$20 an Hour is How Much a Year? (Monthly Budget Guide for 2024)

20 dollars an hour is how much a year? Plus, all the Q&A on how this wage works with a monthly budget

Author: Kari Lorz – Certified Financial Education Instructor

You just got a new job that pays $20 an hour. That sounds great, but is it really as much as you thought – $20 an hour is how much a year? Don’t worry; we’ve done all the math for you!

We’ve dug into all the important financial numbers on $20 an hour pay. Plus, we’ve got tips on how to earn more, spend less, and live a good life at $20 an hour!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- 20 dollars an hour is how much a year? Plus, all the Q&A on how this wage works with a monthly budget

- 20 dollars an hour is how much a year? (short answer)

- 20 dollars an hour is how much a year? (long answer)

- Before tax & after tax pay

- $20 an hour is how much a year

- $20 an hour is how much a year with part-time work:

- $20 an hour is how much a year chart breakdown

- Workplace perks & bonuses

- Jobs that pay $20 an hour with little or no experience/degree

- Can I live off $20 per hour?

- Tips to live on $20 an hour

- $20 an hour budget examples

- Ways to increase your pay

- $20 an hour pay FAQs

- 21, 22, 23… 29 an hour is how much a year?

- Other posts on hourly wage breakdowns

- At the end of the day

20 dollars an hour is how much a year? (short answer)

$20 an hour is $41,600 a year (gross). This is based on working 40 working hours per week, 52 weeks per year.

20 dollars an hour is how much a year? (long answer)

Let’s go through all the calculations for $20 an hour pay (let’s assume an 8-hour workday, at 40 hours a week).

$20 an hour is how much a day?

$20/hour = $160 for an 8-hour workday

$20 an hour is how much a week?

$160 x 5 days a week = $800 a week

$20 an hour is how much bi-weekly?

Getting paid bi-weekly is when you get paid every two weeks, which is one of the most common ways that businesses pay hourly employees (salaried employees usually get paid monthly).

$800 x 2 weeks = $1,600 every 2 weeks

How much is $20 dollars an hour per month?

There are 52 weeks a year, which don’t come out even when you divide by 12 months. It comes to 4.33 weeks in a month. But normally you get paid 2 times a month. There are two months a year in which you get paid three times (aka a bonus check sort of).

- 2 pay periods a month: $3,200 (gross)

- 3 pay periods a month: $4,800 (gross)

- The average of 4.33 weeks a month: $3,464 (gross)

Before tax & after tax pay

Just because you make $20 an hour that doesn’t mean you get to keep it all.

Your take-home pay will be lower than this because you will have to pay taxes and other deductions from your gross yearly salary. In the US, the average worker pays about a third of their income. That’s taxes, insurance, and retirement contributions. But for the sake of this post, we’ll just focus on taxes and insurance deductions.

Here are some other helpful terms…

- Before-tax = gross income. This is the full $20 an hour x # working hours in your pay period.

- After-tax = net pay (this is the amount you take home). This also accounts for other paycheck deductions like insurance and retirement contributions.

- Hourly rate = your hourly wage (i.e. $20 an hour)

- Exempt employees – these are people who are paid a salary. They get paid the same no matter how many hours they work.

- Non-exempt employees – these are people who are paid hourly. They get paid for every hour they work and may receive overtime pay if they have more than 40 working hours in a week. This post focuses on this employee classification.

$20 an hour is how much a year

$20 an hour is how much a year before taxes

- $20 x 40 hrs week x 52 weeks = $41,600 annual salary (gross)

$20 an hour is how much a year after taxes

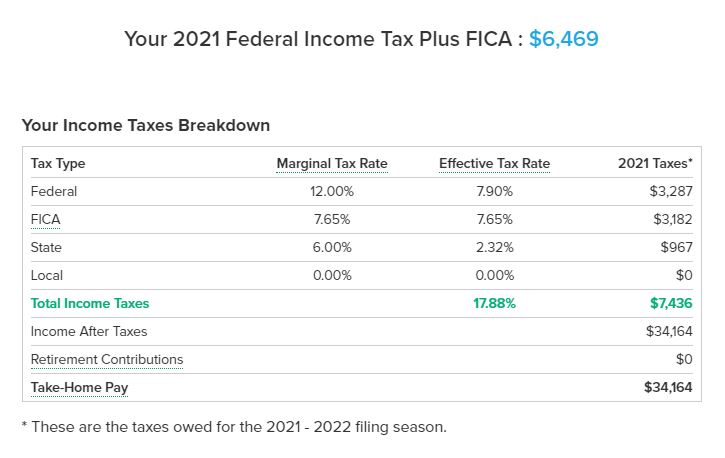

This depends on the state in which you live. Everyone pays the same federal tax amount (depending on your tax bracket), and then you pay state taxes (which is also a different amount depending on your tax bracket).

