$40 an Hour is How Much a Year? Will it Cover Your Lifestyle? (Find Out Now)

You just got a job offer and are wondering about the wage – 40 dollars an hour is how much a year? Let’s see how much you’ll actually take home

Author: Kari Lorz – Certified Financial Education Instructor

You’ve heard that $40 an hour is a great wage, but you’re not sure what that means for your yearly salary.

So $40 an hour is how much a year? It can be tough to figure out how much you’ll make each year if you’re working hourly, especially when considering things like taxes, healthcare, retirement contributions, etc.

Don’t worry; we did the math for you! We break it all down with a 40-hour workweek and standard deductions, so you’ll know exactly how much money you’ll be bringing home.

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

- You just got a job offer and are wondering about the wage – 40 dollars an hour is how much a year? Let's see how much you'll actually take home

- 40 dollars an hour is how much a year? (short answer)

- 40 dollars an hour is how much a year? (long answer)

- Before-tax & after tax pay

- $40 an hour is how much a year after insurance

- $40 an hour is how much a year with part-time work

- Workplace perks & bonuses

- Jobs that pay $40 an hour

- Can I live off $40 per hour?

- $40 an hour budget examples

- 5 tips to live on $40 an hour

- Ways to increase your pay

- 41, 42, 43… 49 an hour is how much a year?

- Other wage rates

- At the end of the day

40 dollars an hour is how much a year? (short answer)

$40 an hour is $83,200 (gross).

This is based on working 40 working hours per week, 52 weeks per year.

$40 x 40 hrs week x 52 weeks a year = $83,200

40 dollars an hour is how much a year? (long answer)

Let’s go through all the calculations for $40 an hour pay (let’s assume an 8-hour workday, at 40 hours a week).

$40 an hour is how much a day?

$40/hour = $320 for an 8-hour workday

$40 an hour is how much a week?

$320 x 5 days a week = $1,600 a week

$40 an hour is how much bi-weekly?

When you get paid twice a month, that is known as bi-weekly pay. It’s one of the most popular methods for businesses to pay hourly workers (salaried employees are generally given one paycheck a month).

$1,600 x 2 weeks = $3,200 every 2 weeks

How much is 40 dollars an hour per month?

There are 52 weeks a year, which don’t come out even when you divide by 12 months. It comes to 4.33 weeks in a month. But you usually get paid two times a month. Yet, there are two months a year in which you get paid three times (aka a bonus check sort of).

- 2 pay periods a month: $6,400 (gross)

- 3 pay periods a month: $9,600 (gross)

- The average of 4.33 weeks a month: $6,933 (gross)

Before-tax & after tax pay

Just because you make $40 an hour, that doesn’t mean you get to keep it all.

You will have to pay taxes and other deductions from your paychecks. The typical employee in the United States spends roughly a third of their income on taxes, insurance, and retirement contributions. But we’ll just concentrate on tax and insurance write-offs for simplicity.

Here are some other helpful terms…

- Before-tax = gross income. This is the full $40 an hour x # working hours in your pay period.

- After-tax = net pay (this is the amount you take home). This also accounts for other paycheck deductions like insurance and retirement contributions.

- Hourly rate = your hourly wage (i.e., $40 an hour)

- Full-time employee = usually, you need to work 30+ hrs to be considered full-time, yet some consider 40 hours full time.

- Part-time employee = usually, you’ll work less than 30 hrs a week; at some places, it’s 25 hrs or even 20 hrs a week.

- Exempt employees = these are people who are paid a salary. They get paid the same no matter how many hours they work. (i.e. $– a month)

- Non-exempt employees = these are people who are paid hourly. They get paid for every hour they work and may receive overtime pay if they have more than 40 working hours in a week. This post focuses on this employee classification, as you’re per hour.

$40 an hour is how much a year before taxes

- $40 x 40 hrs week x 52 weeks = $83,200 annual salary (gross)

$40 an hour is how much a year after taxes

You pay the same amount of federal taxes (depending on your tax bracket), and then you pay state taxes (a different amount depending on your tax bracket).

