Quick & Easy Guide to Using a Zero Based Budgeting Template

Here’s how to fill out your zero based budgeting template (in just 15 minutes)

Author: Kari Lorz – Certified Financial Education Instructor

Do you want to do better with your money? Most of us do. The problem is that we don’t always have the right tools to help us accurately and efficiently plan our finances.

Let’s go through how a zero based budgeting template can be used to better organize your money and keep you on top of your spending.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

What is the zero based budgeting method?

It’s also known as the zero-sum budget method, and it’s Dave Ramsey’s go-to budgeting method.

This is where you give every single dollar a purpose in your money plan! You start with your take-home pay, and then you budget down each individual category until you have $0 left.

Income – Expenses = $0

That’s the quick & simple answer. How it works out in real life is a bit more involved; let’s dive right in!

What does a zero based budget template look like?

A zero based budget template looks similar for most people; just the dollar amounts and some of the discretionary spending categories are different.

It flows from the top to the bottom, with the most important things being at the top, and the least important expenses at the bottom; these are your discretionary budget categories.

Here’s what the zero-based budgeting template should look like. Down at the bottom left, you’ll see the ending total is $0. I’ve given each dollar in my budget a job.

So, let’s start at the top of the page and work down the 4 steps of filling out your zero-based budget template.

Filling out your zero-based budget worksheet

1. Income:

You set your household budget up at the beginning of the month. You most likely know your income if it’s salary. But if you’re on hourly pay, it’s best to be cautious and work off your average paycheck.

If you work more hours, then great, that’s a bonus to your monthly spending. But to be safe, and use your average. Then add in your extras like side hustle money.

This section includes all of your sources of income, including…

- Wages

- Side hustle income

- Tips, etc.

Total it all up, that’s your monthly income.

2. Must spend expenses:

Next, it’s time to tackle your must-spend items. You can come pretty close to what your utilities should be (more don’t his below in the tips section).

These are the things you have to pay for no matter what. It’s your…

- Rent/mortgage

- Home/renters insurance

- Utilities – water, power, natural gas, garbage, phone

- Health insurance (if not covered by a job)

- Basic transportation

- Basic groceries/food

3. Debt payments:

For step three, grab all your credit card statements and loan papers and fill in your minimum debt payments. (don’t worry, we’ll get to paying extra on your debts later).

- Credit card debt

- Student loan payments

- Car payments

- Personal loans

The above 2 categories (steps 2 & 3) are your “must spend” line items (unless you stop paying your creditors, which is possible, but it’s not recommended). The next zero-based budgeting category is where you get to spend money on your “wants.”

Take your income minus must-spend items minus debt repayments = leftover to spend on discretionary items.

4. Discretionary spending categories:

Discretionary categories are your optional ones (i.e. wants). These are usually your variable expenses (amounts that change month to month). List out each spending category that your family wants to do. This includes any cash envelopes that you’re using for your sinking funds too. For example…

- Grocery splurges – chips, candy, etc.

- Dining out – fast food, restaurants, delivery, etc.

- Memberships & clubs – gym, Amazon Prime, etc – (These are usually fixed expenses)

- Consumer goods extras – clothing, beauty, etc

- Entertainment – movies, adventures, hobbies, etc.

When deciding on dollar amounts, it’s either a fixed amount (I.e. a monthly membership fee), or you’re giving it a budget amount. Make a good educated guess based on your recent trends in this category (and budget constraints).

Take the total amount from step three and minus the total from step four, and you should end at zero.

Now, in a real & regular world, you’ll end up with a negative number, meaning you’ve spent too much. That’s normal; you just need to go back and do some trimming to come in at $0.

This is the hardest part of budgeting, deciding what to cut (and actually sticking to it).

