20+ Money Saving Challenges Try This Year to Save a Ton of Cash!

Here are 20+ fun money saving challenges to make saving money more fun than spending money!

Author: Kari Lorz – Certified Financial Education Instructor

I am very competitive with myself! I love to push myself to take on new things or to do things better than before. That is why I love these fun money-saving challenges!

Seriously, I love them, and I force myself to be creative with finding free things to do; I surprise myself with my determination to succeed. Sometimes, being proud of myself is the best thing I could have asked for.

Let’s go through the most popular money-saving challenges and see which will be the best for you!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What are money saving challenges?

Money saving challenges are when you try and either save as much money as possible or save a predetermined dollar amount. Sounds fairly simple. It’s simple to understand because it’s basic math, namely subtraction, and the goal is to subtract as little as possible.

YET, doing these challenges can be very difficult, which is half the fun, right? If it were easy, we’d all be a money saving ninja!

1. The No Spend Challenge

Doing a no-spend challenge is by far my favorite type of money saving challenge because it’s so clear, just don’t spend anything. Ha! Some of the challenges listed below are less restrictive, but they have you save random denominations, which you then need to withdraw to set aside.

In order to succeed with a no spend month, you need rules in place, because there will be times where you have to spend something.

Yes:

- gas for your car

- necessary groceries: dairy/produce/meat

- mortgage/rent

- utilities

- insurance

No:

- date night out

- coffee shops

- happy hour or lunches out

- paid activities

- uber/lyft

- beauty stuff

Doing a No Spend Month is also a great way to help clear out your freezer & pantry! You know, the can of artichoke hearts and the frozen tilapia fillets that have been in there forever! I talk about how this monthly no spend challenge fits into saving money on groceries, and if you can clean out old items that are just taking up space then that’s a double win!

I did a no-spend month a little while ago, and it was fun! Seriously, I loved it! I turned my kitchen refrigerator into No Spend Central by putting a bunch of challenge printables up on there to help me keep track of what I spent, how much I saved, and so on.

I also did a weekly review sheet, where I looked back and analyzed if every purchase was truly a need, and then I gave myself a trade on how I did. You know, A, B, C, D, F, just like in school. I will admit I did give myself a C one week.

Doing this helped me to make better decisions (and plan ahead better) the next week. Who knew you could get graded for spending money? 🙂

You can absolutely make your own money challenge forms, just grab a pencil & a ruler and you’re all set. However, if you just want to get straight to it you can grab all 14 of the money savings challenges here in the shop!

No Spend Weekend

If the thought of not spending any fun money for a month terrifies you, then breathe, you can still do a no spend challenge! Try it just for a weekend; if that goes well, then try it for a week, and work your way up to a full no spend month.

Things to do for free on a no spend weekend…

- couch movie night

- go for a run or nature walk

- explore your city on foot

- play board games

- read the book that you’ve always been meaning to!

- write a letter to an old friend

- DIY spa day (you know you have stuff in your bathroom cupboards for this!

- plant a garden (or some porch planters)

- go to the library

- go to your city park

- clean out your closet (and sell your unwanted clothes)

- work on your hobby

- do a puzzle

- bake some treats!

- call your mom

2. 52 week money challenge

Let’s say that you have a pretty lofty financial goal, maybe a fully funded emergency fund, or enough for a killer vacation, or money for a new back patio remodel. Whatever you want money for, this 52 week savings challenge idea is only for the committed!

Your savings plan each week is either the exact same amount or it’s varied to make it more of a challenge. And a typical savings goal for one is either $1,000, $5,000, or $10,000, but you can really pick anything.

Just a tip, for this one, you should really get a visual chart or checkoff sheet so you can see how far you have come to help keep you motivated.