However, nine states don’t tax income – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

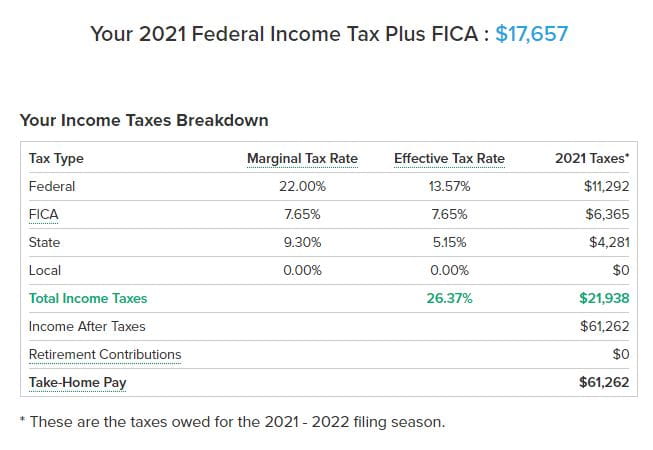

For example, let’s use this calculator to determine our federal & state taxes if we lived in California and filed as a single…

This shows that you’ll pay…

- Federal tax: $11,292

- FICA tax: $6,365

- State tax: $4,281

- Total income taxes: $21,938

- = after tax pay of $61,262

Current tax rate for $40 an hour wage rate

If you make $40 an hour and are single with no children, your current tax rate is 22% for federal taxes (single filer), yet most of your income will fall into the 24% tax bracket.

- $40,526 to $86,375 income = 22% tax rate

- $86,376 to $164,925 income – 24% tax rate

In addition, you’ll need to take away state income taxes.

$40 an hour is how much a year after insurance

We’re still in the process of making payroll deductions, which means we’ll need to pay for medical insurance that our employer covers.

According to the US Bureau of Labor, “Health care is typically one of the most expensive benefits for employers to provide, constituting 8.2 percent of total compensation for civilian workers in March 2020.”

These are things like…

- Health Care/Limited-Expense Health Care Flexible Spending Accounts

- Dental

- Vision

- Health Savings Account

- Optional Life Insurance Premiums

- Long-Term Care Insurance Programs

- Dependent-Care Flexible Spending Accounts

- Thrift Savings Plan (TSP)

So if we take your take-home pay of $61,262 and x 8.2% for healthcare = $5,024 a year for healthcare, this means you’ll actually take home…

- $61,262 – $5,023 = $56,238 (this is your net income)

- $56,238 / 12 months = $4,686 on average

This means you lost 32.4% of your paycheck to deductions, and remember this doesn’t include any retirement contributions, which is 5% (an average) for those who contribute.

If you’re changing jobs, then you need to make sure that you take all your money with you! According to Capitalize, “As of May 2021, we estimate that there are 24.3 million forgotten 401(k)s holding approximately $1.35 trillion in assets, with another 2.8 million left behind.

That’s a lot of money for employees to just “forget about.” Don’t be a worker who left money on the table when they switched jobs! Beagle can help you find your old 401k accounts and help you roll them over into an account that you can easily manage.

While the full process takes a few days (they need 2-3 days to research everything), the initial sign-up process takes less than 15 minutes. You tell them your info, give them an idea of what companies you worked for, and they go find your old accounts.

We went through the process, and it was super easy; you can read our full review on Beagle retirement savings finder here! Or you can check out Beagle by clicking the green button below.

$40 an hour is how much a year with part-time work

$40 per hour working 20 hours a week

If you worked only 20 hours a week, that would be $800 a week (gross income). You’d still need to pay taxes. However, your medical deductions would be minimal (if any) as part-time workers usually don’t get these benefits.

$40 a week x 20 hrs weeks x 52 weeks = $41,600 annual salary

$40 per hour working 30 hours a week

You would take home $1,200 a week, and you would need to pay federal and state taxes. You may (or may not) qualify for medical benefits, which would be another expense to factor out of your paycheck.

