How to Make a Budget Binder Like a Pro (Free Budgeting Printables)

Let’s go through how to make a budget binder in four simple steps (you can have it done in 15 minutes!)

Author: Kari Lorz – Certified Financial Education Instructor

Do you feel like your finances are out of control? If so, you know it’s time to get a handle on them. One way to do that is by creating a budget binder with free printables!

This post will show you how to make a budget binder with free templates so you can start budgeting right now – like in 5 minutes!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What’s in a budget binder?

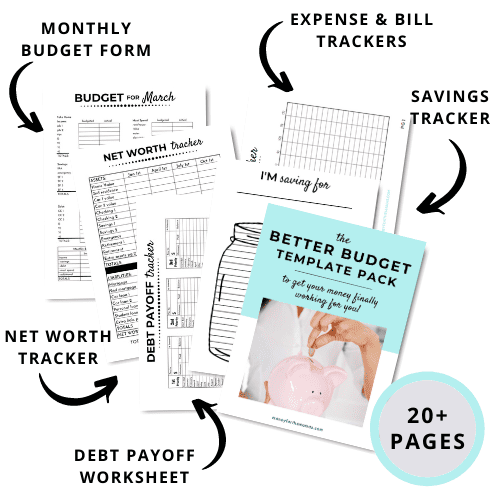

A budget binder is a binder or notebook that you use to track your income, expenses, and budget goals. It can be as simple or complex as you want it to be. Typically, a budget binder includes:

- A cover page with your name

- Financial goals worksheet

- An overview of your financial situation (net worth statement)

- Monthly budget template

- Debt payoff tracker

- Space for monthly bills

- Bill log & expense log

- Savings tracker

- Account Log

- Cash envelopes (for saving money in sinking funds)

- Monthly calendar

Now you can certainly pay for these printables (I even sell them in my shop), but if you’re trying to save every penny and don’t have time to search for them, you can get them for free.

Many people have free budgeting printables that you can download to make your own budget planner. In fact, I have free budgeting printables just for you! Click here, and put in your email, and I’ll send them to you right now.

We’ll dig into each of these templates pages below.

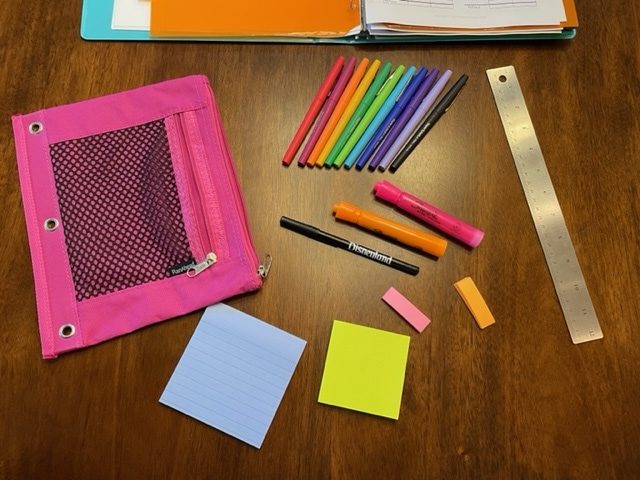

Step #1: Get your supplies together

You don’t need to go out and buy supplies for your binder, as you probably have most of these on hand. But in case you don’t, here are a few helpful items.

- Three-ring binder

- Dividers with Pockets – to hold bills & receipts. You’ll need 2 sets if you want one for each month. But you can use one side for one month and the other side for the next month’s bills. (This is what’s shown in the pics – I only used 6 dividers).

- Fun pencils & eraser

- Colored pens (for coloring savings trackers)

- Highlighters

- Plastic sleeves – optional – use can use a hold punch instead for everything

- Pencil pouch

- Post its and Post it Flags – optional

- Calculator – you can just use your phone

- Ruler – to make folding cash envelopes easier and straighter (optional)

- Your favorite pen – I love my Disneyland pen, I actually get excited to use it #nerdmuch

The main thing you need to focus on when figuring out how to make a budget binder is ensuring that it’s easy to use! That is the #1 most important thing because if it’s too complicated, you’re not going to use it.

