The Absolute Best Way to Bank for Budgeting Success; it’s using multiple bank accounts

Using multiple bank accounts to budget is the best way to organize your money!

Author: Kari Lorz – Certified Financial Education Instructor

Everyone is looking for the magic ticket to budgeting success, and I am going to share it with you right now.

THIS is the thing that you need to do to set yourself up to succeed with budgeting.

There is no game. It’s super straightforward, yet most of us have never considered it before because we (as a society) have always done our banking a certain way. Yet, this traditional way isn’t helping us; it’s actually making things more difficult.

What is the magic ticket? It’s using multiple bank accounts for budgeting.

That’s it. Mystery solved. Now, I’ll show you how to use multiple bank accounts to fund all your dreams!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

Why do we need to use multiple bank accounts to budget?

Having multiple bank accounts lets you divide your money into different, easily distinguishable buckets. You give each bank account a name, so at a quick glance, you know that you have $567 for home repairs and $723 in your vacation fund.

There is no mixing those amounts up or getting confused about what each and every dollar is for.

Having multiple checking accounts sounds like it would complicate things, but it truly makes things so much easier! I promise!

With traditional banking, you have one checking account and one savings account. All your money is pooled together in those two accounts. You may have a written tally of what money is for what purpose, but with more money and over time, it can get confusing. Then whoops, you just spent your home repair money on your weekend away at the beach. Dang it!

With your money divided up, it is extremely obvious what the dollars are for. No confusion and no mistakes. Easy peasy lemon squeezy, as we like to say.

How to set up multiple bank accounts for budgeting

1. Find your bank

If you are happy with your current bank, then check online to see if they allow multiple accounts (almost all banks do!).

Then the most important thing is to see what their fee structure and minimum balance requirements are. If they charge per account, then it’s time to look for a new bank (or a local credit union). Don’t set up a great system with a spendy structure. That defeats the purpose and the benefits.

I have researched some great online banks (they’re all available nationwide). See more below.

2. Have a primary checking account

This will be where all your money flows in as the first step. You have two options…

- Ask your HR department if you can split your paycheck into different accounts. Usually, it’s just a form you fill out, where you say 50% goes to this account, 30% to another account, and 20% to another account. Then it’s already done for you.

- If your workplace doesn’t have this option, or you’re pooling paychecks from multiple places, have it all pool into your main checking, and then set up auto transfers to go into your separate accounts. Remember to give yourself a few days between payday and the transfer so it has time to clear accounts in case of weekends or holidays.

3. Write out your financial goals and see how many sub accounts you need

In addition to your must-have accounts, you need to identify your goals and support those goals with the funds needed to make them a reality!

Must Have Accounts:

- primary checking

- emergency fund

- house repair fund

- car repair fund

- retirement account (401k, IRA, etc, at a separate investment company)

Optional Accounts:

- vacation fund

- personal splurge fund

- kiddo fund

- pet care fund

- new car/house fund

- anything you want

If you don’t have a car (and don’t want one), then no need for that on the must-have list. If you rent your living space, then do still have a fund, but it may not need to be as big as someone who owns their own home.

These are your basic accounts. Now let’s talk about your goals and putting those goals into your optional sinking fund accounts.

If you’re not familiar with sinking funds, it is a way to pre-fund your purchases, planning ahead on things that you know you want or will eventually need. Like new tires for your car or your family’s annual vacation to Walt Disney World!

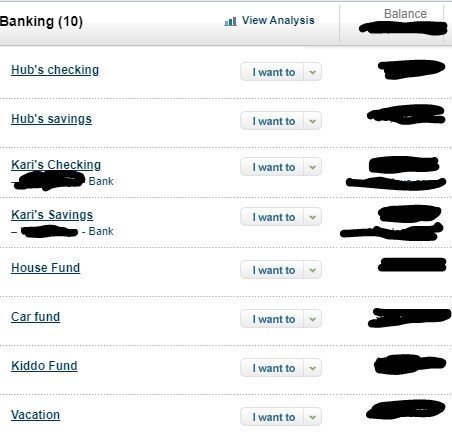

Here are my family’s sinking funds, and you can see that each is its own account!

- Vacation fund – it’s for vacation 🙂

- Kiddo fund – all expenses relating to her, so medical stuff, birthday party presents that she goes to, her BTS clothes, her own birthday party events, and such.