$40 a week x 30 hrs a week x 52 weeks = $62,400 yearly salary

| $40 an hour per… | Before Tax | After Tax |

|---|---|---|

| Year | $83,200 | $58,240 |

| Month | $6,933 | $4,583 |

| Bi-week | $3,200 | $2,240 |

| Week | $1,600 | $1,120 |

| Day | $320 | $224 |

| Part-time 20 hrs a week | $41,600 (annual) | $31,200 |

| Part-time 30 hrs a week | $62,400 (annual) | $46,800 |

- *For part-time figures, we assume a 25% (for 20hrs) and a 25% (for 30 hrs) tax bracket for state & federal taxes (in California) and no medical deductions (as part-time workers may not qualify for medical benefits).

- All other after-tax figures assume a generalized 30% combined federal & state deduction and small misc deductions.

Workplace perks & bonuses

The amount of money you make isn’t the only thing to consider when determining how suitable your employment is. You should also think about other perks, such as PTO, medical insurance, discounts, etc.

Paid time off

Many businesses offer paid time off (PTO) as part of their benefits package. The average worker gets ten days of paid vacation and six sick days. This time can be used for anything – doctor’s appointments, mental health days, or actual holidays.

This perk usually kicks in after you have worked a certain number of days. For example, after 90 days, you will start earning PTO, which is a percentage of how many hours you work. So if your employer allows it, you may take 1.5 days off each month (or whatever your company policy is).

Time off without pay

All of our income amounts are listed for the total amount, as if you worked 8 hours a day, five days a week, 52 weeks a year.

Yet, if your company doesn’t provide paid time off, you will most likely take home less; due to sickness, unavoidable schedule conflicts, and vacation. This means you’ll take home less.

Even though you’d want to be paid for your time, unpaid time off is still a nice bonus. This implies that you can ask for days off and keep your job. Some corporations have strict attendance rules, and missed days might result in disciplinary action (i.e., write-ups or reprimands), leading to employment termination.

Let’s say that over the course of a year, you took two weeks of unpaid time off. That’s…

- ($40 an hour x 8 hours) x 14 days = $4,480 less in annual income

Overtime pay

According to the Fair Labor Standards Act (FLSA), “Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.”

Time and a half is your hourly pay x 1.5. So if you made $40 an hour and worked 8 hours of overtime that week (maybe you came into work because someone was sick), it would look like…

- $40 x 1.5 = $60 x 8 hours = $480 for the day

Holiday pay

Some businesses are closed on government holidays, but others remain open, and employees get holiday pay. This is where you’ll make more money (if you’re on the clock).

Depending on your workplace’s benefits package, it can be time and a half or double pay.

Double pay is just like it sounds, so…

- $40 x 2 = $80 x 8 hours = $640 for the day

There are eleven annual US federal holidays on the calendar designated by the United States Congress.

Most holidays fall on a specific date, but some fall on a certain day of the week (i.e., the first Monday of the month). For 2022, these are the federal holidays…

- New Year’s Day – January 1st, 2022

- Birthday of Martin Luther King, Jr. – January 17th, 2022

- Washington’s Birthday – February 21st, 2022

- Memorial Day – May 30th, 2022

- Juneteenth Independence Day – June 20th, 2022

- Independence Day – July 4th, 2022

- Labor Day – September 5th, 2022

- Columbus Day – October 10th, 2022

- Veterans Day – November 11th, 2022

- Thanksgiving Day – November 24th, 2022

- Christmas Day – December 26th, 2022

Employee discounts & misc benefits

Many businesses provide their workers with discounts on goods and services. This is generally a percentage off, such as 10% or 20%. It can be useful if you’re purchasing an expensive item (such as a new lawnmower) or using the company’s services regularly (such as getting your automobile serviced).

While this benefit isn’t directly seen on your paycheck, it can make a big difference to your monthly expenses.

In addition to a standard discount of 10%, there may be other benefits that impact the worthiness of a job.

For example, I worked in the grocery industry for six years. Employees got to take home free food that had exceeded its expiration date (or sell-by date). This was a huge benefit as people saved a lot on their grocery bills by eating a salad that didn’t sell the day before, canned beans, or box of pasta, etc.

Other benefits may include…

- Discounted public transportation passes

- Discounted parking passes

- Discounts at local gyms or health programs

- Unpaid vacation opportunities (i.e., sabbatical)

Jobs that pay $40 an hour

According to Indeed, here are some of the top jobs that pay at least $40 an hour…

- Midwife – $41.41

- Senior web developer – $42.43

- App developer – $43.74

- Speech pathologist – $45.12

- Massage therapist – $46.09

- Software developer – $47.81

- Physical therapist – $49.07

Can I live off $40 per hour?

