8 Simple Steps to Setting up Your Foolproof Bi-Weekly Budget

Struggling with not having enough money at the end of your month? It’s time to try bi-weekly budgeting!

Author: Kari Lorz – Certified Financial Education Instructor

Are you struggling to budget your money each month?

Biweekly budgeting can be a more effective way for those who are paid every two weeks to budget their money. This method ensures your bills aren’t stacked back to back, so you don’t run into “too much month” left at the end of the money.

We’ll go through how to set up your own bi-weekly budget and start seeing your hard work pay off!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

How to set up bi-weekly budgeting (short answer)

- Step 1. List all your bills, amounts, and their due dates

- Step 2. Write down your paydays and bills on a monthly budget calendar

- Step 3. Do you need to spread your bills out? Call your lenders

- Step 4. Create budget categories for spending

- Step 5. Write out the first two weeks’ income & bills

- Step 6. Repeat for 2nd half of the month

- Step 7: Track your spending

- Step 8: Analyze & adjust

What does it mean to get paid biweekly?

If you are an hourly employee, the odds are good that you get paid biweekly. This means that your employer pays you every two weeks, as opposed to once a week or once a month. While getting paid more often may sound like a good thing, it can actually make making a personal budget more difficult, as our bills are typically due monthly.

In one year, there are…

- 12 monthly pay periods, or

- 26 biweekly paychecks, or

- 52 weekly pay periods

Why would you want to budget bi-weekly?

If you find yourself struggling to make it to the end of the month on your current budget, biweekly budgeting could be a way to help stretch your money further. When you get paid biweekly, you can use what’s known as the “paycheck budgeting method” to help ensure that your money is more evenly spread out over the month.

How do you budget if you are paid biweekly?

There are seven steps to get your bi weekly budget set up. But don’t worry; you only need to do some of the steps once, and then with each new month (and pay period), it gets easier and easier. Let’s go through the steps together.

Step 1: List all your bills, amounts, and their due dates

Some examples of monthly fixed expenses are…

- Rent or mortgage

- Car payment

- Insurance

- Internet

- Utilities – water, gas, electricity, sewer, etc.

- Phone

- Subscriptions – Disney+, Hulu, meal kits, etc.

Now, list when your credit card bills are due and their minimum payments.

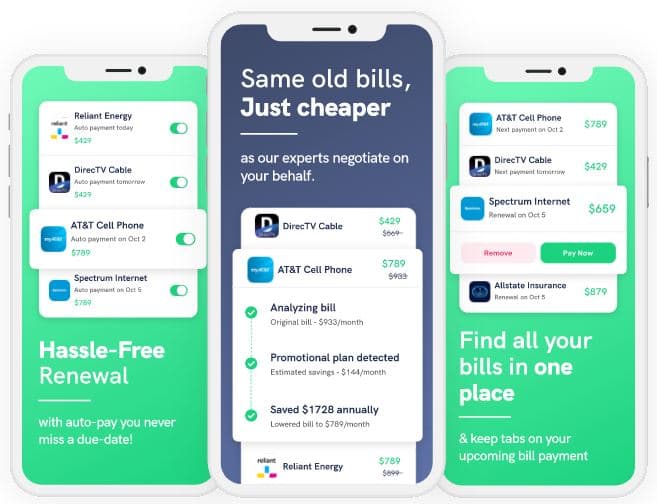

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

Step 2: Write down your paydays and bills on a monthly budget calendar

It can be helpful to print out a blank monthly calendar (get your free calendar budget template with our free budget printable pack) and plot your bills and planned expenses out. Looking at your money this way (visually spaced out) is a huge help when doing bi-weekly budgeting.

Note: With the calendar below, we get paid on the 1st and the 15th of the month. I leave a few days in between deposit and when the first bills are due as a buffer (in case of weekends/holidays delay anything).

Here’s an example our how my calendar looks.

Don’t forget about your annual expenses like your Amazon Prime subscription or bi-yearly expenses like car insurance.

Step 3: Do you need to spread your monthly bills out? Call them.

Each month has two pay periods (usually), but there are two times a year when you get paid three times a month.

According to Grow, “The months in which you take home three checks depends on your pay schedule. If your first paycheck in 2022 is scheduled for Friday, January 7th, your three-paycheck months will be April and September. If your first paycheck in 2022 is Friday, January 14th, your three-paycheck months are July and December.”

