How to Save Money for EVERYTHING with Sinking Funds!

Saving money has never been easier than with sinking funds!

Author: Kari Lorz – Certified Financial Education Instructor

One of my family’s favorite things to do is to go on vacation! A weekend at the beach, a trip to Walt Disney World, or wherever.

We can do it even though we’re certainly not rich, and no, we don’t make high salaries. But yes, we pay for these trips in cash.

Read on to learn how you can buy your family everything you need (and most of what you want) through the magic of saving money with sinking funds!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is a sinking fund?

Budgets are great! You are telling your money where to go and not wonder where it went (Dave Ramsey is credited with this little truth nugget).

Yet, many people forget about the random, irregular expenses. Like when you find that you need to buy soccer shoes for your son, there goes your spending budget!

Insert the sinking fund account, the answer to your problem, and one of the best ways to save money!

The term sinking fund originally came from managing corporate debt, and the issuance of bonds to “soften the hardship of a large outlay of revenue”, according to Investopedia.

Similar to our use but on a whole different level. But let’s look at it from a regular household budgeting standpoint.

A sinking fund is a strategic method of saving money for a known but unexpected expense and for an upcoming planned expense.

For example – vacation, house repainting, new tires for your car, kid’s activities, kitchen remodel, etc. The process is to identify a goal, assign it a dollar amount, decide the date of when you need it, and divide the total by the number of months left until the due date and start saving money for it!

Sinking Funds are a necessity in every great budget! You can read about my signature Better Budget and see how it all flows together!

Sinking Funds Example 1: One time purchase

Your son, Alex, needs $240 for this season’s soccer fees, uniform, and pictures. Soccer starts in 6 months. So…

$240 / 6 months = $40 a month you need to save into your sinking fund for “kids activities.”

Then come soccer season, you already have the money for all the expenses! Sinking Funds are the next level of the pay-yourself-first model.

Sinking Funds Example 2: Revolving account

Your family really likes to go on vacations, both big ones and small weekend trips. So you set up a Vacation Fund. This is a revolving sinking fund, never getting “full” and never getting “empty” (hopefully). Money flows in and out of the account on a regular basis, and in some months, money flows out.

Every month you put in $100 automatically. Then when you take a vacation, you pull the funds from this account to cover the cost.

How to set up your sinking funds

If your sinking fund is a one-off, type thing (i.e., a fun yoga class), a cash envelope system will work well. I use a cash envelope for my Christmas spending money.

If the sinking fund is an ongoing expense such as vacations, then consider opening up multiple savings accounts to hold this money. And YES, the funds must be kept in a separate savings account, so there is never any confusion about what your $$$ is for.

My bank allows us to have multiple checking accounts without fees. Please check with your bank on any qualifiers that you need to meet in order to have multiple accounts. You can easily get free accounts, so don’t settle if your current bank doesn’t offer it. Look around for a better bank! Nerdwallet has a great post about the best banks with free checking accounts.

