$50 an Hour is How Much a Year? Does This Make Me Rich? (What You Need to Know)

Are you wondering about a new job’s wage – I mean 50 dollars a year is how much an hour? Let’s dig into the numbers!

Author: Kari Lorz – Certified Financial Education Instructor

Are you wondering if a salary of $50 an hour is enough to live on? I mean, $50 an hour is how much a year? How much do taxes take?

We did the research for you! This article breaks down all the numbers on what $50 an hour looks like on an actual paycheck. You’ll see how much your take-home pay would be and how much your budget would cover with that wage.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- Are you wondering about a new job's wage – I mean 50 dollars a year is how much an hour? Let's dig into the numbers!

- 50 an hour is how much a year? (short answer)

- 50 dollars an hour is how much a year? (long answer)

- Before tax & after tax pay

- $50 an hour is how much a year

- $50 an hour is how much a year with part-time work

- Is this annual income level really hourly?

- Workplace perks & bonuses

- Jobs that pay $50 an hour

- Can I live off $50 per hour?

- Tips to live on $50 an hour

- $50 an hour budget examples

- Ways to increase your pay

- 51, 52, 53… 59 an hour is how much a year?

- Other wage rates

- At the end of the day

50 an hour is how much a year? (short answer)

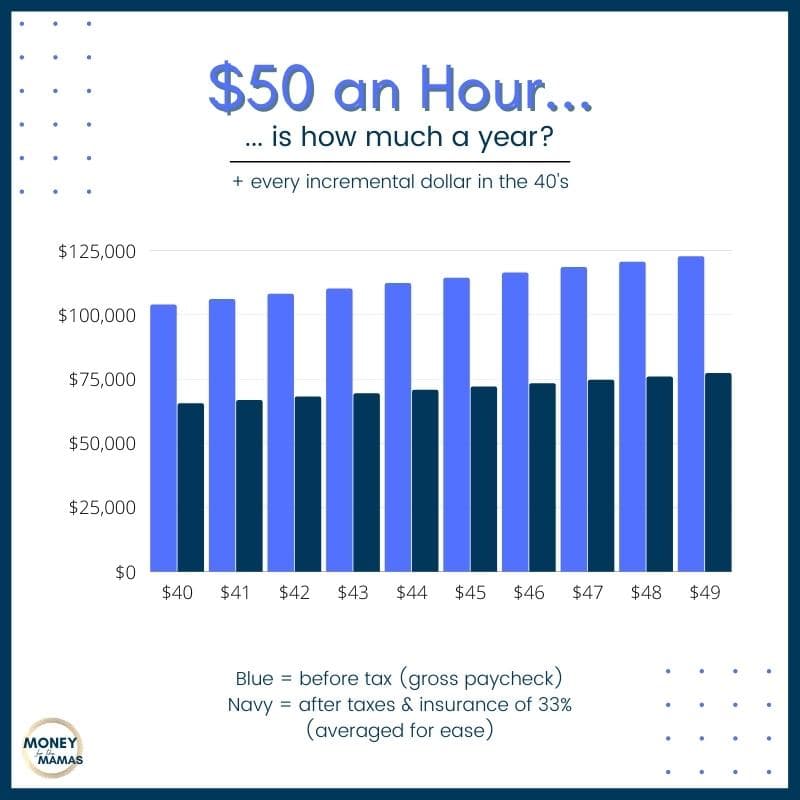

50 dollars an hour is $104,000 (gross).

This is based on working 40 working hours per week, 52 weeks per year.

$50 x 40 hrs week x 52 weeks a year = $104,000

50 dollars an hour is how much a year? (long answer)

Let’s go through all the calculations for $50 an hour pay (let’s assume an 8-hour workday, at 40 hours a week).

$40 an hour is how much a day?

$50/hour = $400 for an 8-hour workday

$50 an hour is how much a week?

$400 x 5 days a week = $2,000 a week

$50 an hour is how much bi-weekly?

When you get paid twice a month, that is known as bi-weekly pay. It’s one of the most popular methods for businesses to pay hourly workers (salaried employees are generally given one paycheck a month).

$2,000 x 2 weeks = $4,000 every 2 weeks

How much is 50 dollars an hour per month?

There are 52 weeks a year, which don’t come out even when you divide by 12 months. It comes to 4.33 weeks in a month. But you usually get paid two times a month. Yet, there are two months a year in which you get paid three times (aka a bonus check sort of).

