10 Best Credit Builder Programs to Boost Your Score in 2024

If you want to raise your credit score, using one of these credit builder programs can jump-start your journey.

Author: Kari Lorz – Certified Financial Education Instructor

Building credit can be tough, especially if you have no credit history or have made mistakes in the past. But having a good credit score is essential for loans, getting an apartment, and even job opportunities.

Luckily, credit builder programs can help you (a step-by-step program) on raising your credit score. Our guide makes it easy for you to find the best program, so you can take charge of your finances and easily boost your credit score.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Quick pick for the overall best credit builder program

If you want to get straight to our pick, here is our recommendation. But we’ll go through all the options in the article below.

What are credit builder programs?

Credit builder programs are designed to help individuals build their credit by providing them with a loan (or secured credit card) and utilizing the payments on that loan to improve their credit score.

With today’s technology and new banking apps, these programs are much more accessible to people than before.

Credit builder programs overview

Here’s a quick comparison chart of the programs we’ll look at; we’ll go into each of them further below.

| Program | Type | Cost/fees | Outcome | Reports to |

|---|---|---|---|---|

| Self | loan & optional card | $9 admin fee + cost of loan | 49 | all three |

| Rent Reporters | bill reporting | $10 month or $96 annual | 40 | Equifax & TransUnion |

| Chime | secured card | n/a | ND | all three |

| Grow | bill reporting | free – $9.99 month | 48 | all three |

| Brigit | loan | $9.99 a month + cost of loan | ND | all three |

| Experian Boost | bill reporting | free | 13 | Experian only |

| Credit Sesame | loan & secured card | $9.99 a month | ND | TransUnion |

| Credit Karma | secured card | n/a | 21 | all three |

| Zolve | secured card | n/a | ND | all three |

| Cleo | secured card | $14.99 monthly | ND | all three |

| MoneyLion | loan | $19.99 monthly + cost of loan | 27 | all there |

Notes on chart:

- Outcome column – this is the average credit score increase that they advertise their customers see. ND = not disclosed.

- For secured credit card programs – usually, the only fees they charge are out-of-network ATM fees, which are usually less than $3 per withdrawal.

- Reports to column – this indicates which of the three main credit bureaus they report to.

Best credit builder programs

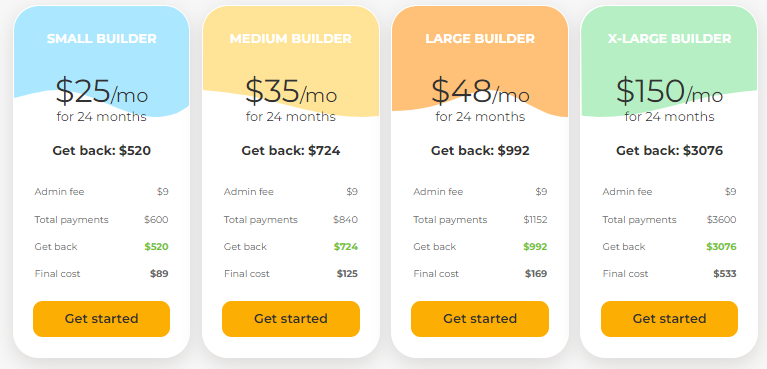

✅ Self Credit Builder account

Self claims, “Customers who make on-time payments can see an average credit score bump of 49 points.” Which is one of the highest score bumps advertised by the credit repair companies we’re looking at today.

Their loans start for as little as a $25 monthly payment and go up to $150, so everyone can find something that works with their monthly budget. You pick one of their predetermined plans and start the process.

Details:

- No credit check

- Offer automatic payments

- Reports to all three bureaus

- Monitor your score for you through TransUnion

- A non-refundable admin fee of $9

Self also offers a secured credit card, Self Visa® Credit Card, as an add-on to their Credit Builder Loan account (eligibility terms apply). You choose a portion of your savings to send to your secured card, then spend as normal up to the limit you set.

This is nice as you don’t have to save additional money on top of your loan, so you can use your own funds while still building credit.

They also have options to add your rent, cell phone, and utility payments to your credit profile (up to two years of past payments) as a part of their monthly plan. This is great as other stand-alone companies mentioned here do this service for their fee. So with Self, you get it all rolled into one monthly membership.

Learn more about Self credit builder loan

Self Inc. Reviews

- The app is rated 4.9 out of 5 stars on the Apple iTunes store, with 230,000 ratings

- The app is rated 4.6 out of 5 stars on the Google Play store, with 73,000 reviews

- 4.7 stars on Shopper Approved, 2,600+ reviews

- 1.7 stars on TrustPilot, 41 reviews (which is odd as this doesn’t line up with the other review platforms)

✅ Rent Reporters

As their name implies, Rent Reporters works with you to get your rent history listed on your credit report. (Did you know your rent isn’t usually a part of your credit history? Nope, it’s not because rent is usually paid via bank withdrawal, not credit card).