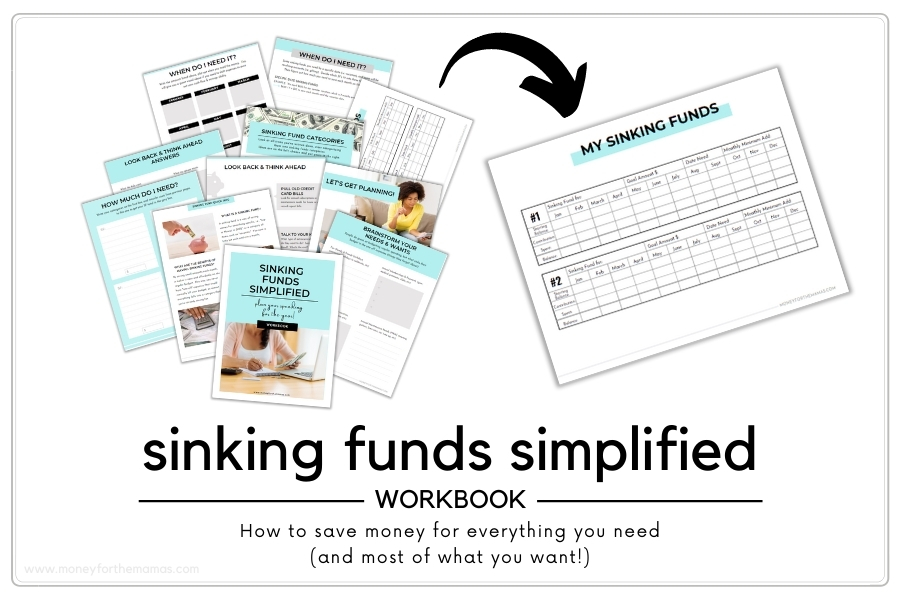

You can also grab a sinking fund template tracker right here to keep your incoming and outgoing amounts organized! Or you can grab the full Sinking Funds Simplified Workbook and plan out everything for the year!

Let’s say that you’ve decided that your kids always have stuff going on. So you need a permanent account, now you’ve opened a checking account (Yaaaa you!) One of the best things that you can do is to name that account “Kids.” Seriously, go into your account settings and edit the name of the account to read “Kids.”

It sounds silly, but the psychology of giving things an exact name absolutely works. I have an account for my kiddo, and I could never (ever) go into that account and borrow money from it other than for its intended use. My conscience would never allow that to fly. That account is safe.

Still need some help working through all of your sinking fund ideas? I have a workbook that walks you through the entire process from start to finish with setting up your sinking funds! It helps you brainstorm all the potential sinking fund categories and gets it narrowed down to fit perfectly within your budget!

How much do I put in my sinking fund?

A good rule is to start planning six months out for an event, but if the item is a large dollar amount, consider nine months. This way, you’re not trying to save for “everything” all at once.

As you look ahead at expenses, start giving them a dollar amount and adding them into the tally.

For example, lets say we want an account for kid stuff, and since this is a revolving account, money will flow in every month, and saved money will flow out when expenses occur (i.e., birthday party expenses, braces, back-to-school clothes, school pictures, sports fees, summer camps, etc.).

A good tip is to go back through your previous bank/credit card statements and see what kind of one-off purchases there have been in your monthly expenses. Do you have enough of one type of purchase to necessitate its own sinking fund?

General guideline of when to start funding your sinking funds for holidays

- Jan Week 1 – I start thinking about Christmas next year (yes really), between presents, holiday breakfast & dinner, stocking stuffers, and charitable contributions it adds up fast. So maybe start with $10 or $15 a week up until Thanksgiving).

- Jan Week 1 – start funding Valentines Day

- Feb Week 3 – start funding Easter

- April Week 1 – start funding Summer Vacation

- June Wk 1 – start for 4th of July

- July Wk 2 – start Back to School

- Sept Wk 2 – start Halloween

- Oct Wk 1 – start Thanksgiving

- Nov Wk2 – start New Year’s

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

My family’s pay yourself first payment structure

If you want to see how I manage our family’s sinking funds here it is, and I’ve done it this way for 6+ years, so I know this works!

I plan my sinking fund into my monthly budget so that the money is planned! And from a cash flow perspective, my sinking funds get paid first before I pay any bills! (my family’s priorities come first!)

Sinking funds examples

My family has multiple sinking funds for holding our financial goals, each with their own checking account…

- Vacation fund: aka my happy place fund! This is where we save on everyday things to splurge on what we really want. Because we decided that getting away as a family is important to us. You can have an entirely different “save to splurge” account, it’s okay whatever it is. Just so long as you plan for it! You can post this vacation savings tracker on your fridge and each time you contribute to it you can color a section in and watch it grow! Nothing beats a little visual motivation!

