10 Best Apps Like Brigit for Cash Advances (Get Money ASAP)

Apps like Brigit can help you get the cash you need in a hurry – let’s go through the best options

Author: Kari Lorz – Certified Financial Education Instructor

When you’re in a bind and need money fast, it can be hard to find loan options that are reliable, fast, and don’t charge crazy high fees.

With traditional banks requiring tons of paperwork and loan processes taking days or weeks, your options may seem limited. On top of that, many payday loans come with insanely high interest rates.

But with cash advance apps like Brigit, you can quickly get the money you need without any extra fees or worries. It’s the ultimate solution for anyone needing quick cash! Let’s go through the best apps like Brigit now.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

A quick rundown of the 10 best apps like Brigit for Cash Advances

Here’s a quick list of the finance apps we will be looking at today…

- Current

- Albert

- Chime

- Dave

- Cash App

- Empower

- FloatMe

- MoneyLion

- Cleo

- Brigit

Top three picks for the best cash advance apps like Brigit

For those of you in a hurry and just want to know what we recommended, here are our top three picks for the best cash advance apps like Brigit.

Albert

Current

How do apps like Brigit compare?

| App | Price | Advance $ | Advance/ Overdraft | Time to Account | Faster Delivery | Fast Delivery Fee |

|---|---|---|---|---|---|---|

| Brigit | $9.99 | $20-$250 | Advance | 1-3 days | 15 minutes | $.99-$3.99 |

| Current | free | $20-$200 | Overdraft | instant | n/a | n/a |

| Albert | free | $20-$250 | Overdraft | instant | n/a | n/a |

| Chime | free | $20-$200 | Overdraft | instant | n/a | n/a |

| Dave | $1 monthly | up to $500 | Advance | 2-3 days | Same day | $1.99-$13.99 |

| Cash App | 5% | $20-$200 | Advance | 1-3 days | n/a | n/a |

| Empower | $8 monthly | up to $250 | Advance | 1 business day | Within the hour | $1 – $8 |

| FloatMe | $1.99 monthly | $10 – $50 | Advance | 1 – 3 days | A few hours | $5 |

| MoneyLion | free | up to $500 | Advance | 12 hours – 5 days* | 15 minutes | $.49 – $8.99 |

| Cleo | $5.99 monthly | $20-$250 | Advance | 1-4 days | Same day | $3.99 |

*MoneyLion’s turnaround time varies depending if you want your money to your MoneyRoar account or to an external bank account.

1. Current

Current is a user-friendly banking app that’s all about helping you manage your money better. But unlike some other apps, Current doesn’t provide traditional cash advances. Instead, it has an Overdrive feature that lets you overdraft up to $200 without any additional fees.

This means if you’re running low on funds and need a little extra to cover a purchase, Current has got your back. It’s like a safety net that helps you avoid those pesky overdraft fees that banks usually charge.

But that’s not all Current offers. This app has features to help you spend, save, and manage your money. You can set up direct deposits, get instant notifications for purchases, block your card if lost or stolen, and even earn points for cash back when you use your Current card.

You can get Current on Android or get Current on iOS

Yet, my favorite feature of Current is their Savings Pods. This feature is a great way to stash away money for specific goals or even just for a rainy day. Users can create up to three distinct Savings Pods, each serving a different purpose. This could be anything from saving for a vacation, a new car downpayment, or just a general emergency fund.

What sets these Savings Pods apart is their high annual percentage yield (APY). Current offers a whopping 4.00% APY on up to $6,000 worth of savings across all pods. This is perfect for small revolving sinking funds like…

- Christmas savings fund

- Summer vacation fund

- New washer & dryer fund

So, not only do the Savings Pods help you keep your money organized, but they also help it grow. And with the bonus of being able to round up purchases and automatically move money into your pods, saving has never been easier.

So, while Current might not offer traditional cash advances, it’s still a powerful tool for managing your money and avoiding unnecessary fees.

