$40k a Year is How Much an Hour? + Monthly Budget Examples

Looking for a new job and wondering how much is $40,000 a year per hour? We’re breaking it all down

Author: Kari Lorz – Certified Financial Education Instructor

You might be wondering, “$40,000 a year is how much an hour?” Is it enough? Well, it may not be very easy living on that salary, but it’s definitely doable.

With the cost of living rising, it’s more important than ever to make sure your salary can cover your expenses. If your dream job pays only $40,000 a year, don’t worry – you can still live comfortably on that amount.

We’ll go through all the details on how much you’ll lose with taxes, health insurance, etc. So you can decide if it’s enough take-home pay for you.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- Looking for a new job and wondering how much is $40,000 a year per hour? We're breaking it all down

- $40k a year is how much hourly (short answer)

- If you make $40k a year, how much is that after federal and state taxes?

- What do retirement contributions do to my take-home pay?

- How much does insurance take from my $40,000 annual salary?

- How to live on $40k a year

- How should I budget a 40k salary?

- Can you live off of $40k a year?

- Jobs that make $40,000 a year

- What is a salaried job?

- $45,000 a year is how much an hour?

- $40k a year annual salary FAQ's

- At the end of the day

$40k a year is how much hourly (short answer)

- Let’s say you work the traditional 40 hr workweek:

- $40,000 / 52 weeks a year = $769.23 a week / 40 hours = $19.23 an hour

- $40,000 / 52 weeks a year = $769.23 a week / 40 hours = $19.23 an hour

- If you work 50 hrs a week (which would be more typical for a salaried worker)

- $50,000 / 52 weeks a year = $769.23 a week / 50 hrs = $15.38 an hour

How much is $40,000 a year as a monthly salary?

- $40,000 / 12 months = $3,333 gross pay

How much is $40,000 a year in bi-weekly pay?

- $40,000 / 26 pay periods = $1,538 gross pay

$40k is how much a week?

- $40,000 / 52 weeks = $769 gross income

$40,000 is how much a day?

If you work 40 hours a week, then that’s 8 hours a day for five days = $154 a day when you’re working.

$40k a year is how much an hour?

Remember you are salaried! That means you get paid that same even when you work overtime. So at five days a week…

- 8-hour workday: $19.23 an hour

- 10-hour workday: $15.38 an hour

Just because you make a $40,000 annual salary, you don’t take that amount home! You still have to pay taxes. Let’s look at how that impacts your take-home (after-tax) pay.

If you make $40k a year, how much is that after federal and state taxes?

Figuring out your tax burden is vital to understanding your pay. You’re in for a nasty shock if you do the math and base your bills on before-tax income! So always consider how much you’ll pay in taxes.

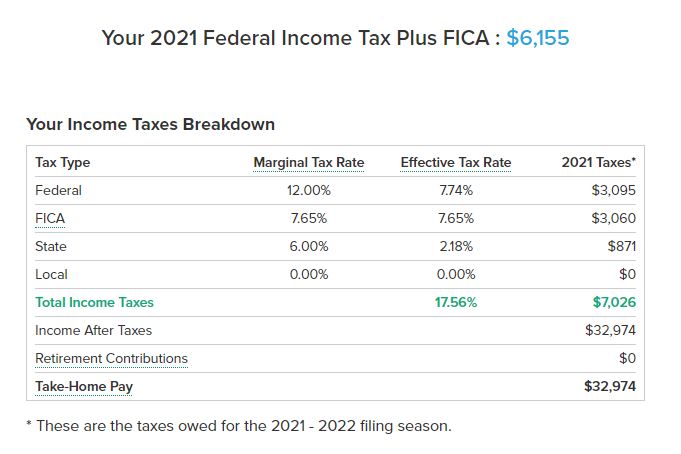

For example, let’s assume you’re a single filer:

- If you live in CA, which has a very high state income tax rate…

- You’ll pay $7,026 in FICA, federal and state taxes (roughly)

- You’ll take home $32,974

You can go here to give you a rough idea of how much you’ll pay. Remember, this is just a reasonable rough estimate, not a guarantee! Or, if you want a super quick calculation, taking 25-30% off your gross is a good and safe estimate for this tax bracket. This percentage would include taxes, insurance & retirement contributions.

The current tax rate for $40k a year

If you make $40k a year and are single with no children, your current tax rate is 12% for federal taxes…

- $10,276 to $41,775 income = 12% tax rate

- $40,526 to $86,375 income = 22% tax rate

In addition, you’ll need to take away state income taxes.

What do retirement contributions do to my take-home pay?

I am so glad you asked! Putting money into your employer-sponsored retirement plan is one of the smartest things for long-term financial planning! So yes, you absolutely want to do this!