Rent Reports says their customers see a 40-point increase in as little as ten days when their rent is added to their credit report.

Rent Reports does charge a fee; you can choose either monthly or for a 20% discount you can choose the annual option.

- Monthly = $10 + $95 one-time fee

- Annually = $8 + $95 one-time fee (comes with front-of-the-line reporting (3-5 days)

Details:

- They report to Equifax and TransUnion

- They can verify up to 24 months of rental history

- Free credit score tracking via TransUnion

- You can add an additional landlord for $50 (good if you’ve moved recently)

- Spouses and roommates can be signed up for $50

- Subleases count with Rent Reporters

Learn more about Rent Reporters

Rent Reporters reviews:

- B rating from The BBB

- 4.8 stars with 900+ ratings on Google (not the app store)

- Trustpilot 3.4 stars with two reviews

Chime Credit Builder Secured Visa® credit card

Chime® is another great multi-faceted financial app offering Checking, Savings, and Credit Builder accounts. Here’s how it works.

You’ll move money from your Chime checking account into your credit builder account; you can then spend up to that limit on your secured credit card. When you have their optional Safer Credit Building Feature turned on, it will automatically pay your Visa bill from your credit builder balance.

Details:

- No credit check to apply

- No annual fees, no interest, and no security deposit required

- Reports to all three bureaus.

- Users saw an average increase of 30 points in their FICO score after eight months.

- You need to set up a Chime Checking Account with a direct deposit of $200 or more to apply for the Credit Builder Visa.

- Does not report credit utilization, so you can spend all the way up to your limit.

Chime reviews:

- Apple iTunes store – 4.8 stars with 580,000+ ratings

- Google Play store – 4.7 stars with 469,000+ ratings

- Trustpilot – 2.9 stars with 8,000+ ratings (73% of ratings gave it 5 stars, while 14% of ratings gave it one star)

Learn more about Chime credit builder program

To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits

Based on a representative study conducted by Experian®, members who made their first purchase with Credit Builder between June 2020 and October 2020 observed an average FICO® Score 8 increase of 30 points after approximately 8 months. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. Results may vary

Out-of-network ATM withdrawal fees apply except at MoneyPass ATMs in a 7-Eleven location or any Allpoint or Visa Plus Alliance ATM.

On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as Credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month.

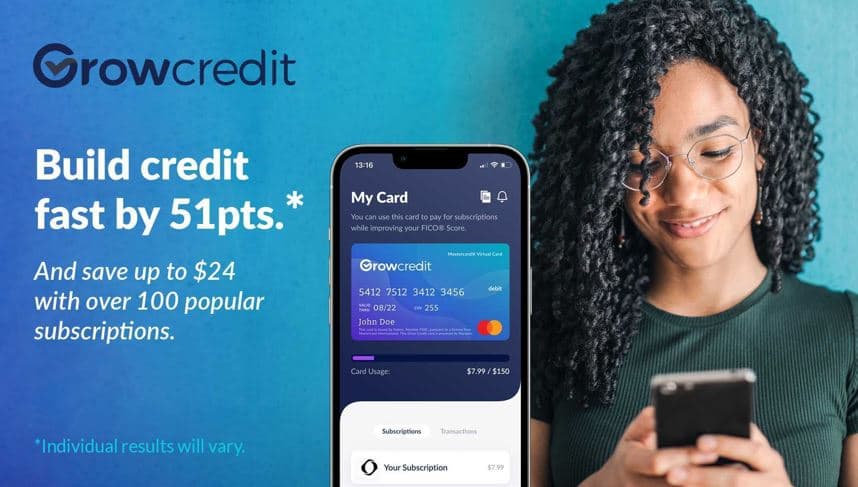

Grow Credit

Grow Credit is fairly new to the industry, yet their service is 100% applicable to today’s spenders. Grow focuses on reporting your payments for subscription services (Netflix, Hulu, iHeart Radio, Ipsy, Discord, and a lot more) to the three credit bureaus.

“Grow Credit users experience a 48-point average credit score increase.” Which is data they collected from over 33,000+ users.

You sign up for a Grow Credit account, an interest-free MasterCard, and connect your bank account to it. Then you log into your subscriptions and change your payment method to your Grow MasterCard.

- 0% interest and completely free with no security deposit required for qualifying customers

- No prior credit history is needed, and no minimum credit score

- No hard credit check; underwriting is determined based on recent banking activity

- Reported to all three credit bureaus

- Free access to your FICO score

They have a few service tiers…

- Build Plan: This is free, and you get $17 per month of subscription services reported.

- Build Secured Plan: This is $2.99 a month, the same reporting amounts as above, but this plan is for those who do not yet meet the criteria for the free Build plan by allowing them to make a small deposit to secure the card.

- Grow Plan: This is $4.99 a month, and you get $50 of subscriptions a month reported.

- Accelerate Plan: This is $9.99 a month, and you get $150 a month reported to the bureaus.