- Current pricing: free

- Current pros: free, lots of additional services to help with money management

- Current cons: Overdrive doesn’t count for ATM withdrawals

- Fine print: all the small details…

- $20 – $250 cash advances available

- 2-3 days to account

- Must have had at least $500 direct deposited into your account

- Fee free Overdrive option applies to debit card transactions and ACH transfers but not ATM withdrawals or checks.

- Teen account doesn’t qualify for Overdrive

- Overdrive starts at $20 and automatically increases over time with the use of the app.

- Qualifying direct deposits are from your employer, payroll provider, or Government payroll.

You can get Current on Android or get Current on iOS

2. Albert

Albert is this handy app that’s all about helping you get a handle on your money. It’s like having a savvy financial buddy right in your pocket. Need some cash in a pinch? No worries! Albert Instant has your back with up to $250 in overdraft coverage. So whether you’re short on rent or need to cover a surprise bill, Albert can help you.

But that’s not all. Albert is also packed with a team of money gurus known as the Genius team. These folks are there to help guide you through your money decisions, big and small. They give you advice tailored just for you, so it’s like having a personal financial advisor at your fingertips.

Oh, and did I mention Albert can help you get paid earlier? That’s right, you can set up direct deposits and get your money up to two days sooner. It’s a real game-changer if you’re living paycheck to paycheck.

Albert for Android and Albert for iOS

And let’s not forget about investing. With Albert, you can start investing with as little as a buck. The app’s robo-advisor will even put together a portfolio that matches your risk tolerance and goals. It’s a great way to dip your toes into the investing world without needing much cash.

The best part? Albert is super easy to use. The app is available for both iPhone and Android users, and its user-friendly design makes it a breeze to navigate. So, if you want to take control of your financial future, Albert might just be the app for you. If you want to know all the details on Albert, be sure to check out our full review.

- Albert pricing: free for almost all features, including cash advances. Upgrade to the optional Genius Plan for $14.99 a month, but there is a free trial of Genius available.

- Pros: No credit check, quick deposits, smart savings tools, and no hidden fees.

- Cons: Limited advance amount in the very beginning.

- Fine print: all the small details…

- Your linked bank account must have been open for at least two months.

- You need to have a balance greater than $0

- You need to show consistent & regular direct deposits.

- Albert Instant covers debit card purchases, ATM withdrawals, and ACH transfers.

- They review Overdrive eligibility daily (turn on your notifications).

Get Albert for Android or Albert for iOS

3. Chime

Chime is like your personal money manager that lives in your pocket. It’s a digital bank that gets rid of the stuffy old banking ways and replaces them with cool features designed for the modern world.

Imagine getting your paycheck two days before everyone else at work. Sounds good, right? With Chime’s early direct deposit feature, that’s exactly what you get.

But they’ve got more tricks up their sleeve. Have you ever been caught short right before payday? Chime’s got your back with their SpotMe feature. They’ll lend you up to $200 without overdraft fees; this feature is available on debit transactions and cash withdrawals. You just pay them back when your next deposit comes in. No stress, no fuss.

In fact, lots of these other cash advance apps work with Chime as the connecting bank account, which is great if you don’t have a traditional brick & mortar bank.

On top of all that, Chime offers a credit-builder account if you need to raise your credit score and access to savings accounts (with automatic round-up features), all with 2.00% APY.

And the best part? No monthly fees or minimum balance. So, if you’re tired of traditional banks and their endless fees, Chime might be just what you need.

- Chime pricing: free

- Pros: High overdraft limit, no hidden fees.

- Cons: Only available to Chime account holders; direct deposit requirement.

- Fine print: all the small details…

- Paycheck advances range from $20 – $200; you get it instantly (no additional fee) as an overdraft protection at the register.

Try out Chime today and get up to $200!

- Paycheck advances range from $20 – $200; you get it instantly (no additional fee) as an overdraft protection at the register.

