The Top 5 Payday Loan Apps That Work with Chime

If you need a cash advance, we’ve laid out the best payday loan apps that work with Chime so you can get the cash you need (and get it quick)!

Author: Kari Lorz – Certified Financial Education Instructor

Unexpected expenses can crop up at any time, and it’s not always easy to come up with the money you need on short notice.

A cash advance app can help you cover that unexpected expense without taking out a high-interest personal loan or awkwardly trying to borrow money from friends or family. These payday loan apps work with Chime, so you can get the money you need quickly and easily.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- If you need a cash advance, we've laid out the best payday loan apps that work with Chime so you can get the cash you need (and get it quick)!

- Cut to the chase – these are the best apps that work with Chime

- Payday loan apps that work with Chime

- 1. Albert – up to $250 cash advance

- 2. Current – up to $200 paycheck advance

- 3. Dave – up to $500 cash advance

- 4. Cash App – up to $200 payday advance

- 5. Cleo – up to $100 payday loan advance

- Other cash advance apps that work with Chime

- Payday loan apps that don't work with Chime (for now)

- Chime's SpotMe® program

- How do I link my account to Chime?

- Why is it important to have other payday loan apps that work with Chime?

- How much is an overdraft fee?

- What is a payday loan app?

- Pros and cons of cash advance apps

- Payday loan apps that work with Chime FAQs:

- At the end of the day

Cut to the chase – these are the best apps that work with Chime

Albert

Current

It’s important to know that these apps aren’t the traditional payday loans that everyone tells you to steer clear of. These cash advance apps don’t charge interest fees, and the other fees (if there are any) are minimal.

Remember, traditional payday loans average about 400% interest, as they prey on people with “bad credit” who can’t get a loan from a traditional bank.

Payday loan apps that work with Chime

There are a handful of cash advance apps that work with Chime®; we’ll go through them all in detail. But first, let’s do a quick glance at your options and what they offer for cash advances.

| Question | Answer |

|---|---|

| Does Albert work with Chime? | Yes, get up to $250 |

| Does Klover work with Chime? | Yes, get up to $200 |

| Does Dave work with Chime? | Yes, get up to $500 |

| Does Cleo work with Chime? | Yes, get up to $100 |

| Does Current work with Chime? | Yes, get up to $200 |

| Does Float Me work with Chime? | Yes, get up to $50 |

| Does Money Lion work with Chime? | Yes, get up to $250 |

| Does Cash App work with Chime? | Yes, get up to $200 |

| Does Varo work with Chime? | Yes, get up to $100 |

| Does Empower work with Chime? | Yes, get up to $250 |

| Does Earnin work with Chime? | Not at this time |

| Does Brigit work with Chime? | Not at this time |

1. Albert – up to $250 cash advance

Budgeting, saving money, and investing can all be accomplished by using Albert. You simply connect your bank account to the app. You also have a team of experts there with their Genius plan, they can do things like create a budget for you based on your spending patterns, or you can ask them questions on loans, financing, etc.

With Albert, there are numerous ways to make extra cash, such as through their saving bonus, direct deposit, referral bonus programs (up to $150), and cash back when you shop. Also, if you direct deposit your paycheck with Albert, you can access your money 2-days earlier than with a traditional bank, and they even offer cash advances up to $250!

The best part about Albert is that they don’t have monthly maintenance fees or minimum balance requirements! (You can opt-in for a subscription for $8 or go with the free account option).

Albert for Android and Albert for iOS

But I know we want to learn about Albert’s $250 payday loan advance. To get an Albert cash advance…

- Your income check is direct deposited into your connected bank account – (aka Chime)

- Your connected bank account has been open for at least two months and has a balance greater than $0 (no negative balance).

- You’ve received consistent income from the same employer in the past two months.

- Your recent paycheck was received on time, and funds are available 24 hours after your payday.

This isn’t a sketchy payday loan scam; Albert legitimately wants everyone to succeed with their finances! It’s important to note that they do offer a paid plan – Genius. But you don’t need to enroll in that to get a personal loan.

We go into detail on Albert’s payday advance and other features here.

Albert is not a bank; they are a tech company. Banking services are provided by Sutton Bank, member FDIC.

2. Current – up to $200 paycheck advance

Current is another banking app that aims to win your banking business. They offer features like…

- High-interest saving rates – 4% APY in the Savings Pods (three pods only, you can earn interest on up to $2,000 per Savings Pod.