3. Holiday Helper Fun

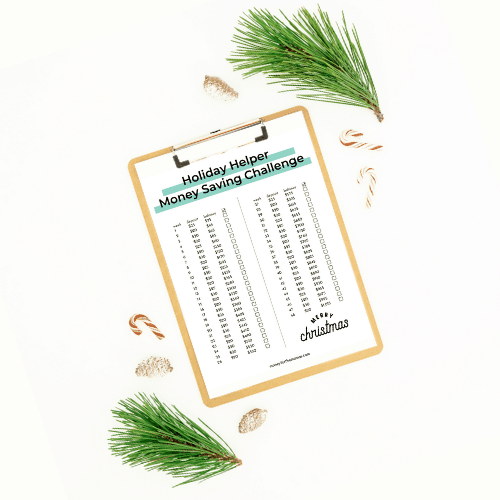

I do this every year, and it totally works. Starting January week 1, I plan to set aside $20 in weekly savings for the holidays (it’s a very specific kind of 52 week challenge). This way, I can save for Christmas dinner, stocking stuffers, and presents. By the time Black Friday rolls around, you will have saved $1,000!

I withdraw this cash and stick it in an envelope, then when it gets to $500, I go and buy a Visa gift card, so it’s easier to carry around come December. If you buy a Visa or Mastercard gift card, be sure to look at the fees associated with purchasing and using it, as some charge per use. The one I get is just a $5.00 fee to purchase and load.

Now some weeks I’m not able to save the $20. One time I didn’t contribute for two months as I went to the chiropractor for a bit, which was over my insurance limit. Oh well, I still did pretty well.

You want to be done saving money for Christmas by Black Friday because you’ll want the last few weeks to go and buy your holiday gifts, I don’t want you to time it to close so you are scrambling with presents.

Also, on the one I show here, one time a month I saved $25 (instead of $20), that’s so there is $1,015 total saved, that last $15 is for you to go get something to celebrate your amazing accomplishment! Grab a fancy coffee and a treat and just sit and relax and be proud of what you have done!

Half Year Holiday Helper

Now a half holiday helper is designed for you to start at Christmas in July, which is July 25th, the official 6 month mark until the big day! This is the perfect day to sit on the couch, with the AC cranked and watch a Christmas movie and make some general plans about the upcoming holiday, namely your budget!

4. $1 bill save money challenge

This is a great option for smaller budgets, you just save all of your $1 bills. Or if you’re saving for a smaller goal, say $200 or less. Now, you can’t cheat and ask for specific change at the register; this one is all up to chance?

This is also a great challenge for your tween! They save up their hundred (no time limit) and then once they reach it they can spend some of it, and put some into savings. A double win!

5. $5 bill challenge

This is similar to the $1 challenge above, but it’s a bit of a harder pill to swallow as stashing away $5 is a bit harder. Yet, you get to your goal a lot faster!

6. Spare change money saving challenge

Most of us are already doing this, but the spare change challenge is great for those with a tight budget. Or one for kiddos to help with, as they can easily see the money adding up in a clear mason jar or a vase. Check out the bottom of this post for piggy banks just for kids!

- IDEAL FOR: These clear jugs are ideal for home brewers, brew pubs and breweries. Great for fermenting small batches of beer, wine, kombucha, lemonade, tea, juice, milk, water and much more!!

- Style: The wooden bank features a sleek white design and screen printed “Our Adventure Fund” design on the glass front.

- ✔ Ideal Capacity – The 8″ H x 5″ diameter medium piggy bank is an ideal choice for first timers to start a money saving challenge or for the parents to teach children about fall and harvest.

If you want to save for a few different things at one time then grab some good old-fashioned mason jars! There are lots of sizes (and case count), so you can grab just what you need. Don’t forget to grab some labels and coin lids, but be sure you get the right size lid for the right sized jar!

- Ball Pint Mason Jar, Regular Mouth, 16 oz (3 Count)

If you usually pay with plastic, then consider trying Acorns it’s an app that lets you round up your transaction to the nearest dollar, and it takes the difference between the price and the dollar and invests it. This one is great if you’d like to start saving for retirement! There are $1 a month options, as well as $2 or $3 a month with added features. This is a GREAT tool for beginners or investing skeptics.