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

Zero based budget examples

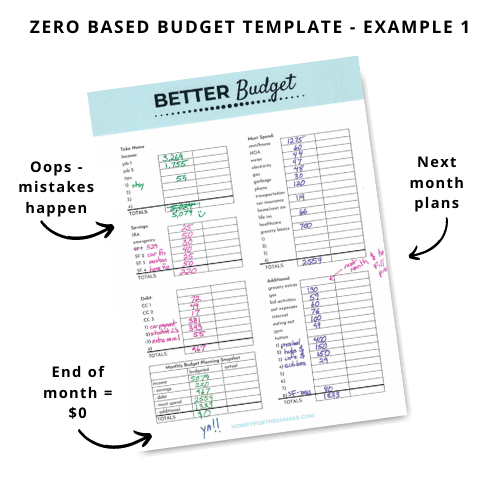

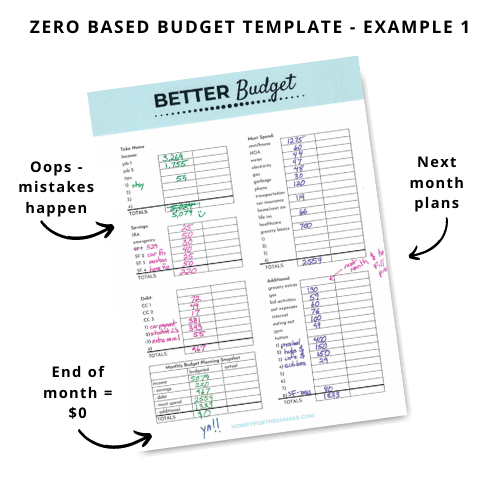

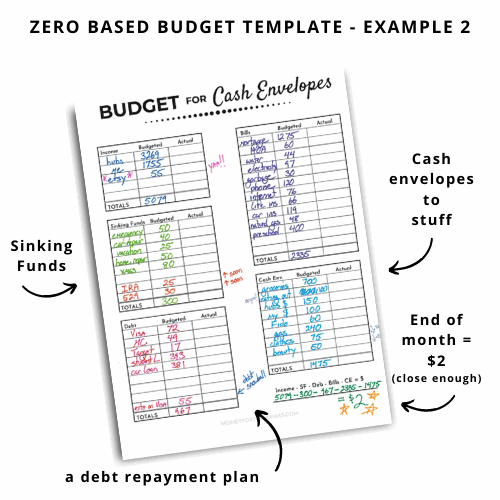

I know that things are a lot easier to understand when you can see it on paper, so here are some examples of a zero based budget templates all filled out. Yes, you can use the method on many different template forms. It doesn’t have to be one way or no way at all; budgeting can look many different ways.

When you start your first draft be sure to use a pencil, and print a couple of copies. I always scratch up my first attempt at my monthly budget, so don’t feel that you have to get it perfect right from the start.

Zero based budget using The Better Budget method –

Here is an example of the exact form that I use every month, it’s called The Better Budget. It combines a few different budgeting principles all in one form.

When you fill out your personal budget, be sure that you put your savings goal at the top. I know it feels weird, especially when you feel you’re running short on funds. But your big financial goal is important, so make those savings goals a priority (even if it’s only $10 at first).

You can always increase savings when you get some extra money. Or set up sinking funds to help pre-save for an unexpected expense.

I have sinking funds for our emergency fund, house repair, car repair, and a vacation fund. At first, I started small contributions, some at $10 a month, but slowly increased amounts as time went on.

Zero based budget using cash envelope method –

Using cash envelopes is a great way to help ensure that you don’t overspend your discretionary categories. You can of course put your utilities and fixed bills on a debit card or a credit card, which is easier.

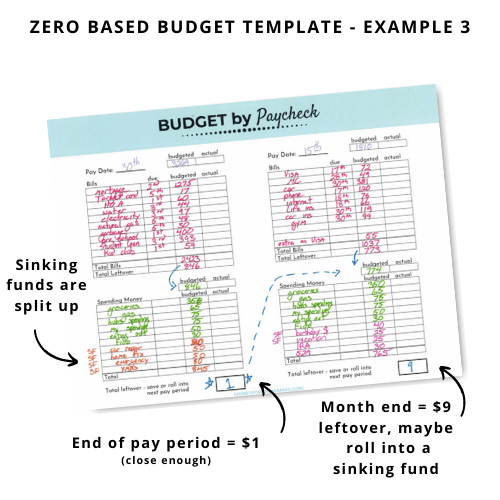

Zero based budgeting using the budget by paycheck method –

You can still use the zero based method while doing the budget by paycheck method (aka biweekly budgeting). You just need to do a little more pre-work in looking at bill due dates, dividing up spending, and sinking funds (this is optional, you don’t always have to have sinking funds, but they are so helpful).

How to use your zero based budget during the month

When your monthly bills come in, you need to log them on your zero-based budgeting template in the “actual” right column. Remember, your estimated guesses go in the “budgeted” left column.

If your bills are over what you expected them to be, then you need to go down to your discretionary spending to decide where you’re going to cut. This stinks I know, but this is the way it goes.

You’ll also need to be diligent about tracking what happens throughout the course of each day as well as weekly, so you can identify where things go off track before it becomes too much work or too late. Use a spending log to keep track of your discretionary category totals.