Yes, you can live off of $40 an hour. With $83,200 a year, that’s well above the average wage for the US. According to the US Social Security Administration (SSA), “The national average wage index for 2020 is $55,628.60.”

So at $40 an hour of full-time work, you make more than the average person in the US.

That means you still need to be mindful of where you live (cost of living), either the city as a whole or your specific neighborhood, as your housing is where you’ll spend most of your paycheck.

With this paycheck, you should be able to afford many of the nicer things in life, such as vacation, etc. However, many of the jobs above require an advanced degree (i.e., physical therapist, speech pathologist). So it’s likely that you will have student loan debt.

For example, according to Student Loan Planner, “The average speech-language pathologist we’ve worked with here at Student Loan Planner has about $131,000 in student loan debt. But that doesn’t tell the whole story. Some have had less than $100,000, while others have had over $200,000, which is a fairly wide range.”

This means that you will need to live frugally to pay off this debt right out of college. Please, don’t pay the minimums and have this hanging around your neck for a decade or more. Live well below your means, pay off this debt aggressively, and then you can level up your lifestyle.

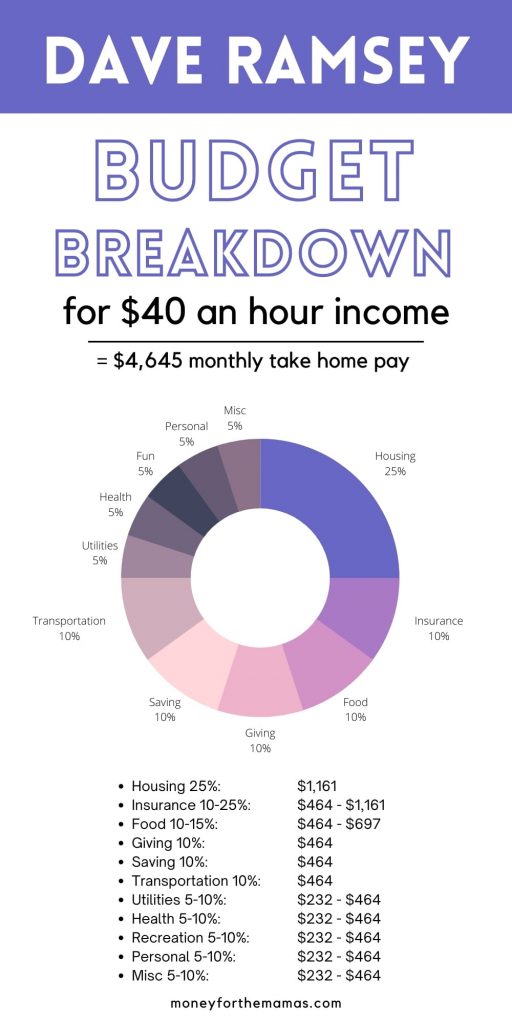

$40 an hour budget examples

Okay, now that you know how much you’ll get paid, what does that look like for your home? Again, let’s assume a safe 33% deduction for everything from your $6,933 monthly gross income. So $4,645 take-home pay.