Get a free $10 bonus when you sign up with this link.

7. Penny savings challenge idea

I know this isn’t the flashiest sounding money challenge because, well, saving a penny isn’t that impressive. But this is a GREAT option to build a savings habit! And our life is decided by our habits! Plus, at the end of the penny challenge, you’ll have saved $667.95! Now there’s something to celebrate!

It goes like this…

- Day one: save $.01

- Day two: save $.02

- Day three: save $.03

- Every day: save an additional penny

- Day 365: save $3.65

Now the hard part will be finding enough pennies. A few times during the year, you may want to go in and trade your pennies for dollars to make enough pennies available. (Or as the savings progress, you save nickels, dimes, dollars, etc.)

8. Hobby swap money challenge

Now this one doesn’t directly deal with money officially, but you do save money. Think of the hobbies that you currently do? Crafting? Does your husband tinker on motorcycle engines? Figure out how much money you spend a month on these hobbies, and then swap this hobby for a free one that you’ve either been meaning to try or get back into. Such as reading books from the library, going hiking, or riding bikes.

Maybe you have a stockpile of crafting supplies, but you usually buy new stuff? Commit to going through what you have to sell it and make some extra cash, or possibly trading your old stuff for new items.

9. Join a community to save money

Many neighborhoods have a Buy Nothing group on Facebook, search out, and join yours. Ask for items that you’re looking for, and then be generous in turn. Make it your goal to buy nothing for your hobby for 6 months!

10. The Dollar Store swap

If you haven’t been to a dollar store, then you’re in for some fun! Your goal with this one is to go to a dollar store and find four items that you would typically buy at a Target, let’s say and then commit to only getting items for a dollar.

For example, greeting cards at Target can average $4 or $6 a pop, but at the dollar store, they are $.50 each! Or other things like aluminum foil, seasonal decorations, cheap sunglasses for during yard work, coffee mugs, etc.

Now be careful when you walk in; you may be tempted to buy a ton because everything is cheap, just DON’T! Walk in with $5 cash and call it a day! Also, please manage your expectations on quality, don’t expect these items to last a long time.

Another hard money challenge that people like is the 100 day envelope challenge. You can save $5,050! Yup, you guessed it, in 100 days! It’s challenging, but that’s why it’s fun!

11. Generic swap money challenge

If you’re not into going to the Dollar Store then consider this tweak. Whenever you buy a category of something (like cereal, or pain relievers, or soup, etc) Then buy the generic version (or store brand) instead.

You can save a lot of money by not being brand loyal, as brands spend a lot of money on advertising, packaging, and so on which increase the price. Generics don’t need to do that, so they can keep the cost of the item low.

Besides, many manufactures put many different brand labels on the exact same item. Look at the ingredient list to see just how similar generics vs. brand names are!

12. Cancel it!

Do you subscribe to Netflix or Hulu? Cancel it and get your screen time fix from the library, there are so many good movies and shows available, all for free! MarketWatch has an amazing online calculator to figure out the true cost of your online streaming services (hint: it’s scarier than you could ever imagine!) Be ruthless with you other subscriptions too! Aim to cut 25% of them.

Remember you can grab all 14 of the money saving challenge printables here in the shop so you can start your challenge right now.

13. 1% money challenge

This challenge is something that you know you should have done a long time ago! Here’s your chance. Go into your workplace and either up your 401(k) contribution by 1% or start contributing (many places have a minimum level at 3%). Then in two months go back and up it again by 1%

If you want to save money but not in a retirement account, then figure out 1% of your gross pay, and then automatically transfer that into a special account, or withdraw it and stick it in a savings envelope in a safe place. Do this either once a month or better yet, once a week!

14. $1+ a day money challenge

Sorry, this one isn’t a flat one dollar a day; that’s a bit too easy (maybe good for a tween), but with this one, you start on the 1st of the month with $1, then on the 2nd, you up it by $1 to save $2 that day, and then on the third, you save $3. So by the end of four days, you have saved $10. And by the end of a month (30 days), you will have saved almost $500! Hot damn!