- Buy and sell crypto right inside the app (without trading fees), and you start with as little as $1.

- Refer a Friend and earn – when you refer a friend to Current, and they receive a direct deposit of at least $200 within the first 45 days of opening an account, you both will get $50.

- Fee-free banking – there are no overdraft fees, no minimum balance fees, and no peer-to-peer in-app transfer fees. The advertise their “no hidden fees” approach. But there are a couple to be aware of if you go out of network for ATMs.

- Cash back with debit – their debit card has cashback point offers at over 14,000 merchants nationwide. You can then redeem these for cash in the Current app.

- Teen banking – this option is with a Current Visa debit card. As the parent, you can easily transfer allowances to your child, track their spending from within the app, block certain sellers and set predetermined limits for purchases. Teen accounts also have access to Saving Pods and automatic round-up savings.

- Current pay – their peer-to-peer lending capabilities

- Faster direct deposit – with Current, you can get paid up to 2 days early (compared to traditional banks) when you sign up for direct deposit with your Current Account.

- Simple budgets – you can set up a budget for a single category or your whole household.

- Overdrive – this is Current’s overdraft protection feature, where you can get up to $200 covered. To be eligible for this offer, you must deposit at least $500 in your Current account through a direct deposit. This fee-free coverage option applies to debit card purchases and ACH transfers but not ATM withdrawals or checks.

You can get Current on Android or get Current on iOS

The Overdrive feature is the one we want to emphasize. Though not exactly a cash advance, it performs similar functions. You can access between $25 and $200 in an instant when you require it most – so you can avoid any overdraft fees.

By actively using the debit card and other features of your Current account, you can increase your limit without requesting a limit increase.

Best of all, there are no hidden fees or monthly subscriptions required to be eligible for this feature. All you need is a qualifying deposit, and – boom! You’re ready with Overdrive. Just note that teen accounts don’t qualify at this time.

Current is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Member FDIC.

3. Dave – up to $500 cash advance

Dave is a financial app to help you avoid overdraft fees, get payday advances up to $500, and even help you find some extra work!

The $500 ExtraCash program is among the highest (most other apps offer up to $250 as the norm). Dave proudly says that their payday loan comes with no interest, no credit checks, and no late fees! What’s more, they don’t require a direct deposit as other cash advance apps do.

Here’s how it works…

- Sing up for Dave

- Connect your bank account (aka Chime)

- Confirm your identity and open your ExtraCash and Dave Spending accounts

- Check to see how much you’re eligible to receive as a cash advance.

- Accept the ExtraCash, and spend your money (either from your Dave Spending Account or transfer it to an external account).

- Pay back your loan by the agreed upon date. You can be eligible for another loan in 2-5 business days.

Dave uses a variety of information points to help determine your short-term loan amount, such as income history and spending patterns. To get a higher loan amount, you’ll need a total deposit of $1,000 or more monthly. (To qualify, your linked bank account must have at least three recurring direct deposits. SSI counts as a recurring deposit!)

Your ExtraCash amount can change daily, so be sure to check back often!

Dave is not a bank. Banking services provided by Evolve Bank & Trust, Member FDIC.

4. Cash App – up to $200 payday advance

Cash App, which began as a simple peer-to-peer payment platform similar to Venmo, has now become something far greater. Let’s take an in-depth look at its many features…

- Free peer-to-peer payments – free for in-app transfers.

- Earn cash back – spend using your Cash Card – use it as a debit card; you can even earn cash back bonus offers with Boost.

- Fee-free banking – banking has no monthly fees and no overdraft fees.

- Get paid up to 2 days earlier – when compared with traditional banks, when you have direct deposit set up.

- Invest – either in stocks or Bitcoin through the app. You can also round up your Cash Card transactions and use that money to invest. You can start investing with as little as $1; you can even gift stocks to other users, just as you would cash.

- Available for 13 yrs and older – they offer family accounts – where parents can monitor their child’s Cash App activity.

- Refer a friend – You can earn $5 – $15 when your friend signs up with your link and completes the referral bonus steps (you can read about Cash App’s free money code right here).

- Cash App Borrow – this is their cash advance option; see below for full details.

Cash App users already love the convenience of receiving their paychecks two days early, but Cash App is taking it to the next level with its new feature: Cash App Borrow. Unfortunately, this feature isn’t available for all customers yet as they are in the developing stages; however, with even more options and benefits soon to come, you won’t want to miss out on using Cash App!

