Why Now is the Best Time to Start Your Christmas Savings Plan

Christmas in July is the perfect time to start planning how you’re going to save money for Christmas!

Author: Kari Lorz – Certified Financial Education Instructor

The middle of summer sounds like an odd time to start thinking about Christmas. But this is actually the BEST time to start your Christmas savings plan!

Planning this far in advance gives you about four months to save before the Black Friday sales hit.

You can certainly save a bunch of money between now and then, so you can avoid the dreaded January credit card bill!

Can you imagine how good it would feel to completely sidestep that huge bill? Yes, you can. So let’s start making our Christmas savings plan now so you can experience it for yourself!

This post may contain affiliate links. If you make a purchase, I may make a commission at no cost to you. Please read my full disclosure for more info

5 steps to having a stress free (and debt-free) Christmas

- Have a Christmas in July (it’s July 25th)

- Start saving money for Christmas now for your grand total budget number

- Figure out how much money you need to save each week/month to reach your goal. How will you do it?

- Plan how much you want to spend on each budget category (holiday food, Christmas gifts, events, etc.)

- Stick to your holiday budget!

Why Summer is the best time to start saving for Christmas

Honestly, summer really is the best time to start your Christmas planning process! Why? Because the holiday is so far removed, there’s none of the stress associated with it that typically comes with the holiday season. Your shoulders aren’t hunched, and your to-do list isn’t as crazy like it is in November.

It’s summer, so you’re relaxed and happy with all that vitamin D soaking into your skin. You haven’t experienced Christmas in 6 months, so you’re not totally “over it” like you are in January. Along with that sitting inside and watching a Christmas movie sounds like heaven (probably because it’s 101 degrees outside)!

Plus, the holiday season is far enough away that saving small amounts each week adds up to a nice big chunk-o-change! It’s totally doable to save $500, or $750, or even $1,000 for Christmas spending! Or however much you want to be able to do all the things on your Christmas bucket list!

Step 1 – Do a Christmas in July

It would seem counterintuitive to celebrate Christmas twice, but go with me here! You are going to have a little mini Christmas planning party, and it will be loads of fun! Invite your best friend over, or spend it with your mom, or even by yourself for a relaxing afternoon.

What is Christmas in July?

Believe it or not, but the unofficial holiday originated in 1933 at a girl’s camp in North Carolina. The camp counselors were just doing something fun, and it went off so well that they did it year after year, and it spread across the US. Lots of brands and retailers have also caught on to this phenomenon; QVC has a big push, and the Hallmark Christmas movies come back for a short time.

Your Christmas in July holiday planning

There is a dual purpose for you celebrating, first is to relax and enjoy yourself. The second is for you to plan Your Ultimate Stress Free & Debt Free Christmas Budget! (Your Christmas Savings Plan is a part of this) Now, I’m not talking “budget” as in cheap or necessarily a frugal Christmas (it certainly can be if you want though).

I’m talking about Christmas on a Budget, as in planning out how much you want to spend this Christmas because you will eliminate that dreaded January credit card bill! This year it’s going to be a debt-free Christmas for you and your family!

This means no guilt of overspending, no worry or anxiety about how you’re going to pay for things! And no last-minute scrambling to get your holiday planning or shopping done!

Supplies for your Christmas in July

If you want to have fun and really get into the spirit, then there are a few things you’re going to need! Don’t worry, they are inexpensive (you probably already have them)!

- Christmas movies; pick 2-3

- Hot chocolate

- Christmas jammies

- Turn on the a/c so you can cuddle up with your blanket on the couch

- Grab Your Ultimate Stress-Free (Debt Free) Christmas Budget, whew, that’s a long name for a holiday budget, but that’s precisely what it will do for you!

How to do your Christmas in July holiday planning

I want you to schedule this for a time when you’ll be relaxed, while kiddos are out playing for the afternoon, or when the house is quiet. Put on your holiday jammies, crank the a/c and make your hot chocolate! You can even get out a few holiday decorations to spruce up your TV room!

Put on your first Christmas movie and just enjoy it! One of my favorite holiday guilty pleasures are the Hallmark Christmas movies. No idea why I love them so much, maybe it’s the right amount of corny & cute! But you can’t beat the old-fashioned classic Christmas movies & cartoons, and everyone in the family loves them!

