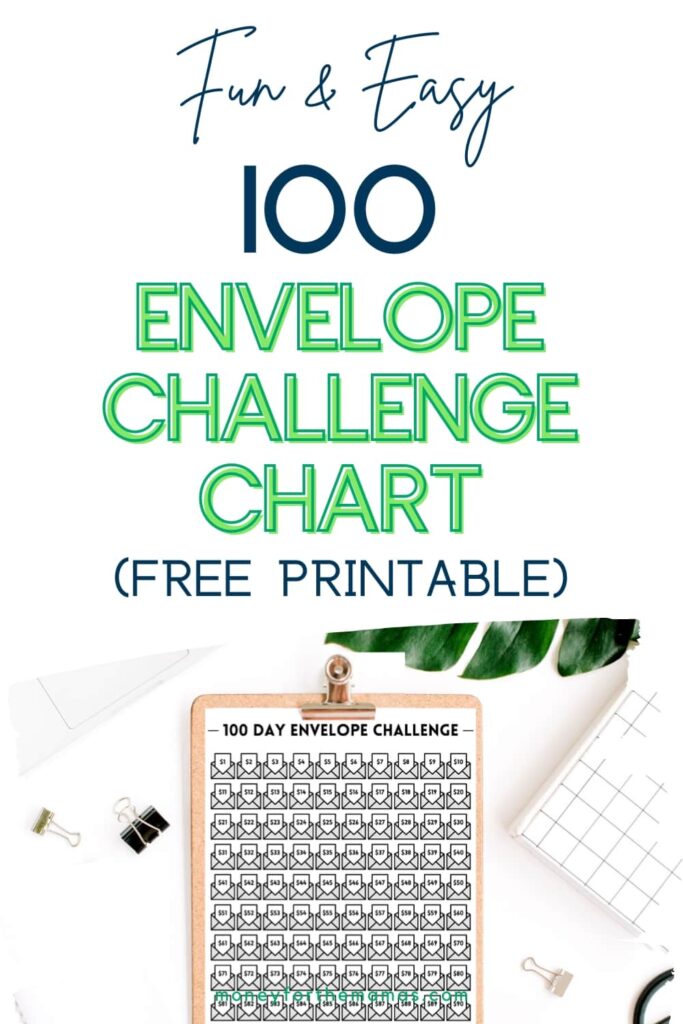

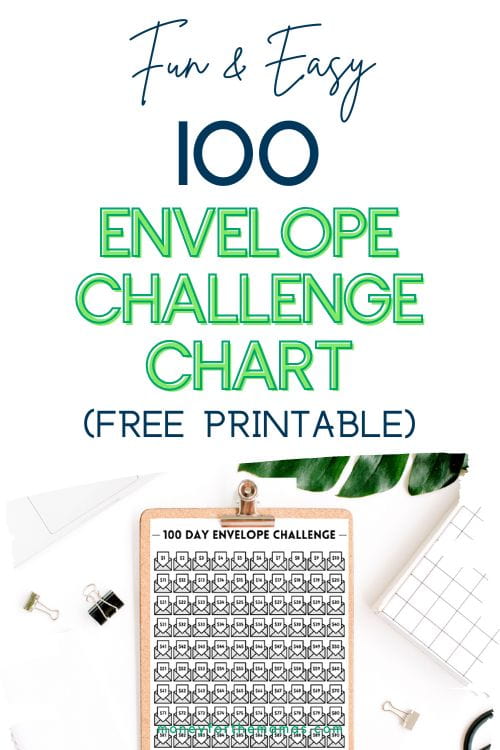

Fun & Easy 100 Envelope Challenge Chart (Free Printable)

If you’re going to do this money challenge, then be sure to grab your free 100 envelope challenge chart!

Author: Kari Lorz – Certified Financial Education Instructor

You want to save money for your future, but you find yourself saying, “I’ll start tomorrow” or “I don’t have enough” every time you try. And before you know it, two months have passed, and you haven’t saved anything.