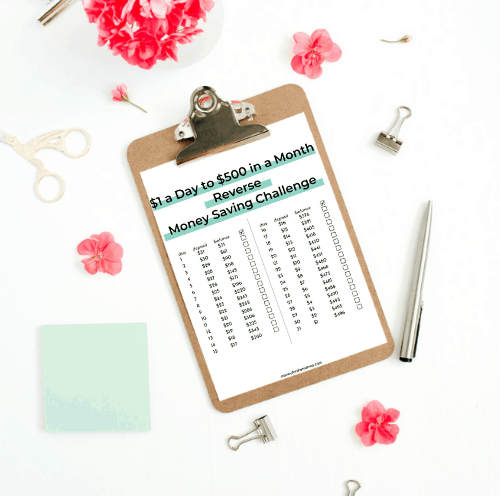

15. $1 a day reverse money savings challenge idea

For those of you where there always seems to be too much month and too little $ then take the above challenge and reverse it. Start with $30 a day, then go to $29, then $28, and so on. So it gets easier as the month goes on and you’ll still have saved $496 that month (for a 31 days month).

16. The luck of the draw!

This is a great family fridge activity. Write down 52 sets of money denominations in a grid style format. Pick anywhere from $.50 to $50 (yes you can repeat numbers). Then each week aim to save one grid (make it a random layout).

Maybe your kids get to choose which amount, and you as the parents then are in charge of the doing. When you’re at the store when the little ones want XYZ toy, you can remind them that they picked the $28 goal for that week, and you want them to get the gold star.

To get kiddos in on this, maybe turn this printout into a connect four competition between them and their sibling, so one child is one color to circle the weekly goal with and the other kiddo is another. The first kid to get five circles in a row can go out for ice cream or stay up until midnight and watch a movie. Whatever you think will be motivational for them. ? (I’d be motivated by being able to go to bed 2 hours earlier, but that’s just me!)

17. Pantry/freezer clean out

This one is good as it kills two birds with one stone; not spending a lot on dinners and cleaning out your pantry; so a pantry challenge so to say. For this, I take an inventory of both freezer and my pantry, and then I take an afternoon and meal plan.

Depending on how stuffed each area is, this could last a few weeks or a month of me cooking four dinners a week (when I cook, I plan for leftovers). For this, I do allow myself to buy fresh produce and dairy to round out the meals. But the meat I usually have frozen and enough dry goods (rice, beans, pasta) are in the pantry.

18. The bi-weekly money saving challenge

This is an excellent option for those that get paid every two weeks. Depending on how much you want to save, you randomize your amounts. For example, if you wanted to do a $1K biweekly money saving challenge, you’d alternate between savings $10 – $60 every two weeks. You just need to make sure that at the end of the year, it = $1,000.

There are 26 savings periods, so during period one save $10, then the next savings period you save $30, and then the next it’s $20, and then the next it’s $50 and so on.

You can do a biweekly money challenge in any total you want, but make sure your contribution day is the day after payday! Don’t delay because the longer you wait, the less money your account will have, and then the less likely you feel you can do the challenge.

19. The habit change money challenge

You’re a great person! No really, you are? Yet maybe you have a small habit that you want to give up? Now’s your chance to put some oomph behind you!

Let’s say you always go to Starbucks in the am and get coffee. People always “say” make your coffee at home, you know this. Yet, you still love some salted caramel mocha, grande please! That’s $4.95 a pop (+ tax).

The thought of trading this in is tough, but you know you “should” because it would be better for your waistline. Yup that $4.95 wallet drainer also has 53 grams of sugar. That’s the same amount of sugar in 11 Oreo cookies. Ugh.

Okay so if you saved $4.95 every workday, that’s $25 a week, or $104 a month. Taking out 2 weeks for vacation & sick time, that’s $1,250 a year. Let’s say you buy supplies for at-home brewing, hen let’s round it out to say you’ve netted an even $1K.