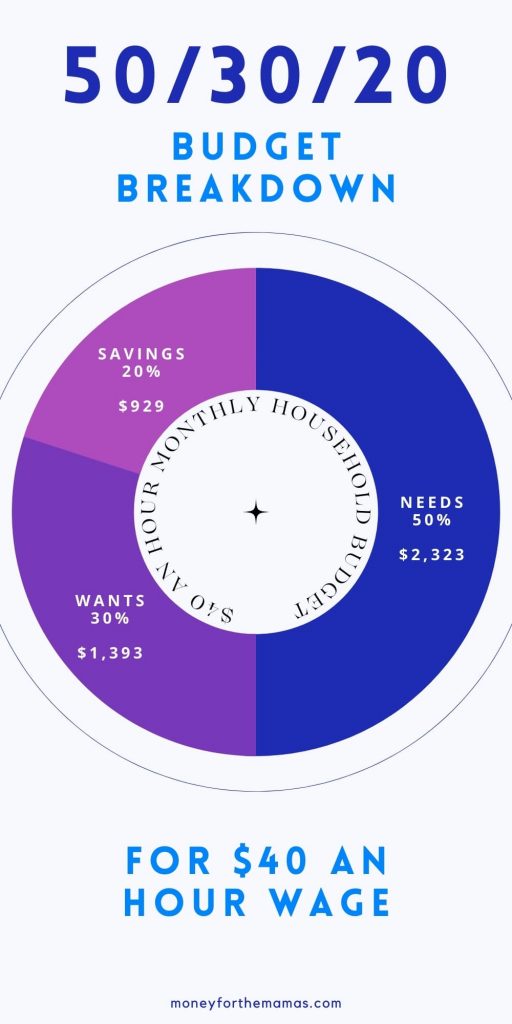

50/30/20 Budget

People who value spontaneity and want the freedom to go with the flow will like this budgeting method. Don’t get me wrong, they want to budget, but they also desire alternatives and choices. So your monthly household budget might appear like this…

- 50% Needs: $2,323 for housing and utilities

- 30% Wants: $1,393 for wants

- 20% Savings: $929 for saving

Dave Ramsey recommended budget percentages

I am a fan of Dave’s budget percentages, but I realize it is very detailed and maybe too strict for some. But for others, that’s the best part; they want to know exactly what to do to make the most of their income.

But let’s just see what your money situation comes to using his recommended budget percentages.

- Housing 25%

- Insurance 10 – 25%

- Food 10-15%

- Giving 10%

- Saving 10%

- Transportation 10%

- Utilities 5-10%

- Health 5-10%

- Recreation 5-10%

- Personal Spending 5-10%

- Misc 5-10%

| Budget Category | Recommended % | Amount |

|---|---|---|

| Housing | 25% | $1,161 |

| Insurance | 10 – 25% | $464 – $1,161 |

| Food | 10 – 15% | $464 – $697 |

| Giving | 10% | $464 |

| Saving | 10% | $464 |

| Transportation | 10% | $464 |

| Utilities | 5 – 10% | $232 – $464 |

| Health | 5 – 10% | $232 – $464 |

| Recreations | 5 – 10% | $232 – $464 |

| Personal | 5 – 10% | $232 – $464 |

| Misc | 5 – 10% | $232 – $464 |

5 tips to live on $40 an hour

1. Hack your biggest expenses

Housing, food, and transportation are typically a person’s biggest expenses. If you can find ways to save in these areas, it will make a big difference.

2. Stick to a budget

It’s simpler to match your budget to your lifestyle when you know how much money comes in and goes out. Track your spending for a month to understand where your money goes, then create a budget that works for you.

3. Pay off debt quickly

If you have debt, it’s important to pay it off consumer debt as quickly as possible. The interest adds up fast and eats away at your paycheck (as you’re getting nothing for it now).

There are a couple of different ways to do this. You should look at how these two debt repayment methods compare and pick the best option for you.

4. Have an emergency fund

An emergency fund is a savings account that you only use for unexpected expenses, like a job loss, car repair, or medical bills. This helps ensure that you don’t have to put these expenses on a credit card and rack up debt.

Ideally, you should have 3-6 months of living expenses saved in your emergency fund.

5. Save in advance

With making $40 an hour, you should have the flexibility to save for large ticket items in advance. (Remember, it’s better to pay off your high-interest debt first and then save for luxury items.)

Using sinking funds has been one of the most beneficial things for my family’s finances. You look ahead at what you want to spend money on, and then you start saving for it, little by little.

Ways to increase your pay

$40 an hour is a good living wage, far above the federal minimum wage. According to Statista, “In 2020, the median hourly earnings of wage and salary workers in the United States was 16.36 dollars.”

While $40 as an hourly salary is great, you may be looking for ways to increase your income; let’s go through your options.

1. Ask for a raise

It never hurts to inquire about a raise if you believe you’re underpaid. Especially if you’ve been with the firm for a while and have done excellent work, your boss may be willing to grant you a raise, as long as you ask for one.

Make sure that you’re ready to talk about how you positively contribute to the company, especially how you impact sales. You are much more likely to get a raise when you can articulate your value and what you bring to the bottom line.

