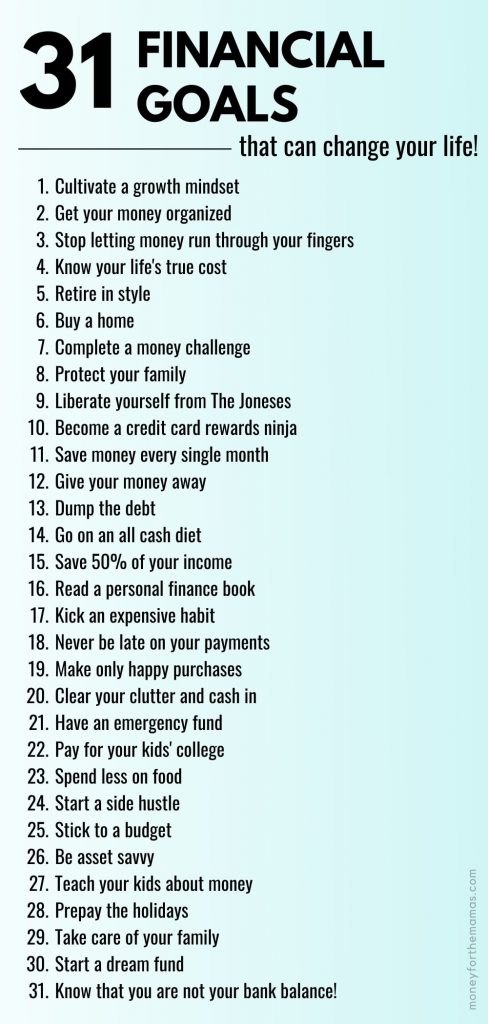

31 Days of Financial Goals Examples to Jump Start Your Bigger Bank Account

Revamp your wallet with the most common financial goals examples to get your money back on track!

Author: Kari Lorz – Certified Financial Education Instructor

Today marks a turning point! We’re getting your finances back on track (just as you promise yourself every New Year). In fact, I am committed to supporting you every single day for an entire month!

Let’s work together to learn about these top financial goals that will help you lead a life free of money worries.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

January 1st – Cultivate a Growth Oriented Money Mindset

I wrote a deep dive into understanding your Money Mindset, but let’s condense this. Because you need to be aware of how much power your mind has over your actions on a subconscious level! And your brain is where it all starts. Very fitting for January 1st and for the first financial goal!

A person’s money mindset is their overarching attitude and belief about money in their life. It influences almost every spending/saving decision that you make. It does this automatically, just under the surface of your consciousness.

At two ends of the spectrum is a scarcity mindset, and then at the opposite is a growth mindset, which is where you definitely want to be! The former being that “the sky is falling, there isn’t enough money!” to the later being “I have the money and the earning power to always be able to take care of my family”. We all fall somewhere between those two opposites.

In short, you cannot win with money when/if you are always operating from a scarcity mindset. It just doesn’t work! So to effectively do a money makeover in January, your money mindset is the very first thing that you need to know about yourself and shift if you are feeling the scarcity panic.

January 2nd – Get Your Money Organized (big-picture viewpoint)

Hmmm… what’s your bank balance? Your retirement accounts? What about the savings account that you started in middle school when you were so sure that you’d make tons of cash making & selling friendship bracelets?

If you don’t know your financial situation, it’s hard to know where you need to go. Maybe you’ve even avoided this step because coming face to face with the full figure of your credit card debt could be a teensy, tiny bit soul-crushing. (ouch!) It’s time to get your big girl panties on and face the truth. Hiding from your money problems will never (never ever!) make them go away.

One of the best ways to get all this information together, as today’s financial goal, is to open an Empower account. It’s not a bank or investment firm (but it does have some limited functionality as such).

It’s an online dashboard where you can get a picture of your entire financial life! Yes, at a single glance, you know exactly where you stand. Then you can figure out a way to get to where you want to be.

Setting it up takes maybe 20 minutes (depending on how many accounts you have), and then once that’s done, it tracks everything for you! It tracks your net worth, retirement savings, investment growth, cash flow, etc!

When you open a free account and link $100k+ in investable assets, you can talk with a financial advisor for a FREE portfolio review.

Empower Personal Wealth, LLC (“EPW”) compensates FlexOffers.com, LLC for new leads. FlexOffers.com, LLC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

January 3rd – Stop Letting Money Run Through Your Fingers

Yesterday we talked about how to get a big-picture view of your finances. Did you know that a small hole can sink a big ship? Maybe your nice big ship has quite a few small holes?

Yup, it’s time to look at your credit card bill for not-so-awesome spending habits. Maybe it’s an overpriced & underused subscription or a slight Taco Bell addiction? Or perhaps if you look at your bank statement, you realize that whenever you pull out cash, it’s gone from your wallet with nothing to show for it. (Hint – stop using cash).

You can have the Trim app do this for you, as it will let you know about subscription costs and even negotiate your bills. Comcast, here we come! and they take 1/3 of your yearly savings amount. Not too shabby!

Yet, if you want to change patterns that you’ve developed over time, I think it’s best if you do this for yourself. Yup, good old-fashioned brain power is what you need to use to understand your weak spots. Then become conscious of them, and fix them. All so that you don’t repeat these mistakes again!

This should be a short-term goal for everybody, as you will need to save money to make your long-term financial goal come true.

January 4th – Know Your Life’s True Cost

Yesterday we talked about cutting costs, like subscriptions. But do you realize how much they are costing you? Hint, it’s a helluva lot!

I know, I know, it’s only $12.99 a month for Netflix, and now Disney+ is $7.99 a month for basic programming, and then there’s cable, Hulu, Amazon Prime, and 457 other options (seemingly).