Hint: If you invested that $1K every year, and do so for 20 years and get a 7% interest rate (very broad average here) you’d have about $47,000!

Do you have something you’ve wanted for a long time that costs about $1K? I bet you do! For this challenge, you can use anything that you want to give up, cigarettes, Netflix binging (aka cancel subscription), Target Dollar spot items, etc. Just get an idea of the cost, and then let your calculator do the rest!

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

20. The surprise money saving challenge

This challenge works great for couples! You essentially save whatever money is in your wallet on a surprise day. Each person (either in the couple or the family) gets to pick one day a month that they deem “surprise savings day.” That means whatever in your wallet gets saved!

So one afternoon, text your hubby with “Surprise Save Day’ and you take the money out of your wallet and put it in your savings jar/account, etc. Now you both need to accept that whatever that money was originally intended for is gone. So if the money in your wallet was for a dinner out that night, then embrace the surprise with good humor and grace!

Fun money saving challenges just for kids

21. Preserve your present

Kids may often get money as a present, make it a challenge to save a portion of it! For example, grab three jars and make one for spending, one for saving, and one for giving! This is great math practice and also encourages kindness by giving/donating.

This can also be done with allowances too!

22. Save your Abraham Lincolns

If you have multiple young ones, consider giving each of them a coin denomination to find and save. You can also make it educational by learning about the President that is on their coin.

- Penny – Abraham Lincoln

- Nickel – Thomas Jefferson

- Dime – Franklin D. Roosevelt

- Quarter – George Washington

- Half Dollar – John F. Kennedy

To make it “fair” maybe change up who is looking for which coin each month.

Piggy banks for kids

If you want to make a money-saving challenge seem like an important and big deal to your kiddos you should check out some nice, and inexpensive (of course), piggy banks. Here are a few below that caught my eye!

- A PERFECT GIFT: This money box as a gift of great significance can help children establish the awareness of saving money from an early age and teach them the concept of saving money.

MOMMED Piggy Bank Digital Coin Bank

This one is perfect for kiddos learning to count money. They can sit at the table and count certain coin denomination, add it up, and then insert it into the bank, and they can see if they are right! All while you cook dinner or pay your bills!

- ★【Perfect Gift for Kids】:Saving is fun with this piggy bank for girls and boys. An adorable way to save your baby’s first coins. This is the perfect gift. Adorable addition for your baby nursery, it is a great gift for Christmas, Easter, kid’s birthdays, and more.

Not just for kids! This comes in three color choices; white, blue, or pink! Call me crazy, but I really like that it is ceramic because you hear that jingle-jangle of coins when you shake it! Yes, even as an adult, this sound is awesome!

- Interactive toy piggy bank with 40+ songs, sounds and learning phrases for infants and toddlers ages 6-36 months

Fisher-Price Laugh & Learn Smart Stages Piggy Bank

For the youngest of kiddos here is a great way that they can not only play along but learn as well!

- 40+ sing-along songs, tunes & phrases

- Includes Smart Stages technology – learning content changes as baby grows

- Two levels of play offer fresh songs, phrases & sounds for your little one’s age & stage

Why do a money saving challenge?

Sometimes the sheer act of doing a challenge is fun, to prove to yourself that you CAN do these things. That’s not to say that you can only do them alone, doing it with your spouse/kids can be just as fun.

Habit reset

Sometimes your spending habits may just need a reset. When you find you’ve been a little too lax in the coffee shop spending, or that your waistline says you need to buy fewer chips at Target. Whatever the habit, this can be a good kickstart to a better you!

Doing a money challenge can help you identify what is truly a need, and what is just a want, that you could (and maybe should) do without.

You need to save money for an upcoming expense

Is your family planning on going to Disneyland and you need a bit of extra money in your vacation fund? Fun saving challenges can be a great way to add some cash to help you have a fun and worry-free time. It’s hard to relax on vacation if you’re worried about how you will pay for it all.

