Thinking of Using the EveryDollar Budget App? Here’s What You Have to Know!

A step by step guide on setting up the Every Dollar budget app and getting the most from it!

Author: Kari Lorz – Certified Financial Education Instructor

Everyone has heard of Dave Ramsey; he’s America’s favorite money coach. He’s taken millions of people through his Financial Peace University program, and part of that program is getting a working monthly budget together.

But you don’t have to spend $100 to go through his paid program.

You can get his budgeting method when you sign up for Dave Ramsey’s EveryDollar budget app. Yup, that’s the secret weapon; and it’s free, so what do you have to lose?

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- A step by step guide on setting up the Every Dollar budget app and getting the most from it!

- What is the EveryDollar budget?

- How does the Every Dollar budget app work?

- Using the EveryDollar Budget app during the month

- How does budgeting give you a raise?

- Should you use the EveryDollar app?

- Should I buy the Every Dollar budget app paid version?

- At the end of the day

What is the EveryDollar budget?

Dave Ramsey has been teaching personal finance since he learned God & Grandma’s way of managing money back in 1987. He filed bankruptcy in 1986 after losing millions and now has a net worth of $200 million from his personal finance empire.

When he started back in 1987, it was good old pen & paper for getting a written budget down. He still prefers the written household budget, but he knows that younger generations use technology more than any other medium.

So he took his own budgeting method and turned it into a budgeting app; the EveryDollar budget app.

How does the Every Dollar budget app work?

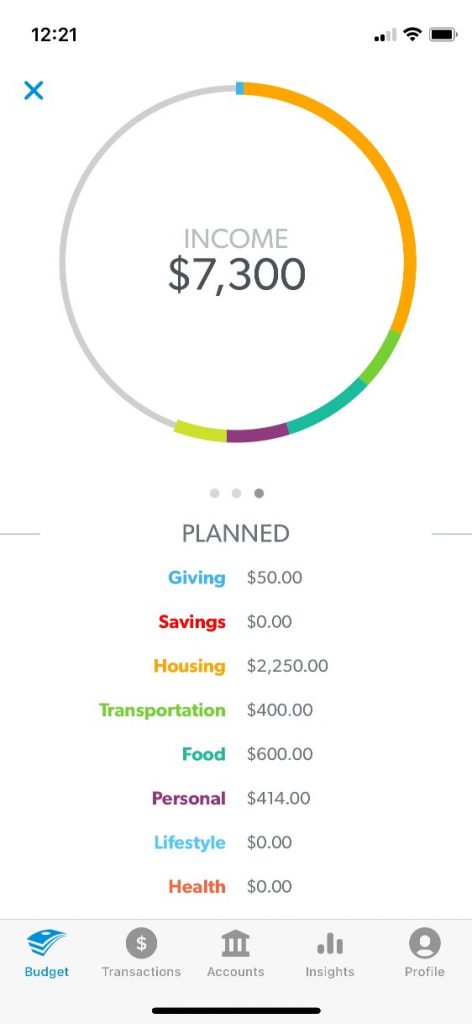

This budgeting tool works just like a paper budget does, but it’s on an app that can show you fun charts; yup charts are fun!

Step One:

First off, go to the app store and download EveryDollar for free. Then you follow the prompts to create an account. So far, easy peasy lemon squeezy!

Step Two:

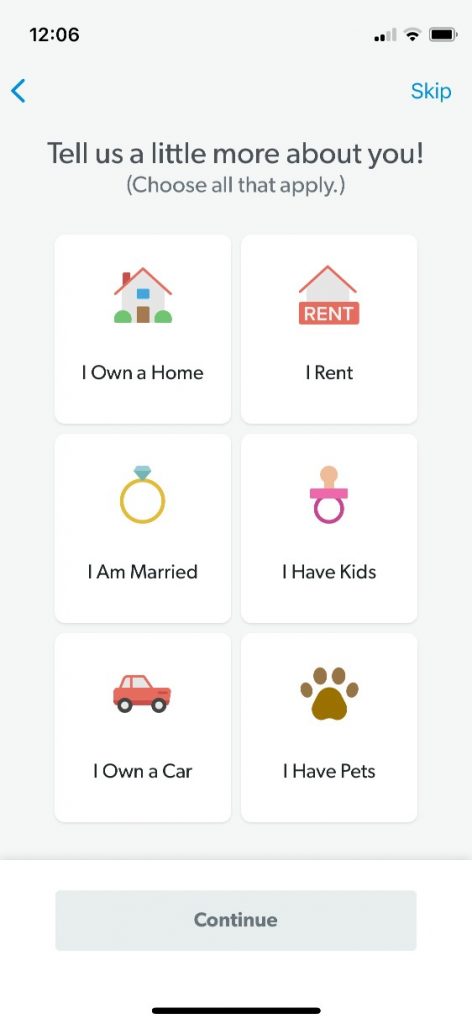

You need to identify your money goal, and you tell them about your family household.

- Pay off debt

- Travel

- Savings goal – saving for retirement, an emergency fund, a new home, kids college, etc.

Step Three:

You input your monthly income (remember, this is your take-home pay, not your gross pay). You can input multiple paychecks from all your sources and all your side hustles.

Note: you can only input the dollar amounts of your paychecks; you can’t actually do mobile deposits. If you’re looking for apps that do mobile deposits check out all our info on easy check cashing places. (and yes, your couch is one of them with mobile deposit!)

Step Four:

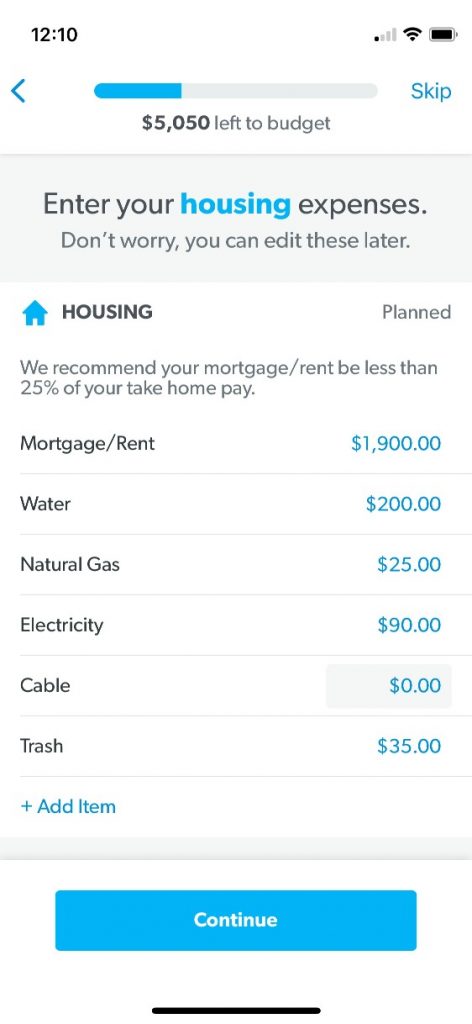

Next, you input your “basic expenses,” these are your four walls, your must spend items.

- Mortgage/rent

- Utilities – electricity, water, sewer, gas, trash, etc.