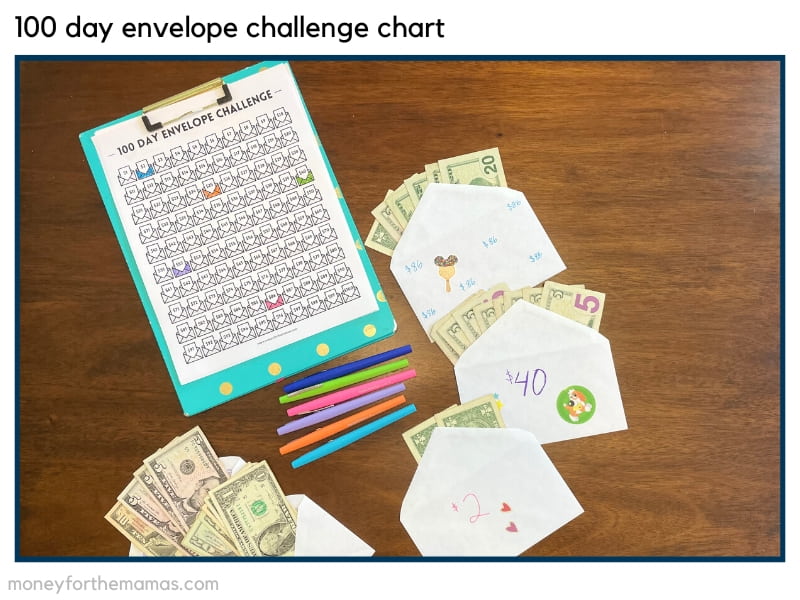

Enter the 100 day money challenge! This fun and easy-to-use envelope system will help you stay on track with your savings goals while also having fun. Grab some envelopes, download your free 100 envelope challenge chart, and start saving!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is the 100 day money challenge?

The 100 day money challenge, also known as the 100 envelope challenge, is a fun way to help you save more money consistently. It involves setting up an envelope system with numbers on each envelope corresponding to how much money you should save every day. You track your progress with a savings tracker; before you know it, you’re on your way to $5,050.

You can use this extra cash to fill your emergency fund, get out of credit card debt, or help you with any financial goal you’re working towards.

How does the 100 envelope challenge work?

It’s pretty easy to set up your 100 day money challenge; you just need a few things (you may already have the supplies in your house). Let’s dive in…

- Step One: Gather 100 money envelopes (here are some cheap ones).

- Step Two: Number your envelopes from $1 to $100, and shuffle them up so the numbers are all mixed up.

- Step Three: Find a place to keep your envelopes – a shoe box or a recipe box works great.

- Step Four: Choose one random envelope every day (just pick one, no peeking!).

- Step Five: Add that amount of money to the envelope.

- Step Six: Separate your filled envelopes (just keep them in the back of the box).

- Step Seven: Track your savings progress! Don’t forget to grab your 100 envelope challenge chart (free printable).

100 day envelope challenge math

When you do the 100 day money challenge, you’ll save $5,050. Your savings amounts will vary each week, as you’ll pick envelopes randomly. So one day, you could grab a $3 envelope and then the next day, a $56 envelope.

- If you grabbed the smallest envelopes, say 1-7, then the least you’d save in a week is $28.

- If you grabbed the highest envelopes, say 94 – 100, then the most you’d save in a week is $679.

Usually, you’ll fall somewhere in the middle.

100 envelope challenge chart

I love a good printable tracker! I find that tracking my progress visually can keep me motivated. (Some people are like this, and others not so much). If you do like tracking, then be sure to grab your free 100 envelope challenge chart.

If you’ve had trackers in the past but haven’t been successful, then I’ll share some tips that may help you.

- Keep your tracker where you can easily see it – Don’t tuck it away in a binder or a pile of papers. Put it on your refrigerator or your bathroom mirror, somewhere where you’ll see it every day. Keeping it up front and center is essential!

- Make it part of your routine – Our bodies love habits (both good and bad), so make filling out your tracker a part of your daily habit. For example, try habit stacking, where you stack a new habit you want to adopt right before or after a habit you already have. For example, you can fill out your tracker right after brushing your teeth before bed at night.

- Go easy on yourself if you miss a day – No one is perfect, and this is a “challenge,” which means it’s hard. So if you miss a day, don’t throw in the towel and quit; just get back at it the next day. I promise nothing bad will happen if you miss a day and need to extend your challenge; it’s okay.