4. Dave

Dave is a financial tech app winning over users with its innovative features. One standout feature is its ExtraCash service, which offers users a paycheck advance. This feature can be a real lifesaver when unexpected expenses pop up. These advances can go up to $500, providing a substantial buffer for users in need.

The best part about Dave’s ExtraCash feature is that it doesn’t come with interest, credit checks, or late fees. It’s designed to help users avoid overdraft fees by providing a small cash advance when there’s a risk of overdrawing their bank account.

Here’s how it works: as soon as your next paycheck hits, your cash advance gets automatically repaid. If you’re new to Dave, you might start off getting less than $250, but don’t worry; you can increase it over time. The more you use the app, the more you can get in cash advances.

In a nutshell, Dave’s ExtraCash feature is like a financial safety net, helping you cover unexpected expenses without stressing over interest or late fees. By offering a straightforward and affordable solution to cash advances, Dave is reshaping how people manage their money.

Dave also has a few other features worth mentioning; their side hustle program helps you find small jobs to help you earn more (either at-home jobs or in your community). They also offer a savings account with 4.00% APY (which is a great interest rate).

- Dave pricing: $1 a month admin fee,

- Pros: No interest, credit check, or late fees for ExtraCash

- Cons: Limited advance amount in the beginning; optional tips are encouraged.

- Fine print: all the small details…

- At least three recurring deposits

- Consistent income history and spending patterns preferred

- A total deposit of $1,000 or more monthly to get a higher advance amount

- If you link your bank, your account must have a minimum 60-day history and a positive balance.

- Express deposit for ExtraCash from $1.99 to $13.99, depending on the loan amount requested, usually get it within an hour. Or free transfer in 2-3 business days.

Try out Dave today and get up to $500!

5. Cash App

Cash App is a popular financial platform that simplifies sending, spending, saving, and investing your money. It’s basically banking right from your phone, and it’s so user-friendly that it’s become the #1 finance app in the App Store, with 4.8 stars and 5.4 million ratings. Best of all, it’s free!

One of Cash App’s standout features is its P2P payment system, which lets you instantly send money to your friends or family. Whether it’s for splitting a dinner bill or sending a birthday gift, Cash App makes it so easy.

Then there’s Cash App’s “Borrow” feature, which is their take on a cash advance. If you find yourself in a pinch, Cash App lets you borrow up to $200 right from the app. Just keep in mind that a 5% fee is associated with this service, and you’ll have to pay back the money within four weeks.

This is a newer feature to Cash App, so it is rolling out slowly to users all over the US. So, if you don’t have this feature now, check back soon.

Cash App also offers investment opportunities. You can start dabbling in stocks or even bitcoin with just a few taps. Even if you’re a brand new investor, you can feel comfortable experimenting as you can start with just $1. In fact, there are lots of ways to make money on Cash App.

So, whether you’re looking to simplify your finances, dip your toes into investing, or just need a quick loan, Cash App has got you covered.

- Cash App pricing: The app is free

- Cash App pros: large user base

- Cash App cons: There are quite a few scams centered around Cash App. Just play it smart (aka, don’t lend people you don’t know money), and you’ll be fine. They also charge a 5% fee on loans borrowed. Borrow isn’t available to all users at this time.

- Fine print: all the small details…

- Cash advances from $20 to $200

- Cash App wants to see you use their CashCard regularly, add more than $200 a month to your Cash App account, and keep a balance above $0.

- 5% fee for the Borrow amount and repayment terms of four weeks. A late fee of 1.25% will be charged each week until the loan is repaid (after a one-week grace period).

Sign up for Cash App, and when you use code NRTZMHV you get a free $5 bonus!

6. Empower Cash Advance

Empower is a mobile banking app that offers more than just the ability to send and receive money. It also provides budgeting tools, savings features, and early access to your paycheck, making it a valuable tool for managing your money.