2. Get a promotion

If you’re looking for a way to make more money, consider applying for a promotion. This can be a great way to earn a raise and advance your career.

Be talking to your manager now about what skills you need to advance in the company. There are hard income skills (technical skills) and soft income skills (interpersonal skills). Both impact how you are viewed as an employee.

If you want a jump start, check out these high-income skills that can help you bring home a big paycheck.

3. Work overtime hours or take extra shifts

If you’re looking for a way to make some extra money, consider overtime wages as a good option. This can be a great way to earn extra household income without committing to a second job.

Make certain that your team members know to ask you first if they want to dump some shifts or need more hands for a particular job.

4. Ask for extra responsibilities or duties

If you’re looking for a way to make some extra money, consider asking for additional responsibilities or duties at work (this isn’t a promotion per se but smaller add-on stuff).

This could include taking on a leadership role, training new employees, being on company committees, or taking on a larger workload.

This will allow you to earn more money, but it will also help you stand out and advance when the opportunity arises.

5. Find a new company that pays higher

If you’re not happy with your current yearly salary, changing companies may be the best option. Check out job postings and see the average salary for your position. If you’re not earning at least that much, it may be time to start looking for a new workplace.

It’s never a bad idea to look around and see what’s available, even if you’re happy with your present position. Keep an up-to-date resume on file to take advantage of a new opportunity when it arises.

Many times with these higher-paying jobs, you’ll find that the most effective way to raise your income in a short amount of time is to job hop. You want to strategically jump from company to company, each time increasing your pay by at least 12% or more.

You need to be careful though, as you don’t want to do this too fast. You want to give each company at least two years. If you do it too fast, you’ll look like a bad hiring option, as you’ll just leave anyway and not bring long-term value to the company.

6. Find alternative ways to make money

There are many ways to make money outside of your 9-5 job. You could start a side hustle in as little as a day! Start Googling side gigs in your area to get a great list of options.

The sky’s the limit when it comes to making money, so get creative and find something that works for you. You can make money woodworking, open an Etsy shop, become a Pinterest Manager, or start flipping furniture.

41, 42, 43… 49 an hour is how much a year?

Assume that you work 40 hours each week and that 33% of your income goes to taxes and medical coverage (this is your after-tax income amount). This is a safe, good-sized general number.

We won’t take any retirement contributions into account, but if you want to include them, move the deductions to 37 percent.

Remember – these numbers are only approximations, not precise figures. It all depends on the year and the number of workdays in a month, your personal paycheck deductions, etc. These amounts are intended to offer you a decent general idea of what you may anticipate in your compensation.

$41 an hour is how much a year?

- before taxes: $85,280 annual income

- after taxes: $57,138

How much is it…

- a month – before taxes: $7,107

- a month – after taxes: $4,762

- bi-weekly – before taxes: $3,280

- bi-weekly – after taxes: $2,197

- a week – before taxes: $1,640

- a week – after taxes: $1,099

- a day – before taxes: $328

- a day after taxes: $220

$42 an hour is how much a year?

You jump to a 24% federal tax bracket with this pay, up from 22%. So we’ll adjust after-tax pay to be 35%, up from 33%. If you want to consider retirement contributions, you’ll want to jump your total deductions to 37%. (again, these are good general estimates).

- before taxes: $87,360 annual income

- after taxes: $56,784

How much is it…

- a month – before taxes: $7,280

- a month – after taxes: $4,732

- bi-weekly – before taxes: $3,360

- bi-weekly – after taxes: $2,184

- a week – before taxes: $1,680

- a week – after taxes: $1,092

- a day – before taxes: $336

- a day after taxes: $218

$43 an hour is how much a year?

- before taxes: $89,440

- after taxes: $58,136

How much is it…

- a month – before taxes: $7,453

- a month – after taxes: $4,845

- bi-weekly – before taxes: $7,453

- bi-weekly – after taxes: $4,845

- a week – before taxes: $1,720

- a week – after taxes: $1,118

- a day – before taxes: $344

- a day after taxes: $224

$44 an hour is how much a year?