Brigit Credit Builder account

Brigit is another finance app with features to help with budgeting, saving money, and even earning money with side gigs.

Brigit arranges an installment loan for their Credit Builder program for you and deposits it into a brand new deposit account. Here’s how it works.

Each month, the minimum loan payment is split in two: you choose an amount to contribute (between $1 and $50), and the rest is paid from your new deposit account, which holds the loan proceeds. At the end of the 24 months, you’ve built up your credit and get access to all the money you’ve saved.

Details:

- No credit check

- 24-month loan, the funds in a locked deposit account in your name

- Reports to all three bureaus

- $9.99 monthly subscription fee

- No interest and no late fees

If you want to know more about Brigit, and how it compares to other similar apps, you can read more here.

Brigit reviews:

- Apple iTunes store – 4.8 stars with 200,000+ ratings

- Google Play store – 4.6 stars with 108,000 ratings

- Trustpilot – 2.1 stars, but it only had nine reviews (all who wanted to cancel their subscription, but it looks like they didn’t cancel in time and wanted their money back).

Learn more about Brigit credit builder loan

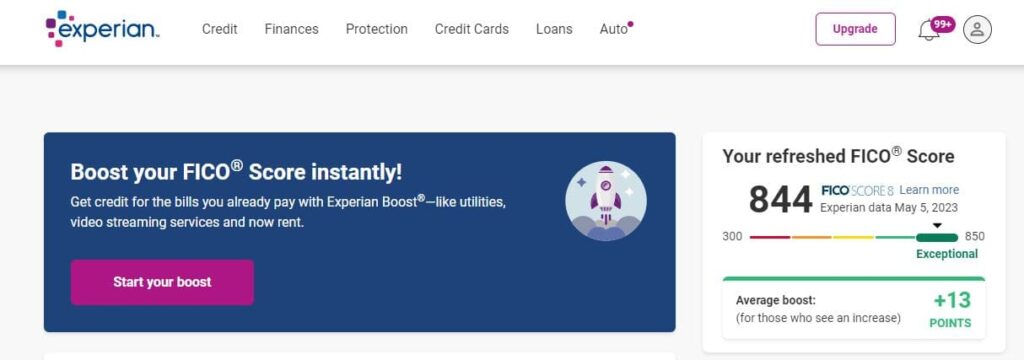

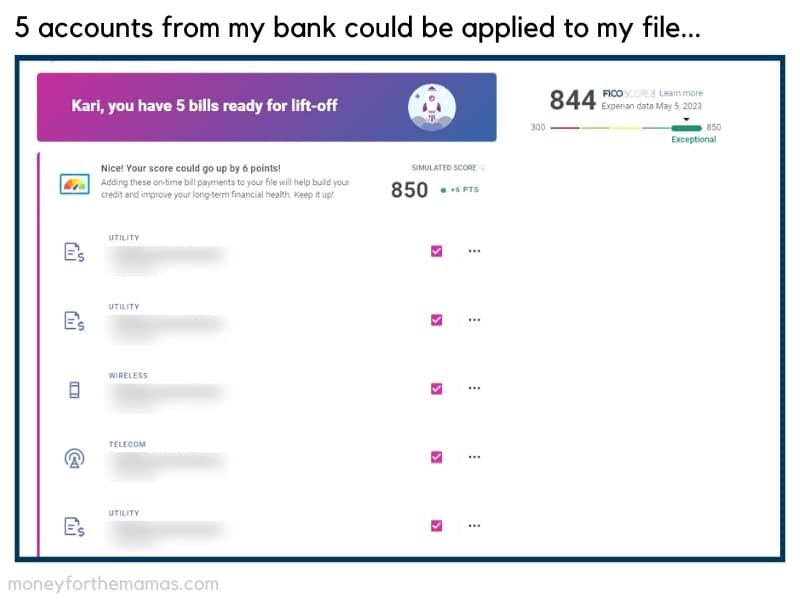

Experian BOOST

Experian is one of the three major credit bureaus (so you can be sure they know their program works). Boost is a program where you can sign up and have the bills you already pay count towards boosting your FICO score, and over 7 million people have signed up for Boost!

Not all bills count, but many common ones do – Verizon, Hulu, HBO, Disney+, AT&T, Spectrum, Netflix, etc. If you pay your rent online, that may also count (it depends on your property management company). Other bills (depending on your provider) may count – trash, gas, electricity, solar, etc.

Users who received a boost from non-rental data improved their FICO score from Experian by an average of 13 points. While that isn’t a ton of change, every little bit counts when talking about your credit score. Besides, it’s a free program, so you can’t really complain.

How it works: Just connect the bank or credit card account you use to pay your bills and/or rent. Experian will look through 2 years of payment history for qualifying bills with at least three payments in the last six months (including one payment within the last three months). Once they find them, all you need to do is verify that the info is correct, and they’ll add them to your Experian credit file.