But let’s focus on when you get paid twice a month, as that’s the most common.

Take a look at your calendar, are all your bill due dates shoved up in one pay period? Now, it’s not necessarily the number of bills but the total amounts in each pay period.

So if in the first two weeks you have $800 in bills due, and in the second half of the month you have $200 due, then that’s bad. That’s making it so that most of your money is spent in the first half of the month, and then you have very little leftover for the rest of the month.

You’ll want to call some of your bill companies and see if they can adjust your monthly bill cycle and/or bill due date. Some companies are flexible, and others are more rigid. Some companies let you choose from a few options, while others let you pick any due date. This includes your credit card company.

Since we get paid monthly, I have my credit cards close their billing cycle on the 1st of the month. Because you can’t have them close on the 29th, 30th, or 31st as not all months have those dates. This ensures that all our spending falls into the month that the money is budgeted.

Don’t get too obsessed with this; just get the closing dates as close as possible to match your planned budget.

Step 4: Create budget categories for spending

You’ll want to start by creating categories for all your spending. Because just like with your bills you don’t want to spend all your money in the first period.

Here are some categories to consider (no need to get too specific here)…

- Groceries

- Fun money – dining out, hobby stuff, new clothes, etc.

- Gas/transportation

Here is a huge list of budgeting categories and line expenses; take a look at the list to jog your memory to make sure you do not forget about any expenses.

Don’t forget to plan for your savings buckets (aka sinking funds). Here, you’re proactively saving for things you will need later on (i.e., new tires for your car, repair $ for your home when something breaks, Christmas fund, and even vacation).

Step 5: Write out the first two weeks’ income & bills

The key to success with bi-weekly budgeting is knowing exactly how much money you have to spend every two weeks.

This is why this budgeting method is easier to stick to. You have less time to spend money without realizing you’ve overspent, which means you’ll spend less overall.

I know that sounds a bit confusing, but think about it. If you’re prone to overspending, having a shorter timeline means you’ll be more aware of where you’re at financially because you have to check in with your money twice as often.

Now, let’s get back to your budget form. You’ll need to take your first paycheck income minus your bills in the first two weeks and what’s leftover is for your saving & spending.

Yes, you should absolutely be working a savings plan into your biweekly budget. If you haven’t saved much before, start with 5%, and then try and work up to saving 15% – 20%.

Ideally, 10% of your savings should go into your emergency fund, with the leftover amount into your sinking funds (use cash envelopes or a savings account). Once you fill up your emergency fund, consider opening an IRA to help your retirement savings.

Then after your savings, is the spending categories that you came up with in step 4. Divide them up reasonably. Yes, the numbers will look very small, as it’s half of what you normally look at when doing a monthly budget.