Today I want you to check out this article & calculator on the true cost of your streaming services so you know EXACTLY how much this is costing you over your life. You will be shocked!

For example, we have Netflix and Disney+, and using Marketwatch’s online calculator to calculate 50 years’ worth of those options (adjusted for 2% inflation) that equals…

$15,044 total cost. Yikes!

However, what really stings is what you could have earned if you had invested that money over the same period of time (at a conservative 6% return).

Are you ready? Those two services have now cost me $68,455!

SHUT THE FRONT DOOR! Ugh! That’s the power of compound interest.

To get a better understanding of how you can use compound interest to become a financial powerhouse, read here.

January 5th – Retire in Style

Do you want to work until you die?

Uhhh….

Me neither, that means you need to start saving money. Like right now! Honestly, this is one of the smartest money rules out there, saving for your retirement! And no, you can’t afford to postpone it!

Make this January the year that you finally open up a retirement account! Be it a 401(k) at work (preferably a Roth IRA, in my opinion). In fact, you should open up both!

Figure out what percent of your income you want to save and break it up into the two accounts mentioned below.

Why open up a work 401(k)?

A workplace retirement account usually means a matching contribution from your workplace, aka free money! How much free money all depends on your workplace. At one place, I got matched, dollar for dollar, 6% of my pay! At another workplace, I got matched $.50 to the dollar up to 5% (basically, and roughly 2.5% match, just worded in a way to confuse you).

Your job for this January is to contribute just enough to get the full employer match! You wouldn’t walk by a $50 or $100 bill every two weeks and not pick it up, right? Nope, me neither. So get the match!

Things to think about

- Traditional 401(k) = Before tax contribution

- Roth 401(k) = After-tax contribution

- Vesting period = Usually, you have to be a part of the company for a certain number of years before you get 100% of their matching dollars.

Why open up an IRA?

Sometimes workplace investments aren’t all that great (i.e., high fees or low performing investments). So you should plan to invest the full matching amount in your workplace, and then with what’s left of your savings goal, you should open up an IRA.

You have more freedom with investment choices AND, when you leave your workplace (which will probably happen at some point), you can then roll over your work 401(k) into your own fund.

Saving money now, when you are young, means that you can take advantage of compound interest and grow your investments to a hefty amount; it’s financial security, and that’s a hard feeling to beat!

401(k) Financial Goal Bonus

If you already have your 401k set up and running, go ahead and increase your contribution by 1%. Some workplaces allow you to automatically increase your contribution percentage every so often. So if you know that you get a raise every August, set it to increase then. Go ahead and be a baller and do 2%!

January 6th – Buy Your Own Home

The American dream that almost everyone has is owning your own home! Picking your perfect neighborhood, the open floorplan, the backyard water balloon fights with your honey & kids. *sigh*

Yet, do you know that you need to start working on this process probably a year before you actually buy?

Uh, why?

It’s called interest, and earning is great, but paying it sucks! Especially when it’s in the tens of thousands. This means that to pay less in interest you need to make sure that you have the highest FICO credit rating that you possibly can! The higher your credit rating, the lower your interest rate will be!

You need to do three things…

- Pull your free credit report (the info on here is what impacts your credit score. Make sure all the info on here is correct, and if you find errors, fix it ASAP!

- Get your FICO number to know your starting point.

- Start saving for a down payment. You need at least 20% not to have to pay PMI insurance, which in and of itself is a great financial goal!

If you have excellent credit, then great! Don’t do anything (financially speaking) until you have your rate locked in.

If you have bad credit, learn how to fix it RIGHT NOW! This process takes time to fix, and then more time for the reporting to correct itself. BUT saving tens of thousands of dollars is absolutely worth it! You can get help with a credit builder program.

This is a great midterm goal that you will need to do at some point down the road.

January 7th – Complete a Money Challenge

Are you a competitive person? I’m not unless it’s with myself. I love a good challenge, especially when it seems like it can’t be done! I used to think that a no-spend challenge wasn’t possible, but I did it! I got totally nerdy with it, as I covered my fridge in brown butcher paper and wrote on it in big letters how much I spent each week and what I saved. I kept a running list of what I did buy; I could buy gas for my car, dairy, and produce, along with limited fresh meat.

It was great! Every day that I spend nothing, I get a nice fat gold star on my fridge (just like you got in 3rd grade!). I saved a nice chunk of money and then used it to help frontload our vacation sinking fund! I remember thinking, while at Disney World, that it was all worth it as we were having so much fun! Especially my daughter, meeting Pooh Bear and Tigger! I think I’ll do another no-spend challenge again this March. Does anyone want to join me?

If you’re not sure what all is in a no-spend month or maybe want something a little less intense, then check out 20+ Money Saving Challenges to Supercharge Your Bank Account. Where you guessed it, I have 20+ different challenges for you to do! Pick whichever one sounds the most fun for you, or whichever will give you the dollar amount that you need to frontload your own vacation fund!

January 8th – Financial Goal Must: Protect Your Family

Are you a Mom who may just a teensy tiny little bit catastrophize things? (I might have my own hand raised right here). If you’ve been reading for a while you know that “security” is one of my most powerful & strongest personal core values.

I “worry” about bad things happening to my family, to my daughter, if the worst should happen to me and/or my husband.

I worry, I’m a Mom, it’s what I do!

If you’re at all like me, then I want you to dump some of that worry. I want you to get life insurance, both you and your spouse. Furthermore, I don’t want you to get it through your workplace! Go out to an independent life insurance company.

I know I know, this sounds boring and totally not a “sexy” financial goal like earning $2,000,000 would be. BUT, this can absolutely ease a heavy heart, it can lessen your fears, AND can protect your loved ones!

