$90,000 a Year is How Much an Hour? (+ Monthly Budget Breakdown)

We’re going through all the Q&A on your new pay; let’s start with $90,000 a year is how much an hour?

Author: Kari Lorz – Certified Financial Education Instructor

You work hard for your money, so you deserve to know exactly how much you’ll take home each pay period.

We’ll break down all possible deductions so you can budget effectively and save up for the things you really want in life.

Keep reading to learn more about your new pay and have all your questions answered. Like, “$90k a year is how much an hour? Can I support a family on $90,000 a year? How much in taxes will I pay on $90k salary?”

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- We're going through all the Q&A on your new pay; let's start with $90,000 a year is how much an hour?

- $90,000 a year is how much an hour (short answer)

- If you make a $90k salary, how much is that after federal and state taxes?

- What do retirement contributions do to my take-home pay?

- How much does insurance take from my $90,000 annual salary?

- How to live on $90k a year

- Middle-class America's enemy – keeping up with The Joneses

- How should I budget a 90k salary?

- Can you live off of $90k a year?

- How much of my $90,000 salary should I be saving?

- How much should I save? – according to your age

- Jobs that make $90,000 a year

- What is a salaried job?

- $95,000 a year is how much an hour?

- At the end of the day

$90,000 a year is how much an hour (short answer)

- Let’s say you work the traditional 40 hr workweek:

- $90,000 / 52 weeks a year = $1,731 a week / 40 hours = $43.27 an hour

- $90,000 / 52 weeks a year = $1,731 a week / 40 hours = $43.27 an hour

- If you work 50 hrs a week (which would be more typical for a salaried worker):

- $90,000 / 52 weeks a year = $1,731 a week / 50 hrs = $34.62 an hour

How much is $90k a year in monthly pay?

- $90,000 / 12 months = $7,500 gross pay.

How much is 90,000 dollars a year in bi-weekly pay?

- $90,000 / 26 pay periods = $3,462 gross pay.

$90k is how much a week?

- $90,000 / 52 weeks = $1,731 gross pay.

$90,000 is how much a day?

If you work 40 hours a week, 8 hours a day = $346 a day when working.

$90k a year is how much an hour?

Remember, you are salaried! That means you get paid the same even when you work overtime. So at five days a week…

- 8-hour workday: $43.27 hourly pay

- 10-hour workday: $34.62 hourly pay (this is your pay per hour worked in time, but your paycheck remains the same because you’re salaried).

Some places give a different answer – what gives?

Yes, hourly salaries have been determined on certain websites by counting the number of typical working hours in a year, which is fine as long as each year is the same. Yes, it’s 365 days (unless it’s a leap year). However, how many of those days are actual working days (versus weekend days) varies based on what year it is.

There are 250 – 262 working days in a year, so hourly that means there are… (250 days x 8 hours) to (262 days x 8 hours) = 2,000 hours to 2,096 working hours in a year.

If you are paid monthly or bi-weekly, your precise hourly earnings (per year) will vary. There is no specific figure; rather, we establish the tightest possible range and provide that as a reasonable estimate.

If you make a $90k salary, how much is that after federal and state taxes?

You don’t just walk away with $90,000 if that’s your compensation. You must still pay taxes. Let’s examine how your take-home (after-tax) pay is affected by this.

To understand your take-home income, you must first calculate your tax burden. You’ll be in trouble if you do the math and use pre-tax income to figure out how much you have to spend on monthly bills! You should always keep an eye on how much you’ll pay in taxes.

For example, let’s assume you’re a single filer:

- If you live in California, which has a very high state income tax rate…

- You’ll pay $24,586 annually in FICA, federal and state taxes (roughly)

- You’ll take home $65,414 (before insurance and misc deductions)

You can go here to give you a rough idea of how much you’ll pay. Remember, this is just a reasonable rough estimate, not a guarantee!

You lost almost 27% of your pay to state & federal taxes.

The current federal tax rate for $90k a year

If you make $90k in annual income and are single with no children, your current tax rate is 24% for federal taxes. As $86,376 to $164,925 income = 24% tax rate. Don’t forget that you still have state taxes to account for. Unless you live in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, these states have no income taxes.

What about tax deductions?