Details:

- Credit score calculated based on FICO® Score 8 model

- It’s a free program

- Your name must be on the linked accounts for it to work (so if it’s in your roommate’s name, it won’t work).

- Your credit reports must have been active for at least three months with at least one account listed.

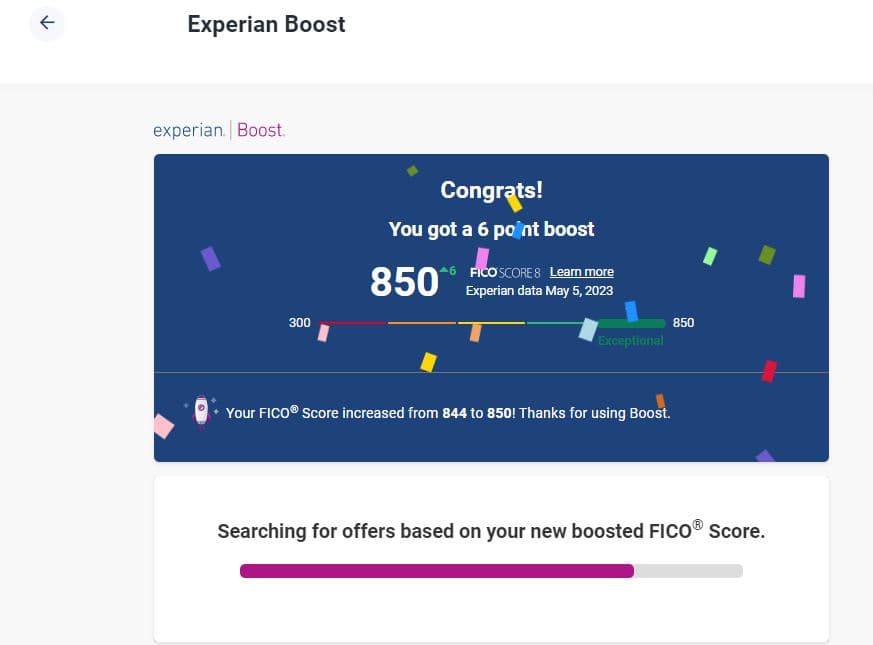

My review of Experian Boost:

Since this was a free program from such a reputable company, I decided to go ahead and try it, and the best part was that it only took 5 minutes to do!

Before I signed up, my score was 844, which is great, but there is not much room to improve, as the highest score you can get is 850.

- Step One: You’ll need to sign up for an Experian account

- Step Two: Choose the Boost option from your dashboard

- Step Three: Choose which bank account you pay your bills from (remember, your name needs to be on the bills for it to count. You’ll sign into your account and grant access to Experian.

- Step Four:

- Step Five: See how many points they raised your score!

It found five of my utility accounts that would work and two potential accounts that didn’t quite meet their recency requirements.

Those accounts added to my credit file raised my score by six points to 850.

Full disclosure – I am very proactive in managing my credit score. I have made most major purchases and financial decisions with my score in mind. I am never risky, and I always practice responsible behaviors (i.e., pay on time, never use too much credit, keep my accounts at a minimum, etc.). Everything the pros tell you to do, I do. I’m annoyingly boring in this way.

So when I signed up for this, I knew my score was good, but I didn’t know it was this good that I didn’t have a lot of room for improvement.

Learn more about Experian Boost

UPDATE: about 10 days after I completed this, my score went back down to 841. I had not opened any new credit nor dramatically changed my balances on my credit accounts. I can’t for sure say what happened, but using Boost was the only credit-related thing that I did. Which seems slightly suspicious.

Experian Boost reviews:

- Apple iTunes store 4.8 stars with 2 million ratings

- Google Play store 4.7 stars with 485,000+ ratings

- Trustpilot 3.8 stars with 59,000+ reviews

Credit Sesame

Credit Sesame has long been known for its credit score monitoring service, but they also offer a credit builder program – Sesame Cash.

With Sesame Cash, you can build your credit with your everyday purchases on a Sesame debit card (unlike other cards, which are credit cards, it works similarly with a secured line where you add money to your account beforehand).

They focus on credit utilization ratio and payment history (they recommend only spending up to 30% off your secured deposit). As you spend during the month, it gets added to your balance, and at the end of the month, they pay with your secured deposit and then report it to the credit bureaus. With this process, you select your utilization ratio, and then they pick and choose purchases that total up to that amount and use that, so you can be sure never to go over the recommended percent.

For example, if you had $150 in purchases and selected 30% as your credit utilization ratio, they’d pick out purchases up to $45 to shift to your secured credit card, and then the rest stays on the debit.

Details:

- No credit check

- No interest or account fees

- Sesame Cash Card also offers cash back from popular chains (i.e., Home Depot, Uber Eats, Sam’s Club, etc.)

- Get access to your paycheck two days early when you set up direct deposit.