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

What if I’ve overspent my monthly budget?

During the month, if you’ve overspent and can’t find anything else to cut, then it’s time to revisit your income category and see if you can increase it. Either work overtime at your regular job, do more with your side hustle, or it’s time to start selling things that you don’t need anymore.

I hate to say it, but the #1 underlying principle of budgeting is to spend less than you make. If you can’t nail this one thing then you will never have control of your finances.

Now, this isn’t to say you need to get 100% right now. You should make easy cuts at the beginning of your budgeting process. Then make small cuts during the month, and see how it goes. It may not be as painful as you expect to only get lunch out two times a week instead of four times.

No one is 100% successful with budgeting from day one. Everyone needs to tweak and adjust their budget. It usually takes three months for people to smooth out the wrinkles. If, after that time, you’re still struggling, then you may want to consider changing to a different budgeting method.

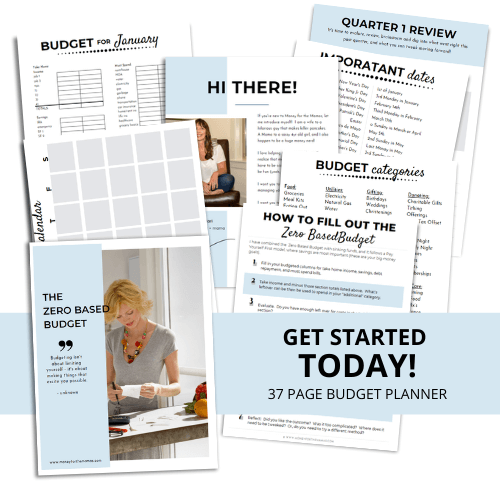

Zero based budget printable planner

You can easily make a zero-based budget planner on your own, or if you want to speed up the process (and make sure you’re not forgetting anything important), you can grab a printable planner.

With a planner, you can be sure everything is laid out correctly, and you can easily walk through the budgeting process a lot faster. Don’t worry, we’ve got you covered! In our printable planner pack (you can be budgeting in just 5 minutes as it’s an instant download), you’ll get…

- How-to instruction guide

- Two pages of potential budget categories

- Page of holidays and important dates for you to remember

- A monthly calendar for each month

- A budget form for each month

- A quarterly review sheet for each quarter

Tips for success with a zero based budget

- When you are filling in your discretionary spending line items, fill in the most important ones at the top and work your way down according to priority. Then when you add things up, if you’re overspent, then you know which ones need to go – the ones at the bottom.

- The goal of the zero based budget is to get to $0 at the bottom os the sheet. Yet some people feel a lot better if they have a slight cushion. Say, less than $50. This way if their utilities are higher than expected (because they fluctuate monthly) then you’re still okay.

- When planning on monthly utility usage figure out your average spending for the season. So every three-four months you should be recalculating your average bill. This is because your usage most likely varies with the weather.

You water your lawn a lot in the summer, but never in winter. Or you use electricity a lot in the summer to run your a/c unit. But not in the winter, when you use more natural gas to heat your home. - When you make your budget every month, you should be looking ahead at any important dates/events where you may need to spend more money. Such as birthday parties, sports fees, etc. You either need to budget these into your monthly spending or use sinking funds.

Remember sinking funds can be a great way to plan for one-off events or big-ticket items that you normally wouldn’t be able to afford out of your regular budget.

Do you like budgeting spreadsheets better?

Tiller Money consolidates all your financial information into a handy dandy spreadsheet (sheets & Excel) that you’ve customized to show exactly what you want to see (and nothing that you don’t).

You’ll have a lovely, super simple spreadsheet, exactly how you like it. The best part is that it automatically updates daily, so you know you’re using accurate figures when spending and saving during the day.

They have budgeting and saving templates ready for you to use if you just want to jump in. They even have a great tutorial library on YouTube to help you customize things.

They offer a free 30-day trial for Tiller Money, so you have nothing to lose!

Who is a zero based budget good for?

There are lots of different ways to budget, which is great as we all operate differently. The variety of budgets helps accommodate lots of different people’s styles and preferences. So this budgeting method is good for…

- Those who really want to know where each and every dollar is going.

- People who want to be very strategic with their spending.

- Those who lose focus with too much wiggle room or quickly forget what money is for what purpose.

The zero based budgeting method may not be the best fit for

- Those that don’t have a lot of time

- People who can get easily overwhelmed by lots of details

- Those with highly variable incomes, if your monthly income changes, it may be hard to nail down exact numbers.