Filling your savings account doesn’t have to be for something to buy, you can also fill your emergency fund, or reach a certain savings goal. Whatever it is you want to save for a fun money saving challenge can get you there!

Start a new habit

You know you need to start saving money for retirement/college/whatever, yet you’re not sure if your budget can handle the loss of funds. Doing a money saving challenge is a great way to see if you can live on less.

Bring the family closer

Maybe you’d like it if your family did more engaging things together. Say doing a puzzle together with your daughter in your family room instead of going out to a movie and mindlessly munching on outrageously priced popcorn. Now I like me some movies, but sometimes you want a little bit more quality time.

Fun saving challenges can also be a great way to teach your children about discipline and patience, working hard towards a goal. Whatever their age, they can benefit from learning about good work ethic.

Now that doesn’t mean that your four-year-old doesn’t get her favorite raspberry bar snack because it’s not a “need”. Yet maybe she participates by doing a “eat your veggie” challenge, or a “pick up your socks” challenge (hmmm… maybe my husband should do that one) ? Be creative and give your kiddos a chance to participate in some way.

Besides, there are lots of ways to keep your kids happy & having fun without breaking the bank! You just need to plan ahead a little bit.

Note: A money-saving challenge typically carries a time frame with it. If you’re not into having deadlines and you just want to track your savings be sure to check out Savings Charts for Supercharging Your Money Stash. These don’t have any time constraints, and you can start whenever!

How to stick to your money saving challenge

Now I’m not going to lie and say that these are all easy like I said above, if everyone could do it then America wouldn’t be in debt by a record-breaking $22,000,000,000.00. Yup, that’s a lot of zeros, that’s $22 Trillion! (source)

Let’s talk about tactics & strategies to help you and your family succeed with a money saving challenge…

- Make it a competition: see if you can get your office friends on board, or your girlfriends, r even just between you & your husband. Keep it light; keep it friendly, remember to support each other!

- Know your goal: What are you saving for? What will keep you going when it starts to get rough?

- Track your progress: If you don’t have to report back to somebody (even if it’s just to yourself), then your progress may become a distant memory. Write it down. Whenever I do challenges, I make it super visual; be it on my fridge or on my bathroom mirror. Read about how I turned my fridge into money saving central in the post below…

RELATED: How to Stay Motivated While Saving Money

- look ahead: Before you start your challenge make sure that you’re not going to run into any road bumps that could derail you (aka birthday parties, holidays, events that would lead you to spend more, etc.).

- Know your triggers: If you know that whenever you are bored you go to Target to grocery shop, and get sucked into the Dollar Spot, then it’s time to check yo’self! Don’t go to Target, go to Winco instead where you won’t be tempted to buy nonnecessities

- Lay out the rules beforehand: Be painfully clear with yourself and your family about what is and is not “allowed” during your challenge

- Make it easy to succeed: Or in other words make it hard to spend money; take your credit cards out of your wallet, clear your saved passwords from your favorite shopping websites, clear your browsing history so you can’t go back to that shirt you were looking at. Another helpful tip is to unfollow favorite stores on social media, as the less you see, the less you will be tempted.

At the end of the day

Doing some fun money-saving challenges can be a great way to not only save money but to challenge yourself and push your preconceived limits. They can be fun, yet they can also bring some stress at times.

Remember that this isn’t life or death, and always offer grace (especially to yourself) if you fall off the money wagon. But you know what? You’ve got this, and I can see the gleam in your eye; you are going to crush it!

Articles related to fun saving challenges:

- How to Stay Motivated While Saving Money

- Know Your Spending Triggers (and how to kick them to the curb!)

- Savings Charts for Supercharging Your Money Stash

- Want to Save A LOT of money? Do a No Spend Challenge!

- My (Mostly) Successful No Spend Month – and I saved a ton!

Boy what a great time for this article. We are a Dave Ramsey family so this article really hit home of how we did one small step at a time to accumulate an emergency/pandemic fund. I love how your article took a not so fun subject (money) and incorporated fun challenges to remove the stigma the reader has to “buckle down” to reap the reward of money-saving.