- 2 pay periods a month: $8,000 (gross)

- 3 pay periods a month: $12,000 (gross)

- The average of 4.33 weeks a month: $8,667 (gross)

Before tax & after tax pay

Just because you make $50 an hour, that doesn’t mean you get to keep it all.

You’ll need to hand over money for taxes and other deductions from your paychecks. The typical employee in the United States spends about a third of their salary on taxes, insurance, and retirement contributions. We’ll focus only on tax and insurance coverage to keep things simple.

Here are some other helpful terms…

- Before-tax = gross income. This is the full $40 an hour x # working hours in your pay period.

- After-tax = net pay (this is the amount you take home). This also accounts for other paycheck deductions like insurance and retirement contributions.

- Hourly rate = your hourly wage (i.e., $40 an hour)

- Exempt employees – these are people who are paid a salary. They get paid the same no matter how many hours they work, aka salaried employee. (i.e. $– a month)

- Non-exempt employees – these are people who are paid an hourly salary. They get paid for every hour they work and may receive overtime pay if they have more than 40 working hours in a week. This post focuses on this employee classification, as you’re per hour.

$50 an hour is how much a year

$50 an hour is how much a year before taxes

- $50 x 40 hrs week x 52 weeks = $104,000 annual salary (gross)

$50 an hour is how much a year after taxes

You pay the same amount of federal taxes (depending on your tax bracket), and then you pay state taxes (which is also a different amount depending on your tax bracket).

However, nine states don’t tax income – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

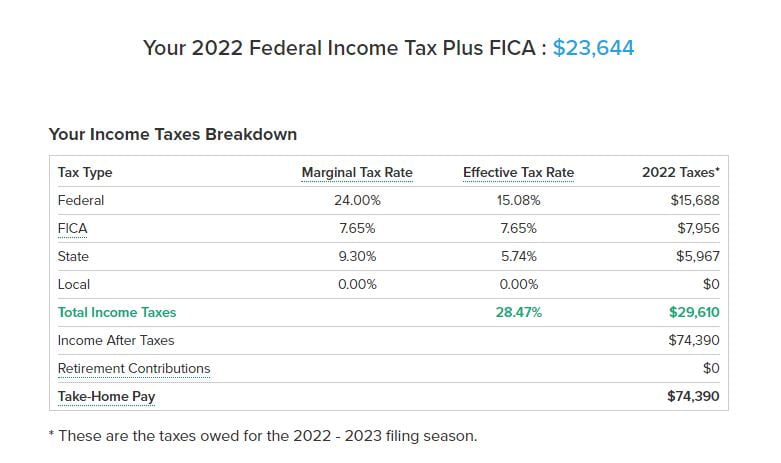

For example, let’s use this calculator to determine our federal & state taxes if we lived in California and filed as a single…

This shows that you’ll pay…

- Federal tax: $15,688

- FICA tax: $7,956

- State tax: $5,967

- Total income taxes: $29,610

- = after tax pay of $74390

Current tax rate for $50 an hour wage rate

If you make $50 an hour and are single with no children, your current tax rate is 24% for federal taxes (single filer – $86,376 to $164,925 income – 24% tax rate). While Your effective federal income tax rate is 15.35%.

$50 an hour is how much a year after insurance

We’re still in the process of making payroll deductions, which means we’ll need to pay for medical insurance that our employer covers.

According to the US Bureau of Labor, “Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020.”

These are things like…

- Health Care/Limited-Expense Health Care Flexible Spending Accounts

- Dental

- Vision

- Health Savings Account

- Optional Life Insurance Premiums

- Long-Term Care Insurance Programs

- Dependent-Care Flexible Spending Accounts

- Thrift Savings Plan (TSP)

So if we take your gross pay of $104,000 x 8.2% for healthcare = $8,528 a year for healthcare, this means you’ll actually take home…

- $73,859 after tax pay – $8,528 = $65,331 (this is your net income)

- $65,331 / 12 months = $5,444 on average monthly pay

This means you lost 37.2% of your paycheck to deductions, and remember this doesn’t include any retirement contributions, which is 5-10% (an average) for those who contribute.

$50 an hour is how much a year with part-time work

$50 per hour working 20 hours a week

If you worked only 20 hours a week, that would be $– a week (gross income). You’d still need to pay taxes. However, your medical deductions would be minimal (if any) as part-time workers usually don’t get these benefits.