- Individual Savings – My husband and I each have our own savings accounts for personal wants. 5% of each of our paychecks goes into this account (in addition to our regular monthly spending). So if he wants a new TV for his man cave, then this is where that money comes from).

- Individual Checking Accounts – we use my husband’s account as the primary checking account, yet I do have my own separate bank account. I’ve had this account since I was 15 so the longevity there is great, so I’ve just kept it. I could get rid of it and being at a different bank altogether, and I probably will. I just need 20 minutes and nothing else more pressing on my to-do list.

- Emergency Savings – now you don’t see account this account on this list I know. That’s because our Emergency Fund is an online savings account with Ally Bank. They give a much higher interest rate than traditional banks (around 20x higher!). So we are making about $50 a month just on interest rate returns. (see the grey call-out box below for more details).

If you want to get started with a similar setup up then be sure to check out this great resource that walks you through the whole process of deciding on and setting up your sinking funds!

For these accounts, we also follow a Pay Yourself First model. That means we put our savings goal before our regular bills. That way, we know we are always moving forward!

Side note on having a retirement account:

I don’t figure retirement planning too much into this formula, as our retirement accounts are funded with pre-tax money. So that is essentially the very first thing that happens after we get paid, and then the remainder of our salary gets deposited into our main account. And then, we put the multiple bank account system into effect.

Yet you could still plan for retirement savings as part of this system if you have a separate investment account, like an IRA, or a brokerage account where the money comes from after-tax funds.

What are the benefits of having multiple checking accounts?

Be able to easily distinguish what each dollar is for

We just went over this main point. Consider this method similar to using the cash envelope system, yet with accounts instead of envelopes. The same benefits apply.

You can see your progress toward your big savings goals

This is a big one! Being able to see your progress toward your goals is very motivating! For my family, we have a home repair fund, a car repair fund, a vacation fund, a kiddo fund, and our emergency fund (this one is at a separate bank in a high yield savings account).

Each month we get to see these individual savings grow, and sometimes we see them shrink, that’s what they’re there for. To cover us when we need it.

I will say, seeing that seeing our emergency savings grow brings a sense of peace and security, while seeing our vacation fund grow brings excitement and joy!

It creates boundaries as well as spending freedom

One thing that many people run into is feelings of guilt over spending money on unnecessary or luxury items, like a vacation. With separate bank accounts for budgeting, you can actually see that you are indeed taking care of all of your responsible adult obligations.

There’s no need to feel guilty about spending money, as you know there is $15,000 in your emergency fund, and you have $745 in your home or car repair fund. You are covered! Go and spend your money!

On the flip side, having multiple accounts with strategic names (this is key!) means that you are internally tied to use that money for its intended purpose. Even though you may want a new TV, you can see that you only have $212 in your splurge fund. Yet, you can see that your “car emergency” fund has $1,230 in it. Maybe you could use that?

Ummmm…. hell no!

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

The trick to guarantee saving money success with multiple bank accounts

In going with the example mentioned above. That account says “car emergency,” and you know that this money is only for that one specific purpose. It’s not for a TV, that’s for dang sure! Creating visual and psychological boundaries can be vital to helping you stay on track with your budgeting game!

The trick is to give your accounts a name that is emotionally motivating for you! (source) You treat things that you have named differently, on a deeper and more emotional level! You have “tied” it to your hopes, dreams, and goals, which can be hugely beneficial in how you contribute to it (source), and in how you don’t spend it!

If your account says “81-9564-5165” on your online dashboard, that could mean anything! And you probably aren’t motivated to contribute to it that much, or you even borrow from it. Oh, and yes, this is your new home fund. Oh, you forgot?

If you’re not motivated by the “new home” account name, maybe you’ll feel more drawn to “my new home where I’ll raise my baby.” You know that more than anything, you want to get out of this apartment and have a backyard where you can lay a blanket down and relax with your little one on sunny spring afternoons.

Now THAT’s an account that I want to contribute to!

Great bank options for multiple accounts

✅ Betterment

Betterment is an online money manager and one of the largest independent online financial brokerage firms. Betterment helps you manage your money through cash management, guided investing, and retirement planning.

Betterment Cash Reserve is a cash account designed specifically for the money you save. You can create separate buckets for specific savings goals and even set up auto-deposits into each bucket. The money in your Cash Reserves account currently earns 4.75% APY, which is better than regular banks. Rate as of October 2023.

Best of all, there are no fees and no minimum balance requirements.