- Building credit with Sesame Cash requires you to also open a virtual secured credit card with Community Federal Savings Bank, and they report to the bureaus. The purchases that total up to your predetermined credit utilization ratio are put on this virtual secured card. The rest of your purchases stay on your debit card.

- Free credit score monitoring

- Monthly fee can be waived by meeting certain requirements

Credit Sesame reviews:

- Trustpilot score of 2.8 stars (out of 5) with over 2,000 reviews

- Apple iTunes store – 4.8 stars with 353,000+ ratings

- Google Play store – 4.7 stars with 132,000+ ratings

Learn more about Credit Sesame

Credit Karma Money

Credit Karma has been in the money game since 2008 with free credit score access. But they’ve branched out into other financial services. Their Credit Builder plan claims you can improve your score by 21 points in just two months. (According to Transunion, for those that started with a score of 619 or below).

The Credit Builder plan requires you to open a no-fee line of credit and a no-fee savings account. You choose how much you want to save, which will automatically move from your line of credit to your Credit Builder savings account. Credit Karma reports to all three bureaus.

The good news is that when you save $500, that amount is available for you to use. You can either access the money to cover your expenses or keep the $500 saved for future use. The decision is yours.

Remember, the main thing that can improve your credit score is making on-time payments (use their auto-save feature) for the amount you save. So you can start with as little as $10 saved each month!

Learn more about Credit Karma Money

Details:

- It’s a fee-free program

- You must have a score less than 619 to enroll (they use TransUnion).

- Does not require an upfront deposit (as secured credit cards do)

- You can use your money every time you hit $500

- Not a hard credit pull

- Earn cash back on card purchases

Credit Karma reviews:

- Apple iTunes store – 4.8 stars with 5.9 million + ratings

- Google Play store – 4.5 stars with 2.5 million + reviews

- Trustpilot score of 1.6 stars with 500 ratings

Note: SeedFi (a credit builder program) is now part of Credit Karma.

Zolve

Zolve is a global money platform, and its Azpire Credit Card is a secured credit card program. So you deposit money up front into the account, and then you charge up to the limit you deposited, and then the account pays the card, which establishes good credit.

This program is very friendly to non-US residents looking to establish credit in the US; you just need your passport and work Visa.

Details:

- No credit check

- Reports to the three bureaus

- No interest charges or late fees

- Up to 10% cash back rewards at over 100k locations

- No subscription fees

- Does not report credit utilization, so you can spend all the way up to your limit

The Azpire card sounds great, with no fees and no subscriptions, so it makes me wonder what the catch is. How do they make money on this program? Because they’re not doing it out of the goodness of their heart. However, I can’t find any information talking about the negative aspects of this card or how the company makes a profit from it.

Overall it sounds like a great option, but I’d be cautiously optimistic. Especially considering the lack of reviews on them.

Zolve reviews:

- Apple iTunes store 4.4 stars with 600 ratings

- Google Play store 4.2 stars with 300 ratings

- Trustpilot 4.1 stars with 160+ reviews

Cleo Credit Builder

Cleo is a well-rounded money management app, as they offer help with budgeting, saving money, and building credit with their credit builder card. So it’s not a loan, just a secured credit card. So you add money to your card account, and then spend up to that limit.

If you’re intimidated by loan programs, this might be a good option, as it’s very simple & straightforward.

Details:

- No credit check

- 0% interest on the card (as your money is already there)

- Credit score tracking

- $14.99 monthly subscription fee (also enables you for their cash advance option) (I think this is fairly high).

- Cash back rewards available for card purchases

- Does not report credit utilization for the card (so you can spend up to your limit)

Cleo reviews:

- Apple iTunes store – 4.6 stars with 80,000+ ratings

- Google Play store – 4.1 stars with 41,000+ reviews

- Trustpilot score of 4.4 stars with 3,000+ ratings

Learn more about Cleo credit builder account

MoneyLion Credit Builder Plus program

MoneyLion offers their Credit Builder Plus program for a $19.99 a month fee, plus the monthly loan repayment terms. They say, “More than half our members raise their score by 42+ points within 60 days.*”

Details:

- Apply for a loan up to $1,000, and pay it back over 12 months

- No hard credit check (soft pull only)

- You get access to a portion of your saved funds early on (as part of their cash advance program)

- Credit score weekly tracking

- Reports to all three bureaus

- Bonuses for using their other products (loyalty program)

- You need a checking account open for at least 60 days to apply for the program.

- The APR for a Credit Builder Plus loan ranges from 5.99% to 29.99%.

MoneyLion reviews:

- Trustpilot score of 4.7 stars (out of 5) with over 28,000 reviews

- Apple iTunes store – 4.7 stars with 99,000+ ratings

- Google Play store – 4.5 stars with 85,000+ ratings

Other Credit Builder Programs

Many credit builder programs are available, yet some may not be the best choice. Here are a few that we looked at but don’t recommend.

