do with my money, so I need to plan for it. It feels less stressful now. I’m not trying to force anything, I’m just making plans, and sticking to them for the most part!

Hi Krista! Yes, making a plan (and writing it down) can help take away a lot of the stress. When you have a plan, you are in the driver’s seat with your money!

This is the kind of thing I needed to read right now. I am just starting to make budgeting a part of my money strategy and it’s definitely getting overwhelming for me. So thank you so much for writing this post, Kari! The tips you mentioned are very helpful, especially the first one about taking a break.

Love,

Shetu 🙂

Yes! Sometimes you just need to walk away from it for a bit, totally a good move to let your emotions and frustrations settle!

I totally love this article because I’m great a tracking where my money goes, I’m just bad with sticking to a budget. Then I get discouraged and one of those three things runs through my mind. These tips will help me break past that!

So glad you connected with this Heather! Getting discouraged is normal, but still hard. It’s good to know that everyone goes through this stage (sometimes multiple times over! Just keep at it, and it will get easier!

Thanks for sharing!

The most difficult part of budgeting is being disciplined and follow what you planned for. For me what really works is following up every week to make sure I am not overspending.

It can be hard, I totally get it, but by looking at it weekly you have a chance to correct any overspending from the week prior, before your end of month bill comes due.

Thanks for these tips! Budgeting can be frustrating but it is so helpful too!

No one says budgeting is bliss, right? 🙂 Totally frustrating but it’s absolutely worth it!

I was never great at budgeting so this article is especially helpful for me. Thank you so much for sharing this!

Budgeting is hard & intimidating at first, I totally get it! Keep at it, making small changes until it works for you and your situation!

great tips for budgeting! thanks for sharing!

Thanks for stopping by Hari!

Wonderful advice! It is truly a struggle if you do not budget. Thank you for sharing these amazing tips!!

No need to struggle, you can absolutely learn to budget, it’s just a slow and steady process!

Budgeting is important. Useful post with helpful tips.

It is so important, so glad you found it helpful!

These are helpful tips. My husband and I actually just started Dave Ramsey’s 7 Baby Steps, so we’re in the thick of all this now! Anxiety definitely does go hand in hand with money!

People have huge success with Dave Ramsey! It will be hard at first, but you will soon see your progress and get addicted to it! It’s going to be great!

Great post.

I find that I have a hard time getting my husband on board with the budget.

I hear you! It can be hard going when spouses don’t align with their saving & spending habits. I’ve had success with giving my spouse an “allowance” and then if he overspends it then I pull from his personal savings account. It took a few months but he caught on to the chain reaction.

Very interesting. Thanks for sharing ways to budget without stressing!

So glad you found it interesting! Thanks for stopping by!

Great tips! Budgeting has really changed my financial life.

It’s amazing the ripple effect that budgeting has on all aspects of our lives huh!

Budgeting is so important these days and it can definitely be stressful! I like your tip on having some fun! I think most people associate budgeting with it being a chore and a hassle. Awesome tips!

Yes, the term “budgeting” definitely has a negative connotation, but in reality it’s just planning on how you want to spend your money!

Awesome budgeting tips for everyone.

Thanks Abby!