Even if you are a SAHM, get life insurance, as you’re spouse will need to find daycare for your young ones, which will dramatically increase expenses, so you do need coverage.

How much coverage you need depends on your family’s needs. If you have super young kids, get more. If your kids are 16 – 18, they will need less help financially to sustain themselves. Is your house paid for, do you have debt? Do you want your kids to go to college without the worry of paying the full cost? If you’re the bread earner of the family, then you probably want to support your spouse too.

Insurance is only part of the picture of protecting your family. If you’re worried that you aren’t on the right track, but not sure what to do then check out this post on making a DIY Financial Plan. It walks you through the process of creating a full & complete plan to set your family up to be covered when something goes wrong. Again, financial security is a hard feeling to beat!

Why not get life insurance through work?

Gone are the days when we’d work at the same company for years. According to a 2019 study from the Bureau of Labor, as Americans, we job hop on average 12 different times during our life, while employee tenure for women averaged around four years (source).

That means, each time you change jobs, you are older, and insurance is more costly. Getting life insurance is much less expensive the younger you get it, so lock in a low rate while you are young. I suggest that you get when you have your first child.

Also, when you lose your job, you lose your coverage, so if something happens to you while out of work, your family will get nothing. That sucks.

Whatever you do. Don’t wait. It’s not fun thinking about your own mortality; I get it. But I feel so much better knowing that my five-year-old daughter will be financially set and cared for if I am not there to do it myself. Peace of mind is an amazing financial goal to have achieved!

January 9th – Liberate Yourself from The Joneses

One of the things that really saddens me is when I hear women talk about their own insecurities, especially when it revolves around what others think of them. This causes them to worry, and overspend on things (i.e., expensive cars, fancy dinners out with friends, designer clothes for them & their family, hair & nails done often, and so on).

I think that I may have suffered some from this when I was younger (20’s), but now, honestly, I don’t give a f*ck! Furthermore, neither should you!

Yes, I want people to like me and think that I am a good person. But if you look down on me because I drive a 2003 Passat with 218K miles on it, or because I use coupons at the store to save $4 (while holding up the line for 28 more seconds), then I don’t care! (can you imagine an aggressive hand clap between each of those words?

Honestly, not caring what others think is liberating. I’ve stopped worrying about …

- Looking silly because I pack my lunch every day to work? Don’t care.

- Wearing yoga pants three days in a row? Don’t care.

- No makeup on for pickup at preschool? Don’t care.

- Wearing trashed-out shoes while on a walk? Don’t care.

Sure, buying new shoes would be nice, or going out to eat all the time too. But my money is so much better spent on the things that really matter to me! I know what makes me happy, and impressing strangers or daycare Moms isn’t what makes me happy!

Can you imagine how nice it would be if someone took 20% of your worries or anxiety off your shoulders? Dang girl that I don’t give a f*ck attitude looks good on you!

I think that this shouldn’t just be a financial goal for Moms, but a life goal for everyone!

If you need some help on how to bust out of caring about what others think, then absolutely check out the book from the New York Times Bestselling author, Sarah Knight’s book!

January 10th – Become a Credit Card Rewards Ninja

So I have reservations about this one, as it’s a slippery slope, which if it gets out of hand (and you charge up $45,897.56 in crap), then that’s bad. So you need to understand how you shop best (and worst).

Yet, if you consider yourself a very responsible person when it comes to using credit cards (aka you pay your bill off in full every month), then this financial goal is for you!

In my home, we only have a few credit cards, ones that bring us the most benefits. And, these are benefits that we actually use. Credit card companies continually report that about 1/3 of the rewards given to customers go unused. That’s money just falling through your fingers!

Credit cards that are staples in our house

- Target REDcard (debit) – gets 5% off and extra coupons

- USAA limitless cashback Visa – gives 2.5% cashback on everything

- Chase Disney Visa – earn 1% cash back (we have this one). The Disney Chase Preferred Visa card earns 2% cashback yet has a $49 annual fee

You may wonder why we even mess with the Disney Visa, as the cashback % is low. Well, we use it when we go to Disney Parks, as the perks you get there are pretty dang good! We get 10% off at quite many shopping stores and 10% off select restaurants. Plus, special character spots and card member discounts at Disney stores across the nation! They are always adding new things so check your card perks info before you go!

So, of course, you can see that earning 10% off right now sure beats getting 2.5% cashback later with our USAA card.

Right now, they’re also offering a $50 statement credit for the Chase Disney Visa once you make your first purchase, or for the Disney Premier Visa, you get a $200 statement credit (which nicely cancels out the annual fee for this year) once you spend $500! So if you have a Disney Parks vacation coming up this year, or if you go back annually like us, then this card is for you!

January 11th – Start Saving Money Every Single Month

This financial goal is something that I think everyone should do or be working towards! In fact, it’s my favorite piece of money advice that I give people! If you’re not familiar with the Pay Yourself First methodology, it’s a game-changer! You are finally putting your priorities and goals first!

Traditionally people get paid, then pay their bills and expenses, and then “save” what money is leftover. Makes sense (because that’s they we have all been taught to handle our money), but guess what? In most cases, there is never anything leftover! So nothing ever gets saved! It’s a repeating cycle that never gets you anywhere, financially speaking.

With a PYF model, you get your paycheck, you immediately put a portion of that into savings, and then you pay your bills and expenses with what is leftover! You always save money every single month, without fail! To learn all the nitty-gritty details check out this deep dive into the Pay Yourself First model!

Here’s a simple and straightforward monthly budget template that is set up with the PYF model in mind. As it has sections for sinking funds right at the top!