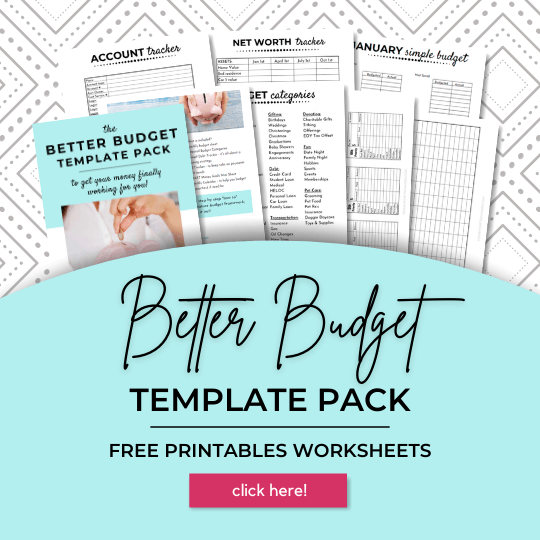

Step #2: Get your free budgeting printables

To follow along with how to make a budget binder, you first need the free printables. As I said, I have free budgeting templates, just put in your email, and I’ll send them to you within a minute. Just download and print. Don’t worry; they have minimal color, so it will be easy on your printer ink.

Now I only put in one of each page, but you may want to print multiple copies of a few pages if you’re setting your budget binder up for an entire year. Consider printing years’ worth of…

- Monthly calendar

- Monthly budget form

- Expense log

And maybe a few extra savings jar trackers (so you can save for multiple different things).

If you don’t have a printer, then check out these places. It may cost you a few dollars to print at a store, but it’s well worth it. Check out…

The monthly budget template is a simple budget form, or you can try the 70/20/10 budgeting method instead. Or even the 30/30/30/10 budgeting method. Just pick one that suits your needs & financial goals.

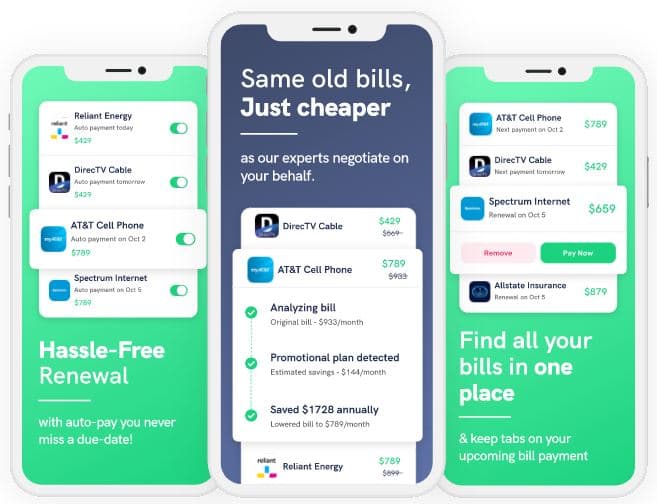

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

Step #3: Organize your printables in the binder

This is the fun part, putting it all together! As you can see, there are a lot of printables. But don’t worry, we’ll walk through how to make a budget binder and what order to put everything in.

Your binder has an annual section – pages that cover the entire year. And then your monthly breakout sections behind that (i.e., monthly budget, monthly expense tracker, etc.).

The first thing you want to do is get your cover page printed out and put it in the front of your binder. This will personalize it, making it yours. Then…

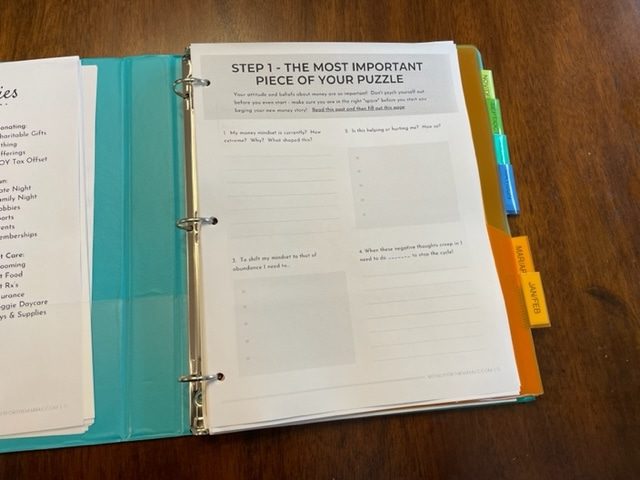

Money Mindset Exercise:

This page is one of your most important, yet many people make the mistake of skipping it, as it sounds kind of wishy-washy – not tactical enough.

Your mindset plays such a powerful role in your success. You can either cheer yourself on or tell yourself that you’ll crash and burn. Understanding your money mindset can help you set up a strong foundation, priming you for success! Please don’t skip this step!