If you’re wondering if Borrow is available for your account, simply navigate to the Money section of the app. Click on your balance in the bottom left corner, then scroll down until you see “more ways to add money.” If Borrow is an option at this time, it will be displayed there. Note that access to this feature may be limited right now due to its recent rollout.

If you are eligible, you can take out a loan between $20 to $200. You will have four weeks to pay it back, along with the 5% fee that is applicable upon repayment. A 1.25 – 1.5% late fee will be charged weekly after a one-week grace period if payment isn’t made within the allotted timeframe!

While it may be a bit of a downer that Cash App charges for their services, it’s also important to remember that many other applications charge subscription fees.

Consider the fact that although there is still a fee associated, it pales in comparison to payday loan percentages and thus makes this service extremely reasonable by comparison.

For example, if you borrowed $100, that would be…

- interest rate/principal amount borrowed –>

- divided by the number of days of the loan –>

- multiplied by 365 days (one year) –>

- multiplied by 100 (to give you the percent)

.05 / 100 –> /28 days –> x 365 –> x 100 = 65% APR. So this is much lower than a payday loan (average of 400%) but a higher APR than a credit card (average of 19.20% right now). The main disadvantage of a credit card is they run a credit check, which most payday advance apps don’t.

If you are enrolled in automatic payments and do not pay off the Cash App Borrow loan by your due date, Cash App may deduct the loan balance from your Cash App balance or debit card. Cash App may also suspend you from the platform until the loan and any finance charges are paid in full.

Cash App’s latest borrowers agreement says that using their borrow feature “may result in an inquiry on your credit report that may affect your credit score.” So it’s a little unclear if, indeed, they do pull your credit.

You can sign up for Cash App right here, and when you use code NRTZMHV you get a free $5 bonus!

Do cash advance apps affect your credit?

No. Payday advance apps do not affect your credit score in any way, as they are not reported to the credit bureaus or pull your credit to process your information. These loans provide a quick and easy solution when you need money fast and don’t have the time to go through traditional banking methods.

5. Cleo – up to $100 payday loan advance

Cleo is your A.I. money assistant who tells it like it is when it comes to budgeting, saving, and building credit. She’ll message you during the day about your purchases and savings, and she won’t let you slack off. Tough love is her specialty, but you can always switch her tone to be “encouraging” if you prefer.

With their Credit Builder subscription ($14.99 per month), you can get up to $120 payday advance (there are eligibility requirements). If you’re a student, you can get a discount on their Credit Builder program too, so be sure to look for that!

With Cleo Plus (only $5.99 per month), you can borrow $20 – $250 with their “spot me money” options. There’s neither a credit check nor any interest to worry about! If you’re not immediately approved, don’t worry, they give tips on improving your eligibility, and you can reapply for a cash advance in only a few days.

I know it can be tough to subscribe when you’re short on money, but $5.99 is much less than potential overdraft charges from your bank!

Overall, signing up for Cleo takes only two minutes, so if you need that budgeting & saving support, it’s well worth your time! Honestly, their A.I. assistant will be your new BFF, and yes, straight talk with a snarky sense of humor is included while improving your bank account balance!

Cleo Credit Builder Card issued by WebBank, Member FDIC.

Many of the cash advance apps have the option to leave a “tip” for using the service. While it’s nice to leave a tip, it negates the promotional jargon of “free borrowing.” So tip or don’t tip; it’s totally up to you. But if you do, make sure you account for it when figuring out how much the cash advance is really costing you.

Other cash advance apps that work with Chime

The apps I mentioned above are what I would consider the best payday loan apps that work with Chime. They have great features that do much more than just letting you borrow money. They help you do a better overall job with your finances, increasing your knowledge and helping you become more confident with your personal finances.

But there are more cash advance apps that work with Chime, but I’m not as familiar with them. But let’s go through their main features so you at least have an idea if you want to check them out more.

Empower

Empower’s main focus is to help you build better credit, which includes taking short-term loans as a cash advance. You can get an Empower cash advance of up to $250 with no interest, late fees, or credit checks.

You can get instant access to your small loan with their Empower card (a debit card), where you can get access to your direct deposit two days early and get cashback when you use your card.