One of Empower’s standout features is its paycheck advance service. This feature allows eligible users, including gig workers or freelancers, to receive cash advances of up to $250. The process is instant, with the funds delivered directly to your bank account.

What sets Empower apart is that they offer these cash advances without any interest, late fees, or credit checks. This can be a real lifesaver if you’re hit with unexpected expenses or find yourself short on cash before payday.

However, it’s worth noting that this service does come with a monthly membership fee of $8. Despite this cost, many users find the convenience and peace of mind provided by Empower’s cash advance feature to be well worth the price due to the fact that you get your cash instantly.

Many other apps have a cash advance feature that gets you money in a few days, or you can pay extra for an instant transfer. But not with Empower; it’s instant transfers every time. How fast do you get the money? 98% of Cash Advances delivered “instantly” arrive within 15 minutes. Typically faster.

Whether you’re looking for an easy way to manage your money, a safety net for financial emergencies, or just a smarter way to budget and save, Empower has got you covered.

- Empower pricing: 14-day free trial, then $8 a month auto subscription.

- Pros: 14-day free trial, gig worker friendly, cash advances for free within one day, other money management tools available, no credit check.

- Cons: Monthly subscription fee after trial, optional fees are higher than other apps, and advances may be smaller than other apps.

- Fine print: all the small details…

- Advance amounts from $10 to $250

- Optional fast funding fee from $1 to $8 depending upon the amount requested; you’ll get it within one hour or wait one business day for a free transfer.

- Optional tipping is encouraged.

- The linked bank account must be at least open for 30 days.

- Likes to see regular deposits and low spending habits.

Sign up for Empower here.

7. FloatMe

FloatMe is a simple and straightforward money-lending app with no credit checks or interest. It’s essentially your best financial friend in app form, as you can borrow up to $50 to help you get by until your next paycheck.

The process to request a Float is simple and quick. With just a few taps in the app, you can have the money sent directly to your bank account, and it will arrive in 3 days. If you need it faster, you can choose the instant delivery for a fee of up to $5 (depending on how much money you request.

So, if you need a small cash advance to tide you over until payday, FloatMe has you covered.

- FloatMe pricing: $1.99 a month subscription, and fees up to $5 for instant transfers

- Pros: No interest or late fees, low cost.

- Cons: Small advance amounts, monthly fee, no repayment extensions, not for self-employed or gig workers, no other money management features available.

- Fine print: all the small details…

- Cash advances from $10 to $50

- Instant transfers are $5; you’ll have your money within a few hours. Or get your money for free in 1-3 business days.

- A Linked bank account must show direct deposits from an employer of at least $200. your account must have a positive balance.

Sign up for FloatMe here.

8. MoneyLion

MoneyLion lets you do a bunch of financial needs like mobile banking, borrowing money, saving up, and even investing. It’s all about giving you the right tools to get your finances in check.

One of MoneyLion’s key features is its cash advance service known as “Instacash.” This feature allows eligible users to get cash advances of up to $500, providing a quick solution for those needing cash before their next paycheck.

While standard delivery of your Instacash could be up to 5 days (for free), you can pay extra to get the funds sooner (fees vary based on the amount requested).

Another thing to be aware of is that in the beginning, you may not qualify for much of a cash advance, but the more income you have direct deposited into the account and the more you use it, the higher your loan amount goes. They state, “it can take about three to eight weeks to become eligible for the maximum amount of Instacash.“

However, if you have their Credit Builder Plus membership, you can unlock an Instacash amount of up to $700 (one of the largest amounts of the payday advance apps we’re reviewing here on this post).

The good news is that MoneyLion’s Instacash doesn’t mess with interest rates, credit checks, or cost anything. But keep in mind you have to be a member to access this feature, and that comes with a subscription fee of $1 for a MoneyRoar account, or for the Credit Builder option, it’s $19.99 a month. You can, however, offer a “tip” for any Instacash services you receive.