For example, let’s use this calculator to figure out our federal & state taxes if we lived in California, and a single filer…

This shows that you’ll pay…

- Federal tax: $3,287

- FICA tax: $3,182

- State tax: $967

- Total income taxes: $7,436

- = after tax pay of $34,164

Remember – to make it easy for those in all states we’re going to generalize take-home pay as being 75% of gross income, so losing 25% to taxes and insurance.

$20 an hour is how much a year after insurance

I wish I could say that we are done with paycheck deductions, but we still need to pay for medical insurance that our employer takes on.

According to the US Bureau of Labor, “Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020.”

These are things like…

- Health Care/Limited-Expense Health Care Flexible Spending Accounts

- Dental

- Vision

- Health Savings Account

- Optional Life Insurance Premiums

- Long-Term Care Insurance Programs

- Dependent-Care Flexible Spending Accounts

- Thrift Savings Plan (TSP)

So if we take your take-home pay of $34,164 and x 8.2% for healthcare = $2,801 a year for healthcare. This means you’ll actually take home…

- $34,164 – $2,801 = $31,363 (this is your net income)

This means you lost 24.6% of your paycheck to deductions, and remember this doesn’t include any retirement contributions, which is on average 5% – for those that contribute.

$20 an hour is how much a year with part-time work:

$20 per hour working 20 hours a week

If you worked only 20 hours a week, that would be $400 a week (gross income). You’d still need to pay taxes. However, your medical deductions would be minimal as part-time workers usually don’t get these benefits.

$400 a week x 52 weeks = $20,800 annual salary

$20 per hour working 30 hours a week

You would take home $600 a week, and you would need to pay federal and state taxes. Depending on your place of employment and their benefits package you may (or may not qualify) for medical benefits, which would be another deduction.

$600 a week x 52 weeks = $31,200 yearly salary

$20 an hour is how much a year chart breakdown

| $20 an hour per… | Before-Tax | After-Tax & Insurance |

|---|---|---|

| Year | $41,600 | $31,200 |

| Month | $3,467 | $2,600 |

| Bi-week | $1,600 | $1,200 |

| Week | $800 | $600 |

| Day | $160 | $120 |

| Part-time 20 hrs a week | $20,800 | $18,096* |

| Part-time 30 hrs a week | $31,200 | $26,208* |

- *For part-time figures, we assume a 13% (for 20hrs) and a 16% (for 30 hrs) tax bracket for state & federal taxes (in California), and no medical deductions (as part-time workers may not qualify for medical benefits).

- All other after-tax figures assume a 25% combined federal and state deduction and no retirement contributions.

Workplace perks & bonuses

Your wage isn’t the only factor when considering how good a job’s compensation is. You also need to consider other benefits; such as PTO, medical coverage, discounts, etc.

Paid time off

Many businesses offer paid time off (PTO) as part of their benefits package. The average worker gets 10 days of paid vacation, and 6 sick days. This time can be used for anything – doctor’s appointments, mental health days, or actual vacations.

Usually, this benefit kicks in after you have worked a certain number of days on the job. For example, after 90 days you would start accruing PTO, which is a percentage of how many hours you work. So you may accrue 1.5 days off a month of PTO (or whatever your company policy is).

Time off without pay

All of our income amounts are listed for the full amount, as if you worked 8 hours a day, 5 days a week, 52 weeks a year.

Yet, if your company doesn’t provide paid time off then you will most likely take home less; due to sickness, unavoidable schedule conflicts, and vacation.

While of course, you’d rather have paid time off, unpaid time off is still a good perk. This means that you can request days off, and still keep your job. Some companies are very strict about their attendance policy, and missed days mean you could be written up (i.e. reprimanded), which could lead to termination of employment.

Let’s say that over the course of a year, you took two weeks of unpaid time off. That’s…

- ($20 an hour x 8 hours) x 14 days = $2,240 less in annual income

Overtime pay

According to the Fair Labor Standards Act (FLSA), “Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.”