To qualify for an Empower cash advance, you’ll need…

- Link your U.S. bank account where you receive direct deposit

- Be 18 years old

- Have a cell phone that receives SMS messages

… and that’s all they publically say about it, which is frustrating. As you know, there must be a couple more data points you need to hit to be approved. I would consider this a red flag. Why go through the process of setting up this app if you don’t know if you’ll qualify for an advance or not?

They also charge an $8 monthly subscription fee.

Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC. Empower Thrive is provided by FinWise Bank, Member FDIC.

Varo

Varo is mainly a banking platform where you can get a checking and savings account, borrow money, and build your credit.

You can borrow up to $100 with the Varo cash advance program. Once you qualify, you’ll have immediate access to $20, and then you can work your way up to higher loan amounts.

While many payday loan apps have free cash advances, Varo does charge a small fee.

- $20 – $0 fees

- $50 – $3 fee

- $75 – $4 fee

- $100 – $5 fee

You just need to pay back your loan in full within 30 days.

To qualify for the loan…

- Your Varo account, and the bank account you link to Varo (aka your Chime® bank account), must be at least 30 days old.

- Have at least $1,000 in direct deposits to that bank account (checking or savings) within the last 31 days.

- Your bank account cannot be overdrawn (aka balance higher than $0)

- You must have an activated Varo bank debit card

- For advances over $20, other qualifiers may come into play.

Money Lion

Money Lion is a full mobile banking app with many features like investing accounts, credit builder plan, crypto, and cashback with their debit card. They also offer Heartbeat, which is an easy way to help you track your money so you can actively improve your financial wellness.

You can get up to $250 with MoneyLion’s Instacash feature, with no credit check, no monthly fee, and zero interest.

To qualify for Instacash, you need to…

- Consistently receive the same amount of money at the same time of the month.

- A linked checking account that has been open for two months has a positive balance.

Here’s how to do it…

- Open a MoneyLion account

- Link your checking account (aka your Chime account)

- Request an advance and select your amount.

Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion.

It’s interesting, but their fine print reads… “You can raise your Instacash limit up to a maximum of $1000 (depending on the anticipated income amount) by switching your direct deposits into a RoarMoney℠ account.” Or, you can raise your limit to $700 by having a MoneyLion paid membership plan.

They don’t advertise this higher amount very much, which makes me wonder why? Yet more fine print reads that they do a soft credit pull for the larger loan amounts.

Your cash advance repayments are automated, taking the money back out of your next paycheck. You can request to defer your repayment date, which is a nice option!

MoneyLion is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and MoneyLion Debit Mastercard®️ issued by, Pathward, National Association, Member FDIC

Many of these apps have other great features, like budgeting help, getting paid 2 days early when you sign up for direct deposit, and credit building help. You can see our full guide, where we compare credit builder programs to help you pick the best option.

Klover

Klover is another option for a cash advance, and they offer up to $200 with zero interest and zero late fees. They are newer to the field, starting in 2019, so there’s not as much user feedback on this app as there is with others.

They have budgeting tools with save-spend goals and credit score tracking, which all sound great. However, they lost me when they told me I could earn points by taking surveys, watching ads, and entering contests.

I don’t know about you, but I like my financial tools to focus on what’s important, managing my money. I don’t want them spending resources on surveys and other silly things. Let’s keep our focus where it should be.

I also cannot find info on their bank partner, which is strange as all the other apps say who handles the banking side of the business.

Float Me

FloatMe claims to be your new BFF (best financial friend), and they can loan you up to $50 with no credit check and no interest.

They have a monthly subscription fee, which is pretty low at $1.99 a month. Yet, their $50 advance limit is low too. I’d pass on this one and aim for a payday loan app that works with Chime that has a higher loan amount.

The FloatMe MVP Card is a secured charge card issued by Evolve Bank & Trust, member FDIC.

Grid

Grid will advance you up to $200 if you need extra cash, yet it comes with a $10 monthly subscription.

They offer some help with tax projections and claims that you can get part of your annual tax refund early through them. It sounds nice, but what if part way through the year, you lose your job? Then you’re probably on the hook for the money that you took early. I’m not a tax pro, but I don’t want to mess with tax money. It sounds like there could be potentially messy problems.

Grid is not a bank, the Grid Card issued by Evolve Bank & Trust, Member FDIC.

Branch

Branch is slightly different from the other cash advance apps, as they are more of a workplace payment solution, not necessarily for personal use. Yes, you (an employee of a place that uses Branch as their payment method) use your own money, but businesses initiate it.