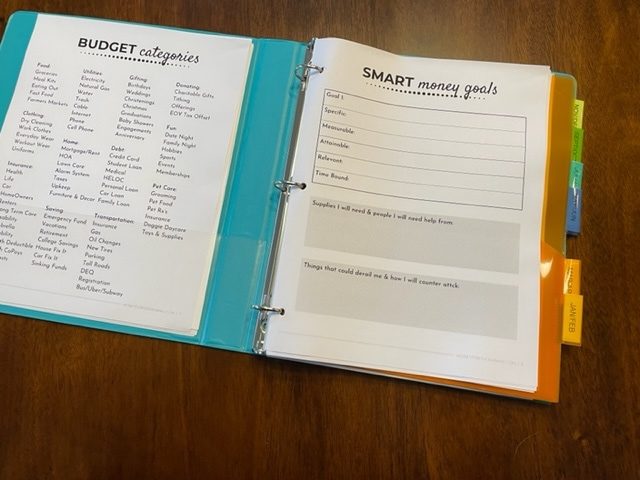

Financial goals page:

You may not realize it, but this is one of the most important pages in your binder! If you’re not clear on your goals (and your reason for those goals), then your motivation may lag, and you’ll end up not using the budget binder.

Write out your goal using the SMART method; this is the most effective way for goal setting as it breaks down your big lofty goal into smaller manageable action steps with details of the who, what, when, how.

This way, you just need to execute the plan, not sit indecisively on what to do next. You just follow the plan.

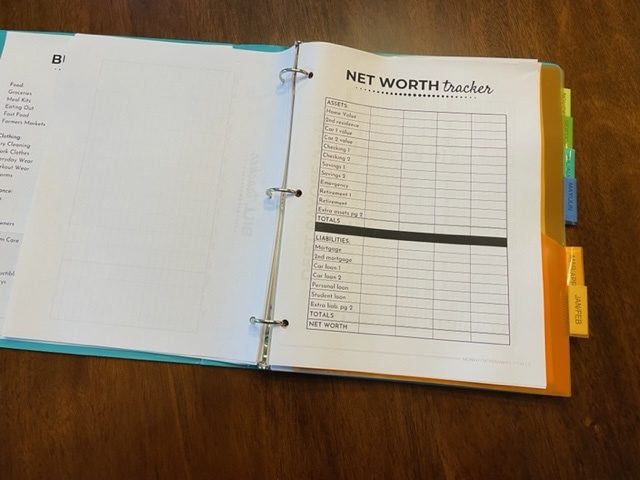

Net worth tracker:

You need to figure out your baseline where you’re at today. Because how will you know how to proceed if you don’t know your starting point? Now, when you fill out this sheet, you might be a little alarmed, as people usually start by having a negative net worth (this means you owe more than the value of your current assets). That’s normal. No, it’s not ideal, but it’s normal.

The importance of this document is in the quarterly tracking. It will help you see how you’re doing over time and determine if your actions are actually moving you closer or further from your financial goals.

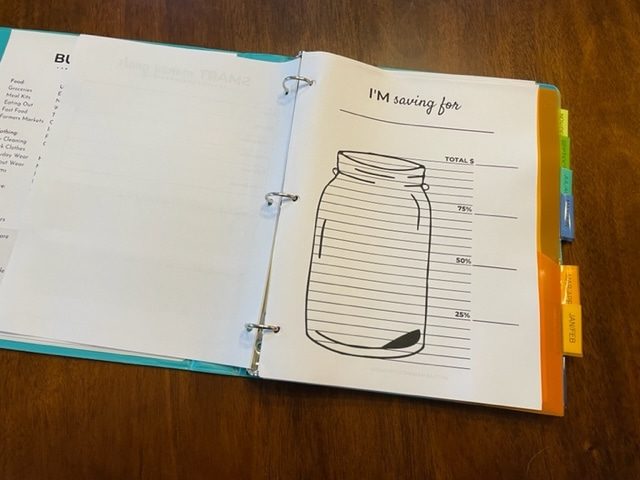

Savings tracker:

This is my favorite sheet, as it helps you keep track of how far you have come towards your savings goal!

For example, if you wanted to save money for a $1000 trip, you can visually see how close you’re getting to it each and every month.

You can print this page out multiple times to use for each sinking fund that you have. What are sinking funds? Well, they’re how you save for a specific thing or event. I have a few permanent sinking funds that I work into my personal budget; vacation, home repair, car repair, kiddo fund. Click to see the complete list of what you can use sinking funds for.