Down below, you’ll see we’ve figured out your net pay for each of the pay types (i.e. monthly, bi-weekly, etc.). When figuring out all the pay deductions (including retirement), it comes to about 40%. This is a lot, yet this doesn’t take into account any tax deductions you might be entitled to.

You could easily drop your taxable income down with a good tax preparer, and lower that 40% down considerably. Yet, it’s hard to measure what that amount might be for each circumstance as there are so many variables. So we’ve ignored tax deductions for the sake of simplicity. But know that this is an option to either take more home each paycheck or get a larger tax return.

What do retirement contributions do to my take-home pay?

I’m so glad you asked this! One of the most crucial long-term financial planning decisions is contributing to your employer’s workplace retirement plan.

Matching is based on a percentage of the money you put in. So, if you contribute 5% of your gross income to a typical 401k, they will match it as well. Companies generally have a maximum amount they will contribute; 5% is a common figure.

So, if you make $90,000 a year and contribute 5%, that means $4,500 annually in workplace retirement plan contributions and another $4,500 with your employer match!

You now have a taxable income of $85,500. Using the same calculator shown above, you’ll take home $63,322 (before insurance deductions).

- $65,414 take home with no retirement contributions

- $63,322 with a 5% contribution

- = a difference of $2,092 in net pay (before medical and other misc deductions).

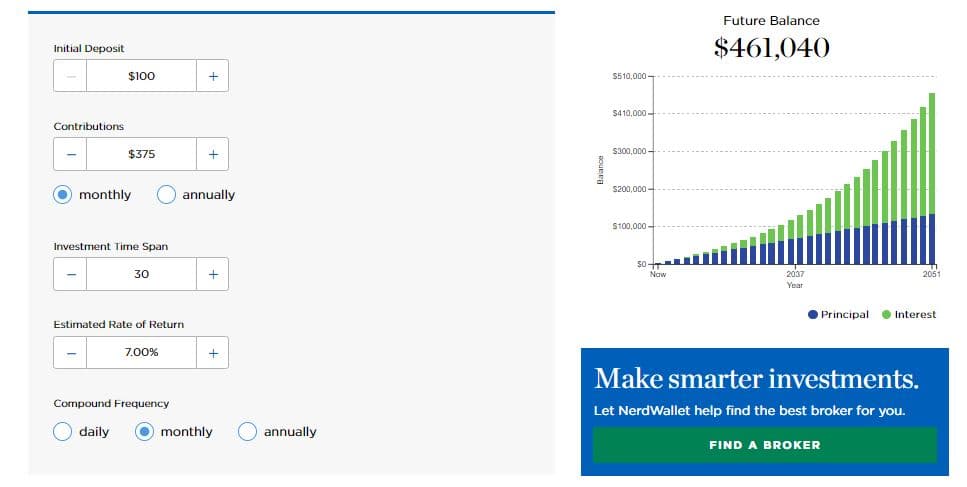

The graph below shows what a 5% retirement contribution looks like ($375 a month) plus a 5% company match over the span of 30 years. Don’t forget that you’ll probably get raises throughout your career, which will cause your eventual overall balance to rise.

At the end of 30 years, at a 7% return (this is a good average), you’ll have…

- Contributed $135,100 (total principal)

- Earned $325,940 in interest

- Total of $461,040

If you’re changing jobs, then you need to make sure that you take all your money with you! According to Capitalize, “As of May 2021, we estimate that there are 24.3 million forgotten 401(k)s holding approximately $1.35 trillion in assets, with another 2.8 million left behind.

That’s a lot of money for employees to just “forget about.” Don’t be a worker who left money on the table when they switched jobs! Beagle can help you find your old 401k accounts and help you roll them over into an account that you can easily manage.

While the full process takes a few days (they need 2-3 days to research everything), the initial sign-up process takes less than 15 minutes. You tell them your info, give them an idea of what companies you worked for, and they go find your old accounts.

We went through the process, and it was super easy; you can read our full review on Beagle retirement savings finder here! Or you can check out Beagle by clicking the green button below.

How much does insurance take from my $90,000 annual salary?

I hate to say this, but we haven’t completed the list of payroll deductions from your paycheck. According to the U.S. Bureau of Labor, “Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020.”