January 12th – Be Wealthy Enough to Give Your Money Away

Wouldn’t it be nice to have so much money that you could just give it away and not feel one bit anxious about it? You can!

You can donate no matter your income; in fact, you should do it today! Don’t feel bad if you cannot give a lot; every dollar is received with gratitude by worthy organizations. So even if you have only $5 to spare this week, tuck it away in an envelope, and when you get to $50 (don’t worry about how long it takes), then donate it to one place.

When you’re ready to donate, check out Charity Navigator, which is an unbiased third-party evaluator of nonprofit organizations. They rate an organization based on financials, accountability & transparency. So you know that when you give money to a highly rated organization, the money is being used for what you intended the donation to be used for.

For example, my favorite place is Give Kids the World Village in Florida, where they provide vacation stays and theme park access to critically ill children & their families. They run an amazingly effective business, where 92.4% of funds received go to the actual programs (only 1.9% to administration, 5.6% to fundraising activities)!

You are not only helping others, but you are fostering a growth money mindset of your own. For when you give money away, you are releasing your tight grip on it, letting your fear of not having “enough” have less power over you. So go ahead, you can afford it!

If you’re having a hard time with this financial goal because you don’t feel that you have the funds, and maybe never will, I want you to take a look at this post on shifting your money mindset. Everyone has a particular outlook on money in their life. You might be sabotaging yourself without even realizing it.

A man’s true wealth is the good he does in the world.

Kahlil Gibran

January 13th – Dump the Debt

You know this financial goal is important because you feel your debt hanging on you every time you open a bill or check your bank account. That lip curls up in a snarl, and you may let a curse word slip out oh so quietly. I know you’re doing it too, because recent findings say that the average Gen X American is $38,000 in debt (excludes their mortgage).

You’re saying, “This damn debt! Ugh! I hate it!”

So get rid of it already! Yes, easy say, hard do. I know. But you need first to make a plan so that you can attack your high-interest debt and get it out of your life! Because this heavy weight on your shoulders is making you not only poorer but miserable as well.

Can you imagine what it would feel like to not owe a dime to anyone? Go ahead, imagine it, I’ll wait… Feels pretty dang good, huh!

Alright, so here’s the debt dumping plan. Grab your credit card and loan statements and then go to Undebt.it and use their payoff calculator to figure out which is the best way for you to pay your debt off. Hint: I am going to suggest the debt snowball method, as it has been proven more effective in the long run with staying power than the debt avalanche method. You can play around with how much money you throw at your credit card debt, so you can see how much faster you’d be debt-free if you increased your payments by $100 or $200 even.

The site has a lot of great features, like payoff comparisons, mini payment add ons, and such so be sure to check them out, and then get to planning your new life!

Once you figure out your plan you can use the simple debt payoff tracker and keep it in your budget binder.

Where your shoulders feel lighter, you stand a little taller, and your smile is that much brighter! Dang girl, you look good!

January 14th – Go On an All Cash Diet

If you find that swiping your credit card is getting just a little too easy these days, and the charges are racking up faster than ever, it might be time to curb your enthusiasm. And by that I mean, going all cash!

I’m not necessarily talking about using the cash envelope system, just using cash instead of credit cards. As research has proven, time and time again, that when you use cash, you spend less!

A famous study cites when McDonald’s first started accepting credit cards. Their transactions jumped from an average of $4.50 to $7, just by taking credit card payments!

Numerous follow-up studies have been done with other products, and people always spend more when using credit. Researchers feel that it has something to do with when using credit, you focus on the perceived benefit of the item, yet when you pay cash, your focus is on the cost (source).

If you’ve been wanting to give it a try then grab your printable cash envelopes right here! These are an instant download, so you can get started right now!

January 15th – Save 50% of Your Income

Wowza! Saving 50% sounds fantastic, yet no one can reasonably do that! I hate to break it to you, but the internet is littered with examples of those rocking their savings rate, shooting towards financial independence!

Now you may not be able to start at 50%, start at say 10%, and then raise your savings rate each month until you get to the point that your lifestyle and pocketbook can agree upon. Don’t forget that this doesn’t have to be forever, try it for 6 months or a year.

Some of you may ask, why save 50%? Save it for what? A vacation? Hmmm… maybe. Yet, more likely, those with huge savings rates are on another trajectory altogether. They are looking for FIRE! And doing it as fast as possible! What’s FIRE? It’s the Financial Independence Retire Early movement that is sweeping across the states with startling speed, picking up converts and believers at every turn!

Have you ever thought about your current work trajectory? You know, work until 65 then retire, and finally, live the good life. Well, some don’t want to wait, and they sure don’t want to work forever, so they are stacking up the bills now so that they can retire at say 35 or 40. This kind of financial freedom sounds pretty good huh! Maybe you should look into it (hint hint) as one of your top financial goals!

January 16th – Read One Finance Book a Quarter

The capacity to learn is a gift; The ability to learn is a skill; The. willingness to learn is a choice.

Brian Herbert

I am a massive fan of continual learning; it fuels the mind and inspires the soul! Yet, I can totally appreciate that personal finance books can be intimidating and may put you off. For this financial goal, I encourage you to set the goal of reading one finance book at least every three months.

For this personal financial goal, go ahead and read your romance novels, your thrillers, and your bios, but every now and then, shake it up with some info that will actively help you lead a better life!

Here are a few great books to get you started learning about personal finance…

- Collins, J L (Author)

January 17th – Kick a Bad Habit

Me: Hello, my name is Kari, and I am a sugar fiend.

You: Hi Kari

This one is more than just a financial goal; it’s a life goal as well! We all have some bad habits we’d like to kick to the curb. Yet they’re habits, so it’s hard. I get it. Yet, maybe you just need to look at things a little bit differently.

