You Need to Have a Financial Why if You Want to Hold Onto Your Money

Get a Savings Anthem; aka Finding Your Financial Why

Author: Kari Lorz – Certified Financial Education Instructor

Everyone knows you “should” save money and that it’s important to have an emergency fund. But maybe you’re a little stumped as to why.

You know why, so you don’t go broke, but there has to be something more than that, right?

Yes, there is. It’s the most important aspect of your finances. It’s your “financial why.”

I know that sounds vague and confusing, but let’s dig into what your financial why is and why you need to figure out yours ASAP!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is a financial why?

Your Financial Why is the “thing” that you want more than anything! It’s the thing that gets you up in the morning, gets your blood pumping, and your heart racing! It’s the thing that gets stuck in your brain, and you can’t stop thinking about it.

Yes, YOU need to do the silly & stereotypical (yet absolutely necessary) thing of figuring out your main financial why! What are you even saving money for? Can you close your eyes and picture it in your head? If not, then I’m not sure if you will succeed.

My financial why

I’m going to get a little personal here. My motivation, my financial why for why I trudge through the hard days of work, is my daughter. That’s not earth-shattering for a mom to say, I know.

What you may not know is that my daughter has Cerebral Palsy. She’s 8 years old, and she cannot sit up unassisted (for very long), nor can she crawl or walk. She’s dependent on my husband and I for almost everything.

This little girl has a world of struggle ahead of her. It breaks my heart. It kills me to know how hard she is going to have to fight for what she wants in life. Yet, I know she can do it; she is a fighter through and through.

Yet, the one thing I CAN DO for her is to set her up financially so that she will never have to worry about money. (Her earning potential is still unknown, so we’re not sure if she can get a job to support herself.)

I can’t make her legs walk. But I can give her security.

I can’t make her core tummy muscles stabilize her so she can sit without tipping over. But I can give her freedom from poverty.

I can’t make her arms loosen up to give us big hugs, but I can give her everything so that she will have a comfortable life after my husband and I are gone.

I can close my eyes, and I can SEE my financial goal.

I can close my eyes and FEEL the relief of knowing she is safe.

I can close my eyes and KNOW that I did everything I could for her.

Can you do that with your why? If you can’t, then it’s time to stop hiding. It’s time you got your game face on and got to work! Because Mama, this thing called life is not going to hand you success. You need to work for it.

How to find your financial “why”

Step One – It’s all about your financial goals

List out everything you want for yourself and your family. Things like…

- A new family home.

- Be debt-free so you can live without that stress.

- Have a fully funded emergency fund so you have that peace of mind.

- Have an easy monthly cash flow; no more living paycheck to paycheck!

- Raise your credit score so you can be approved for a home loan.

- Get your spending habits and expenses under control so you can actually save more.

- Have a savings account for sinking funds like vacation, new car, and a home repair fund.

- Have a financial plan in place so you don’t have to question anymore – “Am I doing this right?”

- Be investing in your children’s future by contributing to a college savings plan.

- You are making regular contributions to your retirement savings plan.

- Be confident with how your financial life is at the moment and where you’re headed (i.e. financial security)

Step Two – goals that resonate

Pick your top 3 most compelling “things”

Step Three – visualize your goals coming true

Close your eyes and think about each of those three things… Yeah, this sounds corny and silly. Go grab a glass of wine and come back to me. You back? Cool!

- What does that “thing” look like?

- How does your family look with that “thing”?

- How do you feel seeing your family with that thing?

- What does it look like around them at that time? Is it raining? Is it hot? Are you inside at the dinner table? Set the stage. I want you to be able to visualize this.

One of those “things” should have brought out a very strong emotion in you. Be it relief, joy, pride, love, serenity, etc. It could be a combination of those feelings. The main thing is that your response is true & strong.

Step Four – Write down your goals, make them real

Write out your top financial goal. Seriously, do it. It doesn’t need to be fancy or typed or on nice paper. Scribble it down, be sure it’s what you see in your head. Fold it up and put it somewhere safe.

Remembering your financial why

So if you think things got a little woo-woo just now, then you’re in for a treat 🙂 We’re going to get dorky and create a visual representation of your “why.”

Maybe it’s a picture of your children, perhaps it’s a picture of the cute house you saw in a tiny homes magazine, or maybe it’s your wedding ring. Even though you now have a great mental picture of your “why,” you need something to remind you of it when times get hard. So when your brain and your heart just aren’t up to conjuring up your goal, you will have —this—- to make your financial why come alive again.

For my daughter and I, it’s a ribbon from a toy that she had in the NICU. It wasn’t really a toy; it was a big ball of cotton covered in soft felt and tied with a yellow ribbon. I wore it next to my skin all day when I wasn’t with her in the NICU.

When I would go to the NICU, I’d visit for hours and hours and then swap out this toy for an identical one in her bed, and I then wore that one. The one that I left with her now had my scent on it, so she could smell me and feel me when I wasn’t there.

That ribbon means everything to me; it signifies so much I cannot even begin to describe it.

It’s my fight song.

She is my financial why. She is my everything. Yet, why did I choose to base this around being a personal finance blogger for moms? You can see the mom piece. I feel for the Moms who fear and struggle to take care of their little ones. You can read about how I turned my finances around (basically a complete 360) below…

RELATED: Financial Literacy – How I learned it all in one hour a day! PS – You can do this too!