It’s important to note the precedence of what get’s taken out of your paycheck and when. Here’s the order according to the U.S. Office of Human Resources…

- Retirement contributions come out first, followed by

- Social Security tax

- Federal income tax

- Health insurance

- Life insurance

- Medicare tax

- State income tax

- Local income tax

- Collections to the U.S. government (if applicable)

- Collections to Court ordered rulings (if applicable)

*Everything below here is optional* - Health Care/Limited-Expense Health Care Flexible Spending Accounts

- Dental

- Vision

- Health Savings Account

- Optional Life Insurance Premiums

- Long-Term Care Insurance Programs

- Dependent-Care Flexible Spending Accounts

- Thrift Savings Plan (TSP)

Did your jaw drop when you saw the list? Because that’s a big chunk of money. Let’s concentrate on medical deductions and how they impact your income.

The situation is the same as in the above example, with a single filer making one deduction and living in California…

- $90,000 gross salary / 12 months = $7500

- Minus 5% in retirement contributions $375 monthly

- Minus FICA, federal and state taxes = $1,932 a month

- Totals $5,193

- Minus 8.2% average medical insurance costs (off gross pay)

- That takes out $615, leaving you with $4,578

- Minus misc small deduction averaging $100 (a total guess)

- = $4,478 net monthly income (take-home pay, which is 40% of gross monthly pay)

| $60,000 a… | Before Taxes | After all Deductions |

|---|---|---|

| Year | $90,000 | $43,730 |

| Month | $7,500 | $4,478 |

| Bi-week | $3,462 | $2,067 |

| Week | $1,731 | $1,033 |

| Day | $346 | $207 |

| Hour | $43.27 | $25.83 |

How to live on $90k a year

When you get a substantial raise, many individuals warn of lifestyle creep. This implies that you spend money without even realizing it as your salary rises. A little upgrade here, a new XYZ product there, Sunday dinner out every week.

To stick to a monthly take-home budget of $4,478, you need to be careful about your spending habits and ensure that all your expenses are accounted for. Here’s how to do it…

- Make a realistic monthly budget; here are the popular budgeting methods

- Save up for significant purchases such as a new car (use sinking funds)

- Dump your debt ASAP (paying interest is eating away at your bank account, do it this way)

- Evaluate, tweak & adjust (everyone needs to adjust, no one is perfect at budgeting)

- Live within your means (you have to say no to yourself). Let’s dive into this aspect more with The Joneses.

Middle-class America’s enemy – keeping up with The Joneses

Americans are constantly subjecting themselves to the comparison game and lifestyle creep. What exactly am I referring to? Americans have a debt problem, a big one, to put it mildly.

Many people think that making $90,000 per year is really good. As a result, you believe you “should” be able to buy the nicer things. And yes, you should be able to afford them, but not in every case. You’ll have to decide what you consider worth investing in and which areas you must reduce spending on.

So how big is our debt problem? CNBC reports that the Federal Reserve data shows that “total U.S. consumer debt at the end of 2021 came to $15.6 trillion.”

- Mortgage debt = $11 trillion

- Credit card debt = $860 billion

- Car loans = $1.46 trillion

- Student loan debt = $1.75 trillion

Forbes reported…

- Credit card debt has also risen faster than after-tax incomes… and amounted to 5.5% of after-tax income.

- Other consumer debt, mainly car and student loans… This equaled 18.4% of after-tax income.

- Business Insider states that 31% of Americans’ net income goes to mortgage payments.

So the average American household spends (5.5% + 18.4% + 31%) almost 55% of their money on consumer debt, car loans, student debt, and a mortgage.

You now only have 45% of your net income to live on. For a $90,000 salary with take-home pay of $4,478, that means you now have $2,060 for utilities, food, fun, giving, clothes, and saving. That money doesn’t stretch very far.

Many will suffer financially from keeping up with the Joneses, and they won’t even realize it. People are spending money, so it appears they have money and can buy whatever they want. However, few people can truly afford it. We just believe that they can because of their appearance.

However, it’s not all bad news; some are rebelling against the current trend of overspending.

A new conscious consumer is rising up; it’s America’s stealth wealth population. These people know that spending a lot just drains their bank accounts. So they drive Ford’s, live in a modest house, and they don’t throw money out the window buying things on a whim.