Perpay

Perpay is a twist on the traditional credit builder program. Their model focuses on you shopping for your everyday purchases through their partner program, which is a Buy Now Pay Later model.

So you shop for things, you submit your order, and if approved, you decide how much you want to pay for it each month. Perpay then pulls the amount you designated for that purchase from your next paycheck.

With this program, you get a spending limit and pay for items over time. So Perpay buys it, and you pay them (which is the installment loan piece that can affect your credit).

While they are a legitimate company, I don’t like the model of promoting regular shopping (as it’s all consumer goods products) to raise your credit. Yes, of course, people need to buy regular things, but it gives a false sense of responsibility while encouraging spending money that they may or may not have.

There are other/better programs out there.

Kovo

While their marketing points (i.e., no fees, no credit check, cash back rewards, etc.) sound great, there is a distinct lack of official details on their site. They don’t have any official legal disclosures that most sites list, nor do they mention their financial partner (as Kovo is just the platform portion of the business).

They also don’t have any reviews on trusted review sites.

While their offer may be good, there are too many red flags to go forward. Besides, why take the chance with so many other options out there?

Overall, we do not recommend Kovo.

Other credit builder programs

While we’d like to be able to talk about every program, there are too many to give everyone a fair look. Other programs include…

- Ava Finance

- Chees

- Boom

- Dovly

- Extra

- Tomo

- Kredit

- Kickoff

- Grow Credit

- Affirm

- Possible

- Credit Strong

- Fundbox

- Brightway

- Atlas

- Cambrio

As we mentioned, we only went through in detail the best credit-building programs; the rest of the ones didn’t offer anything above and beyond the ones we went through, nor did they have the experience or as good of reviews as others.

How does a credit builder loan work?

A credit builder loan program works by providing the borrower with a loan (usually, these loans are under $1,000) and then reporting their payments back to the three major credit bureaus (Experian, TransUnion, and Equifax). The lender will place this amount in a secure account, which you can access when all your payments have been made.

The idea behind these loans is that they provide an easy way for individuals to build up their credit score by making on-time payments, and the lender earns a fee for lending you the money, and there’s little risk to them as they hold the funds.

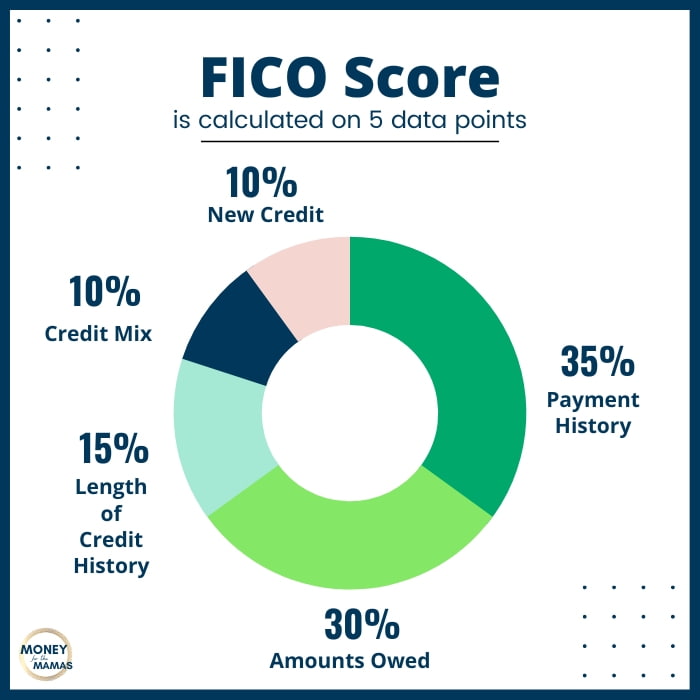

The important thing for you is that your payment history makes up 35% of your FICO score (the largest of the five components). So improving this one component will have the biggest impact on your score.

How does a secured credit card work to build credit?

Some of the credit builder platforms mentioned here also offer a secured credit card as a way to build credit. Here’s how they work…

With a secured credit card, you put down a deposit (usually in the amount of the limit on the card) held as collateral against any money you charge to your account. This allows lenders to provide access to credit for individuals who may not have established positive credit history yet.

Making payments on time each month and keeping your spending low and steady on the card (credit utilization) will also help your credit score.

Yes, it can be beneficial to your credit score if you have multiple lines of accounts (and types of accounts) to help your score. So you could benefit from a loan and a secured credit card. Just remember, these things don’t improve your score on their own. You have to responsibly use the accounts to improve your score. If you misuse your accounts, you could end up lowering your score even more.

How much do credit builder programs cost?

It depends on the program and the lender. You’ll usually pay a small admin fee to open the loan, and then there will be the interest rate that you’ll be charged for the loan. You’ll want to read the fine print when looking at loan options to see what type of loan fees you may be subject to. Always read the fine print; that’s where the fee information usually is.

At the end of the loan, you get the money (minus interest and fees) from your credit builder account. So you’ve saved a large chunk of money and raised your score (if all goes according to plan).