Time and a half is your hourly pay x 1.5. So if you made $20 an hour and worked 8 hours of overtime that week (maybe you came into work because someone was sick) it would look like…

- $20 x 1.5 = 30 x 8 hours = $240 for the day

Holiday pay

Some workplaces close on federal holidays, while some remain open and the employees get holiday pay. This is where for that day if you get a higher hourly wage (if you’re on the clock). It can be time and a half (see example above) or double pay, all depending on your workplace benefits details.

Double pay is just like it sounds, so…

- $20 x 2 = $40 x 8 hours = $320 for the day

There are eleven annual U.S. federal holidays on the calendar designated by the United States Congress.

Most holidays fall on a specific date, but some fall on a certain day of the week (i.e. the first Monday of the month). For 2022, these are the federal holidays…

- New Year’s Day – January 1st, 2022

- Birthday of Martin Luther King, Jr. – January 17th, 2022

- Washington’s Birthday – February 21st, 2022

- Memorial Day – May 30th, 2022

- Juneteenth Independence Day – June 20th, 2022

- Independence Day – July 4th, 2022

- Labor Day – September 5th, 2022

- Columbus Day – October 10th, 2022

- Veterans Day – November 11th, 2022

- Thanksgiving Day – November 24th, 2022

- Christmas Day – December 26th, 2022

Employee discounts & misc benefits

Lots of businesses offer their employees a discount on goods and services. This is usually a percentage off, like 10% or 20%. It can be helpful if you are looking to make a large purchase (like a new TV) or if you need to use the business’s services often (like getting your car serviced).

While this benefit isn’t directly seen on your paycheck it can make a big difference to your monthly expenses.

In addition to a standard discount of 10%, there may be other benefits that impact the worthiness of a job.

For example, I worked in the grocery industry for 6 years. Employees got to take home free food that had exceeded its expiration date (or sell-by date). This was a huge benefit as people saved a lot on their grocery bills by eating a salad that didn’t sell the day before, canned beans, or box of pasta, etc.

Other benefits may include…

- Discounted public transportation passes

- Discounted parking passes

- Discounts at local gyms or health programs

- unpaid vacation opportunities (i.e sabbatical)

Jobs that pay $20 an hour with little or no experience/degree

According to Indeed, here are some of the top jobs that pay at least $20 an hour…

- Medical coder – $20.87

- Solar installer – $21.29

- HVAC installer $22.42

- Electrician – $23.33

- Plumber – $24.38

- Writer – $26.29

- Audio visual technician – $27.21

- Aircraft mechanic – $28.17

Can I live off $20 per hour?

Yes, you can live off of $20 an hour. With $41,600 a year that’s on the lower end of wages for the US. According to the US Social Security Administration (SSA), “The national average wage index for 2020 is 55,628.60.”

So at $20 an hour of full-time work, you make less than the average person in the US.

However, that doesn’t mean you can’t do it. Here are some tips to help you make the most of your pay and ensure it’s a living wage.

Tips to live on $20 an hour

1. Hack your biggest expenses

Housing, food, and transportation are typically a person’s biggest expenses. If you can find ways to save in these areas, it will make a big difference.

For housing, consider roommates or look for cheaper options like RV living or house hacking. You may need to look at living in a low cost of living area (LCOL)

For food, cook at home as much as possible and meal prep on the weekends.

2. Stick to a budget

When you know how much money you have coming in and going out, it’s easier to make your money fit your lifestyle. Track your spending for a month to get an idea of where your money goes, then set up a budget that works for you.

When you budget, you are making sure that you aren’t spending too much and racking up debt, which can be very hard to pay off.

We’ll go through a couple of monthly budget examples below.

3. Pay off debt quickly

If you have debt, it’s important to pay it off as quickly as possible. The interest can really add up, making it difficult to get ahead.

There are a couple of different ways to do this. You can either make the minimum payments on all of your debts and put any extra money towards the debt with the highest interest (known as the debt avalanche method).

Or, you can make the minimum payments on all of your debts and put any extra money towards the debt with the lowest balance (known as the debt snowball method). You should look at how those debt repayment methods compare, and pick the best option for you.

4. Find inexpensive or free hobbies

When your free time is filled with expensive activities, it can be tough to make ends meet. Instead, look for hobbies that are inexpensive or even free.

There are plenty of options out there, like hiking, biking, running, walking, playing sports, going to the library, and more.