- White Christmas

Figure out your Christmas savings goal

We go over this step in-depth in Making a Stress Free & Debt Free Chrismas, but let’s do a quick recap here. Basically, you need to figure out how much you need to save; your Christmas savings goal.

- Who you will buy presents for

- How much you want to spend per person

- Travel plans?

- Entertaining – food, decorations, baking supplies, etc

- Holiday events to attend

- Misc holiday expenses – new holiday party outfit, etc.

Once you figure out those pieces, just add them up, and there’s your savings goal!

Step 2 – Create your savings goal

During Christmas movie #2, let’s take a look at how you can actually save for Christmas! This is your official Christmas Savings Plan!

This is the not-so-secret sauce for having a debt-free Christmas! You’re going to save for it beforehand (aka a sinking fund )! Yes, this doesn’t sound like “fun,” but trust me, come Black Friday, you will be so happy (and relieved) to have the cold hard cash in your hand!

I’ve given you a few different Christmas savings trackers to use in the Stress Free (Debt Free) Christmas Budget Workbook. You can use them for your different categories (food, gifts, fun, etc.). Or just use your favorite and save for the total amount.

Don’t forget to time the end of your Christmas savings plan correctly. Even though, as of Christmas in July (July 25th), there are six months until Christmas, you probably need to have your savings for gifts done by Black Friday, so you have time to do your Christmas shopping. Then you have an extra few weeks to save money for Christmas dinner.

That means in 2023, it’s a full 17 weeks to be done by Nov 24th, which is Black Friday.

Step 3 – Ways to save for Christmas

There are many ways to save money for Christmas; it’s up to you how hardcore you want to go!

- Stockpile your ibotta savings (sign up for $10 in welcome bonuses!)

- Hold a garage sale to earn extra money

- Round up any gift cards you may have laying around, can you use them to buy your Christmas present list? Or maybe sell them online and use that money.

- Sell handmade items online for extra cash (be sure to grab your online sales tracker)

- Use your credit card rewards (cash back or gift card redemption)

- Get a part-time job for a few months

- Do a no-spend month (or just two weeks may be enough), find the perfect money-savings challenge idea here!

- Plan your purchases for sale times (Black Friday). Don’t forget to be searching for gifts all year long so that when it goes “on sale,” you’ll know if the sale price is indeed a good deal!

- Get crafty and make some easy Christmas crafts to sell online or at a craft fair.

For me, I found that the easiest thing to do is to cut $20 a week from my regular spending budget. So each week, I go to the ATM, take out that $20, and stick it in an envelope.

I also save up all my earnings on my receipt apps and redeem the money for gift cards. I use this money for our Christmas baking supplies and Christmas dinner money.

Step 4 – Check-in on your progress

You have your plans, and you’re ready to go! (Yaaa!!!) The last thing you want to do is let time get away from you. Set a reminder in your calendar to check in on your progress every month up until October and then every two weeks until it’s go time! Ask yourself…

- Are you saving what you wanted?

- Do you need to pick up the pace and earn extra money? How will you do that?

- Does your Christmas gift list still look accurate? Need to add anyone to the list?

- Start saving recipe ideas, look at the local events calendar for things to do, make plans with extended family, etc.

I love to use a coloring savings tracker to track my progress. I use these for lots of different sinking funds. You can get a basic tracker with my free Christmas worksheets, or you can grab a bunch of trackers with the full Christmas Planner Workbook.

Step 5 – Spend

Once I make my final deposit into my sinking fund envelope, I go and buy two of the prepaid Visa gift cards. This way, I can spend my savings online.

Be careful to look at the card’s fees. Most will charge a $5 initial fee, but some charge extra. Just read the back of the card to see their fees.

- Sign up with ibotta and get $10 sign up cash as a new customer!

- Earn points on ANY receipt from ANY store and redeem for gift cards with the fetch rewards app.

- Sign up with Inbox Dollars and get paid to read emails, watch videos, and take surveys. Easy peasy!

- Get free gift cards & cash for the everyday things you do online at Swagbucks. Use the link and get a $5 bonus

- Save money on gas by signing up with Upside; it gives you up to $.25 cents cash back per gallon! Use the code AFF25 when you sign up; you’ll get a $.25 cents per gallon bonus!

- Sign up with Cash App and get a $5 bonus when you use code “NRTZMHV.” You have to complete the sign up requirements to get the bonus! Read how to do this here with point #1.