What are the advantages of a zero based budget?

There are many advantages of using a zero-based budgeting template. Some of the key advantages include

- You can see where every penny is going, and where you can make changes in your spending. This allows you to be proactive about your finances, and stay on top of your budget.

- It can help you stick to your financial goals, by giving you a clear plan of action for each month.

- It’s easy to follow; all you have to do is execute the plan.

What are the disadvantages of the zero based budget method?

There are a few disadvantages to using the zero based budgeting template. Some of these include:

- It can be time-consuming, especially in the beginning when you’re setting everything up.

- You need to be disciplined and stick to the plan, or you could end up spending more money than you intended.

- It’s not for everyone; some people find it hard to follow a detailed budgeting plan. They want more room for spontaneity, so they find on constricting.

I personally feel that the advantages far outway the cons; but that’s because I am Type A, I like to plan. I personally use this budgeting method (in combo with other methodologies in my signature Better Budget Method.

Zero Based Budgeting FAQ’s

I don’t want to use a printable zero based budget template – is there an app for that?

Everydollar – Yes! There’s absolutely a zero based budgeting app – it’s Dave Ramsey’s EveryDollar app. It’s a great way to do zero based budgeting digitally and is super easy to use. I wrote a full review right here. It’s so easy, you can have your budget up and running within 5 minutes!

The #1 thing I really like about it is that it gives you recommendations on what percent of your pay should go to each budget category which is helpful.

YNAB – One of the other popular budgeting apps is YNAB (You Need A Budget). This app really helps you set and achieve your financial goals, which in a way makes it great for zero based budgeting. The goal is to get all your budgeted money to $0, which means you’ve spent it on the purpose that you planned.

YNAB really helps with overspending in certain categories by giving warnings when approaching (or going past) a category’s limit. There is a free trial so be sure to check it out before signing up for the full program.

Google Sheets – I love a good google sheet; you can do so many different things with it! You can absolutely build your own zero based budget. Sometimes making something from scratch helps you wrap your brain around it better. You can add in as many monthly expenses as you like (while traditional budgeting templates only have so many lines).

I don’t want to spend down to $0 – that feels risky. Do I have to?

I know how you feel, you’d feel “safer” if you left a little cushion in your budget. Because it’s laid out perfectly on your zero based budget template, but in reality, we know things don’t go perfectly.

An easy area for you to overspend is in utilities, if it’s super hot outside all month your electric bill may be a lot higher than you expect. You don’t want to blow your budget plan. So you could add in an “overspend” category down at the bottom of your budget template, and that can be your cushion.

Can I use the zero based budget method if I have an irregular income?

Absolutely! Your budget is something that you should be doing every month, it’s not a one and done with the numbers being set forever.

If you’re unsure of your income, then figure out what is the lowest amount you’d likely take home that month, and then build your budget from there. (Look back over your paystubs from the last 12 months and see what your rock bottom number was, and use that).

When you set up your zero based budgeting template, put the lowest priority items at the bottom – as these are the ones most easily cut and added back in. Then during the month, if you find you’re getting more hours at work, and thus more income, then you can add those items don’t he bottom back into your spending plan.

Can I use this budgeting method with other methods?

Great question! You can absolutely use this method inside another budgeting method. For example, when using the 70/20/10 budget rule method, you can budget as close as possible in each category and then shift the few leftover dollars to your emergency savings.

I’m ready to try the zero based budgeting method!

Great! I’m so glad you’re on board as I really think this is one of the best ways to budget your money (I use this method). You can grab the free budgeting templates up above, which has a form you can customize to this budgeting method.

Or you can grab the Zero Based Budget Planner right now. It’s already all set up for this method and all you need to do is to fill in the numbers.

Save $900 a year with BillTrim

You don’t have to find a new (and cheaper) cable or phone company; that’s where BillTrim comes in.

You have the same providers; BillTrim just negotiates your monthly bills down. On average, they save their customers $900 a year (that’s $75 a month)!

At the end of the day

Zero-based budgeting is a great budgeting tool to managing your money strategically. It helps you plan ahead and stay on top of the details for every dollar that comes in or goes out.

What are your thoughts about zero based budgeting? Do you use it, or do something similar that works better for you? I’d love to hear from you in our comments section below!

Okay well I LOVED this!

I actually will be using your templates with my husband VERY soon.

This was extremely helpful and very well written. Thank you so much for this awesome info!

So glad you liked it Rachel! I hope your free budgeting templates help you and your husband get your money organized!