$50 a week x 20 hrs weeks x 52 weeks = $52,000 annual salary

$50 per hour working 30 hours a week

You would take home $– a week, and you would need to pay federal and state taxes. You may (or may not) qualify for medical benefits, which would be another expense to factor out of your paycheck.

$50 a week x 30 hrs a week x 52 weeks = $78,000 yearly salary

| $50 an hour per… | Before Tax | After Deductions |

|---|---|---|

| Year | $104,000 | $65,520 |

| Month | $8,667 | $5,460 |

| Bi-week | $4,000 | $2,520 |

| Week | $2,000 | $1,260 |

| Day | $400 | $252 |

| Part-time 20 hrs a week | $52,000 (annual) | $36,920 |

| Part-time 30 hrs a week | $78,000 (annual) | $55,380 |

- *For part-time figures, we assume a 29% tax bracket for state & federal taxes (in California) and no medical deductions (as part-time workers may not qualify for medical benefits).

- All other after-tax figures assume a generalized 37% combined federal & state deduction, insurance, and small misc deductions.

Is this annual income level really hourly?

It’s commonly known that lower-skilled jobs pay less, usually at an hourly rate. In contrast, higher-skilled jobs pay more, usually at an annual salary. So, if you’re working $50 an hour, which seems pretty good, is that really a likely hourly job?

Is it realistic to find this amount of an annual income at an hourly pay structure?

Good question. It depends on the type of work being performed. Jobs that require a lot of manual labor (i.e., electrician, carpenter) who work for a large company can commonly be hourly at a high hourly rate. If they work on their own, it’s common for them to be paid by the job (i.e., It will cost $600 to fix your broken HVAC system).

While more white color jobs (i.e., office settings) usually turn to salaried positions by the time you get to annual income in the $50k range, sometimes even before. And managerial jobs (you manage employees under you) turn salaried even earlier.

Generally speaking, at this annual income amount ($104,000), you would most likely see a person be a non-exempt employee (aka salaried employee).

If you’re changing jobs, then you need to make sure that you take all your money with you! According to Capitalize, “As of May 2021, we estimate that there are 24.3 million forgotten 401(k)s holding approximately $1.35 trillion in assets, with another 2.8 million left behind.

That’s a lot of money for employees to just “forget about.” Don’t be a worker who left money on the table when they switched jobs! Beagle can help you find your old 401k accounts and help you roll them over into an account that you can easily manage.

While the full process takes a few days (they need 2-3 days to research everything), the initial sign-up process takes less than 15 minutes. You tell them your info, give them an idea of what companies you worked for, and they go find your old accounts.

We went through the process, and it was super easy; you can read our full review on Beagle retirement savings finder here! Or you can check out Beagle by clicking the green button below.

Workplace perks & bonuses

The amount of money you earn isn’t the only factor to consider when determining whether or not your work is a good fit for you. Other advantages, such as paid time off (PTO), medical insurance, discounts, and so on, should be considered.

Paid time off

Many organizations offer paid time off (PTO) as part of their employee benefits package. The typical employee receives ten days of paid vacation and six sick days. This time period may be used for any purpose – doctor’s appointments, mental health days, or actual holidays.

This benefit usually kicks in after you have worked a certain number of days on the job. For example, after 90 days, you will start earning PTO, which is a percentage of how many hours you work. So if your employer allows it, you may take 1.5 days off each month (or whatever rate your benefits package outlines).

Time off without pay

All of our income amounts are listed for the total amount, as if you worked 8 hours a day, five days a week, 52 weeks a year.

Yet, if your company doesn’t provide paid time off, you will most likely take home less; due to sickness, unavoidable schedule conflicts, and vacation.

Even though you’d want to be paid for your time, unpaid time off is still a nice bonus. This implies that you can ask for days off and keep your job. Some corporations have strict attendance rules, and missed days might result in disciplinary action (i.e., write-ups), leading to employment termination.

Let’s say that over the course of a year, you took two weeks of unpaid time off. That’s…

- ($50 an hour x 8 hours) x 14 days = $5,600 less in annual income

Overtime pay

According to the Fair Labor Standards Act (FLSA), “Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.”

