$50,000 a Year is How Much an Hour? Is it Enough to Live on After Taxes?

That big of a salary sounds great but $50k a year is how much an hour? Let’s dig into what that salary actually gets you

Author: Kari Lorz – Certified Financial Education Instructor

Getting a new job can be one of the most exciting things in your life, especially if it pays well! Congrats! This is your first job that pays a salary; no more working for $13.78 an hour for you! Nope, you’re making a fantastic salary!

But then you start to wonder, and you break out your phone’s calculator. You try and remember all your bills, and you wonder; $50,000 a year is how much an hour? It’s got to be more than my last job… hopefully.

Don’t worry; today we’re going to break down that $50,000 salary to hourly pay and see precisely what it can buy with different budgeting methods.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- That big of a salary sounds great but $50k a year is how much an hour? Let's dig into what that salary actually gets you

- $50,000 a year is how much an hour?

- If you make $50,000 a year how much is that after state and federal taxes?

- What about retirement contributions?

- How much does insurance take from my $50,000 annual salary?

- How to live on $50k a year

- How should I budget a 50k salary?

- Can you live off of $50k a year?

- Jobs that make $50,000 a year

- What is a salaried job?

- $55,000 a year is how much an hour?

- At the end of the day

$50,000 a year is how much an hour?

Okay, let’s cut to the chase; you want the numbers so let’s get right to it!

- Let’s say you work the traditional 40 hr workweek:

- $50,000 / 52 weeks a year = $961.54 a week / 40 hours = $24.03 an hour

- If you work 50 hrs a week (which would be more typical for a salaried worker):

- $50,000 / 52 weeks a year = $961.54 a week / 50 hrs = $19.23 an hour

How much is $50,000 a month?

- $50,000 / 12 months = $4166.67 gross pay

How much is $50,000 bi-weekly?

- $50,000 / 26 pay periods = $1,923.07 gross pay

How much is $50,000 weekly?

- $50,000 / 52 weeks = $961.54 gross weekly pay

$50,000 is how much a day?

If you work 40 hours a week, then that’s 8 hours a day = $192.24 a day when you’re working. BUT, remember you are salaried! That means you get paid essentially every single hour of every single day (kind of fun to think of it this way). So that means…

- $50,000 / 8760 hours in a year = $5.71 an hour, which is a lot less impressive than when you say $50K annual salary. Oh well.

Now just because you make a $50,000 annual salary, you don’t take that amount home! You still have to pay taxes. Let’s look at how that impacts your take-home (after-tax) pay.

If you make $50,000 a year how much is that after state and federal taxes?

Figuring out your tax burden is such a vital part of understanding your pay. If you do the math and base your bills on before-tax income, you’re in for a nasty shock! So always consider how much you’ll pay in taxes.

For example, let’s assume you’re a single filer with one exemption:

- If you live in CA, which has a very high state income tax rate…

- You’ll pay $9,675 in FICA, federal and state taxes (roughly)

- You’ll take home $40,325

- If you live in FL, which doesn’t have state income tax, then…

- You’ll pay $8,140 in FICA and federal taxes

- You’ll take home $41,861

You can go here to give you a rough idea of how much you’ll pay. Remember, this is just a reasonable rough estimate, not a guarantee! Or, if you want a super quick calculation, taking 30% off your gross is a good and safe estimate.

States that don’t tax wages: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire, and Tennessee, according to AARP.

Don’t get so busy making a living that you forget to make a life.

Dolly Parton

What about retirement contributions?

I am so glad you asked! Putting money into your employer-sponsored retirement plan is one of the smartest things that you do for long-term financial planning! So yes, you absolutely want to do this!

Companies usually match a specific amount (as a percentage) of the pay that you put in. So if you put in 5% of your gross income into a traditional 401k, they will also match that 5%. Usually, companies have a max amount that they will contribute; 5% is a general figure.

So, if you make $50,000 a year and get paid monthly, that means your gross pay is $4166.67 a paycheck; you then contribute 5% of that to a 401k, which is $208.33. You then get taxed on the remainder, which is $3,958.34. So essentially, you’re losing $2,500 from your annual pay, but it’s well worth it as now you have contributed approximately $5,000 into your tax-advantaged retirement account!

If you’re changing jobs, then you need to make sure that you take all your money with you! According to Capitalize, “As of May 2021, we estimate that there are 24.3 million forgotten 401(k)s holding approximately $1.35 trillion in assets, with another 2.8 million left behind.

