How to be a Financial Powerhouse – the Powerful Benefits of Compound Interest

What I wish I knew in my 20’s about growing my money with compound interest!

Author: Kari Lorz – Certified Financial Education Instructor

Do you want to be a superstar at saving money? It sounds nice, right? But what does that even mean?

Well, what if I told you there was a way to save millions by the time you wanted to retire, all without having a crazy high salary or cutting your spending to the bone?

Lucky for us, there’s an easy way. It’s called compound interest. And the best part is that anyone can do this. In fact, you could start today! I want to show you how to harness the power of compound interest and retire with millions!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

How does compound interest work?

“Compound interest can be defined as interest calculated on the initial principal and also on the accumulated interest of previous periods. Think of it as the cycle of earning “interest on interest” which can cause wealth to rapidly snowball.”

In a nutshell, this means that as time passes, you will make more and more money. Your initial investment grows, and your interest also earns interest. It’s all snowballing together to make one big money-earning machine.

Conversely, with compounding interest, you will pay more for the pleasure of borrowing money (aka credit card interest rates fees). So charging a $29 shirt on your credit card will soon calculate into costing you $47 overall if you don’t pay your credit card off in full every month.

Llet’s not look at it that way; let’s go back to the sunny side of compound interest, the earning of it.

The power of compound interest in saving for retirement

Recall that compound interest takes your initial investment and then figures out an interest payment on that principal plus the previous time periods interest earnings, and this compounding effect keeps rolling and rolling every single month without fail. Hopefully, in the example of retirement accounts, it will roll for a good 30-60 years.

What I wish I would have done in my 20’s was to have saved as much as I could have and invested it into my retirement savings. Let’s say if I could have invested $400 every month starting at age 23 I would be set right now with the future value of my investments. But I didn’t.

My reality is that I saved $50 a month at that age, it was great that I was saving, but I had no idea what my money could have been doing for me! It KILLS ME to think about the amount of money that I spent on things that I didn’t really need, but I had the money; my bills were covered, so I blew the money on dumb stuff.

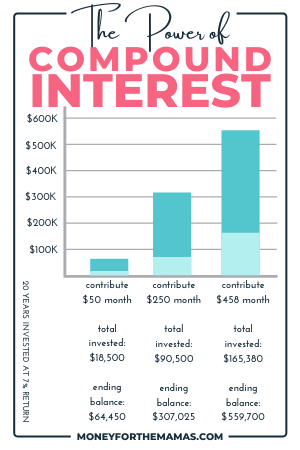

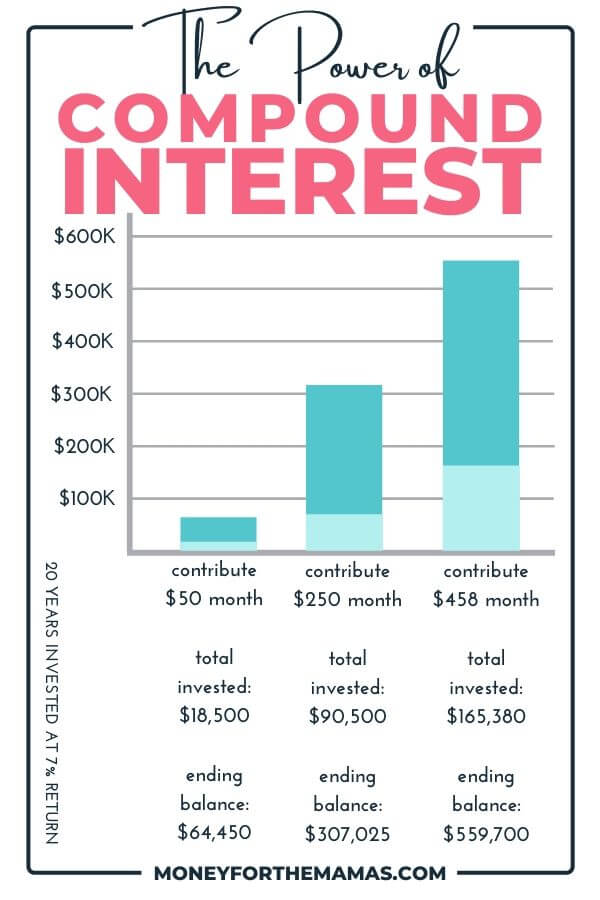

So here’s a scenario that’s a lot closer to what I did, from age 23 up to let’s say the age of 53 because a good round 30 years is a good amount of time for having money in a retirement account. Let’s also say my initial investment was $500, I deposited $50 every month and got a 7% rate of return.