According to the Centers for Disease Control and Prevention, the average cost of a pack of cigarettes is $6.28. So if you smoke a pack a day, that’s $2,292 a year, and over 20 years, that’s $45,216.

That’s a lot of money (that you’re now probably going to need for healthcare!)

Yet, $45K isn’t where this money pit stops. If you would have instead invested that $2,292 a year at a modest 7% return, at the end of those same 20 years, you could have had $100,538!

So instead of earning $100K, you spent $45K, a swing of $145,000. Now tell me, does that cigarette taste like its worth $145,000?

I didn’t think so.

January 18th – Start a Dream Fund

This is a financial goal that everyone can get behind! What’s something that you want? Like, really want? For me and my hubs, it’s taking vacations. We love vacation time! In fact, it’s so important to us that we are always saving for our next vacation, whenever it may be!

We love vacationing so much that we have a dedicated sinking fund just for it! We use these fun printable savings trackers to help keep our goals visual! We also have a sinking fund for our house, our car, and our kiddo expenses too! You can read more about how we allocate money to our sinking funds here.

But the sinking fund for vacations is special. As every month, we see it grow, that means our next vacation is much more real and closer! It’s turning a dream into a very likely possibility, all because we are planning for it to happen.

So what are your dreams? Are you planning for them by putting dollars behind it? Or are your dreams still only just dreams? Come on, get an envelope, write your dream on the outside, and stuff some bills into it. If you have big money goals then you need to name them! Make it real, and get working on them with the help of the Big Money Goals Planner!

There! Your dream is now drifting into reality, a little bit closer than it was yesterday. doesn’t that feel good?

January 19th – NEVER Be Late Again!

One of the dumbest purchases I have ever made was a late payment fee. Yes, it was a fee, but my inaction (not paying a bill on time) was, in essence, a choice to blow $25. I had just forgotten to pay a bill; it got buried in my inbox (I usually try and keep it pretty empty). But for some reason, I didn’t pay it.

Bye-bye, $25. Dang it!

In fact, according to NerdWallet’s 2019 Consumer Credit Card Report, ” Late credit card payments may be costing Americans billions. More than a quarter of Americans (26%) have made a delinquent credit card payment (30 or more days late), and 12% have made multiple delinquent payments. According to NerdWallet’s analysis, the late fees alone on these delinquent payments top $3 billion. And that doesn’t include the interest charges accrued from carrying a balance.”

It is so very easy to avoid late payment fees, just set up autopayment! It takes maybe 4 minutes to do it, and it will save you money, and what’s more important, it keeps you from being pissed at yourself. (I hate making stupid mistakes, I get so MAD at myself!) So just do it already!

Even if you’re a very hands-on person (like me), you should set up an autopayment for the minimum due, so you don’t get hit with a fee. Then you can still go back and do your tallying up and pay the full amount as you regularly do.

One of the things you should also consider is to automate your savings too! It’s a surefire way to save money every month, and that’s something we could all use a helpful nudge with!

January 20th – Make Only Happy Purchases

I am a firm believer in spending money! I know, I know, as a finance blogger, I should be promoting “saving money,” and I do. YET, money should eventually be spent. You should spend it on things that you either 1) need or 2) make you very happy.

For example, how many times have you gone to Target or Nordstrom in the past and just bought something, and then later regretted it? You were like, “Why did I even buy this? I don’t really like it, and I don’t need it” But, still there you are.

Then on the flip side, there are times when you’re like, “This was the best purchase EVER!” What was different? Think about it. For myself, I know that clothes, shoes & fashion aren’t part of my personal core values, which means it’s not important to me, so buying clothes won’t make me happy. So why would I go out and spend money on something that I know isn’t important to me?

I have identified what purchases make me happy and what my money would be wasted on. So for myself, I don’t have a “clothes” budget. I maybe buy 1-3 items of clothes a year, and 99% of that is either new jeans (I wear mine out on the leg inseam) or I buy new fresh, clean white t-shirts. That’s it.

What does make me happy is spending my money on vacations, good food, and family outings to the zoo and such. So look at setting at least one specific goal that just makes you happy!

January 21st – Clear the Clutter & Cash-In!

As a kiddo, I had a lot of collections, like small porcelain Royal Doulton figurines. My mom got me started on it, and so finding them was just something that we did (she was big into antiquing). They decorated my childhood room, but for the past 20 years, they have been in a box in my garage.

I like them, but they don’t do anything, and my little one can’t play with them as they’re fragile. So I sold them. In fact, last January, I went through a purge phase, and I spent one full day posting taking pictures of them and posting them on eBay. They were taking up space in the garage, and I was tired of feeling guilty about having them boxed up. Yes, I did feel a twinge selling them, but only temporarily.

I feel much better, having the space (mental space as well), and I earned about $1,250 from them, which was a great way to front-load some of the new sinking funds that I set up! Or use it to start (or fully fund) your emergency fund (see the next financial goal below). Use this printable online sales tracker to keep everything organized.

So what’s been hiding in your garage for decades? Can you sell it? Just dedicate a day, clear it out, sell it, and feel the room that you now have! Oh, and enjoy the money and use it for something that makes you happy!

January 22nd – Have an Emergency Fund

This financial goal example is absolutely one to have under your belt! Yet, it continues to be the elusive unicorn from most families. “Nearly three in 10 (28 percent) U.S. adults have no emergency savings, according to Bankrate’s latest Financial Security Index. One in four have a rainy day fund, but not enough money to cover three months’ worth of living expenses.”

It’s hard to save money, and the stats don’t lie. Yet beyond the primary benefit of having enough money to cover an unexpected expense, I want the other significant benefit of having an emergency fund. As a Mama, you might be all too familiar with this; it’s stress and worry. The stress & worry of not knowing how you would survive (financially) if something were to happen. This eats away at us, and long-term stress is no friend to our health!