Supplies needed for 100 day money challenge

While you probably have everything you need already in your house, if you do need to order stuff, this is what you’ll need…

- DIY 100 envelope challenge tracker – get it here! (it’s free, just download and print)

- 100 cash envelopes – you can use plain white or colorful envelopes

- 100 envelope challenge box – any shoe box will do, or if you can get a fun cash box

- Pens – colorful markers to doodle your favorite quotes on your envelopes

- Stuff to make it fun – stickers, stamps, etc. (optional)

- Features: These money envelopes measure 3.2 x 6.6 inches, making them the ideal small envelope for cash, budgeting, coins, jewelry, medications, resistors, capacitors, seeds, credit cards, SD memory cards, or any other small items. The 8.1 x 16.8 + 2.2 cm sealable envelopes cater to all your home and office needs. Use these cash envelopes to store or organize various small accessories, keeping things tidy and saving time.

- HIGHLY QUALITY: Cash box is made of durable steel which is solidly built and can prevent it from drops and impacts.Equipped with a wide carrying handle, you can transport your locking cash box easily.

Since this is a money savings challenge, I highly suggest using what you already have, as it’s free. But if making it cute and pretty will make it more likely for you to stick with then, by all means, make it fun for yourself; the supplies aren’t too expensive.

Don’t forget to ask around for supplies; I love my local Facebook Buy Nothing group. This is a group where you ask your neighbors for things you need so you don’t have to buy things. You can also get rid of stuff you don’t need anymore to neighbors who want them.

So if you have a bag of clothes your kiddo is outgrown, you post a picture of the items on the group page, and people can request the items from you (they even come and get them off your front porch!)

Buy Nothing groups are all over the country; just go on FB and search for “buy nothing near me,” and you’ll see some local groups in your area.

Pros & cons of the 100 day money challenge

Pros of 100 envelope challenge

- Save money for a purpose – if you have a big expense coming up, a money challenge is a great way to save for it. It’s fun to challenge yourself to do hard things!

- Makes savings a habit – by creating a routine around filling out your tracker and picking envelopes, you’ll create money habits that will stick with you long after the challenge is over.

- Improve your cash situation in 3 months – this money challenge is fairly short, so you can save money fast.

- Easy to follow – This challenge is very simple & straightforward; just grab an envelope and put that amount in it. Done.

- Restart if needed – While it is a 100-day challenge, you can easily pause it if you need to (i.e., job loss). It can be a 148-day challenge if you want! You should make it work for you, just don’t quit!

- There’s a tracker – You can see your progress with a printable 100 envelope challenge pdf! Again, I love a tracker! I get a lot of satisfaction from seeing my dedication and hard work add up!

Cons of the 100 day money challenge

- Access to cash – I’ll admit that I don’t usually have much cash lying around. So I’d have to go to the bank to get all sorts of bills. But if you are a server, bartender, or get cash tips, this will be easier for you.

- Figuring out the budget with high dollar days – While grabbing the $2 envelope will be easy peasy, grabbing the $83 envelope will be a bit tougher to handle. Maybe if you have some really good cash days, you tuck the extra away for days when you know you’ll need a little extra help/cushion. Kind of like a short-term rainy day fund.

- Getting over the mental hurdle of finding the money to save – If you’re doing a money challenge, that means you’re trying to save, as money is tight. It might feel disheartening when you draw an envelope that’s a high dollar amount. You don’t want to slack, but you’re not sure how you’ll get that much. My advice is to draw the envelope in the morning; then, you have all day to figure out how to come up with it.

Who should do the 100 envelope challenge?

This challenge is great if you have a goal like saving for a vacation, a car, or your wedding! It’s also great if you want to improve your cash situation and get more disciplined with spending. This challenge can give you that bit of extra motivation so you can reach your savings goals faster.

It’s important to remember that this challenge won’t make extra money magically appear in your bank account or wallet. It’s meant to teach you how to save more, be mindful of your spending, and have a plan for where your money is going.

Who should NOT do the 100 envelope challenge?

If you are already in a difficult financial situation and don’t have enough money to cover your regular expenses, this challenge might not be the best idea. It might be better to focus on covering your 4-walls – housing, utilities, basic food, and insurance. Those are the must have’s in every person’s monthly budget.

You can try doing the Penny Challenge or a $5 a week challenge, which is much easier to fit into your budget (details below).

Besides, you can always do a money challenge later when your income increases or you get rid of debt; both will free up money to enable you to do a challenge from start to finish.

Ways to get quick money for your challenge

There are lots of different things you can do to help you get some quick cash to use for your savings challenge. We’ve linked to our best ways of making quick & easy cash here…

- Sign up to answer surveys with companies that pay to PayPal.