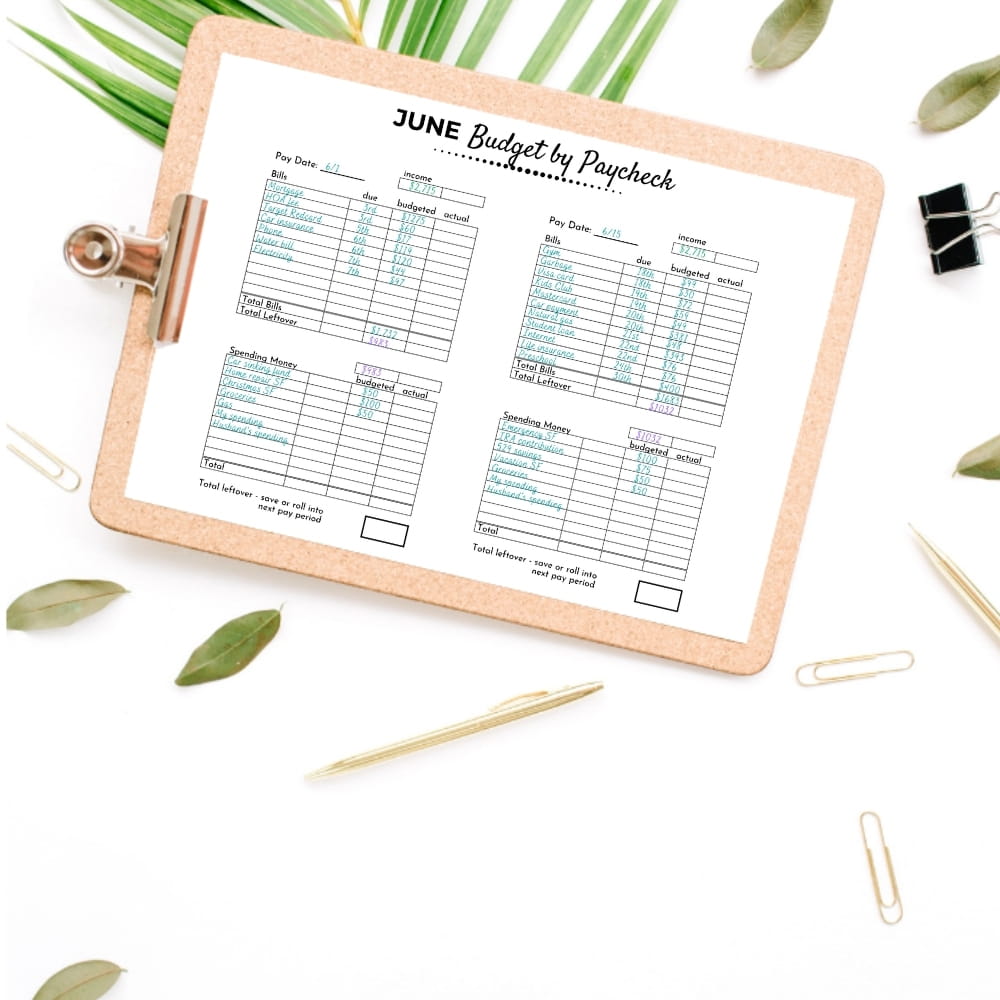

In the picture below, this person has gone through and planned most of their month. They’ve done their bills and their sinking funds. Now all that’s left is to allocate their discretionary income (i.e. variable expenses).

Step 6: Repeat for 2nd half of the month

You’ll want to do the exact same thing for the second half of the month. The only difference is that you might have a bit more/less money if you over or underspent during the first two weeks of the month.

But if you have extra money, that doesn’t mean you need to spend it. Consider adding to some sinking funds to help you save up faster for your big purchases!

Note: You may want to write out the 2nd half of your biweekly budget in pencil. As after the first two weeks of the month are up, you’ll want to audit your spending and adjust budget amounts in the 2nd half. You may need to cut back on some variable expenses.

Step 7: Track your spending

Your careful monthly budgeting won’t work unless you spend less than you make. To make sure that happens, you need to track your spending. I track mine in excel, but you can use a super easy printable. Yup, I got you covered; you can grab your free printable bill tracker and expense tracker right here.

This is the hardest part of the whole “budgeting process,” and I hate to mention it, but it’s the obvious white elephant in the room. So many of us overspend without even realizing it. How do I know?

The Motley Fool reports that “the average American spends around $7,429 more than budgeted each year, the Slickdeals survey found. That’s a lot of dough, but it breaks down to about $20 per day. In other words, all it takes is spending an extra $20 at the grocery store or splurging on popcorn and candy at the movies to ultimately end up overspending by thousands per year.”

If you know this is where you struggle, don’t worry; we’ve got a (not so) secret weapon for you. It’s using the cash envelope budgeting method! And yes, you can easily combine cash envelopes with the bi-weekly budgeting method.

Using cash envelopes forces you to stop spending. Because when the envelope is empty, you literally can’t overspend!

Now you only need to use envelopes for your discretionary spending. Your regular bills can be put on your credit card or deducted from your checking. So you’ll probably want an envelope for…

- Gas for your car

- Groceries

- Dining Out

- Fun money

- Clothes

- Health & beauty items

- Whatever you normally spend, that’s not a bill

Step 8: Analyze & adjust

The final step is to evaluate how the previous pay period went and make adjustments to next month’s budget plan. Odds are there’s something that didn’t go quite as you expected (either good or bad).

Everyone has to tweak and adjust their budget, especially during the first three months. So don’t feel bad if you didn’t nail it on the first go.