There is something HUGE to be said for having peace of mind, and that’s why I want you to make this THE YEAR that you get your emergency fund up and rolling! So you can breathe easier and not have so much of that mental burden on your shoulders!

Now, the next question is how much to have in your emergency fund? The general rule of thumb is that you need at least $1,000 in a starter emergency fund. This is a decent amount to set aside in a savings account while you are still paying down debt, as there’s no point paying down debt if you’re just going to rack it back up with the cost of a new washing machine.

After you attack your debt, it’s then time to fully fund your emergency account. Experts say at least 6-9 months of living expenses, which I think is a good amount. So it could be anywhere from $7,000 – $30,000 depending.

Remember, this money needs to be easily accessible, so don’t invest it or get a CD, even though you’ll get better returns, that defeats the purpose. Check out some high-interest savings accounts. I like Ally as they offer competitive rates (as of January 2020, that’s 1.6%). So have it at least earning something; don’t just let it sit in your regular savings account earning .03% or worse!

So, start saving, and start relaxing (just a little bit more)!

It’s not money I’m after. It’s freedom!

unknown

January 23rd – Pay for Your Kids College

As parents, we want to do everything we possibly can for our children. One smart financial goal that will have a massive impact on your kids is getting a 529 college savings account started!

Everyone knows that college is getting more expensive by the minute. But what does that even look like? According to ValuePenguin, “researchers found that the average cost of college for the 2017-2018 school year was $20,770 for public schools (in-state) and $46,950 for nonprofit private schools, only including tuition, fees, and room and board.”

Yeesh! That’s expensive! The solution in front of students today is to take out student loans. Everybody has one, it’s the cool thing? And when we’re young, it’s hard to see that far into the future, so we do it, and then only after graduating do we see what’s really before us.

According to credit.com, here’s a snapshot of student loan debt in early 2019…

- Average student loan debt total per person: $31,172

- Average monthly student loan payment for graduates: $393

- Total student loan debt in the U.S.: $1.52 trillion

- Time to pay off student debt: 10 to 30 years

Double Yeesh!

So as parents, if we are able, we should strongly consider opening a 529 account to help cover the cost of college and keep our kids out of the black hole that is student loan debt. You probably won’t be able to cover it all, and that’s fine. Do what you can, as every dime adds up!

Only about a month after my daughter was born, we opened a 529 account, as we knew our greatest ally would be 18 years of compound interest growth! If your kids are older, no problem, every little bit helps. Start saving for college right now!

January 24th – Spend Less on Food

This is a hot topic for Moms and individuals all over the US! We are spending too much of our income on food! Eating out too much is a common culprit, and rising food costs are becoming more apparent. I’ve got two ways to help you with this financial goal!

If you are looking to start cooking more at home, one of the best ways to get started is with the $5 Meal Plan! They do all of the hard work with meal planning and creating a grocery list! You just buy the groceries and cook it! (You can even get another leg up and order through Instacart!).

You choose between the Classic Plan or the Gluten-Free plan, and then that’s it. They email you once a week with 6 Dinner Meals, a Breakfast, a Lunch, a Snack and a Dessert (and occasionally a Side Dish or other tasty treat!)!

$5 Meal Plan even has a free 14-day trial period, so you can be sure that you like them before shelling out the $5 a month. Best of all, the creator of the plan says, ” I make these plans myself and I’m able to make each meal for less than five dollars. You can too!”

If you’re already cooking at home and are looking to trim down your grocery budget, you need to check out Money Saving Mom’s Slash Your Grocery Bill eBook! So many great tips from Crystal on how she feeds her family of 6 on $70 a week! She’s been doing this for a long time, so she absolutely knows her stuff!

January 25th – Start a Side Hustle

Everyone needs a hobby, and a money-making hobby is the best kind! For myself, I took a roundabout way to blogging, as I originally never wanted to write. I did some very interesting things to make money, and they were fine, but nothing that lit me up. Then with blogging, that’s when I found my groove.

Not sure what to do? I want you to embrace the concept of Ikigai! I talked about this in my most personal post ever, finding your financial why. It’s a Japanese concept for finding your reason for being. Now, don’t get intimidated and think this is only for big picture stuff; it can absolutely work for finding your perfect hobby, too!

Go find your hobby, try a few different ones, and see what’s lucrative & meaningful. Then use that money to help fill your dream fund (financial goal #18), so you can get there that much faster!

January 26th – Finally Stick to a Budget!

People fall off this wagon so often, and it’s frustrating and demoralizing for them. “What went wrong?!?”

I’ll tell you; it’s usually one of two things why budgets fail.

1) They tried to go too strict, and their numbers were unrealistic for how they live. You can’t take a food budget from $700 a month down to $200 and expect everything to be peachy. Remember slow & steady ALWAYS wins the race!

2) They forgot about a lot of things that needed to go into their budget. This one is hard, as you think you have everything covered, then up pops your nephew’s birthday party and your Amazon Prime annual subscription, and your budget is blown! ARG!!!! You feel defeated, and you’re mad at yourself (which is the worst kind of being mad), and you just want to quit!

Both of these reasons can definitely put a kink in your plans, but don’t let it derail you completely! For the first reason, you need to embrace the idea that it is okay to be a beginner, it’s okay to make mistakes, and it’s best to start conservatively and work your way towards a goal. Just keep tweaking, trying, and tweak some more!

For the second reason, I’ve got some good news! I have a great cheat sheet on the most commonly missed budget items, that if forgotten, will throw your budget into a tailspin! These are all of the random, one-off things that you buy but don’t really ever think about. Go get it now to be sure that you’ve got everything accounted for!