- House fund: all large purchases such as new furniture, HVAC services, large tree limb pruning service, carpet cleaning, etc

- Car fund: car insurance, oil changes, car repairs, new tires

- Kiddo fund: all her medical costs (our 5-year-old has Cerebral Palsy, so her expenses are considerable even with health insurance). Also, a new set of clothes each spring and fall (as kiddos grow fast!), etc. In the graphic below this is the “ABLE” account, it’s similar to a college savings 529 account, but it can be used for more things than just college, (i.e. medical needs).

- We each also have our own personal savings, where 5% of each of our paycheck goes immediately into there. This is our extra fun money, I use this account to save for splurges.

Other sinking fund examples are…

- pet care

- hobby fund

- holiday fund – i.e. Christmas sinking fund

- insurance – life, car, home

- medical expenses, premium, co-pays, and prescriptions

- annual subscriptions (i.e. Amazon Prime, Disney+, gym membership, etc)

- taxes – property, self-employment

- new clothes for you and the family

- beauty – hair cuts, waxing, nails, etc

- charitable giving

- new car sinking fund

- medical expense

- big events – your wedding, your parents 50th anniversary, etc

- new spring veggie garden

To see a full list of what you can save for, check out the complete guide to sinking fund categories.

We used to have a sinking fund for emergency savings , but once we hit nine months of living expenses, we stopped contributing. So it just holds steady, and we disperse that money to other areas.

I also use cash envelopes for my Christmas Spending money; come January week one, I start with $20 saved each week. Come November I buy a prepaid credit card, and then use that for all my holiday shopping (as I do a decent bit online). I also use cash envelopes for large, one-off purchases for things that I personally want.

If you want a very quick way to figure out your savings rate, then check out my sinking fund calculator. You input the dates to start/stop saving, the amounts, and if there’s any interest (if the money is in an interest bearing account, like a high-yield savings). The calculator will tell you exactly how much to save each week and/or month; super quick and easy!

The easy approach to sinking funds

If your brain is exploding with thinking of “all the things” you could have a sinking account for then let’s make this super easy on you! I am an aspiring minimalist, and personally, my brain got a bit overwhelmed with all the possible expenses. So we pared it down and do it the way I am about to describe it to you.

Think of a sinking fund category that you want, add up a year’s worth of expenses, and then divide by 12. Set up an automatic deposit for that same amount every month. Done. Easy. Maybe start an account with a decent balance (say $100) from your upcoming tax return or funds from a garage sale. That way you’re primed if something comes up earlier than anticipated.

Ideas on how to front-load your sinking funds by saving money

Sometimes you just need to a little bit of a head start to make this all run smooth! So here are some ways that you can get some money to fill your sinking funds before you start pulling from them.

- Try a money-saving challenge! It’s actually fun to challenge yourself on how you can play Tetris with your money to make it all work. Try a no-spend month for maximum savings! Check out 17 Money Saving Challenges to Supercharge Your Bank Account

- Box up your unwanted clothes and sell them on ThredUp

- Hold a garage sale

- Get a part-time job for a few months

- Get a money-making hobby – sell crafts on Etsy, walk dogs, etc

- Set aside a portion of your tax return

- Ask for cash for birthday or Christmas presents (this sounds weird, I know, but it works!)

- Watch your neighbor’s kiddos 1-2 days a week

- Don’t eat out at restaurants for 1-2 months

- Get your hands on a cash windfall – (the easiest and most unlikely way of filling your sinking funds)

- If you drive a lot, is there a way to cut your driving in half? Carpool?

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Benefits of sinking funds

Okay, so besides the obvious benefit of saving money there are a few other key benefits to this system of saving money

- You’re planning ahead for purchases, so you have time to think about which TV is the best, of what your Mom really wants for her birthday. In essence, you’re more mindful of your purchase so you’re likely to make a better choice and not just snatch up something halfway decent at the last moment

- Now this right here is honestly the biggest benefit to me. It’s having peace of mind! Yup! Before I had sinking funds up & running I would be so worried about a random but known expense, the new car tires I had to buy that day. “How the hell could I come up with $500 in the next month to pay off that credit card?” Now, I don’t have to worry about it, but it’s no big deal!