That’s a lot of money for employees to just “forget about.” Don’t be a worker who left money on the table when they switched jobs! Beagle can help you find your old 401k accounts and help you roll them over into an account that you can easily manage.

While the full process takes a few days (they need 2-3 days to research everything), the initial sign-up process takes less than 15 minutes. You tell them your info, give them an idea of what companies you worked for, and they go find your old accounts.

We went through the process, and it was super easy; you can read our full review on Beagle retirement savings finder here! Or you can check out Beagle by clicking the green button below.

How much does insurance take from my $50,000 annual salary?

Sorry to say that we’re not done with your paycheck deductions. According to the US Bureau of Labor, “Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020.”

It’s important to note the precedence of what get’s taken out of your paycheck and when. Here’s the order according to the US Office of Human Resources…

- Retirement contributions come out first, followed by

- Social Security tax

- Medicare tax

- Federal income tax

- Health insurance

- Life insurance

- State income tax

- Local income tax

- Collections to the US government (if applicable)

- Collections to Court ordered rulings (if applicable)

- *Everything below here is optional*

- Health Care/Limited-Expense Health Care Flexible Spending Accounts

- Dental

- Vision

- Health Savings Account

- Optional Life Insurance Premiums

- Long-Term Care Insurance Programs

- Dependent-Care Flexible Spending Accounts

- Thrift Savings Plan (TSP)

Did your jaw just drop? Mine too; that’s a lot of deductions. Let’s focus on the medical deductions and what that does to your paycheck. Same scenario as above, a single filer with one deduction, living in California…

- $50,000 / 12 months = $4,166.67

- Minus 5% in retirement contributions $208.33

- Minus FICA taxes = $317.41

- Totals $3,640.93

- Minus 8.2% average medical insurance costs

- That takes out $298.55 leaving you with $3,342.38

- Minus federal income tax of $332.50

- Minus state income tax of $114.41, leaving you with $2,895.47

- Minus misc small deduction averaging $75 ( a total guess)

- Net income $2,820.47

| $50,000 a year salary | Income |

|---|---|

| Monthly pay (gross) | $4166.67 |

| Bi-Weekly paycheck amount (gross) | $1923.07 |

| Weekly paycheck amount (gross) | $961.54 |

| Daily pay at 8 hours (gross) | $192.32 |

| – 8 hours a day hourly wage – 40 hrs wk (gross) | $24.04 |

| Daily pay at 10 hours (gross) | $192.32 |

| – 10 hours a day hourly wage – 50 hours wk (gross) | $19.23 |

| Monthly net income (approximate) | $2,820.47 |

| Daily income – 21 working days a month (net) | $134.31 |

| – 8 hours a day hourly wage (net) | $16.79 |

| – 10 hours a day hourly wage (net) | $13.43 |

How to live on $50k a year

When you get a big income jump, people often warn about lifestyle creep. This can mean that you start spending more money, sometimes without realizing it.

To stick to a monthly budget of $2,2820 a month, you need to be careful about your spending habits and ensure that all your expenses are accounted for. Here’s how to do it…

- Make a realistic monthly budget; here are the popular budgeting methods

- Live within your means (you have to say no to yourself sometimes).

- Save up for big expenses (use sinking funds)

- Dump your debt ASAP (paying interest is eating away at your bank account, do it this way)

- Evaluate, Tweak & Adjust, and reanalyzed (everyone needs to adjust, no one is perfect at budgeting)

How should I budget a 50k salary?

Okay, let’s take the figures from above and figure out your monthly budget. So we’re using a take-home pay of $2,820.47 and giving figures for two popular budgeting methods.

The 50/30/20 budgeting method

This budgeting method is good for people who like flexibility and have leeway for spontaneity. They want general guidelines, but they want options & choices too. So your monthly household budget would look like…