- MoneyLion pricing: $1 for admin fee for a RoarMoney account and $19.99 for a Credit Builder account.

- Pros: High advance amounts, additional financial services available, you can extend your repayment date.

- Cons: Requires membership; some features have additional costs and higher expedited funding fees.

- Fine print: all the small details…

- Cash advances up to $700 with a subscription or $500 with a regular account.

- A fast funding fee of $.49 to $8.99, depending on the amount requested, and you’ll usually have the money within 15 minutes. Or get your money for free within 24 hours into your Roar account or in 2-5 business days to an external checking account.

- Optional tips are encouraged.

- The linked bank account needs to have been open for at least two months, have at least three direct deposits into your account, and must have a balance greater than $0

Note: Not everything is roses on MoneyLion. In September of 2022, “the Consumer Financial Protection Bureau (CFPB) sued MoneyLion Technologies, an online lender, and 38 of its subsidiaries, for imposing illegal and excessive charges on servicemembers and their dependents. The CFPB alleges that MoneyLion violated the Military Lending Act by charging more than the legally allowable 36% rate cap on loans to servicemembers and their dependents, through a combination of stated interest rates and monthly membership fees.” (source).

So, excessive fees seem to be an issue when using multiple products and loan services from MoneyLion. Just something to be aware of.

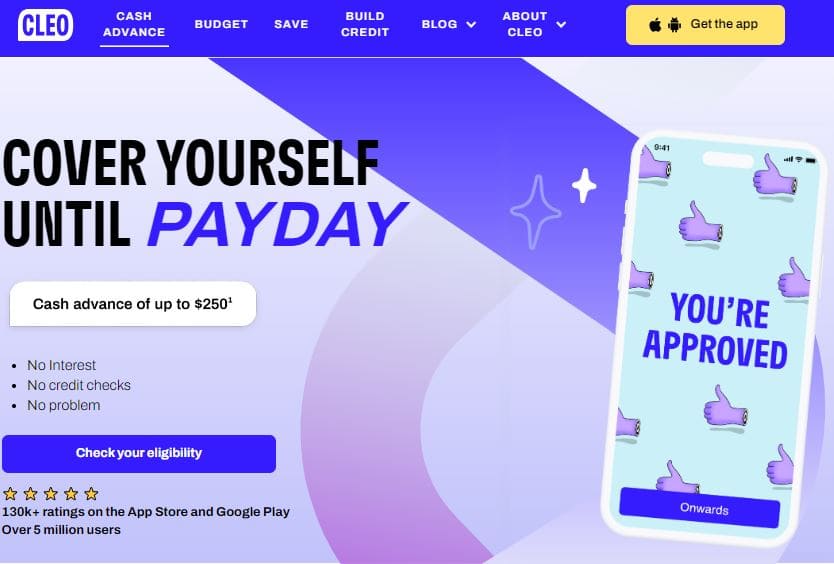

9. Cleo

Cleo is an AI-powered app that offers a range of financial tools, including budgeting, saving, credit building, and cash advances. The platform aims to make managing money fun and accessible for its users. Yes, I said fun. But how can budgeting be fun?

Cleo is the straight-talking AI money app that gives it to you, no pulling punches; if you go out for fast food too much, Cleo will call you on it, usually in a hilarious but absolutely honest way.

Cleo offers cash advances up to $250 without any interest or credit checks. However, to access these advances, you need to be a Cleo Plus member, which involves a monthly fee of $5.99 a month. Or, for their Credit Builder account, it’s $14.99 a month.

First-time users can generally access between $20 to $70, and once they pay back their first advance, they may qualify for additional funds. This feature provides a quick and easy way to get cash when needed. You can get your funds for free in 3-4 days, or you can pay $3.99 for express delivery.

One thing that makes Cleo stand out is that they are freelancer and gig worker-friendly. No employment verification, no time-sheet checking. They just make sure you’re a real human; no bots allowed.