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

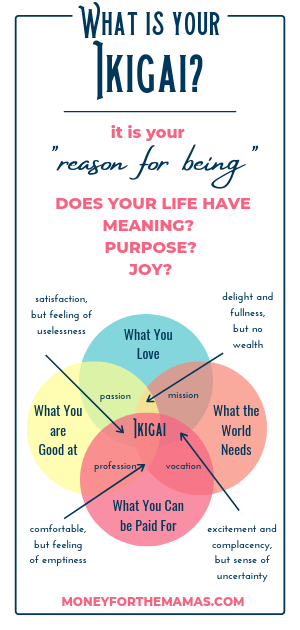

Ikigai can help you find a way to reach your financial why

If you want a quick visual, I found out my HOW through Ikigai, though I didn’t know what it was at the time. Ikigai is the Japanese term for your “reason for being.” Basically, your purpose in life. An easier way to describe it is based on its circles. They encompass…

- Your Passion: What you love

- Your Mission: What the world needs

- Your Vocation: What you are good at

- Your Profession: What you can get paid for

Answering these questions made it so clear to me what I needed to do. Not only to reach my financial why but to have a real passion for what I was doing every day.

Here are some other Moms who struck out on their own; these Mamas are talking all about their money goals, and all of them are doing it for their family! These Mompreneurs are making life better for all of us and inspiring us to reach for more!

If you want to try and figure out your own Ikigai, along with finding your financial why, then grab a piece of paper, make four sections, and answer the four points above. Write down lots of answers, then go back and find the “one” that is the strongest for you.

Hint: for “what the world needs,” reach into your heart and think about your own Personal Core Values. These are things that guide you. To learn more about Personal Core Values and how to identify them check out the workbook below.

Not sure if you have the capacity to put more onto your plate right now? (I totally understand, and the concept of the mom’s mental load is 100% real! Forbes talks all about how Moms are better suited than others to start their own business. Women say that motherhood has helped them be better entrepreneurs by…

- I am painfully aware of my strengths and weaknesses

- You’re forced to get comfortable trusting your own opinions

- The tenacity muscle develops

- Being a mother instills a powerful sense of discipline

- I plan for tomorrow today

- I’ve developed more empathy

- I see more joy in the world

- I have been trained to have patience

- I’ve learned not to sweat the small stuff

- I know how to guide people to make the right choices

- I’m so much stronger than I ever thought I was

I hope you find your Ikigai; the clarity it brings is so powerful, and with that your financial why will become clear to you. This picture is what you need to hold on to!

At the end of the day

If those new shoes call out your name as you are walking down the aisle of Nordstrom. Just stop (a fair distance away, of course), and ask yourself, “Will these shoes get me closer to my dream vacation to Hawaii?”

Or closer to a newer car, or a new house, or a fully-funded emergency stash. Whatever it is, you need to visualize your long-term goal and make it more powerful than the short-term temptation.

Articles related to finding your financial why:

- Identifying Your Personal Core Values

- Financial Literacy – How I learned it all in one hour a day! PS – You can do this too!

- Mamas Talk Money Goals!

- About Me – How I Started Money for the Mamas

Great post. I have recently been looking at my financial why and mine is to be able to get me and my daughter a forever home. A home big enough that will adapt as our lives change.

having a forever home is a GREAT why! I love it!!!!

Great post! I love your writing style and the information is great. I was a Credit Union Financial Counselor so I spoke to people about things like this a lot. Thanks!

Thanks so much, I’m so glad you liked it! A Credit Counselor is a tough (but very much needed role), I’m so happy you are out there helping people become more comfortable with their finances!

I had never thought of having a financial why! I live this and it’s great how you break down the steps in trying to find your own reason and drive to save money. Thanks for this great article!

So glad you liked it, thanks for stopping by!

Thank you for sharing your Why, it’s beautiful. In the past, my why would have been to simply be financially free. But now, I just want to be able to help my loved ones. Gift my dad, mom, and sister a trip to Europe and help them make their dreams come true. I’m doing the exercises you mention in your post and writing my whys in my journal. <3

Taking care of your family is such a compelling reason! So glad you could relates and connect, I hope the exercises help you find a clear and solid path!

I cannot begin to explain how inspirational and timely this post was. Thank you.

Kimberlie, I am so happy I was able to help you, even if it was just a small way. Your comment made my day! Thank you for sharing!

All your tips are great and you are so right as we really don’t need half of what we spend our money on. Thanks for making it so clear!

So glad you like it!

No, those shoes won’t get me closer to my trip to Hawaii! 🙂 You made tons of great points and there are LOADS of good takeways here. Thanks for sharing.

So glad something resonated with you! I’d so much rather have a trip to Hawaii than shoes (the shoes would probably hurt my feet, as all cute shoes do!).

I really enjoyed your article. It’s not often I get to read article that grab my attention like yours. Thanks.

Thanks so much, so glad you liked it!

This is a great point! Too many people overlook the real power in ‘why’… By applying that to any goal we give ourselves motivation and drive

Yes! This can, and should, be done with any big goal that you have. It’s such a powerful tool.

I enjoy your why and your inspirational story of getting your self together for yourself the sake of your child. things like those encourage me to pull myself together

So glad you liked it, and deep down please believe that you can do whatever you set your heart and mind to!

These tips are really helpful. It’s so important to have a plan with a motivating end goal.

So glad you liked it, thanks for stopping by!

Great perspective to see money as a financial why. I can relate with this and I love visualizing goals it keeps me on track to meet them.

– Kristen

So glad you liked it and can get behind visualization (it sounds so corny I know but it totally works!). Thanks for stopping by!

This is great, I never thought about money in terms of a financial why. I think it ties in a lot to your attitudes about money and what habits or thoughts you’ve ingrained over the years. My financial why is all about creating a sense of security, which goes back to living in poverty as a child. All of the smaller money goals I set feed into that one big goal.

I can totally relate, “security” is a big core value of mine too! You’re totally right, what we learn as children definitely impact and skew things for us as adults. Thanks for sharing!