Where to put your Christmas savings

Christmas Club Savings Account

There are these fun, quirky accounts called Christmas Club Savings Account, popularized in the ’70s. According to Bankrate, they are short-term savings accounts usually found in smaller banks or local credit unions.

“Rules and requirements for Christmas Club account holders can vary from one bank or credit union to another. With some accounts, there’s the opportunity to earn interest. And at some banks, Christmas Club accounts more closely resemble CDs. There’s a penalty for any withdrawal that happens prior to a certain date during the holiday season.”

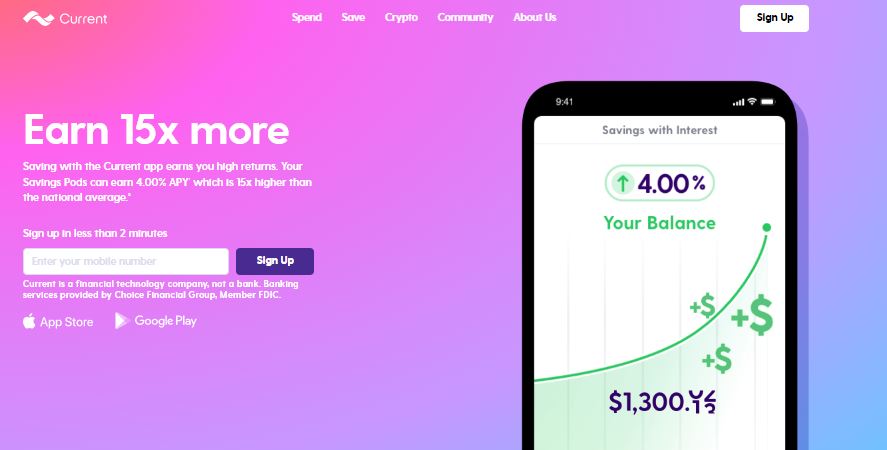

Set up an online sinking fund with Current

Current is another good banking option, and you can even set it up in 20 minutes! Current is a money management app that offers spending and savings accounts (along with cash advances, teen banking, 2-day early access to direct deposit, and crypto investing).

When you bank with Current, you can open up three savings pods in that account, which is exactly what we want). The best part is that you can earn 4.00% APY (as of October 2023) on up to $2,000 in each pod (so $6,000 total). This is a phenomenal rate!

Since there’s a cap on interest-earning, this is great for smaller sinking funds like Christmas, vacations, etc.

You can get Current on Android or get Current on iOS

Use a cash envelope

You can save all your funds in one cash envelope and then divvy it out to other “sub-account cash envelopes” totally doable, and this is how I keep my Christmas money.

When my Christmas savings are “full,” I go to the store and buy a Visa gift card with the saved cash. This way, I can use the money online to do my holiday shopping, and I just feel better about not carrying all that extra cash around.

What if I’m reading this after Christmas in July?

First of all, no worries! You can still save a good amount of money for Christmas, even if you start in the fall! You may have to save more per month to reach your goal. Or take it to the next level by getting a part-time job, but it’s still doable.

The number one factor for not going into debt this Christmas is to establish

- Who you are buying presents for

- The gift budget per person, and total savings goal

And stick to it 110%! That right there will take you 75% of the way to saving your credit cards from swipe burn (Post 2 in this series has some great ideas on how to stick to your budget!) So still keep reading, the information is totally applicable even if you’re starting late!

Christmas credit card debt in America

Why would you want to ruin a perfectly good Christmas in July by thinking about making a Christmas savings plan? I mean, saving for Christmas now is too soon!

I know it doesn’t sound fun, but the reality is we need to think about this because like it or not, we’re adults!

According to CNBC, the Christmas debt hangover is real! “Among those who put all those holiday presents on plastic, less than half of shoppers, or 42 percent, said they’ll pay off the debt in three months or less. More said it would take five months or more to pay it off, MagnifyMoney found. Nearly a quarter or 22 percent said they would only make the minimum payments.”

What’s even more troubling is that according to Maginify Money, “For a borrower making a minimum payment of $30 a month on a $1,230 tab, that means it would take more than five years to pay off the balance – and you’d also be shelling out $592 in interest over that time (assuming an annual percentage rate of 16.5 percent).” Yikes! Christmas gifts and entertaining cost a lot after interest is tacked on!

Wouldn’t it be great to bypass that January bill altogether? You can, and I’m going to show you how! Because you don’t need the stress and anxiety that comes with financial debt! That just drags you down and clouds everything around you. It steals the joy from the holidays and keeps you from appreciating the small blessings that come with the season.