- Cleo Pricing: $5.99 for Cleo Plus or $14.99 for Cleo Credit Builder (student discount available).

- Pros: Offers budgeting tools, no interest charges, funny straight talk direct to you, no credit checks, freelancer friendly.

- Cons: Subscription fee, lower payday advance amount.

- Fine print: all the small details…

- Cash advance amounts of $20 – $250

- Express pay option for a $3.99 fee, and you’ll get it within the day. Or you can get it for free within four days.

- A linked bank account needs to show “regular income,” red flags are too many cash withdrawals from the account or not enough transactions to show regular usage.

Try Cleo today!

So these are the top 9 apps like Brigit. Yes, I said ten apps at the beginning, but after looking into the last few remaining options, they were employer-sponsored apps (so your workplace has to use them). Or the apps weren’t good enough to recommend. I don’t want to point you to an app that isn’t user-friendly (i.e., fees are too high, misleading benefits, or will get people into bad financial habits).

So, let’s round out the top 10 payday advance apps by actually talking about Brigit and what it has to offer.

10. Brigit app

If we talk about apps like Brigit, it’s only fair that we talk about the features of the Brigit app because maybe you’re not aware of all the things it can help you with. For example, Brigit offers…

- Instant Cash – cash advances of up to $250 with no interest, late fees, credit checks, or tipping. You can get your money in 2-3 days for free or pay a small fee for instant transfers. You also have a few options in picking your repayment date, which is really nice to have that flexibility.

Not everyone will qualify for the full $250 at first; you’ll need to show good spending & earning habits to get the full amount. You can request a loan amount or turn on the “auto-advance feature” to act as a fee-free overdraft protection. - Credit Builder – By saving at least $1, you can start building your credit history. You don’t even need an upfront deposit to get started. Brigit will help you apply for a small loan (soft credit pull), and then over the next months, you’ll pay a minimum of $1 of your own money and then use the funds from the loan to pay back the loan.

This builds your positive credit history. Your payments then get put into a savings account that you can withdraw anytime. Brigit reports to all three credit bureaus. - Finance Helper – Brigit can help you track, understand, and better manage your money habits by giving you free budgeting tools and helping you track your bills.

- Earn & Save – This feature can be extremely helpful for those looking to make a little extra money. Brigit has an online job board where you can go to find a side gig or freelance work. (Dave is the only other app that offers this feature). They offer a selection of at-home jobs or placements out in your local area.

Brigit seems to have a lot of helpful money management features, but will these help you enough to offset the cost of a subscription? Only you can decide that. Let’s dig into the details.

- Brigit app Pricing: Free plan (budgeting and earning tools only), or their Brigit Plus plan for $9.99 monthly (you’ll need the Plus Plan for cash advances).

- Pros: No tips, lower fast funding fees, and other money management tools.

- Cons: Monthly subscription fee.

- Fine print: all the small details…

- Cash advance amounts of $20 to $250

- A fast funding fee of $.99 to $3.99, depending on the amount requested, and you’ll get your money within 15 minutes. Or get the money for free in 1-3 business days.

- The linked bank account must have been open for at least 60 days and have a balance over $0.

- You must have at least three recurring direct deposits from your employer (and have money left in your account at the EOD on payday.

- “Good income and spending habits,” which is vague and open to interpretation.

Sign up for Brigit and get up to $250 today!

Why apps like Brigit are better than payday loans

Cash advance apps like Brigit are a much smarter (and easier) choice than using a payday loan company. It’s true that with payday loans, you can get higher amounts, but it’s definitely not worth it with the interest they charge.

The fees and interest rates are much more reasonable compared to those payday loans. Payday loan apps & companies can be brutal, with sky-high interest rates and extra charges. I’m not exaggerating when I say it’s not uncommon for places to charge about 400% interest when all the fees are added together.

But with apps like Brigit, they’re all about keeping things affordable. That means you can avoid getting trapped in a never-ending cycle of debt caused by insane fees and interest charges.