If your workplace does use Branch, they offer “earned wage access,” which is a way for employees to access their earned wages ahead of the traditional payday, allowing them to better manage their finances. With Branch, you can access up to 50% of your already-earned wages (before your regular payday).

Payday loan apps that don’t work with Chime (for now)

While many payday loan apps work with Chime, not everyone does; but maybe they will soon. Here are the apps that don’t currently work with Chime®.

- Earnin

- Brigit

- Vola

Chime’s SpotMe® program

We’ve talked a lot about cash advance apps that work with Chime, but let’s take a minute to walk you through Chime’s SpotMe program so you can see if you want to try it anyway.

As I said, when you initially sign up for Chime, your SpotMe limit may be low, but it may be set at just what you need.

When you bank through Chime and use their SpotMe* feature, you don’t have to worry about getting turned down at the register for a declined card, as Chime spots you up to $200 to cover you! (SpotMe only works on debit purchases, cash withdrawals at ATMs, and cash back at stores).

To fully access Chime’s SpotMe, you must fulfill a few requirements…

- You must set up a qualifying direct deposit of $200 or more into your Chime account (within the previous 34 days).

- You need to activate your free debit card.

- Go to your settings tab and see if you are eligible; if you are, just enroll in SpotMe and agree to the terms & conditions, and you’re all set!

As we discussed, your SpotMe limit will likely be set low ($20), but it can be changed depending on account activity.

Here’s what their website says, “Your Chime SpotMe limit is set automatically by a variety of factors related to how you use your Chime account. This may include how long you’ve been a member, your account history, and how much you direct deposit per month. We’ll notify you if and when you qualify for a higher limit.”

So keep those phone notifications on so you know when your limit is raised!

*Chime SpotMe® is an optional service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially but may be later eligible for a higher limit of up to $200 or more based on the member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third-party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.

What counts as a direct deposit with Chime?

Direct deposit is one of the main qualifiers for being eligible for SpotMe, so here’s what kind of direct deposit counts for this requirement. It must be at least $200, within the previous 34 days, and made by Automated Clearing House (ACH) from your…

- Payroll provider

- Gig economy payer

- Benefits payer

- Original Credit Transaction (OCT) from your gig economy payer.

How do I get a higher SpotMe limit?

You can also get your SpotMe limit increased by receiving Boosts from friends! A Boost from friends temporarily raises your SpotMe limit by $5 for each Boost. You can also give your friends a Chime Boost when they need it too.

You can send & receive up to four Boosts a month, which lasts until the first day of the next month. It’s important to note you can’t give more than one Boost to the same person in a single month; you need to spread the Boost love around.

There are Boosts, and then there are SpotMe Bonuses. This also temporarily increases your SpotMe limit. Bonuses are given out based on your account history and activity. The max bonus amount at one time is $50.

Is SpotMe free?

You won’t ever need to pay to use the SpotMe, as one of the main points is that it’s fee-free! However, you can leave an optional tip* if you want. Tips allow Chime to improve this service and help more people get the cash they need.

*Tipping or not tipping has no impact on your eligibility for SpotMe.

How do I pay back my Chime cash advance?

If you use SpotMe, the easiest part is paying it back, as the app will automatically take the funds back when you get your next direct deposit or when funds are transferred into your Chime account.

How do I link my account to Chime?