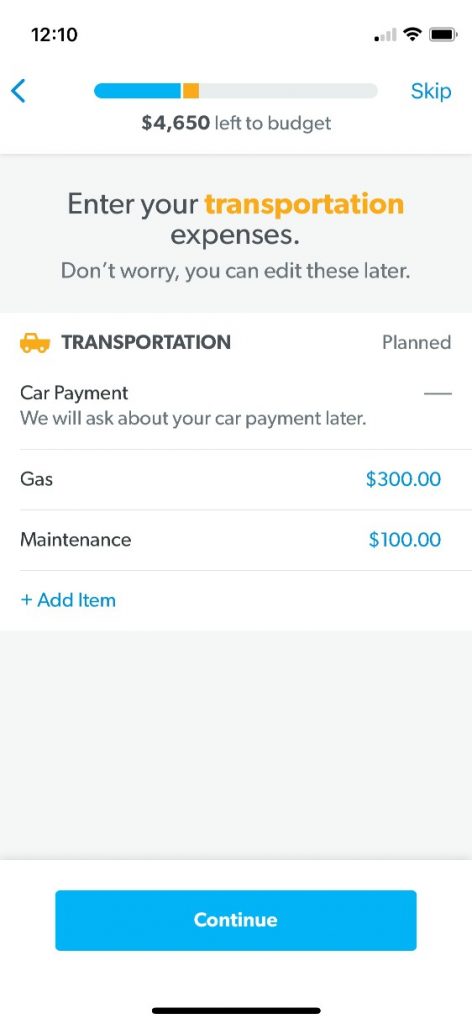

- Transportation – gas, oil changes

- Basic food – groceries

The app gives you recommendations on what percent of your pay should go to each category which is helpful. So when I’m inputting food, it says that they recommend that 15% of your income go here. You can also read about Dave’s recommended budget percentages (and why they may not work for you) right here.

Now you input your personal expenses

- Clothes

- Subscriptions

- Phone

- Fun money

- Beauty stuff

Step Five:

Now you enter your giving amount. Dave Ramsey is a loud and proud Christian, and part of that values system is tithing money to his church and donating to good causes.

Step Six:

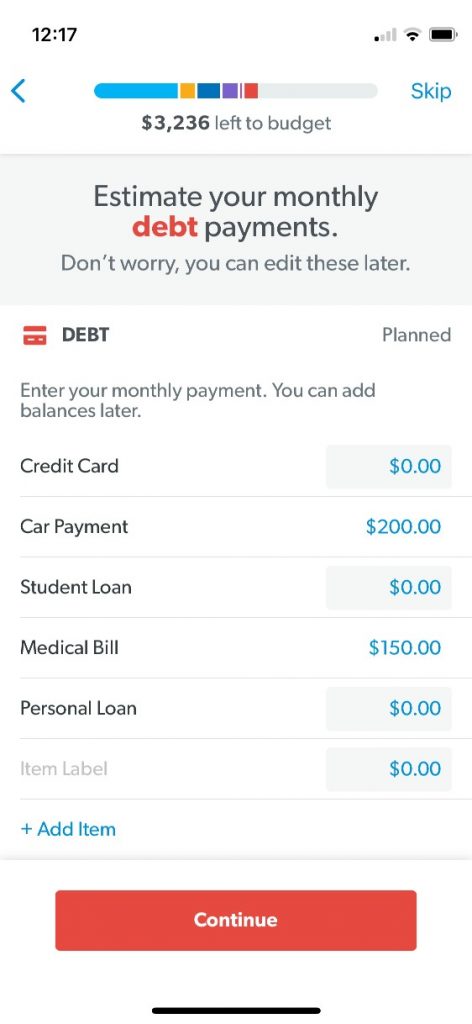

Now you input your debt details. So any credit card debt, car payments, student loans, medical debts, etc., go here. Don’t forget to prioritize your debt payment according to the debt snowball method!

At this point, you’re basically done. The Every Dollar budget app tells you how much you have left to spend or how much to cut.

You’re DONE… for now.

There is a free version of the EveryDollar budget app and a paid version called Ramsey+, which has more bells and whistles. But if you’re new to budgeting, that might be overwhelming.

For now, just get your feet under you with budgeting, and in a few months, maybe consider layering in the paid version. Plans (in August 2021) range from $59 to $129. Good news – someone can gift it to you!

Using the EveryDollar Budget app during the month

Using the app is easy enough; you can always go back in and edit something or add things you forgot.