What about a credit repair service?

A credit repair service is when you hire a company that disputes any inaccuracies on your credit report with credit bureaus and other creditors on your behalf. Negatives like…

- Late payments

- Charge-offs

- Collections

- Repossessions

- Inaccurate accounts

- Fraudulent activity

- Foreclosure

- Credit inquiries

They go through your credit report with you, talk about what’s hurting your score, and then they reach out to the companies that are dinging your credit and start the dispute process. Take note that this is a long process. When you challenge items on your report, it can take 30-45 days on average to come to a close (yet some take longer), and some may not be resolved in your favor. Additionally, those fixes could take 1-2 months to appear on your credit report.

While I don’t suggest using a credit repair company (as I think it’s very valuable information you need to know and understand how it all works, which you can learn by doing this yourself – for free). I know that this process can seem very intimidating. If you feel that you’re not up to doing it on your own (yes, you’ll need to learn new things), hiring a credit repair company can be comforting.

Yet, this will cost you, and it’s important to know that depending on what’s on your credit report (legitimate negative reports), they may not be able to help you.

Credit Saint

Credit Saint has over 15 years of experience in the credit repair industry (with over 200,000 people served) and is rated as one of the best credit repair companies to work with by Money.com.

They have 8,000+ reviews on Google with 4.8 stars, and they’re also an A-rated company by the Better Business Bureau, so it feels safe to say that they can get the job done for you when it comes to repairing your credit. Plus, with a 90-day money-back guarantee, what do you have to lose?

They offer three program tiers…

- Credit Polish for $79.99 a month (challenging five credit report inaccuracies)

- Credit Remodel for $99.99 a month (challenging ten credit report inaccuracies)

- Clean Slate for $119.99 a month (challenging unlimited credit report inaccuracies)

Learn more about Credit Saint’s credit repair services

When you sign up with them, they…

- Review a copy of your credit report with you, looking for errors

- Analyze your positive credit and optimize your report

- They work with your creditors & credit agencies to remove inaccuracies from your report

Again, I think people should know how to do this process independently. Yet, if this terrifies you, and you probably won’t take action on your own, I suggest contacting Credit Saint to help you (at least get the free consultation). After all, their 90-day money-back guarantee states, “If you sign up for service with Credit Saint in any program, and do not see any questionable items deleted from your credit in 90 days, you will be entitled to a full refund.”

Credit monitoring

Some credit cards you already have may be monitoring your credit score; just check out your perks or benefits info. If you don’t have credit monitoring, it’s easy to sign up for if you just want that feature and not a full credit builder program.

Many companies offer it as a service. You can sign up with TransUnion, which is one of the three main bureaus. They give you your VantageScore 3.0 (similar to FICO but slightly different).

With TransUnion credit monitoring, you’ll get…

- Unlimited updates to your TransUnion credit report and score

- Email updates of critical changes

- Instant email alerts are sent as soon as TransUnion finds out someone’s applied for credit in your name

- Lock and unlock your TransUnion and Equifax credit reports

- Personalized debt analysis

- Score simulator—see how specific credit choices may affect scores

- Toll-free access to ID theft specialists

- Up to $1,000,000 ID theft insurance

This service has several nice features, especially if you’re concerned about ID theft.

If you prefer to get your FICO score instead of a VantageScore (FICO is the more established measurement), then you can sign up with MyFICO, and they will get you credit reports and scores from all three credit bureaus with quarterly updates, as well as ID theft insurance.

Learn more about TransUnion credit monitoring

Learn more about MyFICO

The Pros and Cons of Credit Builder Loans

Pros of credit builder loans

- Easy to get and typically no credit check needed

- Can help you build positive payment history over time, helping to improve your credit score

- Interest rates are usually lower than other types of loans, such as payday and car title loans

- May access funds before the secured loan is repaid, depending on the terms.

- At the end of the loan, you will have saved up a good amount of money.

Cons of credit builder loans

- Interest rates can be higher than a traditional personal loan

- You may need to pay a fee for setting up the loan

- Payment schedule may be inflexible, with payments due on certain days or months only

- If you default on the loan, your credit score could suffer.

What to Look for in a Credit Builder Loan program

- Loan fees and APRs – this can be the most important factor when deciding on a credit builder program.

- Secured loan repayment terms – can your monthly budget comfortably afford the monthly loan payments?

- Misc fees – is there a fee for ending the loan early?

- Reporting – do they report to all three credit bureaus – Equifax, TransUnion, and Experian?

- Features – what other programs do they offer (i.e., secured credit card, credit monitoring, etc.)?

What impacts your credit score?

Your credit report impacts your credit score; they are different things but closely related. Your FICO score is calculated on five data points listed in order of how much (the %) they impact your score.

- Payment history (35%) – do you pay on time, every time?