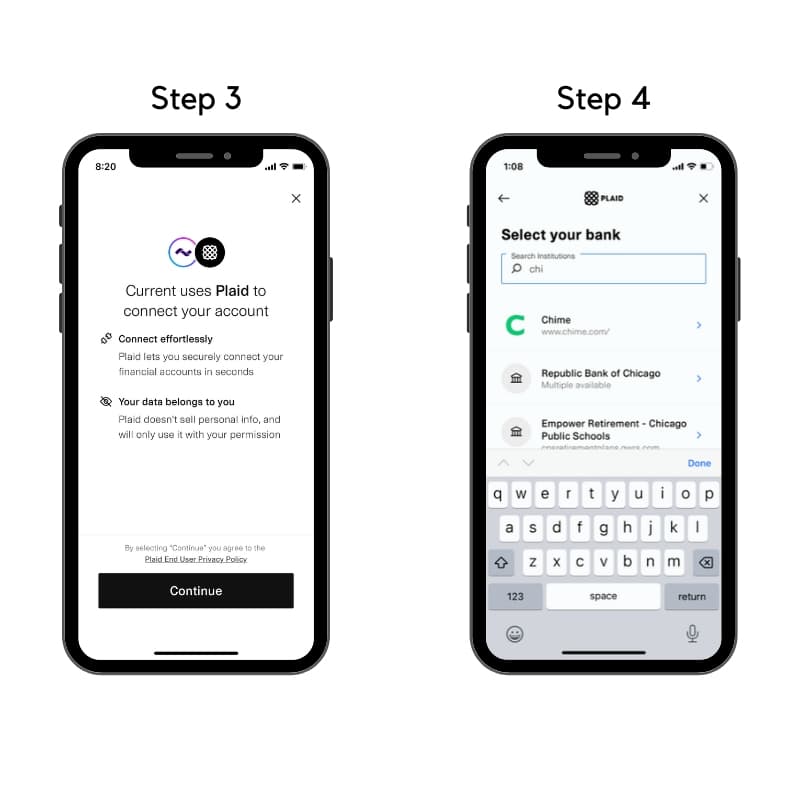

Payday loan apps make it really easy to link your accounts with Chime. Many of them use Plaid as a way to do that instantly. Plaid takes your login info, encrypts it, and sends it to the account you are linking to. They take security very seriously and have many safeguards.

In general, here’s how it works, but each of the apps may have different looking screens (we’re using Current to connect to Chime shown below), but the info required is the same.

If you are prompted to type in “Chime” as your bank, and it can’t find it, don’t panic. You’ll click on the “add info another way” and then type in your account numbers or use your debit card info to link it. Nine times out of ten, this will connect you.

Why is it important to have other payday loan apps that work with Chime?

To use a paycheck advance feature with some apps, you need a bank account to link it to. And many payday loan apps work with Chime as a qualifying bank account. And since Chime is a fairly easy account to open, it’s a great option for anyone.

It’s important to note that Chime is not a bank; they are a financial technology company. This may seem like an odd arrangement, but it is becoming a lot more common for tech companies to manage one side of the business (the part they’re good at) and partner with a bank to do what they are good at (safely holding money). So we should expect to see a lot more partnerships like this in the future.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

How much is an overdraft fee?

Many cash advance apps highlight that you can “avoid the overdraft fee.” But what are they talking about?

An overdraft fee is when you spend on your debit card, and there isn’t enough in your checking account to cover the purchase, so it pulls it from a linked savings account. Doing that causes a fee, a big one.

Overdraft fees vary from bank to bank, but typically they are around $35. Be sure to check with your specific bank or credit union for their policy on overdraft fees. Banks can apply continuous overdraft fees or daily overdraft charges if an account remains negative. This is a fee assessed each day the balance stays overdrawn.

Remember, an overdraft fee is per transaction. So if you shop at three different places in one day, and your overdraft protection kicks in, that’s $35 x 3 transactions = $105.

What about overdraft protection?

Overdraft protection sounds like a good idea, in theory. But it’s just another way for the bank to add on fees. With overdraft protection, your transaction (or check) will still go through, but you’ll be charged that $35 fee for that service.

People may not think over-drafting is common, but sadly it is. According to CFPB, “Banks continue to rely heavily on overdraft and nonsufficient funds (NSF) revenue, which reached an estimated $15.47 billion in 2019, according to research released today by the Consumer Financial Protection Bureau (CFPB).”

That’s a lot of money for the banks; of course, they don’t want to give that up! But what does that amount mean to you? The Fool reports, “the average U.S. consumer pays over $250 annually on overdraft fees.”

People often think the embarrassment of their card being declined is worth the $35 fee, but it’s not, as those fees stack up quickly, especially because in the moment, you won’t know that you’ve over-drafted. So you could go to three more stores that afternoon and repeat the process. My advice is to always opt-out of overdraft protection.

What’s a nonsufficient funds fee?

A NSF fee happens when a bank declines to approve your transaction, which would put your account into the negative. Depending on the bank, these fees can be just as costly as an overdraft fee.

You’ll want to check with your specific bank to learn about your fees.

Banks while they’re still great places to cash a check, they are riddles with fees. For example, you can be charged a fee for trying to cash a third-party check. Or you can be strapped if you need to cash a check and you don’t have your ID; you’ll be turned away.

Banks are becoming less and less customer-focused, while mobile banking apps are coming to the rescue. So even if you don’t need a cash advance, they still have a lot of value and are worth looking into.