Companies usually match a specific amount (as a percentage) of the pay that you put in. So if you put in 5% of your gross income into a traditional 401k, they will also match that 5%. Usually, companies have a max amount that they will contribute; 5% is a good general figure.

So, if you make $40,000 a year and contribute 5%, that means $2,000 annually in workplace retirement plan contributions by you and another $2,000 with your employer match!

You now have a taxable income of $38,000. Using the same calculator shown above, you’ll take home $31,298 (before insurance deductions).

- $32,974 take home with no retirement contributions

- $31,298 with a 5% contribution

- = a difference of $1,676 in take-home pay (before medical and other misc deductions).

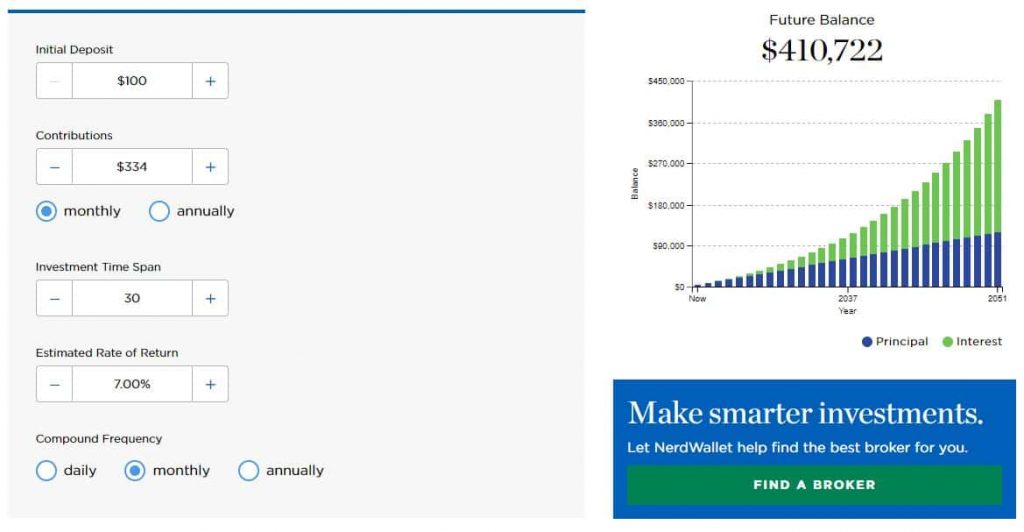

The graph below shows what a 5% retirement contribution looks like plus a 5% company match over the span of 30 years. Don’t forget that you’ll probably get raises along the way too which will bump up your future total balance.

At the end of 30 years, at 7% return, you’ll have…

- Contributed $120,340 (total principal)

- Earned $290,382 in interest

- Total of $410,722

If you’re changing jobs, then you need to make sure that you take all your money with you! According to Capitalize, “As of May 2021, we estimate that there are 24.3 million forgotten 401(k)s holding approximately $1.35 trillion in assets, with another 2.8 million left behind.

That’s a lot of money for employees to just “forget about.” Don’t be a worker who left money on the table when they switched jobs! Beagle can help you find your old 401k accounts and help you roll them over into an account that you can easily manage.

While the full process takes a few days (they need 2-3 days to research everything), the initial sign-up process takes less than 15 minutes. You tell them your info, give them an idea of what companies you worked for, and they go find your old accounts.

We went through the process, and it was super easy; you can read our full review on Beagle retirement savings finder here! Or you can check out Beagle by clicking the green button below.

How much does insurance take from my $40,000 annual salary?

Sorry to say that we’re not done with your paycheck deductions. According to the US Bureau of Labor, “Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020.”

It’s important to note the precedence of what get’s taken out of your paycheck and when. Here’s the order according to the US Office of Human Resources…

- Retirement contributions come out first, followed by

- Social Security tax

- Medicare tax

- Federal income tax

- Health insurance

- Life insurance

- State income tax

- Local income tax

- Collections to the US government (if applicable)

- Collections to Court ordered rulings (if applicable)

- *Everything below here is optional*

- Health Care/Limited-Expense Health Care Flexible Spending Accounts

- Dental

- Vision

- Health Savings Account

- Optional Life Insurance Premiums

- Long-Term Care Insurance Programs

- Dependent-Care Flexible Spending Accounts

- Thrift Savings Plan (TSP)

Did your jaw drop? It did for me; that’s a lot of deductions. Let’s concentrate on medical deductions and how they affect your earnings.