- 50% Needs: $1410 for housing and utilities

- 30% Wants: $846 for wants

- 20% Savings: $564 for saving

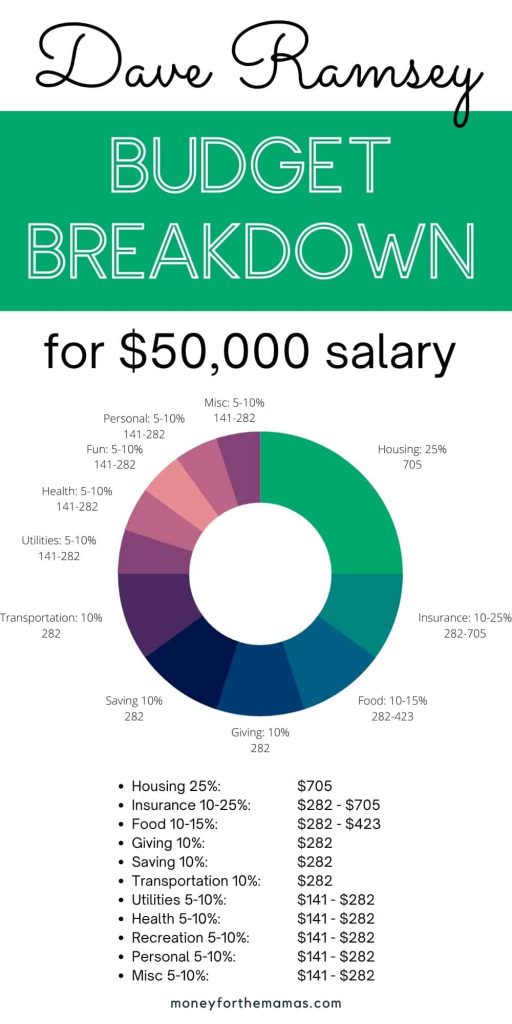

Dave Ramsey recommended budget percentages

I am a fan of Dave’s budget percentages, but I realize that it can be too detailed and constraining for some. But for others, that’s the best part, they want to know what to do with each and every dollar to make the most of their $50k salary.

But let’s just see what everything comes to…

- Housing 25%: $705

- Insurance 10 – 25%: $282 – $705

- Food 10-15%: $282 – $423

- Giving 10%: 282

- Saving 10%: $282

- Transportation 10%: $282

- Utilities 5-10%: $141 – $282

- Health 5-10%: $141 – $282

- Recreation 5-10%: $141 – $282

- Personal Spending 5-10%: $141 – $282

- Misc 5-10%: $141 – $282

Can you live off of $50k a year?

Depending on where you live, these figures may not be a suitable living wage. Such as in a high cost of living area. Your housing and food could cost considerably more than the allotted budget category wants, or the opposite in a low cost of living area.

To add in another layer of difficulty, if you made $80K in a metro area doing a high-income skill, that same skill may only pay only $50K, which can be frustrating.

According to the Bureau of Labor Statistics for May 2020, the average annual wage for a US worker across all occupations is $56,310. So a $50K a year job is less than the average. HOWEVER, where you live plays a significant impact in if it’s considered a good wage.

For example, the BLS states that in NYC, the average yearly salary is $71,050. While in Idaho, the average salary is $46,800. But remember, for these BLS averages, there are a few people that totally skew the numbers.

A better number is the median wage, that’s the halfway point of the number of people. The BLS site shares info on the national median hourly wage being $20.07. Remember, with a 40 hr work week that makes your $50,000 salary at being $24 an hour, so well over the median wage.

Another factor is your household income (as a whole) not just your income. So The US Census says that in 2019 (the most recent data), the median household income is $62,843. So if you make $50,000 and your spouse makes $50,000 then you two are doing great!

Is $50,000 a year salary good if you’re single?

If you’re single, then your $50K salary is considered good (assuming you live in a low cost of living area). But if you live in NYC or San Francisco, then it may not be enough to cover your costs.

With this salary, you should easily be able to cover all of your essential expenses, like housing, utilities, transportation, and food. You should also be able to save up for big-ticket items (i.e. vacations, new cars, etc.), and hopefully not accrue any debt.

Is $50k a good salary for a family?

A $50,000 salary may not be enough for a family, depending on the size of the family and where they live. In a low-cost living area, this salary could cover all essential expenses and leave some room for savings and recreation.

But in a high cost of living area, this salary may not be enough to cover everything. Especially if you’re the sole income earner for the family. You’ll want to look at add another earner in the family or increasing your salary.

Let’s go ahead and take a look at a few other typical salaries, and see how they’d support your family’s needs.

- $30,000 a year is how much an hour

- $40,000 a year is how much an hour

- $50,000 a year is how much an hour (you’re here)

- $60,000 a year is how much an hour

- $70,000 a year is how much an hour

- $80,000 a year is how much an hour

- $90,000 a year is how much an hour

Jobs that make $50,000 a year

There are many jobs that make $50,000 a year; let’s look at Indeed’s list…

- Property manager – $51,903

- Executive assistant – $51,976

- Law enforcement officer – $53,567

- Claims adjuster – $55,002

- Pipe welder – $55,211

- Insurance specialist – $55,293

- Warehouse training manager – $55,752

- Sales representative – $56,247

- Sanitation supervisor – $57,673

- Xray technologist – $58,738

What is a salaried job?