By the end of 30 years, I will have $64,450. not bad, but not great either.

Now let’s take that same initial investment, same time, and rate of return, and I was killing it by putting $250 into that account. My investment would have ended up being $307,025. Did you choke? I did, even though I’ve run these calculations many, many times before.

Let’s say this was an IRA, and I maxed out my yearly contributions at $5500 (update – the limit is now $6,000); that’s $458 dollars a month. That would have ended up being $559,700. There’s a rock in my stomach. Do you have a rock in your stomach? Maybe it’s a lovely little nauseous feeling. Oh joy.

Yes, these equations were very even and straightforward, and life isn’t like that. Annual contribution limits increase, your average interest rate can (and will) go down drastically, or up even, or you may not always be able to save $458 a month, which is totally reasonable because that’s a hefty savings amount to go straight into retirement, especially if you have a family to consider.

Yet, the fact remains, most of us would rather have $559,700 in our bank accounts than $64,450.

This is my biggest financial regret, not saving more money from my salary, it hurts especially because when I was young and single, with a decent job I could have saved more. But I just didn’t know, so I didn’t do it. Now I am playing catch up, and I’ll be playing catch up for the rest of my life.

How to be a Financial Powerhouse – start retirement savings early!

Another way that I could have helped my future self out would have been to start saving & investing earlier. Now starting a retirement account at 23 yrs old is pretty dang good. I’m proud of myself. But if I didn’t want to have to save $458 a month, I could have started earlier.

If I had started five years earlier (all other things being equal), I could have gotten the same $559,700 by saving $312 a month. Or if I started ten years earlier, I would have only had to save $215 a month.

Again, I want to stress the simplicity of the equations; I didn’t take into account market fluctuations as I want to create a linear picture to help with understanding the concept of compounding interest, so please don’t get all crazy on me with specifics, or historical trends and such. We cool? Thanks.

How you can get started growing your money through investing

Many people don’t know how to get started with saving money in an investment account, so they put it off. This is a totally natural reaction, yet this is the worst thing you can do! Open an account for an IRA with a respected and trusted firm. Google it.

I personally have my accounts with Vanguard, as they have some of the lowest fees for INDEX funds around. You could choose Charles Schwab or Fidelity, the main thing is to just get started.

Now you need some starting money to get the ball rolling! Maybe consider doing a money-saving challenge!

Or throw a garage sale, make items to sell on Etsy, or whatever. Now some investment firms do require an initial deposit of a certain dollar amount – Vanguard just lowered their admiral accounts to a $3,000 buy-in, yet there are options at $1,000 opening.

Once you open it, you need to fund it regularly, the amount is up to you, but remember the power of compound interest! If you can swing more (the max for an IRA is $6,000 in 2021) then by all means do so! Just make sure you are consistent! I practice the Pay Yourself First model, so I always know that my long-term goals are gaining traction!

What is simple interest?

Let’s first look at compound interest’s younger and less complicated brother – simple interest.

Simple interest is the amount of the initial investment calculated with the agreed upon rate. Just as the name implies, it’s an easier, simpler, and more straightforward calculation.

You would use simple interest for a personal loan, or a car loan. If you are the “borrower” of money, this is the better deal for you. While compound interest account is used on investments and on credit card debt.

Compound interest formula and simple interest formula

Simple Interest:

simple interest = dollar amount of initial loan x interest rate.

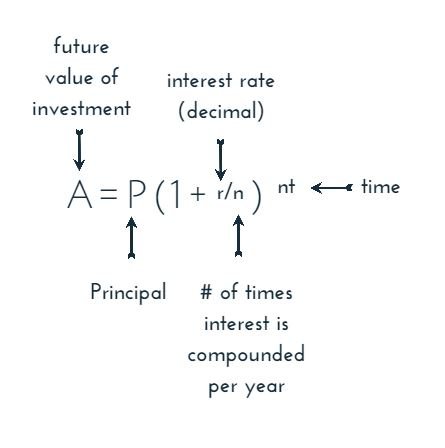

Compound Interest:

Example of compound interest

Let’s say you had $1,000 to invest for the next five years at 7% interest. What would that dollar figure look like?

Compound Interest:

I am going to write this one out in long format to give an easier visual. It’s the same formula as above, just broken down by year, which I feel is easier to understand. (interest is compounded annually).