Debt repayment tracker:

This sheet will help you organize, plan and track any debt payments you may have things like credit card debt, student loans, personal loans, etc.

Your first step is to decide which debt payoff strategy you want to use; debt snowball or debt avalanche. Yes, you’ll want a strategy, not just haphazardly paying things here or there. With a strategy, you can pay it off faster and pay less in fees.

I recommend you start with the debt snowball method; it’s been proven to be more effective than the avalanche method in most cases.

Account log:

Be sure that you keep track of all your important login information. It’s so frustrating going through the “forgot your password” reset loop of agony. It’s enough to make anyone quit what they’re trying to accomplish.

Monthly bill tracker:

You’ll want to write down all your monthly bills and reoccurring expenses. Think utilities, memberships, monthly subscriptions, etc. Once you have this sheet filled out, you can transfer the numbers to your monthly budget sheet.

The bill log will help you keep track of if you paid your bills for the month and if you’re trending too high with utilities. For example, it might be time to turn down the heat a few degrees to keep your bills in line. Also, take note on the sheet which bills are on autopsy, as you don’t want to accidentally double pay.

Monthly budget template:

From here on down, these printables are for your monthly breakout section. So have one of each of these pages for every month.

Your monthly budget worksheet is the second most important page in your budget planner. This is how you set your budget, how much you plan to spend your money each month.

There are many different budgeting methods, but I’ve included a very basic form so you can use any of the methods. This sheet (and the method you choose) is usually the distinction between a free printable and a paid-for budgeting template. The paid ones are specific to a method and guide you accordingly.

In the beginning, a free one is just fine; but as you go on, you may want to upgrade to a specific budgeting method planner. If you’re curious about what those look like, you can check out my list for the best printable budget planners.

This page is where you’ll lay out your monthly income and your expenses. It’s helpful to group your expenses into categories, so I’ve included a few sheets to help you organize your expenses into groups.

To help you figure out all your expenses grab the past three months of your banking and credit card statements. If you do a lot on Paypal or Venmo, you’ll want to grab that info too.

How do I know exactly how to budget?

It can be confusing if you’ve never made a monthly budget before. There’s only one hard and fast rule. Don’t spend more than you earn in a month. So your monthly expenses must be less than your income.

For a step-by-step approach, check out: Budgeting 101 – A How to Budget Guide for Beginners.

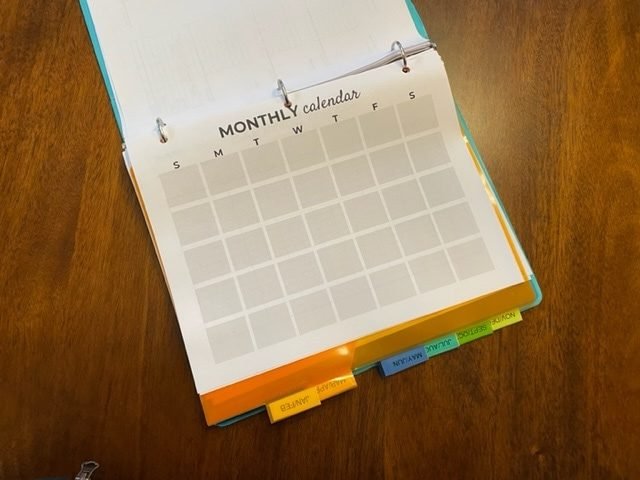

Monthly calendar:

You can print this sheet multiple times, one for each month. You’ll want to write out when your bills are due and any special events where you’ll need to spend money (i.e., birthdays, anniversaries, parties, etc.).

This is a great visual to see how your bills and expenses are spaced out during the month. If you get paid every two weeks, you don’t want to have all your bills due in the first half of the month. That would drain your bank account for half of every month. Space expenses and bills out evenly to make it easier to manage your cash flow. You can absolutely call your utilities and credit card lenders to adjust your account due date.

Also, please keep track of when any annual memberships come due, and write down things like your Amazon Prime subscription, yearly gym membership, etc.

Step #4: Using your budget binder during the month

Using your budget templates during the month is where the magic happens. You’ll ideally use your budget notebook a few times a week to make sure you’re on track and not overspending.