Time and a half is your hourly pay x 1.5. So if you made $50 an hour and worked 8 hours of overtime that week (maybe you came into work because someone was sick), it would look like…

- $50 x 1.5 = $75 x 8 hours = $600 for the day

Holiday pay

Some businesses are closed on government holidays, but others remain open, and employees get holiday pay. This is where you’ll make more money (if you’re on the clock).

Depending on your workplace’s benefits package, it can be time and a half or double pay.

Double pay is just like it sounds, so…

- $50 x 2 = $100 x 8 hours = $800 for the day

There are eleven annual US federal holidays on the calendar designated by the United States Congress.

Most holidays fall on a specific date, but some fall on a certain day of the week (i.e., the first Monday of the month). For 2022, these are the federal holidays…

- New Year’s Day – January 1st, 2022

- Birthday of Martin Luther King, Jr. – January 17th, 2022

- Washington’s Birthday – February 21st, 2022

- Memorial Day – May 30th, 2022

- Juneteenth Independence Day – June 20th, 2022

- Independence Day – July 4th, 2022

- Labor Day – September 5th, 2022

- Columbus Day – October 10th, 2022

- Veterans Day – November 11th, 2022

- Thanksgiving Day – November 24th, 2022

- Christmas Day – December 26th, 2022

Employee discounts & misc benefits

Many businesses provide their workers with discounts on goods and services. This is generally a percentage off, such as 10% or 20%. It can be useful if you’re purchasing an expensive item (such as a new lawn mower) or using the company’s services regularly (such as getting your automobile serviced).

While this benefit isn’t directly seen on your paycheck, it can make a big difference to your monthly expenses.

There may be other incentives that impact the attractiveness of a position, in addition to a basic discount of 10%.

For example, I worked in the grocery industry for six years. Staff members got to take home food that had exceeded its expiration date (or sell-by date) for free. This was a huge benefit as people saved a lot on their grocery bills by eating a salad that didn’t sell the day before, a can of beans that was dented, or a box of cereal that had a squished corner, etc.

Other benefits may include…

- Discounted public transportation passes

- Discounted parking passes

- Discounts at local gyms or health programs

- Unpaid vacation opportunities (i.e., sabbatical)

Jobs that pay $50 an hour

According to Indeed and CareerBuilder, some of the top jobs pay at least $40 an hour…

- Clinical psychologist – $50.45

- Loan officer – $50.55

- Adjunct professor – $51.16

- Medical & health services manager – $52.84

- Project Manager – $53.49

- Physicist – $55.35

Can I live off $50 per hour?

Yes, you can live off of $50 an hour. With $104,000 a year, that’s well above the average wage for the US. According to the US Social Security Administration (SSA), “The national average wage index for 2020 is $55,628.60.”

So at $50 an hour of full-time work, you make almost double the average person in the US.

That means you still need to be mindful of where you live (cost of living), either the city or your specific neighborhood, as your housing is where you’ll spend most of your paycheck.

With this paycheck, you should be able to afford many of the nicer things in life, such as vacation, a nice car, meals dining out often, etc. However, many of the jobs above require an advanced degree (i.e., Clinical Psychologist). So it’s likely that you will have student loan debt.

For example, according to the American Psychological Association, ” Seventy-eight percent of graduate students in clinical, counseling, school and combined psychology programs have grad school loan debt, with a median debt of $80,000.”

The APA continues, “Financial aid calculators, such as the one at FinAid, recommend allocating 10 percent of income to debt repayment. That means that students with a $750-a-month loan payment, for example, need to earn $90,000 a year to handle their repayment comfortably.”

Tips to live on $50 an hour

1. Hack your biggest expenses

Housing, food, and transportation are typically a person’s biggest expenses. If you can find ways to save in these areas, it will make a big difference.

For housing, consider a starter home. This is a home that you’ll live in for less than five years; it’s adequate, and it may not be as fancy as you want, but it works for now. People’s starter homes are usually smaller, may not be in the best neighborhood, and they may not furnish it as they want. That’s okay; it’s not forever; it’s just to get you out of the renting market and start building equity through some ownership.

2. Stick to a budget

With $50 an hour, it may seem like money isn’t an issue, but your spending can get out of hand easily if you’re not paying attention.

It’s simpler to match your budget to your lifestyle when you know how much money comes in and goes out. Track your spending for a month to understand where your money goes, then create a budget that works for you.

When you budget, you make sure that you aren’t spending too much and racking up debt, which can be very hard to pay off.

We’ll go through a few popular monthly budget methods below.