If holiday shopping is your guilty pleasure and you can easily get out of hand, read this post for ideas on how to stop overspending on Christmas presents if that happens to be your downfall. There are some great ideas on how to shift the focus of the season and the day of Christmas.

At the end of the day

By the end of movie #3, you should have a framework for how you are going to fill your Christmas savings, either out of your regular monthly budget (i.e., putting away $20 a week) or selling items or getting a part-time job. Whichever way you do it, I know it’s going to work great!

I am so happy that you’ve gone through this process. This year Christmas shopping will be a breeze!

Articles relating to saving for Christmas:

- How to Actually Enjoy the Holidays Again with the Help of a Holiday Planner!

- How to Dump Your Financial Stress

- What Every Budget Savvy Mom Actually Wants for Christmas

- The Perfect Christmas Bucket List the Whole Family Will Love

- How to Stop Overspending on Christmas Presents

I love this plan for Christmas and Christmas in July is such a good idea.

So glad you liked it Audrey!

These are all really great tips! I’m a horrible Christmas budget-er? I need to get it together.

Don’t lose heart, you’re not horrible! You may just need some help, that’s all!

I agree with you dear, starting from July actually makes sense and thanks for these wonderful tips ?

So glad you clicked with it!

I loved Christmas Clubs in the small town in I lived in NC.

It’s so much easier just to have the money in the bank, or taken right out of your check.

Less tempting to “dip” into than a cash envelope.

The holidays sneak up fast!!

Oh yeah! So glad you like Christmas Clubs! It’s such a fun idea, and so helpful!

I absolutely agree with you that now is the time to start saving for the holidays. I’m going to use the information from this article to start planning.

So glad you liked it Janitza! Thanks for stopping by!

I love this!! We alwatmys start all our Christmas planning in July!! Such great advice!!!

We need the extra Christmas cheer this July huh!

Absolutely love this! Perfect plan to gear up for Christmas season! Love the tips! Thank you for sharing ?

You’re very welcome Samantha!

These are great tips. I always look forward to Christmas…but not the spending. Guess I better start saving now. Thanks!!

Spending money at Christmas is so much easier when you know you have the funds to cover it!

Great tips for saving up for the most wonderful time of year! It can be hard to start saving so early but it really makes sense!

I admit, it does seem odd at first glance, but it truly does give you a huge advantage!

I love this! Its never too early to start buying for Christmas! I personally buy things throughout the year and save them for Christmas to help save and prevent the huge splurging in Dec.

Such a smart idea as it spreads the cost out to be much more manageable!

These are such great suggestions! I hope to do a no spend challenge myself to see how much extra savings I can collect!

I love no spend challenges! So much fun (and such a challenge, you’re always at your best when competing with yourself!)

This is a fantastic idea! I never thought of saving this early for Christmas. But with the pandemic not going away anytime soon, I could definitely use some extra savings when the Christmas season start rolling in. 🙂

Yes, difficult times for all! It’s hard to save money (when we need it now), but all the small contributions add up!

We budget and plan ahead of time for Christmas and birthdays. Helps tremendously.

So glad you found a method that works for you!

I am all about budgeting and living a frugal life!! Budgeting ahead is always the winner!!

Maybe we need to make a cheesy I (heart) budget sticker!

I love the idea of starting your Christmas savings in July, and it makes total sense do so. You are right that by January, you are over it. Thank you so much for suggesting this; I will definitely be trying this.

Yaaaa Robyn! You’ll do great! It will be great!

I really want to use August to plan ahead! In October or November, we have a minivan and a ton of baby stuff to buy, so planning ahead for the holidays will make us feel a lot less stressed. We also have 5 birthdays in our immediate family in December and a baby coming in January LOL

Ohhhh Mama! You are going to be busy! My family has 5 birthdays in September so I totally get it! Fingers crossed for you!

This is so informative. Thanks so much for sharing this!

Glad you liked it Adriana

This is such a great post! So much information! I definitely need to get better about planning for Christmas earlier than December 🙂

Ohhh, as long as you enjoy it and aren’t feeling frazzled then do what works for you! I hate scrambling late minute, I’m a planner by nature 🙂

I love Christmas and budgeting has always been hard!! These are great tips to saving up for Christmas! Thank you x

Thanks Raisa! I hope some of them work for you this holiday season!