The situation is the same as in the above example, with a single filer making one deduction and living in California…

- $40,000 / 12 months = $3,333

- Minus 5% in retirement contributions $167 monthly

- Minus FICA, federal and state taxes = $559 a month

- Totals $2,607

- Minus 8.2% average medical insurance costs

- That takes out $214 leaving you with $2,393

- Minus misc small deduction averaging $50 (a total guess)

- = $2,343 net monthly income

This means roughly 29.7% of your paycheck is money you never see in your bank account.

| $40,000 per… | Before Taxes | After Deductions |

|---|---|---|

| Year | $40,000 | $28,120 |

| Month | $3,333 | $2,343 |

| Bi-week | $1,538 | $1,082 |

| Weekly | $769 | $545 |

| Daily | $154 | $108 |

| Hourly | $19.23 | $13.63 |

How to live on $40k a year

People often warn about lifestyle creep when you get a big income jump. This can mean that you start spending more money, sometimes without realizing it.

To stick to a monthly budget of $2,343, you need to be careful about your spending habits and ensure that all your expenses are accounted for. Here’s how to do it…

- Make a realistic monthly budget; here are the popular budgeting methods

- Live within your means (you have to say no to yourself sometimes).

- Save up for significant expenses (use sinking funds)

- Dump your debt ASAP (paying interest is eating away at your bank account, do it this way)

- Evaluate, Tweak & Adjust, and reanalyze (everyone needs to adjust, no one is perfect at budgeting)

How should I budget a 40k salary?

Okay, let’s take the figures from above and figure out your monthly budget. So we’re using a take-home pay of $2,343 and giving figures for two popular budgeting methods.

The 50/30/20 budgeting method

This budgeting method is good for people who like flexibility and have leeway for spontaneity. They want general guidelines, but they want options & choices too. So your monthly household budget would look like this…

- 50% Needs: $1,172 for housing and utilities

- 30% Wants: $703 for wants

- 20% Savings: $469 for saving

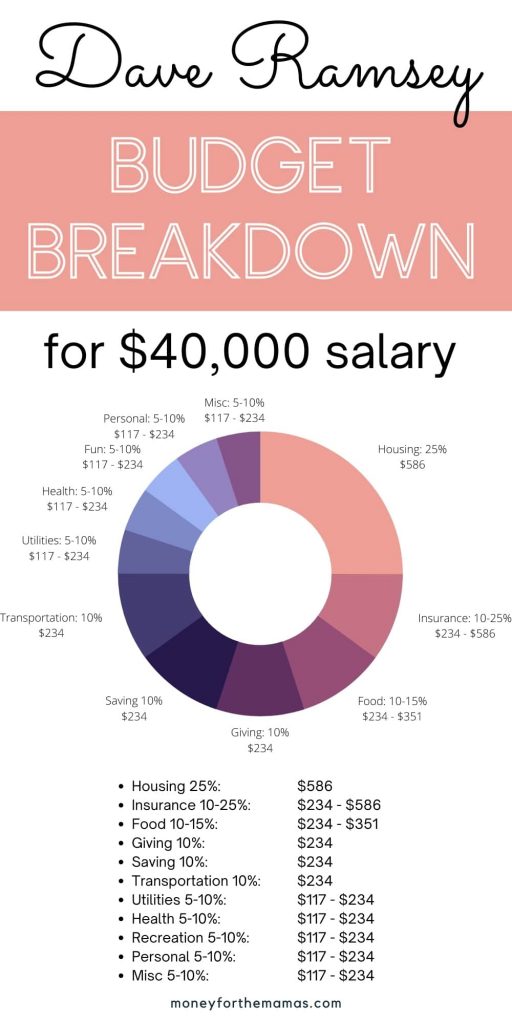

Dave Ramsey recommended budget percentages

I am a fan of Dave’s budget percentages, but I realize that it can be too detailed and constraining for some. However, others need to be told exact amounts to help them feel comfortable and secure.

Knowing norms is a good place to start with budgeting, but know that people always tweak and adjust their numbers.

But let’s see what everything comes to…

- Housing 25%

- Insurance 10 – 25%

- Food 10-15%

- Giving 10%

- Saving 10%

- Transportation 10%

- Utilities 5-10%

- Health 5-10%

- Recreation 5-10%

- Personal Spending 5-10%

- Misc 5-10%

| Budget Category | Percentage | Amount |

|---|---|---|

| Housing | 25% | $586 |

| Insurance | 10 – 25% | $234 – $586 |

| Food | 10 – 15% | $234 – $351 |

| Giving | 10% | $234 |

| Saving | 10% | $234 |

| Transportation | 10% | $234 |

| Utilities | 5 – 10% | $117 – $234 |

| Health | 5 – 10% | $117 – $234 |

| Recreation | 5 – 10% | $117 – $234 |

| Personal | 5 – 10% | $117 – $234 |

| Misc | 5 – 10% | $117 – $234 |

Can you live off of $40k a year?

These numbers are not a living wage if you live in a high cost of living area. Your housing and food expenses may be considerably higher than the budget category allowance allows, or vice versa in a low-cost of living region.