They know that you may need to limit your travel expenses if you buy a luxury automobile. Alternatively, if you want to send your children to private school, you may have to live in a smaller home in an average neighborhood. Alternatively, if you care about a nice house, you will most likely drive a cheaper vehicle. It’s all about keeping a close eye on your money and costs – evaluating trade-offs.

Is $90,000 an income considered middle class?

Yes.

According to Fortune, “The Pew Research Center has put a financial definition to the term “middle income.” To be considered part of that group in 2021-which is synonymous with middle-class, according to Pew-a single American must have earned $30,003 to $90,010, according to a new set of reports released Wednesday.

But that range does vary by the size of the household. A three-person household must have earned $51,962 to $155,902 to be considered middle-class while a family of four must earn about $60,000 to $180,000.”

Pew Research Center has a fun calculator where you can input your city/state, household number, and income to find out your area’s income spectrum. This will give you a good idea of how your income matches your location, and you can further filter with nationwide demographics.

While you likely already know where you’re at, it’s still interesting to see how you measure up against national norms and statistics. However, don’t become too caught up in being below/average/above average. There are a lot of things that impact your personal situation.

How should I budget a 90k salary?

Okay, let’s take the figures from above and figure out your monthly budget. So we’re using a take-home pay of $4,478 and giving figures for two popular budgeting methods.

The 50/30/20 budgeting method

This budgeting method is best for people who like flexibility and have leeway for spontaneity. They want general guidelines, but they want options & choices too. So your monthly household budget would look like this…

- 50% Needs: $2,239 for housing and utilities

- 30% Wants: $1,343 for wants

- 20% Savings: $896 for saving

Dave Ramsey recommended budget percentages

I am a fan of Dave’s budget percentages, but I realize this method can be too detailed and constraining for some. However, others like to be told exact amounts to help them feel secure.

Norms are a good start for budgeting, but keep in mind that individuals adjust and update their numbers based on what works best for them and their current season in life.

Let’s see what Dave recommends for each category…

- Housing 25%

- Insurance 10 – 25%

- Food 10-15%

- Giving 10%

- Saving 10%

- Transportation 10%

- Utilities 5-10%

- Health 5-10%

- Recreation 5-10%

- Personal Spending 5-10%

- Misc 5-10%

| Budget Category | Percentage | Amount |

|---|---|---|

| Housing | 25% | $1,120 |

| Insurance | 10 – 25% | $448 – $1,120 |

| Food | 10 – 15% | $448 – $672 |

| Giving | 10% | $448 |

| Saving | 10% | $448 |

| Transportation | 10% | $448 |

| Utilities | 5 – 10% | $224 – $448 |

| Health | 5 – 10% | $224 – $448 |

| Recreation | 5 – 10% | $224 – $448 |

| Personal | 5 – 10% | $224 – $448 |

| Misc | 5 – 10% | $224 – $448 |

Jean Chatzy’s budgeting recommendations

If the 50/30/20 feels too broad, and Ramsey’s budgeting percentages seem way too tight & controlled, then you’ll be happy to know that finance expert Jean Chatzy covered the middle ground with her recommendations (my personal budget uses her percentages). Here’s how it looks…

- 35% Housing – rent or mortgage, plus the cost of insurance, taxes, utilities, and maintenance.

- 15% Transportation – your car payment falls here (if you have one), but taxis, parking, and insurance also go here.

- 15% Other Debt Repayment – credit card payments, student loan payments, and any other debts you owe.

- 10% Long-term saving – putting money away as an emergency cushion, as well as the retirement account you should be contributing to (whether it’s at work or on your own).

- 25% Everything else – this is your life. Food, entertainment, clothes, cosmetics, travel, and anything that doesn’t fit into the other categories.

These recommendations feel doable to me; they feel like you’re being responsible but not too straight-laced. That’s why I follow them for my own budget category percentages.

If you’re out of debt (congratulations!), consider moving 5% of your income to living costs or long-term savings. Then use the rest of your money to prepare for significant expenditures like a holiday, a new car, a new house, and so on.

| Category | Budget Percentage | Amount |

|---|---|---|

| Housing | 35% | $1,567 |

| Transportation | 15% | $672 |

| Debt Payments | 15% | $675 |

| Saving | 10% | $448 |

| Living | 25% | $1,120 |

Can you live off of $90k a year?