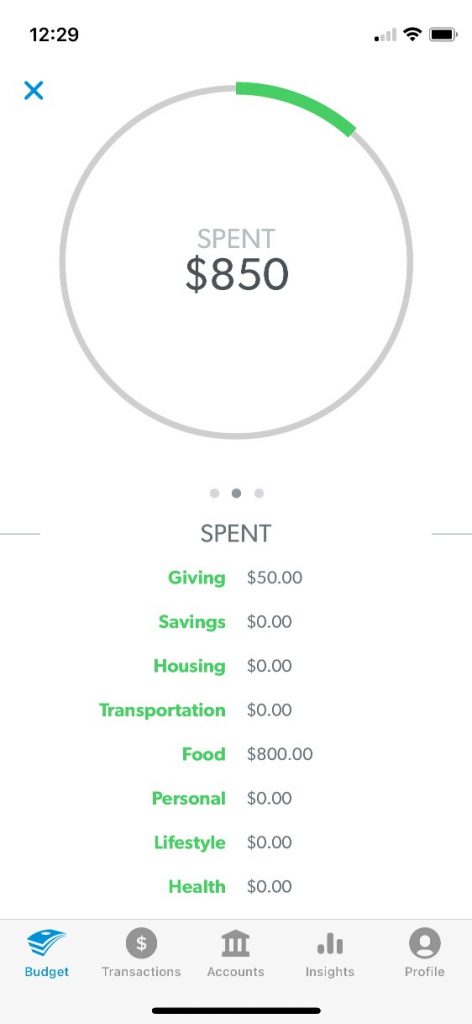

Each time you spend money, you go into your app and log how much you spent (aka expense tracking), where it was, and what category it falls into. Then the app keeps track during the month and tells you how much you have left to spend. Actually seeing that you have only $23.47 left to spend for the month can be a hard but helpful tool to help you curb your spending habits.

You can also connect your bank account to the app with the paid Ramsey+ plan. Good news, you can get a 14-day free trial (it’s promoted within the app, so keeps your eyes peeled for it).

You can set up the app to remind you to log your monthly expenses during the week and do a new personal budget as the new month gets closer, which is a nice feature. I could see that the biggest hiccup would be that you forgot to log something and now can’t remember the details. So if you do it every few days, you should stay on track.

How does budgeting give you a raise?

I know it sounds silly, but when you proactively plan for where you want your money to go, you can accomplish more with the same amount.

Let’s say your big goal is to save for a vacation. Well, when you have no idea where your money is going, you’re probably spending all of it. That leaves little leftover for your vacation goal. Dave loves to use a zero-based budget, and that means you put every dollar to work for you!

When you plan your spending (which is all that a budget really is), you can say I want $150 to go to my vacation fund every month. So you know every month you are making progress on your financial goal! That’s how it’s like getting a raise.

Yes, you’ll have to cut back spending in other areas, but if you’re buying clothes out of habit, and they don’t matter that much to you. Then you won’t miss cutting your spending in this category. It’s all about identifying your priorities and then acting on those priorities!

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Should you use the EveryDollar app?

This can be answered with a yes and a no. (of course)

If you are following Dave Ramsey’s plan already, and do zero based budgeting, then this app is a great tool to use. It has good functionality, easy to use, and matches the Baby Steps plan.

If you follow another money guru or use a different budgeting method and don’t want to change, then this might not be the best fit.

Again, do your first few month’s budget on paper and then when you get into a groove, go ahead and try the Every Dollar app.

Don’t forget, that you can always go the old-fashioned route for budgeting, and that’s using cash envelopes! Dave is a huge fan of the cash envelope budgeting method (no credit card allowed). No app needed, just spend from your envelope and when the envelope is empty you’re done spending!

Here’s what you HAVE TO know about the budget app

Using a budgeting app is a great way to gain control over your money. But in order for it to work, you HAVE TO use it frequently and consistently. If you only log your purchases at the end of the month then you will have zero time to course correct. You’re doomed, all because you wouldn’t take two minutes a day to log your purchases.

Set up a phone reminder, say at 7:05 pm, it goes off, and you go into your app and log your spending. It’s so easy to stay on top of it, and to have it work for you and your financial goals!

How to get the most from the every dollar budget app

If you want to be sure that you’re getting the most from the EveryDollar budgeting app then you need to make sure you have clearly defined goals, know the action steps to reach the goals, and are tracking your progress.

You shouldn’t say, “I want to save more money.” You need to say, “I want to pay all cash for a family Disneyworld vacation in 2022, which will be $3,700.” And then an action step could be to save $250 every month. And, then at the end of the month, you will know if you’ve reached that action step goal because it’s a very specific yes/no answer.

Other tips to get the most from the Every Dollar budget app…

- Use it regularly – get in there and log purchases every 1-2 days and see if you need to cut back in any category.

- Be realistic with how you allocate your budget money. You’ll never meet your goals if they are unrealistic.

- Use one form of payment when purchasing things (it’s a lot easier to track this way).