5. Have an emergency fund

An emergency fund is a savings account that you only use for unexpected expenses, like a job loss, car repair, or medical bills. This helps to ensure that you don’t have to put these expenses on a credit card and rack up debt.

Ideally, you should have 3-6 months of living expenses saved in your emergency fund.

$20 an hour budget examples

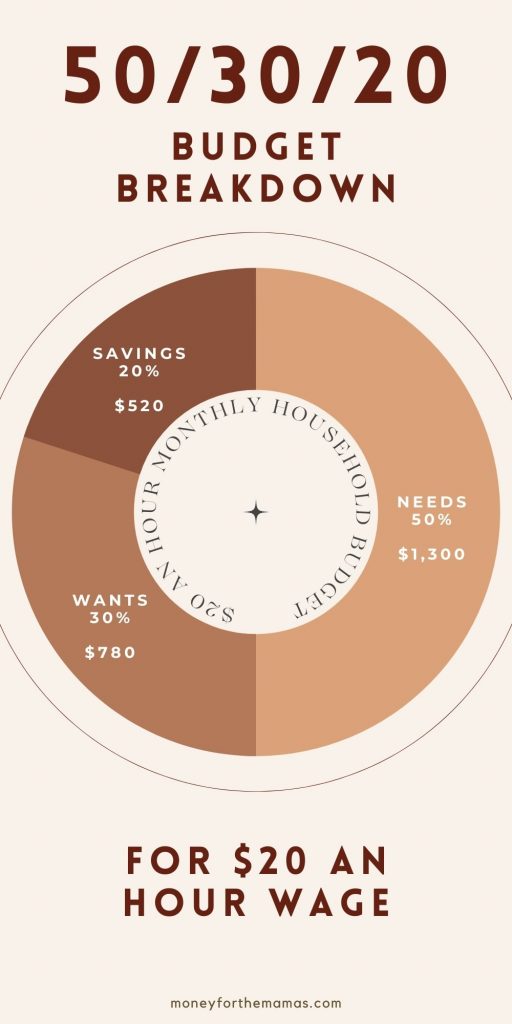

50/30/20 budget

People who prefer flexibility and have leeway for unpredictability will benefit from this budgeting approach. They want broad rules, but they also desire alternatives and choices. So your monthly household budget might appear like this with a take-home pay of $2,600 a month (a good general average).

- 50% Needs: $1,300 for housing and utilities

- 30% Wants: $780 for wants

- 20% Savings: $520 for saving

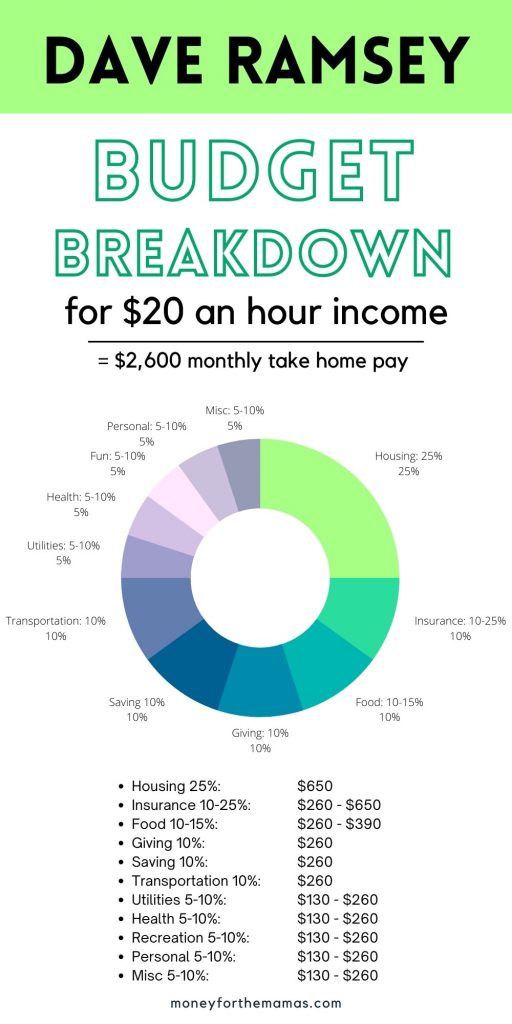

Dave Ramsey recommended budget percentages

I am a fan of Dave’s budget percentages, but I realize that it is very detailed and maybe too strict for some. But for others, that’s the best part, they want to know exactly what to do to make the most of their income. so, for a $2,600 take-home pay…