Year 1: $1,000 x .07 = $70

$1,000 + $70 = $1,070

Year 2: $1,070 x .07 = $74.90

$1,070 + $74.90 = $1,144.90

Year 3: $1,144.90 x .07 = $80.14

$1,144.90 + $80.14 = $1,225.04

Year 4: $1,225.04 x .07 = $85.75

$1,225.04 + $85.75 = $1,310.79

Year 5: $1,310.79 x .07 = $91.76

$1,310.79 + $91.76 = $1,402.55

Using online compounding interest calculators

Here’s the funny thing about me, I stink at math. Yup, I use a calculator for everything more complicated than counting up to 10 (I use my fingers for that). Even back in the day, before cell phones, I carried a calculator around in my handbag.

Here is a useful online simple & compound interest calculator, which has just enough variables to help you but not confuse you. Yes, some calculators try and get all fancy with oddball options, but they are unnecessary, so even though these calculators may look simplistic, they are just fine and all that you really need.

Just make sure you start on the right tab (simple vs compound).

At the end of the day

If you haven’t started saving money yet, don’t waste your time with regret. I’ve got that covered enough for the both of us. I wish I could let this go, and I try hard every day. If I ever go back to therapy, then this will totally be on the agenda of the “guilt to ditch” list. Trust me; this regret is a WASTE. Focus your energy and attention on starting now, whatever day it is, start today.

Related articles to growing wealth with compound interest:

- 17 Money Saving Challenges to Supercharge Your Bank Account

- The Most Important Strategy to Help You Build Wealth

- Are You Throwing Your Money Away on Credit Card Interest Fees?

- How to Save More Money From Your Salary

Compound interest can be defined as interest calculated on the initial principal and also on the accumulated interest of previous periods.

even with compounding interest, is it too late to get started in early 40s?

It’s never too late! You may have to save more out of pocket to help you catch up to those that started saving earlier, but every bit will help you!

Yes, yes, yes – awesome post and so easy to follow, love it! Thanks for sharing 🙂

So glad you liked it!

You made it so easy to understand

I’ve had a lot of financial regrets! I wish I read this before! Huhu

I know, me too. Yet looking backwards is the surest step towards failure. Easy to say yet sometimes hard to do. We can only focus on making better choices today, and tomorrow and the days after!

Thanks for this post. Compound interest is so powerful. Until they invent time travelling, yes, you really need to start saving today!

OMG! Time Travel for compound interest would be amazing! Could you imagine buying Apple stock at its IPO? 🙂 I’m such a nerd!

I wish I had known this long ago! I have had a pretty bad relationship with money, but it’s getting better! Thanks for sharing!

Relationships are hard work, especially ones that you will have forever and deal with it multiple times a day! I think our own relationship with our money, our food, and ourselves are ones we definitely need to cultivate and focus on. As we will carry these with us forever and ever. Thanks for reading!

Thank you for making this so easy to understand. Great read. Thank you mama.

You’re welcome!

I wish I had started saving and using compound interest to my benefit so many years ago! Thanks for a great read and advice.

So glad you liked it!

This is such a great read! Thanks! I had no clue about this stuff!

The topic of compound interest us definitely not average mom chat 🙂 I too have learned so much from others sharing their experiences, I can only hope to do the same in my own way.

Hey Kari, This is a great piece! I’m a fan of using compound interest unless you are planning to use your investment as asset income! Do you have any suggestions on where to find a 7% interest rate like the one your referencing?

Hi Jodi – I’m so glad you liked the post. Using a flat 7% is a very simplistic calculation, as we know the market is anything but that, it fluctuates wildly. I mostly wanted to get the concept of compound interest across, without muddying the waters of it too much. Yet the S&P 500 has returned on average 10% over the past century. Some years very low, and some a lot higher (2013 – 2017 averaged a little over 14%). Overall, if the average person wants their money to grow they need to invest it over a long period of time. The sooner you start the more it will grow, and that’s what we all want!

Yes, many people don’t realize the power of compound interest. We work so hard for our money physically and yet many don’t do much with their savings. Great article! I’m sure it will open many peoples eyes!

Hi Minda! Yes, I hope it gets people thinking about what “could be” if they start planning now!

Compound interest is huge and I think if more people understood how it worked, they wouldn’t wait to save. The younger you are when you start, the more time is on your side to grow your money through compounding interest.

Yes! If I “had only” started when I was younger I could have retired at least 5 years ago 🙂

Interesting and made easy to understand

Thanks so much!

You did an excellent job of making a “complex” issue understandable. Thanks for the insight.

You’re welcome, so glad it was a good read for you!