3. Pay off debt quickly

If you have debt, it’s important to pay off consumer debt as quickly as possible. The interest adds up fast and eats away at your paycheck, essentially losing money.

There are a couple of different ways to do this. You should look at how these two debt repayment methods compare and pick the best option for you. Let’s do a quick peek at the two options…

Option 1: You make the minimum payments on all of your debts and put any extra money towards the debt with the highest interest (known as the debt avalanche method).

Option 2: You make the minimum payments on all of your debts and put any extra money towards the debt with the lowest balance (known as the debt snowball method).

4. Have an emergency fund

An emergency fund is a savings account that you only use for unexpected expenses, like a job loss, car repair, or medical bills. This helps ensure that you don’t have to put these expenses on a credit card and rack up debt.

Ideally, you should have 3-6 months of living expenses saved in your emergency fund

5. Save in advance

With making $50 an hour, you should have the flexibility to save for large ticket items in advance. (Remember, it’s better to pay off your high-interest debt first and then save for luxury items.)

Using sinking funds has been one of the most beneficial things for my family’s finances. Basically, you look ahead at what you want to spend money on, and then you start saving for it, little by little.

For example, if you want to take a beach vacation in four months, and you did a rough budget, it will cost $650 total. So…

- $650/4 months = $163 a month to save for it

6. Learn how to maximize your tax deductions

When you get to this level of annual income, you most likely are hiring a tax professional to do your taxes (vs. you yourself doing them). Tax professionals usually can figure out ways to get you more deductions & credits to lower your taxable income. So you’ll take home a lot more than the calculations figured in this post.

“ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.”

“The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.”

Now, I’m not saying you could end up paying only 3.4% in taxes; I am saying there are ways to legally lower your tax burden. For example, Go Banking Rates lists these things to look at…

- Claim Depreciation

- Deduct Business Expenses

- Hire Your Kids

- Roll Forward Business Losses

- Earn Income From Investments, Not Your Job

- Sell Real Estate You Inherit

- Buy Whole Life Insurance

- Buy a Yacht or Second Home

$50 an hour budget examples

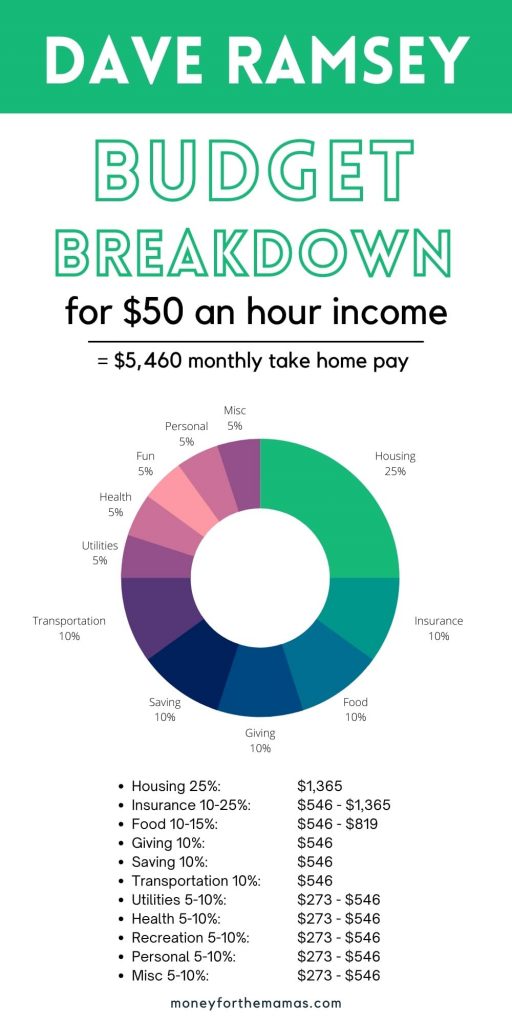

Okay, now that you know how much you’ll get paid, what does that look like for your home? Again, let’s assume a safe 37% deduction for everything from your $8,667 monthly gross income. So $5,460 take-home pay.