Current

Current is part of the new wave of banking. A tech company provides and manages the user platform (the app with all the latest bells & whistles), while a traditional bank manages the holding of the money. So you’re getting the best of the tech world and the banking world.

With Current, you have one main account, and you can have up to three Savings Pods, which is like a subaccount. So you can have an emergency pod, a vacation pod, and a new car savings pod.

The best part is that you earn 4.00% APY (as of January 2023) on up to $2,000 in your savings pod funds! (You can have more than $2,000 in your pod, but you only earn the interest on the first $2,000. So $6,000 total across all three pods. Note: you must enable the high-yield savings feature by agreeing to the terms & conditions (very standard).

You can also enable their Round Up feature to save even more. When using your Current card, it will round up purchases to the next dollar and send the extra change to one of your savings pods.

Current is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Member FDIC.

Learn more about Current on Android

Learn more about Current on iOS

Good options for high-interest savings account

If your current bank already has the option for multiple accounts then great, you can get started right now! Be sure to check into their savings account rates first, as you don’t want to put your money into an account earning .06% interest (more on this below in Pitfall #3).

If you find you do need a high-yield savings account at a different bank, then check out…

Chime

Chime® is an excellent option for those just starting with banking, as they offer their Chime Checking account with no monthly fees, no minimum balance fees, and fee-free overdraft. Plus, opening an account is very easy and fast; you can do it all online in under 2 minutes!

It’s important to note that Chime isn’t a traditional bank; they’re a financial technology company (the new wave of banking). But they offer banking services through The Bancorp Bank, N.A. or Stride Bank, N.A., which are FDIC insured

You can only have one checking and one savings account, so it only makes sense to open these accounts if you need just a couple of accounts to add into your current banking system.

In addition to checking, they offer an optional high-yield savings account with 2.00% Annual Percentage Yield (APY)*, which is a great rate right now (aka your money grows much faster than at regular banks with .01% interest – which is most traditional banks).

Learn more about Chime

Just an FYI, a Chime Checking Account is required to be eligible for a Savings Account.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

*The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of November, 2022. No minimum balance is required. Must have $0.01 in savings to earn interest.The average national savings account interest rate of <x.xx%> is determined by FDIC as of <date> based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. Visit National Rates and Rate Caps to learn more.

Chime also works as a verifying bank for other financial apps, so read here if you need a paycheck advance app that works with Chime.

Aspiration

Among other benefits of this green financial company, their savings interest rate returns are amazing! “Aspiration Save Accounts can earn 3.00% annual percentage yield (APY) interest (5.00% for Aspiration Plus subscribers) on the first $10,000.00 of their balance when certain conditions are met.”

The condition is that you need to spend $1,000 a month from your spending account (aka regular checking). If you spend that much in a month on bills, this might be an excellent option for your bills account.

The interesting part is that you choose your own fee, even if it’s zero. For extra services, such as wire transfers, they charge you at cost (what it costs them to do it, no profit included).

You have the option to upgrade to their Plus account for $5.99 a month for extra environmentally friendly perks and be a part of their 5% APY savings program (on your first $10,000), but the 3% with their pay what’s fair rate.

Be sure to check Aspiration out, as they periodically offer some outstanding signup bonuses!

How to easily manage multiple accounts, investments & credit accounts

I know that having multiple accounts seems more complicated at face value, but I promise you it’s not. It makes your finances (especially your savings) so much clearer; you know exactly what money is for what purpose.

One thing that can help make it even easier is a dashboard where you can see all your financial info in one spot, in real time. Empower does precisely that, and for free, a one-spot glance at everything. You can see all your assets & liabilities at one glance, making decision-making so much smoother and faster. (see the image below for how the dashboard looks.)

I also love all of their free life planning calculators (i.e., net worth calculator, life insurance, college savings, emergency fund calculator, etc.). They also offer investment help with financial planning, so a whole suite of helpful financial services.

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Word of caution with multiple accounts

As with everything in life, you do need to be aware of a few pitfalls using this method.

Pitfall #1 – Having a separate account for EVERYTHING

You don’t need an account for groceries, and one for car payments and another for car repairs, and one for birthday spending and one for clothes spending, and on and on.

Use this system, but don’t abuse it by opening 20 accounts. That is unnecessary and a waste of time. Remember, you want this to be easier, not more complicated. If you need more accounts, then consider using cash envelopes instead. I use cash envelopes for smaller sinking funds, like Christmas spending, Halloween supplies, a spa day, etc.