- They say that “getting there” is half the fun, right? So when you have a savings goal tracker, let’s say for vacation, it’s a lot of fun to color in that next spot! It’s building the excitement, the anticipation. And besides, each time you fill in a segment you are damn proud of all your hard work! (way to go!)

- When you have sinking funds set up you pay less for an item (usually). Let’s face it, we’re a credit card world. And when you buy an item with a credit card, you then carry a balance (unless you pay it off every month), which is the goal). So you end up paying interest on that item. That $45 shirt may end up costing you $67!

“Credit card balances carried from one month to the next hit $422 billion in December 2020”, according to NerdWallet’s annual analysis of U.S. household debt. That’s a lot of interest that’s being racked up! YIKES! - You can buy what you want (with your sinking fund money) and not feel guilty about it! This can be huge for the person that feels bad buying things for themselves! Or you can go on a family vacation without worrying the whole time “How am I going to pay for this?”

Because when you’re on vacation you want to enjoy it, not panic about the fact that your husband ordered the seafood extravaganza platter for dinner!

Common mistakes of having multiple accounts and how to sidestep

Don’t use your regular bank account

If you have the habit of all too easily transferring money back and forth into accounts, maybe consider opening an account at a separate establishment. That way, you don’t see it on your regular banking interface. For example, my family’s Emergency Fund is in a high-yield savings account; I never actually see this money on banking screens; it’s entirely separate.

One of the great things about having a high yield savings account for our Emergency Fund is that it earns a MUCH HIGHER interest there than it would at our regular bank. Every day banks typically offer horrible interest rates on savings accounts, like .08% APY, while some even go as low as .01%.

Current is a great banking option, and you can even set it up in 20 minutes! Current is a money management app that offers spending and savings accounts (along with cash advances, teen banking, 2-day early access to direct deposit, and crypto investing).

When you bank with Current, you can open up three savings pods in that account, which is exactly what we want). The best part is that you can earn 4.00% APY (as of October 2023) on up to $2,000 in each pod (so $6,000 total). This is a phenomenal rate!

Since there’s a cap on interest-earning, this is great for smaller sinking funds like Christmas, vacations, etc.

You can get Current on Android or get Current on iOS

Having too many sinking funds

Another common problem is that people get super excited about sinking funds. So after doing all their brainstorming, organizing, and such, they end up with 50 different things they are saving for. It is good that you’re planning on saving for things, but it’s a bit of overkill which can dilute and confuse the process.

I personally don’t want more than 10 sinking funds, and only the ones mentioned above (vacation, car fund, house fund, kiddo fund) have their own separate accounts. I could see adding more funds if they were cash envelope only.

The savings hierarchy

Also, don’t forget that with all of these short-term saving goals for spending money, you DO still need to save for the long term (aka retirement), so be sure that you are funding your 401(k) or IRA first! Here’s the savings hierarchy…

- Starter emergency fund of $1,000

- Retirement contribution to get the full matching amount

- Fully funded emergency savings of 6-9 months of living expenses

- Fund retirement up to goal percentage (aim for 10-15% of gross pay)

- Fund sinking funds

At the end of the month

When I reconcile bills at the end of the month, I look at our credit card statement and tally up any expenses for our sinking fund accounts. Then I transfer money out of those sinking fund accounts, into our main account, and then I pay the cc bill out of that main account.

Sinking fund example:

- At the beginning of the month (a few days after payday), $50 gets transferred into the kiddo account.

- During the month, I charge a few of her medical co-pays and bought her some new clothes.

- At the end of the month, I look at the credit card bill and add up everything that was a charged for her; let’s say it was $75.

- I transfer out $75 from her account into our main checking account.

- Repeat with other sinking fund accounts for the month.

- Pay the cc bill from the main checking account.

It may seem like an odd way to save money, maybe a bit clunky at first (as anything new takes a bit of getting used to). But this process of an entire month’s bill pay probably takes 30 minutes, one time a month. That’s it!

Don’t forget to grab your Sinking Funds Made Simple Workbook so you have a framework for your own sinking fund needs, and get started on it today!