These apps don’t just stop at giving you money; they’ve got your back when it comes to managing your finances, too. With useful features like budgeting tools and expense tracking, they help you stay on top of your money game. It’s all about promoting financial wellness and empowering you to make smarter choices.

So, if you need some quick cash without the headache of payday loans, pick one of these apps like Brigit (or even the Brigit app itself). They’re all about convenience, affordability, and helping you take control of your financial future.

How to be approved for a higher cash advance limit

When you first download and sign up for one of these cash advance apps, it’s important to know that you won’t be approved for the full amount immediately. Your borrowing limit could take weeks to a few months to reach the cap. But there are things that you can do to help speed this along.

- Link a bank account that you’ve had open for at least 60 days (some apps say 30 days) that shows that you maintain a positive balance (aka greater than $0). It is even better if you maintain a minimum balance of $100.

- Some apps like to see regular activity in your bank account, that is, a transaction every couple of days for small amounts.

- Use their app regularly; it’s best when you spend small amounts.

- Have a few different income sources with regular payments directly deposited into your app account.

- Some apps let you “boost” friends, and in turn, they can boost you back; these are usually small temporary increases to your borrowing limit.

Cash advance apps fine print

Before signing up for a cash advance app, it’s important to consider the following factors…

- Requirements: You will need to have a paycheck direct deposited into your account to enable the cash advance features. Your account will need to be open for a certain time length before you’re approved to borrow (so sign up for the app before you need it!).

- Fees and Interest Rates: Look closely at the fees and interest rates associated with the cash advance app. Ensure you understand the cost of borrowing and any additional charges that may apply. Even though most of these apps advertise that they are fee-free, you will have to pay for some things (i.e., instant transfer vs. standard delivery, late fees if you don’t pay it back on time, etc.).

- Reputation and Reviews: Research the reputation of the cash advance app and read reviews from other users. Look for feedback on the app’s customer service, ease of use, and reliability.

- Terms and Conditions: Carefully review the terms and conditions of the cash advance app. Understand the repayment terms, late payment penalties, and any potential consequences for defaulting on the personal loan. For example, some apps state that your linked banking account must be open for at least 30 or 60 days or that your account must have a positive balance for the past thirty days.

- Privacy and Security: Ensure the app has robust security measures to protect your personal and financial information. Look for indicators such as encryption and secure data handling practices.

Apps like Brigit FAQ

Q: What app will give me $100 instantly?

A: There are several apps available that offer instant cash advances, such as Cleo, Dave, Current, and Albert. These apps allow you to request small amounts like $100 and receive the funds quickly.

Q: How can I borrow $200 from Cash App?

A: Unfortunately, Cash App is rolling out their “Borrow” feature to select users only at this time. If you don’t have the feature now, keep checking back in to see.

Q: What apps let you borrow the most money?

A: When it comes to borrowing larger sums of money, there are a few apps you can consider. Dave will let you borrow up to $500. Or some of the other apps will increase your limit if you subscribe to their top-level plan. For example, MoneyLion will let you borrow up to $700 if you have their Credit Builder Plan.

Q: Are there apps that let you borrow money instantly?

A: Yes, there are apps specifically designed to provide instant access to borrowed funds. Almost all apps offer a standard delivery time of 2-5 days. Yet you can opt to pay a small fee (usually less than $6 – depending on the personal loan amount requested) to get the funds instantly, which could be anywhere from 15 minutes to a few hours.

At the end of the day

These instant cash advance apps like Brigit can help you get the money you need fast, with minimal to no fees charged. Whether you’re dealing with a financial emergency or just an unexpected expense, these apps are here to help reduce the burden and provide much-needed financial relief in trying times (even if you have bad credit).

Researching and deciding which loan app is right for you could save hundreds of dollars in fees and interest payments. If you need financial assistance, Brigit and similar loan apps are an ideal way to help manage your money more effectively and worry less about emergencies.