For the smaller things that you want to save for, you can always set up separate cash envelopes to make it so “the system” is still the same, but you’re just housing money at home in an envelope instead of a bank. Be sure to check out the complete list of sinking fund categories, and grab your cash envelope templates so you can make your own!

Pitfall #2 – Being Transfer Happy

The key to using these accounts is to keep it simple. Don’t go crazy transferring money back and forth multiple times. It would get confusing, be a waste of time, and your bank may charge you a monthly fee for too much activity.

Don’t use multiple savings accounts for budgeting purposes. A federal rule called Regulation D has put a six transaction limit on how many transactions per month you can do in & out of a savings account fee-free. It’s this way for all banks, for all savings accounts. So you’re better off sticking with mostly checking accounts.

However, if using multiple savings accounts get you a much better interest rate (i.e. high yield savings account), then by all means do it, but you need to be sure that you keep under the monthly 6 transactions limit, or you’ll start paying fees.

Update: Regulation D was changed in 2020 so there are no longer federal limits on the number of transactions you are limited to. Yet many banks still have these restrictions written into their rules. So if you want a savings account for a higher return, yet the flexibility of checking be sure to talk with a customer service rep to see if the bank has altered their language.

One time a month (3-5 days after we get paid), money automatically gets transferred into savings and sinking fund accounts, at whatever predetermined monthly contribution amount we decided upon.

Then one time a month (when I am paying bills), I transfer money out of those accounts, and the money goes into our primary checking so I can then pay the credit card bill in full.

For example, each month we transfer $100 into our car repair fund. When I pay the month’s bill, I know that there is a $165 charge for a new car battery on my credit card bill. I’ll transfer that amount into our main checking account, and then pay the full cc bill from that.

Pitfall #3 – Having your emergency fund in a regular savings account

Looking at our account name screenshot, you’ll notice there’s no “emergency fund.” rest assured, we do have one. It’s just with a different bank.

Ally Bank is a great option for online banking, they offer one of the best online savings accounts with interest rates many times higher than that of the average bank’s savings account. That means you’ll earn a lot more interest!

For example – if you had $30,000 in emergency savings. In one year at a regular financial institution with a savings account of .06% APY (the national average), you’d earn $18. While at Ally, with .50% APY, you’d earn $150. Then that money starts earning interest too, so you’ll automatically pay yourself first again and again!

Ally bank is so consistent with its rates, service, and features that Money Magazine rated it one of the Best Online Banks for 2022 (source). Oh, and $0 service fees on both checking and savings accounts!

During my time with Ally, the rates have gone from 2.2% APY to .05%; it all depends on national inflation and how the Feds control the rate. So while banks may offer different rates, they all fluctuate off of the prime rate.

Pitfall #3 – Not having fee-free accounts

For having multiple accounts you absolutely need to make sure you use fee-free accounts. Many financial institutions have them (mostly online), you just need to read the requirements. This can usually be done by…

- having a direct deposit

- maintaining a certain minimum balance

- have a debit card

- have multiple accounts with them (i.e. savings, and checking, sometimes they offer a money market account)

- opting in for electronic statements

- having direct debit transactions (aka auto-pay bills)

- sign up for their banking or budgeting app

When to use a bank account and when to use a cash envelope

We talked a bit about this in Pitfall #1; you don’t want too many accounts, and you don’t want to run on less than you need. You need the right balance.

Your savings accounts for your “must haves” are your long-term accounts, ones that you’ll need for a long time. These are usually revolving accounts, which means every month, money comes in, and some months, money goes out when you pay your bills.

For smaller savings goals or ones that are one-time events (aka spa day, new hobby XYZ), consider using a cash envelope. They will work just the same, just in cash.

At the end of the day

Using multiple bank accounts can be a massive game-changer for your budgeting system! I strongly urge you to give it a try and see how much faster you gain traction with your financial goals! Being able to see your progress is hugely motivating! Be sure you do your homework, though, and find a bank that suits your needs (fee-free)!

Articles relating to managing multiple bank accounts for budgeting:

- It’s a Better Budget

- Sinking Funds – The Smartest Strategy On Saving Huge Stacks of Money

- The Key to Always Saving Money, Without Fail!

- Sinking Funds Simplified Workbook

- Emergency Fund FAQ – Everything You Need to Know

It depends if it’s a full-blown side business or just a small hobby that pays. If it’s a business, then you’d want to use the “profit first business model.” If it’s small amounts of irregular income, you could hold it all in a PayPal account and then, once a quarter transfer over funds and portion it out based on what percentages you use for your other amounts (i.e. 5% to personal savings, 10% to your emergency fund, 10% to home repair, etc).