To add in another layer of difficulty, if you made $40K in a metro area, that same skill might only pay $30K in a more rural area, which can be frustrating.

According to the Bureau of Labor Statistics for May 2020, the average annual wage for a US worker across all occupations is $56,310. So a $40K a year job is less than the average. HOWEVER, where you live plays a significant impact in if it’s considered a good wage.

For example, the BLS states that in NYC, the average yearly salary is $71,050. While in Idaho, the average salary is $46,800. But remember, for these BLS averages, a few people skew the numbers.

A better number is the median wage; that’s the halfway point of the number of people. The BLS site shares info on the national median hourly wage being $20.07. Remember, with a 40 hr work week, that makes your $40k salary $19.23 an hour, so just under the median wage.

Another factor is your household annual income (as a whole), not just your income. So The US Census says that in 2019 (the most recent data), the median household income is $62,843. So if you make $40,000 and your spouse makes $40,000, then at $80,000 total, you are doing good.

Is $40,000 a year salary good if you’re single?

If you’re single, then your $40K salary is considered below average. You are well above the federal poverty level, but you may have a hard time paying a mortgage on your own. You’ll probably have to rent an apartment or share a house payment with another.

Is $40k a good salary for a family?

A $40,000 salary may not be enough for a family, depending on the size of the family and where they live. This salary could cover most of your essential expenses in a low-cost living area.

But in a high cost of living area, this salary won’t be enough to cover everything. You’ll either need to earn extra income or have another person in the household get a job to help support the family.

Let’s go ahead and take a look at a few other typical salaries and see how they’d support your family’s needs.

- $30,000 a year is how much an hour

- $40,000 a year is how much an hour (you’re here)

- $50,000 a year is how much an hour

- $60,000 a year is how much an hour

- $70,000 a year is how much an hour

- $80,000 a year is how much an hour

- $90,000 a year is how much an hour

Jobs that make $40,000 a year

There are many jobs that make $40,000 a year; let’s look at Indeed’s list…

- Admissions coordinator $40,857

- Equipment operator – $40,860

- Kindergarten teacher – $40,865

- Carpenter – $41,440

- Reporter – $42,255

- Machinist – $42,940

- Mental health counselor – $44,360

- Junior copywriter – $44,532

What is a salaried job?

Salaried employees are usually called “exempt” employees. Being salaried means getting paid the same flat amount every payday, usually once a month. No matter how many hours you do or don’t work, the pay is the same unless you take unpaid time off. people say, “I get paid $40K a year.”

Pros of being salaried

- You can better budget because you know exactly how much you’ll get each paycheck

- You don’t have to punch in/out of a timeclock

- These positions usually come with a better benefits package (i.e., higher retirement contributions, etc.)

- Higher perceived status/position in the company

- Get paid time off (paid vacation, sick leave, etc.)

- You can work fewer hours and still get paid the same.

Cons of being salaried

- No overtime pay, so if you work more hours, it’s not reflected in the pay

- You might be expected to take work home with you.

- Higher responsibility and more duties to perform

Note: According to the US Dept of Labor, “Effective January 1, 2020, employees must earn at least $684 per week ($35,568/year), receive a salary, and perform particular duties (as defined by the FLSA) to be considered exempt from overtime requirements under federal guidelines.”

$45,000 a year is how much an hour?

- $3,750 a month

- $1,731 bi-weekly

- $865 a week

- $173 a day

- $21.62 an hour (for 8 hr workday)

All figures are gross (before taxes).

$40k a year annual salary FAQ’s

$40k a year is how much an hour?

It’s $19.23 an hour before taxes, and then $13.63 after deductions.

$40k a year is how much a month?

It’s $3,333 a month before any deductions and $2,343 after deductions of taxes and insurance.

$40k a year is how much a week?

It’s $769 before any payroll deductions and $545 approximately after deductions.

How should I budget for 40k a year?

This all depends on your goals and your behaviors. In the sections above, I went through Dave Ramsey’s budget suggestions and the 50/30/20 budget method.

If you like a detailed plan, then try Dave Ramsey’s method. If you like more flexibility and freedom, then try the 50/30/20 method.

At the end of the day

It can be tough to decide whether or not to take a job that pays less than you want. But if you break it down, $40,000 an hour is still a pretty good wage. And, if you can find ways to reduce your living costs, you may be able to live quite comfortably on that salary.

Going from hourly pay to salary is a switch, so breaking salaries down in a familiar way (i.e., hourly) can help you decide if it’s “worth it.” So I hope we answered your question, “how much is 40000 a year per hour?”

So don’t be afraid to go after a $40k job – just make sure you do the math and see if it’s still feasible once all of your expenses are taken into account.