- Play games on your phone for money, look for games that pay instantly to PayPal.

- If you live in a bottle redemption state, you can return bottles.

- Cash in your spare change at a coin machine

- You can sell things you don’t need…

Tips on how to do the 100 day money challenge when it’s hard

- Know your goal – You need to save for something important to you when times get hard, and you feel like quitting. Cut out a picture of what you’re saving for and put it right next to your tracker to keep your goal up front in your mind.

- Use your tracker – While you may be tempted to skip using the 100 envelope challenge chart, please don’t skip this! A tracker can be hugely helpful in not only showing you how much you saved but showing your progress and commitment to doing this hard thing!

- Look ahead – Before you start your challenge, make sure you won’t run into any road bumps that could derail you (aka birthday parties, holidays, events that would lead you to spend more, etc.).

- Know your triggers – If you know that whenever you are bored, you go to Target to grocery shop and get sucked into the Dollar Spot, then don’t go to Target. Go to Winco instead, where you won’t be tempted to buy nonnecessities.

100 envelope challenge variations

If the dollar amount doesn’t work for your budget (or you want to be a bit more ambitious), try one of these 100 envelope challenge variations.

- 50 day envelope challenge – If you want to scale back a bit, try the 50-day challenge, it just cuts the numbers (and timeline) in half. So you’d label envelopes 1 – 50. And in the end, you’d have saved $1,275.

- 10k in 100 days envelope challenge – This is the same framework as before, except the envelopes are numbered $20 – $2,000, and you label the envelopes by ’20s. So… $20, then $40, then $60, then $80, etc. At the end of the 100 days, you’d have saved $10,100, which is amazing! Yet, this is certainly for those with a lot of flexibility in their budget.

Other money-saving challenges

There are many different money-saving challenge ideas for you to try if the 100 envelope challenge isn’t right for you.

- The Penny Challenge – This is a year-long challenge where you start with $.01 on day one, then $.02 on day two, and so on. On the last day, you save $3.65. In the end, you will have saved $667.95.

- No Spend Challenge – This is my favorite of all money challenges! Basically, you can only spend money on must-haves (i.e., basic food, gas for your car, medications, etc.). Here’s how to do a no-spend challenge, and you can read about how I did a no-spend month right here.

- The $5 to $500 Challenge – This challenge has no time limit; it’s just that every time you get a $5 bill, it goes into this fund. No cheating by asking the cashier for different bills! If you get a fiver, it goes into savings until you get to $500.

- The $1 to $100 Challenge – This is a great one for your tweens to try, as they’re at an age to have cash of their own. It works the same as the $5 to $500, so no time limit.

Those are just a few ideas, and there are a ton more money-saving challenges right here.

Why should I do a money challenge?

Doing a money challenge can help you save more and still have fun while doing it. It’s a great way to stay motivated, focus on your savings goal, and build good financial habits. Plus, I like to do hard things and challenge myself to see if I can accomplish something ambitious and a bit intimidating.

100 day money challenge FAQ

How much do you save from the 100 envelope challenge?

At the end of the challenge, you will have saved $5,050.

Does the 100 envelope challenge work?

Yes, it absolutely works to help you build a savings habit and to save up a lot of money.

What happens if I quit the 100 day money challenge?

Nothing happens to you. You’re still the same amazing person you were before you started the challenge! Again, you can pause the challenge but don’t quit it altogether.

Is there a 100 envelope challenge app?

At this time, there’s no app for the 100-day envelope challenge. It would be very convenient to do this so you don’t have to handle cash. But you could do it on your own. Here’s how…

You’d need 3×5 cards instead of physical envelopes, and write 1 – 100 on each one. You’ll also want to set up a separate savings account for the challenge. Then every day, when you draw a card, you’d transfer that amount to your savings and then fill in your savings tracker. This would function the same; just how you hold the money is different.

Free printable 100 envelope savings challenge chart

Don’t forget to grab your free printable; just click the button below for your download.

At the end of the day

Whether the 100-day money challenge is right for you or not, there are several things to be learned from it. Finding ways to save money doesn’t have to feel like a chore – with some creativity and motivation, anyone can add a little fun to their savings. It also helps us prioritize that even small amounts add up over time.

Above all, the key takeaway is developing a meaningful, consistent saving habit with your finances, and it will pay off in the long run (aka financial freedom). So, why not give it a shot? Who knows, you may surprise yourself with just how much you can save!