What is a payday loan app?

Payday loan apps provide quick and easy access to short-term loans; people also call them cash advances or payday loan apps. These loans are usually the best option when you need cash quickly, as they can get approved within a few minutes and the money deposited into your bank account almost immediately.

Pros and cons of cash advance apps

While these apps sound like a great option, you’ll want to be sure that you know the pros & cons of anything you get into that can impact your finances.

Pros of payday loan apps:

- You can access funds quickly. Usually for free with 1-3 business days or a small fee to get the loan within the hour.

- Many apps are free or have minimal fees (usually only out-of-network ATM fees).

- Some apps provide budgeting & saving tools.

- You can set the repayment date to coincide with your payday, so you don’t have to worry about forgetting or accidentally leaving it unpaid.

- Usually, there is no credit check for cash advances.

Cons of payday loan apps:

- Some apps have monthly membership fees.

- The loan will be repaid from your next paycheck, which stinks if you miss any days of work, you’ll be short funds again, causing a repeating cycle.

- It’s still a loan, which means somewhere something went wrong with your budgeting. Accidents of course happen, but if you find yourself constantly depending on cash advances, you need to look closer at your income and spending levels to see what needs to be adjusted so you can get out of the cycle.

Payday loan apps that work with Chime FAQs:

What do I need to apply for a payday advance app loan?

Most payday loan apps will require you to provide some basic information such as your name, address, employment status, and bank account number to link it. Some might also say that you need to direct deposit your payroll check with them to use their payday loan feature.

You also need a phone that accepts text messages, as that’s another step in the account verification process.

How do payday advance apps work?

These tech apps have partnered with banks to provide customers access to different financial tools and services such as budgets, saving accounts, banking, investing, and cash advances.

When you use a particular app and direct deposit your check with them, they may allow you to access funds early through a small loan, and they can take that loan amount back out of your next paycheck.

These amounts are anywhere from $20 loan up to $250 (usually), with a couple of apps giving you access to $500+.

How does a Chime Spotme work?

Chime Spotme is a feature of the Chime app. It allows you a fee-free overdraft of up to $200 for eligible members.

This is different from traditional payday loans in that it’s fee-free. Remember, the main complaint with old-school payday loans is their outrageous fees!

Does Chime work with Zelle?

Kind of. It isn’t as straightforward as you hope, but there is a workaround.

When you go through Zelle and are trying to connect to Chime, you’ll want to skip the initial “Where do you bank” question. Instead, go to the app’s “Move Money” section, then go to add a bank, and click on the “don’t see your bank” link. This will allow you to input your Chime account’s debit card info into Zelle. That’s it; you’re done.

Are payday advance apps worth it?

In a nutshell, yes, they are worth it. An online payday loan can provide you with the money you need most at a very low cost (usually for free). These apps are a much better option than going the old-school sketchy payday loan route, where the interest rates are crazy high.

Do cash advance apps report to credit?

No. Payday advance apps do not report to credit bureaus (nor do they pull your credit to process your info). These short-term loans do not affect your credit score.

Why is a payday advance app better than a payday loan?

Payday advance apps are a much better option than payday loan companies. They don’t have the same high-interest rates and fees, so you’ll pay much less to borrow money. Plus, they’re more convenient since you can access the money straight from your bank account or the app’s debit card.

While cash advance app loans are smaller than payday loans, the terms are much better.

According to Bankrate, “Theaverage payday loan is $375 on a two-week term with an average of $520 in fees.” Which is an insane amount to pay. The article continued and stated that Texas has the highest APR rate of any state at 664%, as the state doesn’t regulate and cap rates for these loans.

What apps let you borrow money instantly?

Getting an “instant payday loan” is subjective, as it depends on what you consider fast. Many apps let you borrow money after you input your info and connect accounts. Some apps say you must have an active account for 30 days before borrowing.

When actually borrowing the money, all apps have a free option of getting the money, which means the money hits your account in 1-3 days. Yet if you pay a small fee (usually around $5), you can get your money within the hour, some say 10 minutes which is basically instant cash!

At the end of the day

Payday advance apps are a great resource when you need some extra cash. Not only are they convenient, but most have zero and flexible repayment options. And since Chime partners with many different payday loan providers, it’s easy to find one that fits your needs.

So if you’re in a bind and need some quick cash, be sure to check out our list of the best payday loan apps that work with Chime. Did we miss any good ones? Let us know in the comments!