So glad you liked it! I love it that you took away “removing the stigma”, so true!

It seems I’m better at money SPENDING challenges ?♀️

I like the idea of a “challenge” versus a “budget”. It feels more empowering.

Ohh, yes a challenge does sound more empowering! I agree! I’ll see if I can come up with a good spending challenge, I have a few ideas on that now that you mention it! 🙂

I am so terrible about money, if my husband wasn’t the opposite of me I think we would be broke lol. Thankfully Target is too far from us, it use to be 5 minutes down the road! I’ve saved some money from that ?

You are not terrible with money! I promise you’re not! You just need to find that “thing” about it that lights you up! Oh, Target is 3 minutes from my house, I feel ya!

Awesome tips. I love the save the dollar challenge. We sometimes add in dollars with our loose change in our piggy bank,so maybe i’ll step it up to the five dollar challenge!

A $5 challenge is a great goal! Go get ’em tiger!

This is an awesome list of ideas on how to save money!!! Well done! Pinning this for later, for sure.

Thanks so much!

Of all these, i just love the dollar store swap. Looking at those low prices is quite exhilarating. I am planning to take some of these challenges starting this month. Let’s see how it goes?

I went to the dollar store today! I got muffin mix for $1, and greeting cards for $.50 each! So fun! I hope you have fun with your saving challenges!

Great ideas,sometimes we just forget how easy it is to save money ! thanks for the great tips, very useful!

So glad you liked it!

You have so many great ideas. Our family has always been relatively budget savvy, but it never hurts to try something new to save for a fun excursion. Thanks for sharing.

So glad you liked the ideas! Something new always lends a bit of excitement!

Wow. These are fun ways to get the entire family involved. My biggee is the Starbucks run. Boy, I could save a bunch, letting that one go for a month. I just sent you an invite for my Pinterest Board, Life on a Budget. It is small, but I am trying to grow. I pinned this post, of course.

Ohhh Starbucks is a tough one to kick for sure! Now that its summer I love brewing my own cold brew iced tea! Caffeine + refreshing + inexpensive = win! (I’d love to join your Pinterest board, thanks!)

Great ideas to get the whole family committed to saving money!

thanks so much!

Fun ideas & challenges! I think my kids might enjoy some of these. Thanks!

Having the kiddos pick the random weekly $ amount savings challenge could be fun!

I was just discussing coffee buying and eating out with my SO last night! At work Fridays are “free days” as they call it. So nobody brings a lunch and they all eat out. Of course I had to put my two cents in about how much money is spent on these “free days” when bringing a lunch costs much less! I will definitely be recommending some of these tips to him, as well. Maybe I can get him to join the savings train right me! 🙂

Ohhh a little friendly competition with your SO might be fun! I agree a free day at work sounds like fun BUT no way would I do it on a regular basis! All that $ gone, with nothing to show for it but some greasy receipts 🙂 ha ha!!!

Some amazing ideas you have here. I normally spend notes and save the change if I can – it adds up!

Cara

http://www.caratigerlilli.com

saving change absolutely counts! 🙂

Great Roundup! I thought I knew all the fun challenges but there were several I had never heard of!

So glad you found some new ones!

Great article. Lots of great ideas on here. I do like #8.

#8. I love my Facebook Buy Nothing Group! This past week I got two separate items that were on my list!

Now… comes deciding which challenge to do first! I’m excited to try a couple of these challenges!

So glad you liked the post! I think the random $ amount weekly saver would be fun 🙂

All such good tips! Especially the coffee tip, I switched to making my own coffee and I have saved so much.

I too have saved a lot (and consumed a lot less sugar 🙂

Great ideas. I think these can be wonderful activities for families and will teach kids the value of saving.

Thanks! Yes, I love the idea of doing it as a whole family, so much more impactful for little ones when you do things like this together, and they can see you doing it.