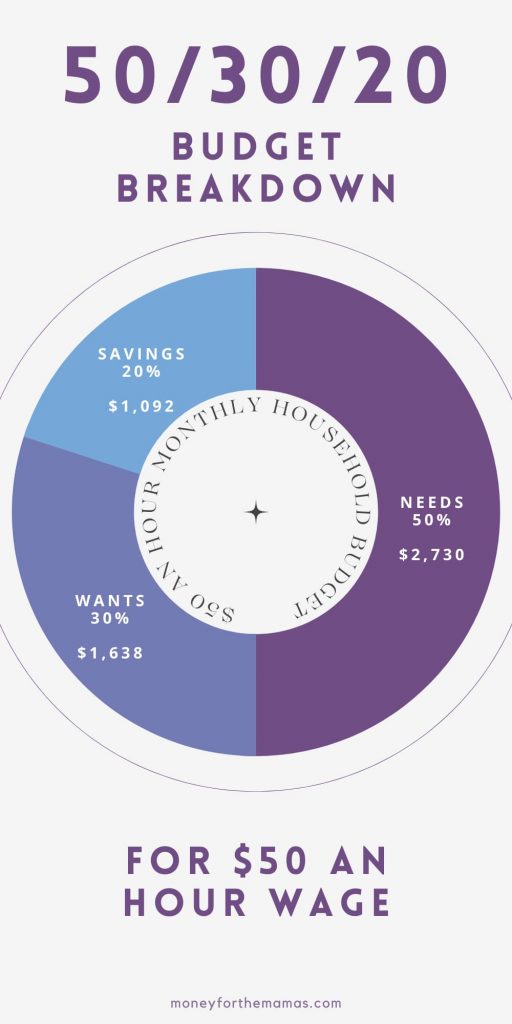

50/30/20 Budget

People who value spontaneity and want the freedom to go with the flow will profit from this method of budgeting. Don’t get me wrong, they want to budget, but they also desire alternatives and choices. So your monthly household budget might appear like this…

- 50% Needs: $2,730 for housing and utilities

- 30% Wants: $1,638 for wants

- 20% Savings: $1,092 for saving (or you can use 1/2 of this for debt repayment)

Dave Ramsey recommended budget percentages

I am a fan of Dave’s budget percentages, but I realize it is very detailed and maybe too strict for some. But for others, that’s the best part; they want to know exactly what to do to make the most of their income.

I’ve read through quite a few of Dave’s books, and there are many examples of people who earned a very high income but were barely scraping by due to their lifestyle and the spending associated with keeping up their norms. So please don’t think that Dave’s methods are only for low-income earners (in fact, quite the opposite is true).

Let’s just see what your money situation comes to using his recommended budget percentages.

- Housing 25%

- Insurance 10 – 25%

- Food 10-15%

- Giving 10%

- Saving 10%

- Transportation 10%

- Utilities 5-10%

- Health 5-10%

- Recreation 5-10%

- Personal Spending 5-10%

- Misc 5-10%

| Budget Category | Recommended % | Amount |

|---|---|---|

| Housing | 25% | $1,365 |

| Insurance | 10 – 25% | $546 – $1,365 |

| Food | 10 – 15% | $546 – $819 |

| Giving | 10% | $546 |

| Saving | 10% | $546 |

| Transportation | 10% | $546 |

| Utilities | 5 – 10% | $273 – $546 |

| Health | 5 – 10% | $273 – $546 |

| Recreations | 5 – 10% | $273 – $546 |

| Personal | 5 – 10% | $273 – $546 |

| Misc | 5 – 10% | $273 – $546 |

Jean Chatzky’s budgeting recommendations

If the 50/30/20 feels too broad, and Ramsey’s budgeting percentages seem way too tight & controlled, then you’ll be happy to know that finance expert Jean Chatzy covered the middle ground with her recommendations (my personal budget uses her percentages). Here’s how it looks…

- 35% Housing – rent or mortgage, plus the cost of insurance, taxes, utilities, and maintenance.

- 15% Transportation – your car payment falls here (if you have one), but taxis, parking, and insurance count here.

- 15% Other Debt Repayment – credit card payments, student loan payments, and any other debts you owe.

- 10% Long-term saving – putting money away as an emergency cushion, as well as the retirement account you should be contributing to (whether it’s at work or on your own).

- 25% Everything else – this is your life. Food, entertainment, clothes, cosmetics, travel, and anything that doesn’t fit into the other categories.

| Category | Budget Percentage | Amount |

|---|---|---|

| Housing | 35% | $1,911 |

| Transportation | 15% | $819 |

| Debt Payments | 15% | $819 |

| Saving | 10% | $546 |

| Living | 25% | $1,365 |

These recommendations feel doable; they feel like you’re being responsible but not too straight-laced. That’s why I follow them.