- Amounts owed (30%) – this is also referred to as credit utilization. It’s a ratio of how much credit you have available to you vs. how much of it you use. For example, if you’re approved for a $25,000 line of credit and charged up to $24,000, your high credit utilization could be a red flag. Ideally, you would keep this at 30%. So if you were approved for a $10,000 line of credit, you’d only use $3,333.

- Length of credit history (15%) – Do you have a track record of credit? This can be hard, as everyone starts out at zero, but you will work up to it over time.

- Credit mix (10%) – They want to see that you have a variety of accounts, such as installment loans, credit cards, and car loans. For example, ideally, you wouldn’t just have ten credit cards.

- New credit (10%) – They don’t want to see that you’ve opened five accounts in the last three months. That looks like something might be wrong, a red flag.

If you want to improve your credit, you should focus the most on managing Payment History, Amounts Owed, and some on #5 by not opening new accounts. You have the most control over those items.

How to check your credit reports and credit score

You can get a free report from each of the three bureaus once a year. They should (in a perfect world) all show the same data, but sometimes they show different things. The only place you should go to pull your information is the Annual Credit Report site.

If you’ve never pulled your reports and are worried that a lot may be wrong, pull all three reports now. Go through each one carefully, looking for instances of identity theft and old balances you need to pay off. Cards you thought you closed etc.

If you’re not too concerned, then pull one report now, another in three months, and the last in another three months.

For your credit score, some of your current financial accounts may already be monitoring your score and have info on it. For example, one of my credit cards emails me my score every month; it’s just part of having their card.

If you’re working through a bunch of issues and need all reports now and again soon, then go ahead and sign up for MyFICO, they will get you credit reports from all three credit bureaus with quarterly updates, as well as ID theft insurance, and credit score monitoring, and alters when new things pop up on your report.

Why do you need to have good credit?

People may say that you don’t need a credit score (especially the followers of financial guru Dave Ramsey). However, in this day and age and where we are headed, technologically speaking), your credit score is becoming increasingly important.

Businesses check your credit score to see how trustworthy you are, not only with money but as a component of your character. I’m not saying this is right or wrong; it’s just how it is.

If you go to rent an apartment, they can pull your credit to see if they want to rent a unit to you. People with good credit appear more responsible than people with bad credit.

When you apply for a job, the hiring process for some positions may require a credit check. Again, you could lose out on a great job because you have bad or no credit.

One of the major reasons why people want a good credit score is the ability to take out a financial loan and get good interest rates. Loans for a home mortgage, a car loan, a kitchen remodel loan, a personal loan, etc.

Someone with poor credit may not qualify for a loan, or they may only be able to get a loan with a really high-interest rate. While a few percentage points higher may not seem like a big deal when you’re signing documents, it could add up to you paying thousands more for the privilege of borrowing money.

Should I get a personal loan to build credit?

You can, but personal loans may not have as favorable terms for someone with bad credit as a credit builder loan may. Credit builder loans usually involve some safeguards to help make sure you follow the required protocol for optimal results, while personal loans are more hands-off from the lender.

Credit builder programs FAQ

Is a credit builder loan a hard inquiry?

It depends on the platform and lender you go through. All will tell you upfront if it is a soft/hard inquiry. Hard inquiries only temporarily lower your score, so it’s not a deal breaker if the loan you want to use does a hard inquiry.

When should I start working on my credit if I want to take out a loan?

This is a great question! If you have poor credit, you should ideally start actively looking to raise your score at least a year before you want to apply for a loan. I know that seems like a long time, but raising your credit score is a slow process. Places report credit only once a month, and information can take a while to even show up on your credit file.

What can I do to protect my credit score?

Besides responsibly using your credit, the easiest (and most important) thing you can do is to freeze your credit. This will keep anyone from opening new financial accounts in your name (aka identity theft) and ruining all your hard work. Setting up a credit freeze is easy to do; it takes about a half hour max to do with all three credit bureaus.

What builds credit the fastest?

Sorry to say that when building your credit, nothing moves very fast. It can take a few months for things to show up on your credit report, and from there only, only updated once a month. It’s frustrating not to see fast progress, but in terms of credit, slow and steady win the race.

If you want to build your score as fast as possible, you’ll want to pull a few different levers simultaneously to raise your score. So get a credit builder loan and a secured card. Lower your balances on your current cards, etc.

Do credit builder programs work?

Yes, they can absolutely work, as long as you are responsible and do everything according to the books. Pay on time, every single month (set up automatic payments), follow the loan terms, etc. If you don’t, you could risk lowering your score even more.

At the end of the day

To wrap up, credit builder programs can effectively build your credit report and score quickly. As shown above, there are a number of different options available, so it’s important to research each one before making a decision.

You can do this independently – paying bills on time, reducing debt levels, and maintaining low balances. But using a program can be faster and keep you on the right path.

Ultimately, by using a few simple strategies and understanding which credit-building program is best for you and your situation, you will be on track to establishing and maintaining good credit. Good luck!