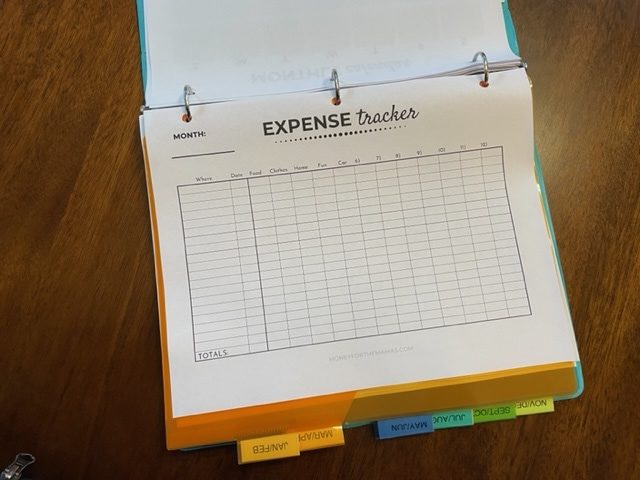

Monthly expense log:

This sheet will help you track how much you spend in each category for the month. This is usually your discretionary spending items – dining out, fun money, variable expenses like groceries and gas.

For this reason, I recommend logging your receipts every two days at most. Honestly, how well do you think you’ll remember how much food cost last week? Or how many times you bought coffee? Trust me; you won’t remember, so log it asap! This budgeting tool has preset budget categories already filled out and some empty ones for your own custom spending category.

Cash envelopes:

Using a cash envelope is how you’ll save/hold your cash for monthly discretionary categories, or for your sinking funds.

If you’re budgeting with cash envelopes, you’ll use these for your discretionary spending (amounts that change month to month). So groceries, dining out, fun money, beauty budget, gas money, etc.

If you’re using cash envelopes for saving then, this is where you’ll keep your savings. I use cash envelopes for event-specific savings, like Christmas, or cash for beauty treatments. For permanent sinking funds, I use separate bank accounts. I have an account for vacation, car repair, home repair, and a high yield savings account for our emergency fund.

If you’re new to budgeting, then there are some important tips that you’ll need to know to help you stay sane and not get discouraged.

Tip #1: Tweak & adjust

Every budget needs to be tweaked in the beginning. No one gets it 100% right the first month. You’ll maybe have forgotten about an expense, or you’ll have underestimated how much you actually spend on dining out.

Whatever it is, learn from your mistake and do better next month. That’s it, no regrets or hating on yourself; it’s okay, everyone screws up.

Tip #2: Pay for things one way

It’s so much easier to track your spending if you use only one form of payment (two max). Think about it, if you pulled out cash from the ATM, used Venmo to pay back a friend for coffee, used your credit card for groceries, debit for gas, and on and on. How confusing is it to track? Very. Keep it simple.

Tip #3: Use it consistently

I mentioned this above, but it’s so important I want to repeat it. Your budget binder printables can help you stay on track… but only if you use it consistently. At a minimum, use it once a week. But it’s better to use it every few days.

If you only used it 1-2 times a month, then you wouldn’t know if you were overspending, so you wouldn’t have time to course-correct things.

So don’t bury it on a bookshelf; keep it on your kitchen counter so you can easily access it.

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

What are the benefits of using a budgeting binder?

There are many benefits of using a budgeting binder- It’s easier to get your finances under control when you have all your financial information in one place; it is much easier to see how much money you have coming in and going out. You can make informed decisions about where to cut back and how to save more money each month.

Getting a binder together means you will never lose your budgeting printables, and you can always refer back to them when need be.

Besides, making a budget binder is kind of fun, and using it is much more of an “event” than just figures numbers in your head. That means using a budget planner gets you into the right headspace.

Do you like budgeting spreadsheets better?

Tiller Money consolidates all your financial information into a handy dandy spreadsheet (sheets & Excel) that you’ve customized to show exactly what you want to see (and nothing that you don’t).

You’ll have a lovely, super simple spreadsheet, exactly how you like it. The best part is that it automatically updates daily, so you know you’re using accurate figures when spending and saving during the day.

They have budgeting and saving templates ready for you to use if you just want to jump in. They even have a great tutorial library on YouTube to help you customize things.

They offer a free 30-day trial for Tiller Money, so you have nothing to lose!

Other fun sheets to add to your budget binder

With the above free budget printables, you’ll have everything you need to get budgeting right now. But sometimes, some printables might be fun to have. Some extras that help make your goals clearer or make budgeting more fun.

At the end of the day

As you can see, budgeting doesn’t have to be complicated. You don’t need a ton of fancy apps and programs- just some simple tools like this free printable budget binder will do the trick!

I hope it helps take your finances from where they are now to where you want them to be in no time. So what are you waiting for? Grab these free printables right now so that you can start building up your own budget binder today!