Maybe your financial goal is a complete budget overhaul? In that case, I absolutely have you covered! I have recreated the budget I have used for the past four years and made it into templates for you! It’s called the Better Budget, and it works! As I said, I’ve used it for four years, and it allows my family to have everything we really need, all without crazy, high salaries! I walk you through it, step by step in a detailed How-to Guide! You won’t be disappointed!

January 27th – Take Care of Your Family

Along with financial goal #8, you need to have your estate in order. Uhh, “What does that even mean?” Well, depending on your family dynamic, you need to plan for what will happen after you pass away.

Lovely.

I know it sucks to think about this, but this is another BIG thing that you need to do to take care of your loved ones. The last thing you would want is for them to be grieving over you and add on top of that the complications and unknown questions of dealing with your assets. Or worse yet, you don’t want your child to have to decide to pull you off life-support if you are incapacitated.

Take responsibility and handle your business!

Many people think that all you need is a will, which is better than nothing, but it’s not enough (especially if you have a large estate). You should absolutely look into getting a Revocable Living Trust.

Revocable Living Trust includes

- last will & testament

- health care power of attorney

- financial power of attorney

- advance healthcare directive

- assets avoid probate court (with a will, your assets could still be held up in court processes for years, leaving your dependants with nothing until it clears the court. With a trust, your assets are typically in the hands of your beneficiaries around two weeks later, all with high court fees.

Having your insurance and estate planning lined up is only part of a well rounded financial plan. To see what else fits into a holistic financial plan check it out here. Or go talk to a trusted financial adviser.

January 28th – Be Asset Savvy

This is a spinoff of Financial Goal #9 – Liberating Yourself from the Joneses. Yet, this financial goal example might be a tough one for some to be okay with.

It’s understanding and correctly using depreciating assets. A depreciating asset is an asset that has a limited useful life and can reasonably be expected to decline in value over the time it is used. That means things like your car are going down in value every day. So does it make the best sense to drive a super nice car, with a sky-high car payment when soon it will be worth nothing?

“The average monthly car payment was $554 for a new vehicle and $391 for used vehicles in the U.S. during the first quarter of 2019, according to Experian data. The average lease payment was $457 a month in the same period.”

Yes, having nice cars is well nice. But having a car that reliably runs is what is important. You need to get from place to place, does it truly matter how “nice” it is?

Now, if all your expenses and savings goals are met, and you’re a billionaire, sure drive an expensive car. But if you’re an average American, like you and me, I think I’d rather have an extra few hundred in my pocket every month by driving a decent car.

A good rule of thumb is to look for a used car that’s two years old (as cars lose the most value within the first two years). As a fun side note, I drive a 2003 Volkswagon Passat with 218K miles on it. It has dents, and the glove box doesn’t open, the back passenger door won’t always lock automatically. But it’s a good car, and not having a car payment (for a long time) is priceless!

January 29th – Prepay The Holidays

Wouldn’t it be amazing to go through a holiday season without worrying about how you’re going to pay for it all? To just spend money and just be excited about the gift and the person receiving it? Or to be able to bypass the dread of when your January bills come!

You can do this! You can have an easier, less stressful Christmas! You just need to plan ahead (like now, in January). At the beginning of every year, I get an envelope and put it on my desk, and each week I tuck a $20 into it. Simple. Then come Black Friday; you have about $920 ready for you to get your shopping on!

Now, I don’t like to carry a lot of cash around, and I like to shop online. So I go to the grocery store and get a prepaid credit card, look for one with no transaction fee (you’ll probably have to pay a $5 initial loading fee though).

If you need some help on thinking about everything that you’ll need to buy for the holidays, check out my holiday planner guide, it covers all the holidays in late fall & winter!

January 30th – Teach Your Kids About Money

So many of us an influenced by how we were raised, be it how our parents spoke to us about money, how they spoke to each other about money, and especially how money impacted happiness (stress, arguments, purchase decisions, etc.).

Your relationship with money is one of three relationships that you will carry for your entire life! (The other two relationships are with food and with yourself). Doesn’t it make sense to have it be as healthy of a relationship as possible?

Things to consider teaching

- how and why to save a portion of their allowance

- how donating to charity is important

- the concept of good value for your dollar

- earning money through jobs and hard work

- money doesn’t buy happiness, and it doesn’t make you a worthy/good person if you have a lot

- talking about money in a comfortable, low-stress way will help make it not a taboo topic.

There is no right way to do it, and you are the best judgment on what age to introduce your little one to the topic and how deep to delve into it. Just remember to keep it light and positive!

Money is not the goal. Money has no value. The value comes from the dreams money helps achieve.

Robert Kiyosaki

January 31st – You Are Not Your Bank Balance

One of the most important examples of financial goals for everyone to master is a healthy distance and separation of their own self-worth and value to that of their bank account balance.

Yes, it would be great to have more money, but just because you don’t have millions, it doesn’t mean that you aren’t as good or as worthy as the next person! You’re not a failure; you’re not a loser; you are not doomed to poor forever!

By all means, strive for more, to better your situation. But don’t let it get to your heart. How many times have we heard that money can’t buy happiness? A lot!

You are great! I promise! Believe it deep down inside your heart!

Important notes on this post…

I originally wrote these financial goals examples as a New Year’s post, but you can start at the beginning of any month. You don’t need to master the goal in one day, just begin to think about it and decide if that’s something you want to pursue.

These are just some of the most common and most popular financial goals examples, some are a must-do, while most are optional. Pick and choose, it’s your buffet! Yet, some goals are long-term goal focused (aka retirement), where you need a short-term goal (or a few) as a stepping stone to get you there.