If you live in a high-cost of living area, this salary might not always be a decent living wage. Your housing and food costs may be far above the budget category allowance, or vice versa in a low-cost of living region.

Additionally, if you make $90K in a metro area, the same skill set may only pay $70K in a more rural location, which is frustrating if you need to move there.

According to the Bureau of Labor Statistics for May 2020, the average annual wage for a U.S. worker across all occupations is $56,310. So a $90K a year job is well above average. HOWEVER, where you live significantly impacts if it’s considered a good wage.

For example, the BLS states that in NYC, the average yearly salary is $71,050. While in Idaho, the average salary is $46,800. But remember, a few people skew the numbers for these BLS averages.

A better number is the median wage; that’s the halfway point of the number of people. The BLS site shares info on the national median hourly wage being $20.07. Remember, with a 40 hr work week, your $90k salary is $43.27 an hour, so well above the median, more than double the median hourly wage.

Another factor is your annual household income (as a whole), not just your income. So The U.S. Census says that in 2019 (the most recent data), the median household income is $62,843. So if you make $90,000 and your spouse makes $90,000, you are doing great at $180,000 total!

Is $90k a good salary for a family?

A $90,000 salary may be enough for a family, depending on the size of the family and where they live. This salary could certainly more than cover your expenses in a low-cost living area.

However, in an expensive living environment like Los Angeles, this income may just cover the basics. It all depends on your lifestyle again. How careful you are with your money and how well you prepare for the future.

Let’s go ahead and take a look at a few other typical salaries and see how they’d support your family’s needs.

- $30,000 a year is how much an hour

- $40,000 a year is how much an hour

- $50,000 a year is how much an hour

- $60,000 a year is how much an hour

- $70,000 a year is how much an hour

- $80,000 a year is how much an hour

- $90,000 a year is how much an hour (you’re here)

Is a $90,000 a year salary good if you’re single?

Your $90K salary is considered above average if you’re single. You’re doing great. But remember, how much you make is only half of the equation; the other half is how much you keep (aka save – we’ll talk more on this later).

Let’s talk about the “cost of living”

An area’s cost of living means how expensive or inexpensive it is to live there. This encompasses the housing market, cost of goods & services, etc. People usually call these high cost of living areas (HCOL) or the opposite is a low cost of living areas (LCOL).

This is significant since no matter how much money you earn in an HCOL sector, a large proportion of your money is being lost as costs rise.

According to Indeed’s Hiring Lab, For most jobs, salaries are higher in smaller metros after accounting for the cost of living.”

“Before adjusting for cost of living, America’s highest salaries are in San Jose, San Francisco, and several other California metros. But these high-salary places like the Bay Area tend to have the country’s highest costs of living – especially for housing, but for other goods and services too. In these high-salary places, it’s money in, money out.”

“When we adjust for cost of living, the highest-salary metros look totally different. Among the 185 US metropolitan areas with at least 250,000 people, adjusted salaries are the highest in…

- Brownsville-Harlingen, TX

- Fort Smith, AR-OK

- Huntington-Ashland, WV-KY-OH

How much of my $90,000 salary should I be saving?

This is a loaded question, as everyone knows you should save. But we don’t actually do it, or we don’t save as much as we should.

Again, knowing norms is helpful; this is a good place to start your planning.

According to The Balance, “The short answer is that you should save a minimum of 20 percent of your income. At least 10 percent to 15 percent of that should go toward your retirement accounts. The other 5 to 10 percent of that should go toward a combination of building an emergency fund, creating other long-term savings.”

So for a $90k pay, you should save $18,000. Where $9,000 to $13,500 should go to retirement funding, and then $4,500 to $9,000 should go to your emergency fund or savings buckets.

However, your financial goals may dictate that you do something else. Think of both short and long-term goals. (I.e., saving for an exterior garage build and saving for a new home. One will take considerably longer to achieve).

However, you should always start your savings with your workplace retirement plan, especially if they have a match (and no, you shouldn’t count their match amount as part of your 20% savings goal).

Once you’ve started your 401k plan, then save to fully fund your emergency fund (6-9 months of living expenses).