- before taxes: $91,520 yearly income

- after taxes: $59,488

How much is it…

- a month – before taxes: $7,627

- a month – after taxes: $4,957

- bi-weekly – before taxes: $3,520

- bi-weekly – after taxes: $2,288

- a week – before taxes: $1,760

- a week – after taxes: $1,144

- a day – before taxes: $352

- a day after taxes: $229

$45 an hour is how much a year?

- before taxes: $93,600

- after taxes: $60,840

How much is it…

- a month – before taxes: $7,800

- a month – after taxes: $5,070

- bi-weekly – before taxes: $3,600

- bi-weekly – after taxes: $2,340

- a week – before taxes: $1,800

- a week – after taxes: $1,170

- a day – before taxes: $360

- a day after taxes: $234

Don’t forget that when looking at these figures, we’re going off the assumption that you work 8 hours a day, five days a week. Yet, many people stay late at the office or take their work home with them. So your “hourly rate” figuratively will be skewed. For example…

$45 an hour x 8 hr day = $360

$45 an hour x (8 hours + 2 hrs of paperwork at home = 10hrs) = $360 still, but your hourly income rate just dropped to $36 an hour from $45.

$46 an hour is how much a year?

- before taxes: $95,680

- after taxes: $62,192

How much is it…

- a month – before taxes: $7,973

- a month – after taxes: $5,183

- bi-weekly – before taxes: $3,680

- bi-weekly – after taxes: $2,392

- a week – before taxes: $1,840

- a week – after taxes: $1,196

- a day – before taxes: $368

- a day after taxes: $239

$47 an hour is how much a year?

- before taxes: $97,760 yearly income

- after taxes: $63,544

How much is it…

- a month – before taxes: $8,147

- a month – after taxes: $5,295

- bi-weekly – before taxes: $3,760

- bi-weekly – after taxes: $2,444

- a week – before taxes: $1,880

- a week – after taxes: $1,222

- a day – before taxes: $376

- a day after taxes: $244

$48 an hour is how much a year?

- before taxes: $99,840

- after taxes: $64,896

How much is it…

- a month – before taxes: $8,320

- a month – after taxes: $5,408

- bi-weekly – before taxes: $3,840

- bi-weekly – after taxes: $2,495

- a week – before taxes: $1,920

- a week – after taxes: $1,248

- a day – before taxes: $384

- a day after taxes: $250

What would retirement contributions do to my pay?

At $48 an hour rate, which is $99,840 annual income, let’s assume you contribute 7% to a traditional 401(k) workplace retirement plan.

Remember, this is pre-tax money, so you can’t just take 7% off the bottom, it comes out first, and then you are taxed on the rest.

- $99,840 x 7% = $6,988 into retirement

- $99,840 – $6,988 = $92,852 that’s now your taxable income

- $92,852 x 35% average tax rate = $60,354 take home

- $60,354 / 12 months = $5,029 take home a month

- Take-home of $5,408 with no retirement contributions

- Take-home of $5,029 with retirement contributions

- = difference of $379 a month in take-home pay

Don’t forget that if you contribute to a retirement plan, most workplaces match part of that money. A standard match amount is 5% by the company. So you put in 7%, and they put in 5% of your pay x a lot of years = a lot of money saved up to retire in comfort!

$49 an hour is how much a year?

- before taxes: $101,920

- after taxes: $66,248

How much is it…

- a month – before taxes: $8,493

- a month – after taxes: $5,521

- bi-weekly – before taxes: $3,920

- bi-weekly – after taxes: $2,548

- a week – before taxes: $1,960

- a week – after taxes: $1,274

- a day – before taxes: $392

- a day after taxes: $255

Other wage rates

- $20 an hour is how much a year

- $30 an hour is how much a year

- $40 an hour is how much a year (you’re here)

- $50 an hour is how much a year

At the end of the day

So, is a salary of $40 an hour great? Absolutely! It affords you opportunities to live a comfortable life and save for the future. You may not be able to afford the fanciest neighborhoods or drive the newest car, but with careful planning and some creative thinking, you can make your wage work for your lifestyle.

And there are plenty of opportunities for career growth if that’s something you’re interested in. $40 per hour is a good wage that allows you to do a lot of things that are important to you.

Q: $40 an hour is how much a year?

A: $83,200