- Make sure you are allocating money to unexpected expenses. Things always come up.

- Customize your spending categories. Just because there’s a “clothing” category doesn’t mean you need to allocate money to it. If you’re not going to use it, delete it.

Save with Rocket Money

Rocket Money helps you lower your monthly bills as they instantly find, track, and negotiate down your subscriptions.

Your concierge is there when you need them to cancel services, so you don’t have to. They also track your spending and notify you of where you can cut down to save even more.

Should I buy the Every Dollar budget app paid version?

No, not at the beginning. When you’re just learning to budget, there are a lot of things that can be overwhelming. I don’t want this to happen to you and have you get frustrated and quit. So just start with the basics, see if you like the format and functionality and if so, buy it after using it for a few months.

There’s a lot to be said for manually inputting transactions. It makes it more “real” when you have to type out that you spent $56.87 at I Love Sushi restaurant. You think about it more, and maybe next time, you’ll decide that sushi isn’t a good idea as it’s not in your budget.

This is the same principle as why the experts say that you should handwrite things out instead of logging them digitally. Yup, handwriting something inputs it into a different part of your brain. So you’re processing it in an additional way, which means your recall is better. This is why Dave prefers a handwritten budget for beginners.

Yet, a lot can be said for the convenience of a budget tool that tracks spending automatically with linked financial accounts! #heyfancy

The bells & whistles of the EveryDollar budget app paid plan

Now Dave gives all the information to you for free (thanks Dave!), but he didn’t get to a net worth of $200 million by giving everything away for free. He runs a business, and as a business, he needs to make money, and the paid app is one way he does that.

Here are the features that you get…

- Insights: The paid plan has “insights,” which is where they show you your spending category in graph form and colorful charts. This feature isn’t anything earth-shattering, but many people are visual learners and processors, so graphs are helpful.

- Connect accounts: you can sync your bank to auto send transactions to the app (you may have to change the category, but that’s a quick edit).

- Downloads: If you still love paper, then you can get a downloaded report of your transactions.

- Learn: You get expanded access to videos and lessons that can help you on your financial path.

- Baby Steps: You get access to their Baby Steps app.

- Move Funds: Move funds from one category to another.

- Recommendations: The app knows your past spending amounts, so it will send you periodic recommendations.

The price is a bit steep if you want the year-long access; it’s $129. But if someone wants to gift this to you as a present then great! Go and check out the Every Dollar budget app yourself!

At the end of the day

Using Dave Ramsey’s EveryDollar budget app can be a great way for people to get into budgeting. I mean, everything is accessible on our phones these days. So if having it on your phone makes it more likely that you will budget, then great! There’s just the right amount of functionality that you can’t get in over your head, and it has the optional upgraded bells & whistles for those that want the whole digital experience of a budgeting app.

Either way, everybody can use a secret weapon in their back pocket, and in 15 minutes, you could have your monthly budget all set up, and that sounds like a superpower that America needs!

Articles related to The EveryDollar Budget App:

- Dave Ramsey’s How to Budget for Financial Peace

- Which is the Best Dave Ramsey Book For You

- How to Use Dave Ramsey Budget Percentages to Make the Best Budget Ever

This is a very important post. Thank you for including so much important thorough information. I appreciated your honesty suggesting trying the basic first in order not to get overwhelmed. Thank you for sharing this post.

So glad you liked it! Yes, the basic version of the EveryDollar budget app is perfect for new budgeters!

Having a budget and putting everything on paper, or in the app is eye opening for many. Instead of wondering where your money went, you’ll give assignment to every dollar you have. Great post Kari! Fellow Dave Ramsey follower here. 🙂

Yes, seeing it all on paper is sometimes a rude awakening, but one that can help you so much! Ya for being a DR fan!!!

I love the every dollar budget app! When I first started budgeting, it was the only thing I used and it was so helpful!

So glad to hear that it helped you with budgeting! Sometimes apps can be so confusing with too many features so that’s why I love the simplicity of this app.

I will try this app if it works in our country. I like how you lay down the tips to maximize the app and realistic with expenses and recording them. Thanks!

Yes, being realistic is the key to any budget!