Salaried employees are usually called “exempt” employees. Being salaried means that you get paid the same flat amount every payday, usually once a month. No matter how many hours you do or don’t work, the pay is the same unless you take unpaid time off. people say, “I get paid $50K a year.”

Pros of being salaried

- You can better budget because you know exactly how much you’ll get each paycheck

- You don’t have to punch in/out of a timeclock

- You can work fewer hours and still get paid the same.

- These positions usually come with a better benefits package (i.e., higher retirement contributions, etc.)

- Higher perceived status/position in the company

- Get paid time off (paid vacation, sick leave, etc.)

Cons of being salaried

- No overtime pay, so if you work more hours, it’s not reflected in the pay

- Higher responsibility and more duties to perform

- Might be expected to take work home with you.

Note: According to the US Dept Labor, “Effective January 1, 2020, employees must earn at least $684 per week ($35,568/year), receive a salary, and perform particular duties (as defined by the FLSA) to be considered exempt from overtime requirements under federal guidelines.”

You can also be a freelancer or project-based earner, like a freelance model. Essentially you get paid for completing a task/project. This type of earnings happens in all markets.

For example, you can be a flipper and make a ton of money! Rob, from flea market flippers, makes well over $50,000 a year, all project-based. You can read about how to make money flipping items.

$55,000 a year is how much an hour?

Let’s say you get a raise from your original salary. Let’s take a look at what a 55k salary looks like…

| $55,000 salary a year | Income |

|---|---|

| Monthly gross salary | $4583.33 |

| Bi-Weekly Paycheck (gross) | $2,115.38 |

| Weekly paycheck (gross) | $1,057.69 |

| Daily pay at 8 hours (gross) | $211.54 |

| – 8 hours a day hourly wage (gross) | $26.44 |

| Daily pay at 10 hours (gross) | $211.54 |

| – 10 hours a day hourly wage (gross) | $21.15 |

But we all know taxes, insurance, and retirement contributions take out a hunk. For speed’s sake, let’s just average it all together at 30%.

- Monthly take home = $3,208.33

- Daily pay (average 21 working days a month) = $152.77 a day

- Hourly pay:

- 8 hours a day = $19.09 an hour

- 10 hours a day = $15.27 an hour

At the end of the day

Getting a salaried job can be a huge boost to your annual income, but be sure you are figuring out all aspects to see if it’s actually worth it and if you can afford it. There are a lot of deductions that come out of your paycheck, which may not make it so attractive, or the number of hours you put in maybe a lot more than you want to do.

Either way, figuring out your pay (i.e., $50,000 is how much an hour) can be a good way to gauge the attractiveness of the job offer. If it’s your dream job, then great! You’re going to love it!

Articles related to $50,000 a year is how much an hour:

- How much is 6 figures? And What Can I Afford?

- How to Save Money Out of Your Salary (at any pay)!

- How to Make Your Fortune Selling Feet Pictures

- Best Items to Flip to Make Massive Money

- Here’s How to Start Freelance Modeling – a Step by Step Guide

Wow! You can’t even get a studio apartment in Utah for $705. Or anywhere out West. The transportation budget would basically cover gasoline. Not an actual car payment or maintenance/repairs. Or car insurance. Public transportation in Utah is deficient, so not owning a car is not an option. A realistic monthly transportation budget to cover all of these costs would be closer to $1000 a month. Maybe if you live in the deep south or in the rust belt you might be able to get by on that budget.

Hi Rachel – Yes! I absolutely hear you, and you’re right, surviving in this economy is very tough financially speaking. The dollar figures in this post are based off of Dave Ramsey’s suggested budget percentages. He hasn’t updated them in a while but it would be very interesting to see what he would suggest.

I love the way your broke down everything

This is really impressive

So glad you liked it! There’s a lot to go through when talking about paychecks (more than even I expected!)

This is so helpful to give context to how much a salary really means for your take home, or how much your hourly rate means you can live off of. Great job breaking down the paycheck to go from a gross wage to what actually hits your bank account.

Right, it’s such a shock to see how much of your paycheck is gone before you even get it deposited!

What a thorough and helpful breakdown! Thank you for factoring in so many variables. This was very helpful.

So glad you liked it Lory! It’s funny that $50,000 sounds like a lot but when you break it down into a budget it doesn’t go as far as you expected.