- Housing 25%

- Insurance 10 – 25%

- Food 10-15%

- Giving 10%

- Saving 10%

- Transportation 10%

- Utilities 5-10%

- Health 5-10%

- Recreation 5-10%

- Personal Spending 5-10%

- Misc 5-10%

But let’s just see what your money situation comes to using his recommended budget percentages.

| Budget Category | Recommended % | Amount to Spend |

|---|---|---|

| Housing | 25% | $650 |

| Insurance | 10-25% | $260 – $650 |

| Food | 10-15% | $260 – $390 |

| Giving | 10% | $260 |

| Saving | 10% | $260 |

| Transportation | 10% | $260 |

| Utilities | 5-10% | $130 – $260 |

| Health | 5-10% | $130 – $260 |

| Recreation | 5-10% | $130 – $260 |

| Personal spending | 5-10% | $130 – $260 |

| Misc | 5-10% | $130 – $260 |

In looking at Ramsey’s recommended numbers, $20 an hour doesn’t look to be a livable wage, especially looking at the housing category. (Unless you live at home with your parents, or have a lot of roommates.) You would have to do some considerable adjusting with these budget category percentages to make it work for you.

Ways to increase your pay

1. Ask for a raise

If you think you’re underpaid, it never hurts to ask for a raise. You may be surprised at how willing your employer is to give you a raise, especially if you’ve been with the company for a while and have been doing good work.

Make sure that you’re ready to talk about all the ways you positively contribute to the company, especially how you impact sales. When you can articulate your value, and what you bring to the bottom line you are much more likely to get a raise.

2. Get a promotion

If you’re looking for a way to make more money, consider asking for a promotion. This can be a great way to earn a raise and advance in your career.

Be talking to your manager now about what skills you need to advance in the company. There are hard income skills (technical skills) and soft income skills (interpersonal skills). Both impact how you are viewed as an employee.

If you want a jump start, check out these high-income skills that can help you bring home a big paycheck.

3. Work overtime hours or take extra shifts

If you’re looking for a way to make some extra money, consider working overtime or taking on extra shifts. This can be a great way to earn a little bit of extra household income without having to commit to a second job.

People call out for their shifts all the time, so make sure that they know to ask you first to pick up their unwanted shifts.

4. Ask for extra responsibilities or duties

If you’re looking for a way to make some extra money, consider asking for additional responsibilities or duties at work, (this isn’t a promotion per se but smaller add-on stuff).

This could include taking on a leadership role, training new employees, or taking on a larger workload.

Not only will this give you the opportunity to earn more money, but it will also help you to stand out and advance.

5. Find a new career that pays higher

If you’re not happy with your current yearly salary, changing jobs may be the best option. Check out job postings and see what the average salary is for your position. If you’re not earning at least that much, it may be time to start looking for a new job.

It never hurts to look and see what’s out there, even if you like your current job. Be sure to have an updated resume at all times so you can jump on an opportunity when it comes up.

6. Find alternative ways to make money

There are plenty of ways to make money outside of your 9-5 job. You could start a side hustle in as little as a day! Start Googling side gigs in your area to get a great list of options.

The sky’s the limit when it comes to making money, so get creative and find something that works for you. You can, make money woodworking, open an Etsy shop, become a Pinterest Manager, or start flipping furniture.

$20 an hour pay FAQs

$20 an hour is how much a year after taxes?

It’s $34,164 after-tax income. But don’t forget about the cost of insurance. After that expense, you’ll end up taking home about $32,000 on average.

$20 an hour is how much a month after taxes?

It’s about $2,600 after taxes & insurance. So this is your take-home amount.

$20 an hour is how much biweekly after taxes

You’ll take home approximately $1,200 (after taxes and insurance).

How much is $20 an hour after taxes weekly?

You’ll take home about $600 a week after taxes and insurance.

21, 22, 23… 29 an hour is how much a year?

Let’s assume that you work 40 hours a week and that 25% of your paycheck goes to taxes & medical coverage (this is your after-tax income amount). This is a good generalized number that’s safe (it overestimates taxes just a tiny bit to ere on the side of caution).

We won’t consider any retirement contributions here, but if you wanted to add that in, then move the deductions up to 30%.