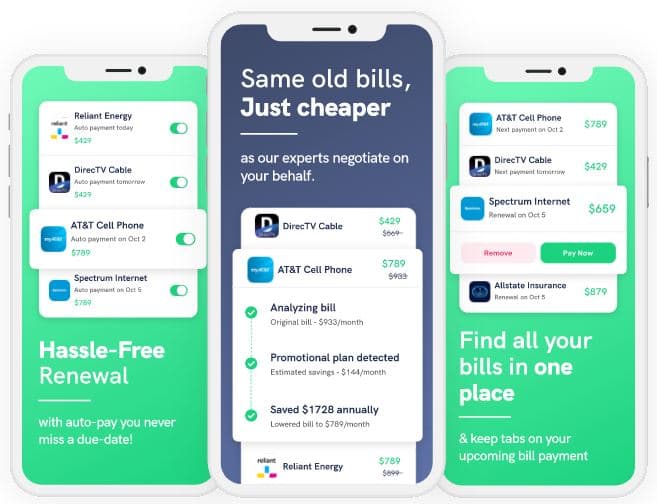

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

At the end of the day

Saving Money is hard, it makes sense to make it as easy as possible by distinguishing what money is for what purpose. Once you get it set up and automated, it is so easy! It feels so good to see those balances grow every month, as we know that we are putting our family’s priorities first, making sure that what really matters to us is taken care of.

This is where personal finance becomes “personal”, it’s helping me take care of those I love… and sending us to Walt Disney World every now and then!

Articles relating to sinking funds:

- The Most Important Strategy to Help You Build Wealth

- It’s a Better Budget!

- The Budgeting Mistakes That You Don’t Want to be Making!

- Sinking Funds Simplified Printable Workbook

- Emergency Fund FAQs – Everything That You Need to Know!

- The Complete Guide to Sinking Fun Categories

I love the way you break the savings down monthly to make a big ticket item seem more affordable!

Thanks so much! Breaking down costs make it so much more manageable!

I didn’t know about the 6 withdrawals a month thing on savings account so thanks for letting me know lol I really like this saving idea!! Saving for an apartment.

So glad you liked it! Thanks for stopping by!

You are so right that you don’t have to be rich to enjoy life and do things with your family. What you need to be is smart! And having designated accounts with specific names is a great way to know exactly how much money you need and have available to get to the things you want.

Totally! You don’t have to be rich, you just need to be able to decide what’s worth spending your money on and what’s not, and then stick to it! Oh, but willpower is hard I know!

This is a fantastic system. We have created a separate bank account just to save for our house and I have a separate bank account to save for temporary things – like vacations. It has worked really well for us so far 🙂

So glad it’s worked for you!

It’s so important to distinguish where your money goes

Sinking funds are the best. We’ve already saved for Christmas this year! And half for our vacation next year 🙂

That’s amazing! Great job planning ahead!

This really I.important especially now xx

Super informative, and I love the section on setting up automatic payments. That is how I do all my planning. I never even think about saving, because it’s set up automatically. Get on that minimalism train! You won’t regret it!

CHOO CHOO! I love the minimalism train 🙂

You really make it seem so easy with your presentation but

I find this topic to be really something that I think

I would never understand. It seems too complicated and very broad for me.

I’m looking forward for your next post, I will try

to get the hang of it!

At first, everything is complicated, don’t get discouraged. We all start at the beginning!

Everyone loves it when individuals get together and share thoughts.

Great website, keep it up!

The 5% you save from your paycheck after payday, is that 5% from your gross or net?

I take 5% out of my net to go into my own savings. I’ve already allocated money for 401k contribution and IRA, so this money is for my fun money big ticket items that I want to buy.

These are great ideas! I’m looking for ways to help us save money with a baby on the way and I might have to try these. I also didn’t know ally had such a great interest rate. I may have to move our savings there too!

Ally has been the best place for our emergency fund! I wish we would have made the switch years ago!

I agree saving is important,very useful content.