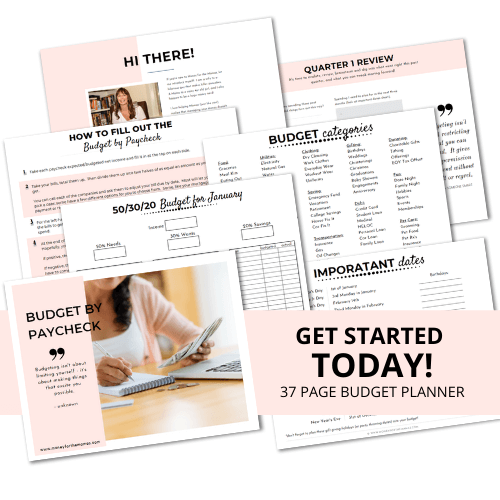

Bi-weekly budget template

I know it’s helpful to see things in action (I learn best by pictures or watching YouTube videos), so here is a picture of the bi weekly budget template form in my bi-weekly budget planner (aka budget by paycheck planner).

In the planner is…

- How-to instruction guide

- Two pages of potential budget categories

- Page of holidays and important dates for you to remember

- A monthly bill payment calendar for each month

- A budget form for each month

- A quarterly review sheet for each quarter

Tips for biweekly budgeting

Of course, we have tips for you! Any type of budgeting has its nuances and tricky sections, so we’re here to help you be as prepared as possible.

1. Get organized

Get all your financial information in one spot. Making a budget binder is a great way to set yourself up for success. Plus, it’s fun – okay, maybe nerdy fun but still. Grab all of your money info, get some fun budgeting stickers, and get everything organized, so managing your money isn’t a huge headache right off the bat.

2. Don’t forget to include a buffer in your budget

It’s always a smart idea to give yourself some wiggle room. No one’s perfect, and you will overspend accidentally. By including a buffer in your budget, you can account for those little overspends so they don’t throw off your entire budget. Depending on your habits, it can be anywhere from $10 – $30.

3. Move your due dates around

Calling your credit card and utility companies sound weird, but it is completely okay. You can oftentimes negotiate your due dates so they fit better into your biweekly budget. This will help you a ton, as you won’t be scrambling to pay a bunch of bills at once.

4. Set up a cushion

If you get paid biweekly, you are most likely on hourly pay (an exempt employee). This means if you get sick and miss a bunch of work for some reason, you will fall behind on your bills.

Don’t let this happen. You should work it to have a buffer, a safety cushion of some sort. So maybe you work some extra shifts or do a no spend challenge to help save up a bunch of money to cover just in case. Maybe try and get three work days of income set aside just in case.

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

FAQ’s on biweekly budgeting:

How much should I save biweekly?

This answer will be different for everyone. It depends on your income, debts, bills, and goals. A good place to start is 5% of your take-home pay, and then try and work up to saving 20% if possible.

How do I budget for three paychecks a month?

If you’re paid every other week, you’ll have three paychecks some months. You can either use the extra money to bulk up your savings or plan ahead for future large expenses, like filling your Christmas savings fund, filing your emergency fund, or saving up for a big vacation. Better yet, use that extra paycheck to pay off your debts and get clear from wasting your money on interest.

Is it better to budget biweekly or monthly?

This answer is different for everyone. You need to figure out which system works better for you and your family. If you find it hard to stick to a monthly budget, then biweekly budgeting may be a better fit. However, if you get paid monthly, then monthly budgeting will probably make more sense.

Cons of budgeting biweekly paychecks

There are a few cons to budgeting biweekly, but they are minimal.

Firstly, setting up the biweekly system takes some time and brainpower. But this can also be a positive thing, as it will “force” you to learn how to manage your money better.

Secondly, some people find looking at their budget so often creates more anxiety. It’s important that you find a system that works for you and that you’re comfortable with it; while still meeting your financial goals.

Don’t ignore your money, but you should ease into stretching your comfort zone with money. No one did any good by overwhelming their brain.

How many times a year will I get paid three times a month?

Two times a year, you will get paid three times a month, but the actual month differs depending on when your first paycheck of the year occurs.

Can I still use my 50/30/20 budget method or my zero-based budget system?

Yes! You absolutely can use those methods inside a budget by paycheck system.

For the 50/30/20, you’ll simply cut those three category amounts in half and base your spending categories accordingly.

The zero-based budget method is the same process, just with smaller dollar amounts.

At the end of the day

Biweekly budgeting can be an effective way to manage your money, especially if you are paid biweekly. This method allows for more frequent check-ins on spending and also helps to keep track of bills that need to be paid throughout the month. By getting organized and including a buffer in your budget, you can easily ditch the feeling of struggling paycheck to paycheck.