Remember – these figures are averages, not exact numbers. It all depends on that specific year, how many workdays there are, how many weeks in a month, etc. These amounts are meant to give you a good general idea of what you can expect for pay.

$21 an hour is how much a year?

- before taxes: $43,680 annual income

- after taxes: $32,760

How much is it…

- a month – before taxes: $3,612

- a month – after taxes: $2,709

- bi-weekly – before taxes: $1,680

- bi-weekly – after taxes: $1,260

- a week – before taxes: $840

- a week – after taxes: $630

- a day – before taxes: $168

- a day after taxes: $126

$22 an hour is how much a year?

- before taxes: $45,760 annual income

- after taxes: $34,320

How much is it…

- a month – before taxes: $3,813

- a month – after taxes: $2,860

- bi-weekly – before taxes: $1,760

- bi-weekly – after taxes: $1,320

- a week – before taxes: $880

- a week – after taxes: $660

- a day – before taxes: $176

- a day after taxes: $132

$23 an hour is how much a year?

- before taxes: $47,840

- after taxes: $35,880

How much is it…

- a month – before taxes: $3,987

- a month – after taxes: $2,990

- bi-weekly – before taxes: $1,840

- bi-weekly – after taxes: $1,380

- a week – before taxes: $920

- a week – after taxes: $690

- a day – before taxes: $184

- a day after taxes: $138

$24 an hour is how much a year?

- before taxes: $49,920 yearly income

- after taxes: $37,440

How much is it…

- a month – before taxes: $4,160

- a month – after taxes: $3,120

- bi-weekly – before taxes: $1,920

- bi-weekly – after taxes: $1,440

- a week – before taxes: $960

- a week – after taxes: $720

- a day – before taxes: $192

- a day after taxes: 4144

$25 an hour is how much a year?

- before taxes: $52,000

- after taxes: $39,000

How much is it…

- a month – before taxes: $4,333

- a month – after taxes: $3,250

- bi-weekly – before taxes: $2,000

- bi-weekly – after taxes: $1,500

- a week – before taxes: $1000

- a week – after taxes: $750

- a day – before taxes: $200

- a day after taxes: $150

$26 an hour is how much a year?

- before taxes: $54,080

- after taxes: $40,560

How much is it…

- a month – before taxes: $4,507

- a month – after taxes: $3,380

- bi-weekly – before taxes: $2,080

- bi-weekly – after taxes: $1,560

- a week – before taxes: $1,040

- a week – after taxes: $780

- a day – before taxes: $208

- a day after taxes: $156

$27 an hour is how much a year?

- before taxes: $56,160 yearly income

- after taxes: $42,120

How much is it…

- a month – before taxes: $4,680

- a month – after taxes: $3,510

- bi-weekly – before taxes: $2,160

- bi-weekly – after taxes: $1,620

- a week – before taxes: $1,080

- a week – after taxes: $810

- a day – before taxes: $216

- a day after taxes: $162

$28 an hour is how much a year?

- before taxes: $58,240

- after taxes: $43,680

How much is it…

- a month – before taxes: $4,853

- a month – after taxes: $3,640

- bi-weekly – before taxes: $2,240

- bi-weekly – after taxes: $1,680

- a week – before taxes: $1,120

- a week – after taxes: $840

- a day – before taxes: $224

- a day after taxes: $168

$29 an hour is how much a year?

- before taxes: $60,320

- after taxes: $45,240

How much is it…

- a month – before taxes: $5,026

- a month – after taxes: $3,770

- bi-weekly – before taxes: $2,320

- bi-weekly – after taxes: $1,740

- a week – before taxes: $1,160

- a week – after taxes: $870

- a day – before taxes: $232

- a day after taxes: $174

Other posts on hourly wage breakdowns

- $20 an hour is how much a year (you’re here)

- $30 an hour is how much a year

- $40 an hour is how much a year

- $50 an hour is how much a year

At the end of the day

$20 an hour is a good wage, but it’s important to remember that you need to budget carefully and live within your means.

If you start at $20 a year, there’s lots of growth potential for you in your career or opportunities to branch out on a new career path.

That said, with careful budgeting and some creative tips, $20 an hour can go a long way!

Q: $20 an hour is how much a year?

A: $41,600

This was very well explained and written for someone who is brand new to budgeting and trying to get their finances on track. I really appreciate the forward thinking in this blog as well. I feel very knowledgeable thanks to you!

So glad you liked it Danielle; thanks for stopping by!