Then once you have that taken care of, shift your focus to saving for your life goals (i.e., vacation, new bobby XYZ, etc.).

Note: if you carry consumer debt, you need to shift your saving focus. Start with contributing just enough to get the company match, then build a $1,000 starter emergency fund. Then pay off your consumer debt, and then fully fund your emergency savings. Finally, go with your life goal savings by using sinking funds.

How much should I save? – according to your age

Again, this is just a good suggestion, based on one factor, your age. These recommended numbers do not account for your personal situation. So take these with a grain of salt, and use them as a place to start your savings plan, but know that you’ll adjust the numbers.

According to the Federal Reserve’s Board Survey of Consumer Finances (2019), here are the actual average savings by age group…

- under 35 yrs – $11,200

- 35-44 yrs old – $27,900

- 45-54 yrs old – $48,200

- 55-64 yrs old – $57,800

- 65-74 yrs old – $60,400

- over 75 yrs – $55,600

While Ally recommends that you should save…

- 30’s – 1x your income

- 40’s – 3x your income

- 50’s – 5x your income

- 60’s – 7x your income

- 70’s – 9x your income

- 80’s – 11x your income

In addition to these numbers, you should consider your personal situation, which may include…

- Your retirement age

- Your living situation (is your mortgage paid off?)

- The kind of lifestyle you want (your monthly expenses, travel plans, etc.)

- Your healthcare needs (health insurance is the highest expense for retirees)

- Your investment withdrawal strategy

Jobs that make $90,000 a year

Many jobs make $90,000 a year; let’s look at Indeed’s list…

- Mechanical engineer – $94,325

- Information security analyst – $95,785

- Database administrator – $97,717

- Mathematician – $99,506

- Statistician – $99,986

What is a salaried job?

“Exempt” employees are those who are paid a salary. Salaried implies that you will be paid a set amount every month, generally once a month. The payment is the same whether you work a few hours or many hours each week, as long as you don’t take any unpaid time off.

Pros of being a salaried employee

- You don’t have to punch in/out of a timeclock

- These positions usually come with a better benefits package (i.e., higher retirement contributions, etc.)

- Get paid time off (paid vacation, sick leave, etc.)

- You can work fewer hours and still get paid the same.

- Higher perceived status/position in the company

- You can better budget because you know exactly how much you’ll get each paycheck

Cons of being a salaried employee

- No overtime pay, so if you work more hours, it’s not reflected in the pay

- Higher responsibility and more duties to perform

- You might be expected to take work home with you.

- When emergencies arise, you’re part of the team (or person) that needs to handle them, sometimes at very short notice.

Quarterly/Yearly Bonuses

Other perks that salaried workers frequently receive include bonuses and profit-sharing arrangements.

Depending on the business, you may be eligible for a yearly or quarterly bonus. This is in addition to your regular income and is frequently given as a percentage of your pay. For example, if you earn $90,000 per year and get a…

- $90,000 x 5% bonus = $4,500 (gross)

- $90,000 x 10% bonus = $9,000 (gross)

- $90,000 x 15% bonus = $13,500 (gross)

Bonuses are frequently offered to employees or groups who meet or surpass a sales objective or achieve some other type of quota.

It’s also worth noting that the bonus money you receive may be taxed in a manner different than your normal pay. It is determined by the employer according to their policies.

Bankrate states, “A bonus is always a welcome bump in pay, but it’s taxed differently from regular income. Instead of adding it to your ordinary income and taxing it at your top marginal tax rate, the IRS considers bonuses to be “supplemental wages” and levies a flat 22 percent federal withholding rate.”

$95,000 a year is how much an hour?

- $7,917 monthly salary

- $3,653 bi-weekly

- $1,827 a weekly income

- $365 a day

- $45.67 an hour (for 8 hr workday)

All figures are gross (before taxes).

At the end of the day

So there you have it! You now know how much an hour of your time is worth on the job market. And we’ve even given you some ideas about budgeting for all that extra cash.

So what are you waiting for? Start applying for those high-paying jobs! Just don’t forget to factor in payroll deductions when budgeting – they can take a big chunk out of your paycheck each month.

With the right attitude and some hard work, there’s no reason why you can’t be making $90,000 a year!