If you find that you have no debt (congrats!), you should consider moving 5% to living expenses or long-term savings. Then use the remaining 10% to plan for large expenses that you need to save up for. Things such as a vacation, a new car, a new home, etc.

Ways to increase your pay

1. Ask for a raise

It never hurts to inquire about a raise if you believe you’re underpaid. Especially if you’ve been with the company for a while and have done excellent work, your boss may be willing to grant you a raise, as long as you ask for one.

Make sure that you’re ready to talk about how you positively contribute to the company, especially how you impact revenue. You are much more likely to get a raise when you can articulate your value and what you bring to the bottom line.

2. Get a promotion

If you’re looking for a way to make more money, consider applying for a promotion. This can be a great way to earn a raise and advance your career.

Be talking to your manager now about what skills you need to advance in the company. There are hard income skills (technical skills) and soft income skills (interpersonal skills). Both impact how you are viewed as an employee.

If you want a jump start, check out these high-income skills that can help you bring home a big paycheck.

3. Work overtime hours or take extra shifts

If you’re looking for a way to make some extra money, consider working overtime or taking on extra shifts. This can be a great way to earn a little bit of extra household income without committing to a second job.

Make certain that your peers know to ask you first if they want to dump some shifts or need more hands for a particular job.

4. Ask for extra responsibilities or duties

If you’re looking for a way to make some extra money, consider asking for additional responsibilities or duties at work (this isn’t a promotion per se but smaller add-on stuff).

This could include taking on a leadership role, training new employees, being on company committees, or taking on a larger workload.

This will allow you to earn more money, but it will also help you stand out and advance when the opportunity arises.

5. Find a new company that pays higher

If you’re not happy with your current yearly salary, changing companies may be the best option. Check out job postings and see the average salary for your position. If you’re not earning at least that much, it may be time to start looking for a new workplace.

With these higher-paying jobs, you’ll often find that the most effective way to raise your income in a short amount of time is to job hop. You want to strategically jump from company to company, each time increasing your pay by at least 12% or more.

You need to be careful though, as you don’t want to do this too fast. You want to give each company at least two years. If you do it too fast, you’ll look like a bad hiring option, as you’ll just leave anyway and not bring long-term value to the company.

6. Find alternative ways to make money

There are many ways to make money outside of your 9-5 job. At the $50 an hour mark, you most likely have a very specific skill set. Can you take on freelance clients on your own time? Some workplaces don’t care, while some frown on this; you just have to do some quiet digging into your company’s HR policies.

Or maybe, you want to do something completely different? Many people who work in a high-pressure setting want to do the exact opposite when off the clock. I.e., Doing woodworking or rehabbing old furniture. Something that uses the other side of the brain can be calming and therapeutic.

51, 52, 53… 59 an hour is how much a year?

Assume that you work 40 hours each week and that 37% of your income goes to taxes and medical coverage (this is your after-tax income amount). This is a safe, good-sized general number.

We won’t take any retirement contributions into account, but if you want to include them, move the deductions to 10 percent.

Remember – these numbers are only approximations, not precise figures. It all depends on the year and the number of workdays in a month, your personal paycheck deductions, etc. These amounts are intended to offer you a decent general idea of what you may anticipate in your compensation.

$51 an hour is how much a year?

- before taxes: $106,080 annual income

- after taxes: $66,830

How much is it…

- a month – before taxes: $8,840

- a month – after taxes: $5,569

- bi-weekly – before taxes: $4,080

- bi-weekly – after taxes: $2,570

- a week – before taxes: $2,040

- a week – after taxes: $1,285

- a day – before taxes: $408

- a day after taxes: $257

$52 an hour is how much a year?

- before taxes: $108,160 annual pay

- after taxes: $68,140

How much is it…

- a month – before taxes: $9,013

- a month – after taxes: $5,678

- bi-weekly – before taxes: $4,160

- bi-weekly – after taxes: $2,621

- a week – before taxes: $2,080

- a week – after taxes: $1,310

- a day – before taxes: $416

- a day after taxes: $262

$53 an hour is how much a year?

- before taxes: $110,240

- after taxes: $69,451

How much is it…

- a month – before taxes: $9,187

- a month – after taxes: $5,788

- bi-weekly – before taxes: $4,240

- bi-weekly – after taxes: $2,671

- a week – before taxes: $2,120

- a week – after taxes: $1,336

- a day – before taxes: $424

- a day after taxes: $267

$54 an hour is how much a year?