Hello Kari,

I enjoyed your article. I am a person who has numerous accounts. I also budget everything. I was tickled with #2, transfer happy. I have done that.

I use a credit union rather than a bank because you can save more at a credit union (less fees).

But good article.

So glad you liked it Sharon! Yes, credit unions can be a great way to save money on fees (and you’re supporting a local business!)

I currently use a system like this. It’s basic but follows the principles you use. I may have to get a bit deeper into this. Great post!

So glad you liked it! Thanks John!

These are excellent tips! I want to open a second savings account for emergencies and life in general. This inspired me to go ahead and do so.

Yaaa!!! So glad you are taking action! It feels so good to get something as important as “money” handled and set to flourish!

Some great advice here! I definitely think have multiple bank accounts is the most effective way to distribute and save money.

So glad you liked the post!

I tried this concept but with different banks and found it very stressful, I didn’t think to open multiple accounts with one bank. What a great idea! I loved the cash envelope system but never carry cash anymore so it wasn’t practical.

Also, for those who have a PNC locally, I believe they have one account that has a similar function of multiple accounts, I used to have one when we lived elsewhere.

Different banks could definitely be hard to manage. You could put everything under a Personal Capital umbrella and see it all that way on their dashboard, but having it in one bank makes transfers very fast.

I have multiple bank accounts but haven’t used them as effectively as you do. What a great idea for budgeting success! Thanks for sharing!

So glad you liked it! You can always tweak & adjust your accounts, I did for a while until I found what really worked well for me!

I like this idea. Does you bank have fees for all of your extra accounts?

Great question! Our accounts are all fee-free with the bank we use. Many bank accounts can be fee-free by meeting a few requirements (i.e. minimum daily balance, direct deposit, etc). While some banks still charge. You should never pay for a bank account in today’s world, there are so many options open to you (and the banks know that!), so look around and call some local credit unions to see what they can offer!

I like this, but my husband is weird about not seeing all his money in one place. Even moving money from checking to savings gives him a bad taste in his mouth. I hope to do this especially when we buy a house in the next year. Thanks for this information!

Husbands are kinda weird in general, 🙂 (I’m half joking!) I think the key for your husband is getting a bank with an umbrella dashboard feature. That way he can see everything on one screen but it’s separated out. Best of luck on your new home search!

Thanks for the insight! I truly think having multiple accounts is a must. It helps create a more organized financial plan.

So glad you found the post interesting! Thanks for stopping by!

This is a great way to ensure that you’re prepared for the bigger purchase items in our lives or the emergency situations that creep up for no reason.

Oh those big surprise expenses! New water heaters, new transmissions, all the fun stuff huh! It’s best to be prepared!

Great tips on saving money! I like the idea of having multiple bank accounts. I need to open one just for my vacation fund! Your ideas in t his post are very practical and wise.

So glad you liked it! Thanks for stopping by!

Wow I never knew this was a thing. I have a budgeting app where I divide my savings from my expenses. I never had more than one account because I thought the fees will add up. What are your thought on this?

You can find banks that don’t charge fees for this. Usually, if you hold a certain $ amount across all your accounts and have one direct deposit it will then be fee-free. It’s definitely worth a call to your bank to see!

Really enjoyed this. My husband and I have had mutiple accts for a long time. We have been married 39 yrs. Worked for us.

A 39-year run is an absolute true testament to this methodology! Thanks for sharing! Here’s to 39 more!

I think having a few different bank accounts is an excellent idea. However, my biggest takeaway is r/t interest rates. It sucks that banks pay so low and I really need to check into sinking funds and Ally rates more closely.

Ugh, traditional savings account rates are a total bummer! Ally is super easy, you’ll love it!

I love this idea! It’s such a simple way to stash money away for fun and rainy days ?

So glad you liked it! Thanks for stopping by!

This makes so much sense! Thank you for sharing! Looking into this right now!

It’s funny how the “traditional way” of doing things can be so backwards! So glad that this clicked for you!

Great post Kari. I love your infographics, they are super easy to understand and make your post a good quality post. All the tips you are sharing make me believe that you are rocking the financial aspect of your life and sharing the wealth with others. Keep up.

Thanks Nadia! So glad you like the graphics! Visuals are so important to tell a story! Thanks for the kudos, it means a lot coming from you!