Be mindful of how you stack these, as some should come before others (i.e. dump credit card debt before buying your first home).

Also, financial goal setting doesn’t have to be set in stone. Your goals can change and morph as your financial priorities change (i.e. adding a new baby to the family). Setting goals should lift you up, not chain you to a past life. Grow! it’s expected and encouraged.

Don’t forget that when you pick your goals, that you should use the smart goal method to help you make your goal achievable!

Or, if you are already gung ho on getting started with your money goals, don’t forget to grab the Big Money Goals Workbook! It will help get you set up with a strategic plan and framework so you can be sure that you’ll not only reach your financial goals but crush them as well!

At the end of the day

This isn’t an exhaustive list of financial goals examples, but it’s a great place to start! Remember, your goals are personal goals, don’t be swayed into something you don’t agree with, yet be open to stretching your comfort zone and reaching for something you think is “too big” or “too audacious”. When you give 100% focus to something you can acheive it!

Love this post and I am hoping to use some of these methods.

So glad you liked it!

January 23th money goal – pay for your kids college. This is definitely on our list as a money goal. With 3 kids… it’s a bit of a challenge! In Canada, we have the RESP accounts of which we are trying to max out contributions each year. $2500/year/kid and the government puts in 20%! How does this compare with the 529 program?

Funding college is a huge goal! Kudos to you for making it a priority! It sounds as though the accounts are similar but with a 529, there is no government match, yet the contribution levels are a lot higher per year. I think its at $15,000 per year max, with a total of $310,000 max. There are other types of accounts for kids here in the US, but the 529 has more potential for growth than the others.

Never understood why it seems to be a parent’s responsibility to pay for college? If they want to go, they need to make it happen – that’s what grants, scholarships, loans and jobs are for.

If you (a general “you”, not you personally) are the type of person who is investing and hustling and doing all this other stuff to reach financial independence, wouldn’t you raise your kids to be that way instead of them expecting to have college handed to them?

I don’t know that I would consider helping to pay for college as being “handed to them.” You raise kids to hopefully be hard workers, grateful, and appreciative. That doesn’t mean they need to struggle and scrape dimes together. Parents should absolutely look after their own retirement funding first, and then if they are willing and able, to bless their child by helping to cover an outrageous cost. What a gift!

Hey Kari, great tips so far. I’m just starting to learn more about investing. I have a traditional IRA but it’s not doing very much. Do you know anything about opening a Roth?

I do have a Roth and a traditional IRA (I wish it was all Roth but I didn’t realize the benefits until later one, so then I opened a Roth). I plan on converting the traditional into the Roth with a backdoor conversion once I reach retirement age, and according tax bracket) so I can get the benefit. But that’s a long way off from now! I like Vanguard, butt hat’s just my personal opinion, they’ve been great to deal with!

This is such a amazing list! You provide so many great ideas and I love how detailed it is. This is going to be a huge help! Thanks for sharing! 🙂

So glad you like it, thanks for stopping by!

The January 4th bit about “life cost” of the streaming services…WOAH. And here I thought I had done a good job this year of refreshing our financial outlook for the year but this article proved I have a lot of work to do! These are excellent tips, thank you!

I was a little startled too looking at the life cost! I am absolutely rethinking some costs!

All awesome tips! Having an emergency fund and a savings is so important and can save you a lot of headaches in the future. Thanks for sharing 🙂

Thanks for stopping by Krissy!

January 21 – I love this money hack! We have so much kids stuff that we don’t use – as the kids have outgrown them. I will totally dedicate a day to purge, post them for sale and just get rid of the stuff! (Now I just need to figure out what day I’m free)

You’ll feel so much lighter and freeing after you do it! Good luck!

Thanks for the good reminders to be intentional with every dollar! I’m going to re-evaluate some things!

So glad you found a few ideas!

These are all great tips and ideas and some of them you don’t even really realize until you mentioned it. Your point about saving for retirement is great, when you’re young you don’t really worry about it but it gets here faster than you think.

When I was younger, never could I imagine being 40, let alone 65. But here I am at 40, thankfully with some retirement savings!

Your January 12th post – made me think. I’m a financial independence journey. But you are right! It doesn’t matter where I am on my journey – I should be able to donate now. So many people and organizations need help and I can do it!

Yaaa Minda, this totally made my day! You can absolutely start small collecting money, it will add up sooner than you realize, and then you can make such a positive impact, beyond what you’ve ever considered!

These are some great goals. Especially learning not to care too much about what others think of you—that’s the best way to save money and feel better!

Ha ha! Yes! Who cares what others think of you, as long as you know you’re a good person!

Great tips! way to help me focus … thanks!

So glad you liked it, thanks for stopping by!

This is a great and timely post. Looking at my finances is so important but makes me so anxious that I keep putting it off.

I know it’s easy to say “don’t be anxious”, but don’t be 🙂 The fastest way to get over it is just to dig in, a little bit at a time!

I need to take action toward my finance. I am so grateful for this post and will follow your tips. Thank you for sharing this.

So glad you liked it, I hope you find some useful tidbits!

Jan 3 – Some of our money holes come from hubby’s spending! We will need to sit down and discuss his spending habits (online purchases, gaming …) As a family, we also have a membership to our community rec center and we don’t use it enough to make the cost worth it! Will have to decide what to do with this expense as well!

ARG! This house knows gaming well! I am also looking at pausing our YMCA membership, in the winter we just don’t use it that much.

Lol. Hubby just bought a really expensive gaming chair (sigh), but he was able to pull some extra money from his investments to pay for it. So I guess it’s ok? Haha.

Shhhh… don’t tell my husband about it, he’ll want one! 🙂