- before taxes: $112,320 yearly income

- after taxes: $70,762

How much is it…

- a month – before taxes: $9,360

- a month – after taxes: $5,897

- bi-weekly – before taxes: $4,320

- bi-weekly – after taxes: $2,722

- a week – before taxes: $2,160

- a week – after taxes: $1,361

- a day – before taxes: $432

- a day after taxes: $272

$55 an hour is how much a year?

- before taxes: $114,400 annual income

- after taxes: $72,072

How much is it…

- a month – before taxes: $9,533

- a month – after taxes: $6,006

- bi-weekly – before taxes: $4,400

- bi-weekly – after taxes: $2,772

- a week – before taxes: $2,200

- a week – after taxes: $1,386

- a day – before taxes: $440

- a day after taxes: $277

Don’t forget that when looking at these figures, we’re going off the assumption that you work 8 hours a day, five days a week. Yet, many people stay late at the office or take their work home with them. So your “hourly rate” figuratively will be skewed. For example…

- $55 an hour x 8 hr day = $440

- $55 an hour x (8 hr day + 2 hrs of paperwork at home = 10hrs) = $440 still, but your hourly income rate just dropped to $44 an hour from $55.

$56 an hour is how much a year?

- before taxes: $116,480 annual pay

- after taxes: $73,382

How much is it…

- a month – before taxes: $9,707

- a month – after taxes: $6,115

- bi-weekly – before taxes: $4,480

- bi-weekly – after taxes: $2,822

- a week – before taxes: $2,240

- a week – after taxes: $1,411

- a day – before taxes: $448

- a day after taxes: $282

$57 an hour is how much a year?

- before taxes: $118,560 yearly income

- after taxes: $74,693

How much is it…

- a month – before taxes: $9,880

- a month – after taxes: $6,224

- bi-weekly – before taxes: $4,560

- bi-weekly – after taxes: $2,873

- a week – before taxes: $2,280

- a week – after taxes: $1,436

- a day – before taxes: $456

- a day after taxes: $287

$58 an hour is how much a year?

- before taxes: $120,640

- after taxes: $76,003

How much is it…

- a month – before taxes: $10,053

- a month – after taxes: $6,334

- bi-weekly – before taxes: $4,640

- bi-weekly – after taxes: $2,923

- a week – before taxes: $2,320

- a week – after taxes: $1,462

- a day – before taxes: $464

- a day after taxes: $292

What would retirement contributions do to my pay?

If at $58 an hour rate, which is $120,640 annual income, let’s assume you contribute 10% to a traditional 401(k) workplace retirement plan.

Remember, this is pre-tax money, so you can’t just take 10% off the bottom, it comes out first, and then you are taxed on the rest.

- $104,000 x 10% = $10,400 into retirement

- $104,000 – $10,400 = $93,600 that’s now your taxable income

- $93,600 x 37% average tax rate = $58,968 take home

- $58,968 / 12 months = $4,914 take home a month

this equals: - Take-home of $5,460 with no retirement contributions

- Take-home of $4,914 with retirement contributions

- = difference of $546 a month in take-home pay

Don’t forget that if you contribute to a retirement plan, most workplaces match part of that money. A standard match amount is 5% by the company. So you put in 10%, and they put in 5% of your pay x a lot of years = a lot of money saved up to retire in comfort!

$59 an hour is how much a year?

- before taxes: $122,720

- after taxes: $77,314

How much is it…

- a month – before taxes: $10,227

- a month – after taxes: $6,443

- bi-weekly – before taxes: $4,720

- bi-weekly – after taxes: $2,974

- a week – before taxes: $2,360

- a week – after taxes: $1,487

- a day – before taxes: $472

- a day after taxes: $297

Other wage rates

- $20 an hour is how much a year

- $30 an hour is how much a year

- $40 an hour is how much a year

- $50 an hour is how much a year (you’re here)

At the end of the day

After looking at all the numbers, it’s clear that a $50 an hour salary is a great wage that affords you many opportunities.

However, it’s important to be mindful of your spending and make sure that your paycheck covers all your needs. With a little bit of planning, you can make the most of your $50 an hour pay and enjoy all that life offers.

Q: $50 an hour is how much a year?

A: $104,000